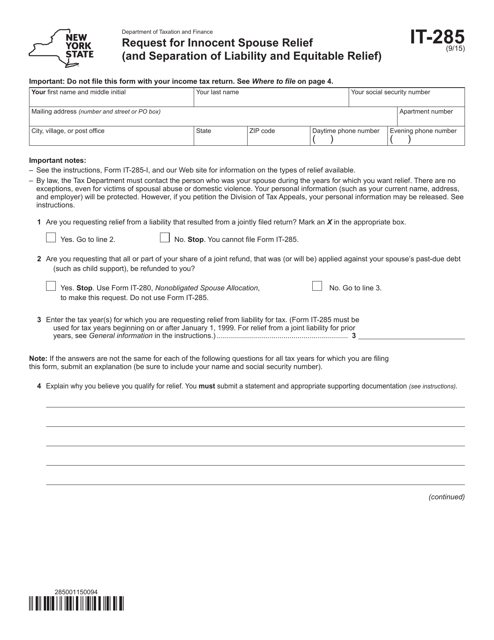

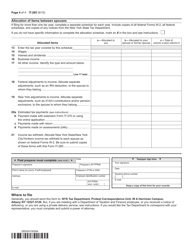

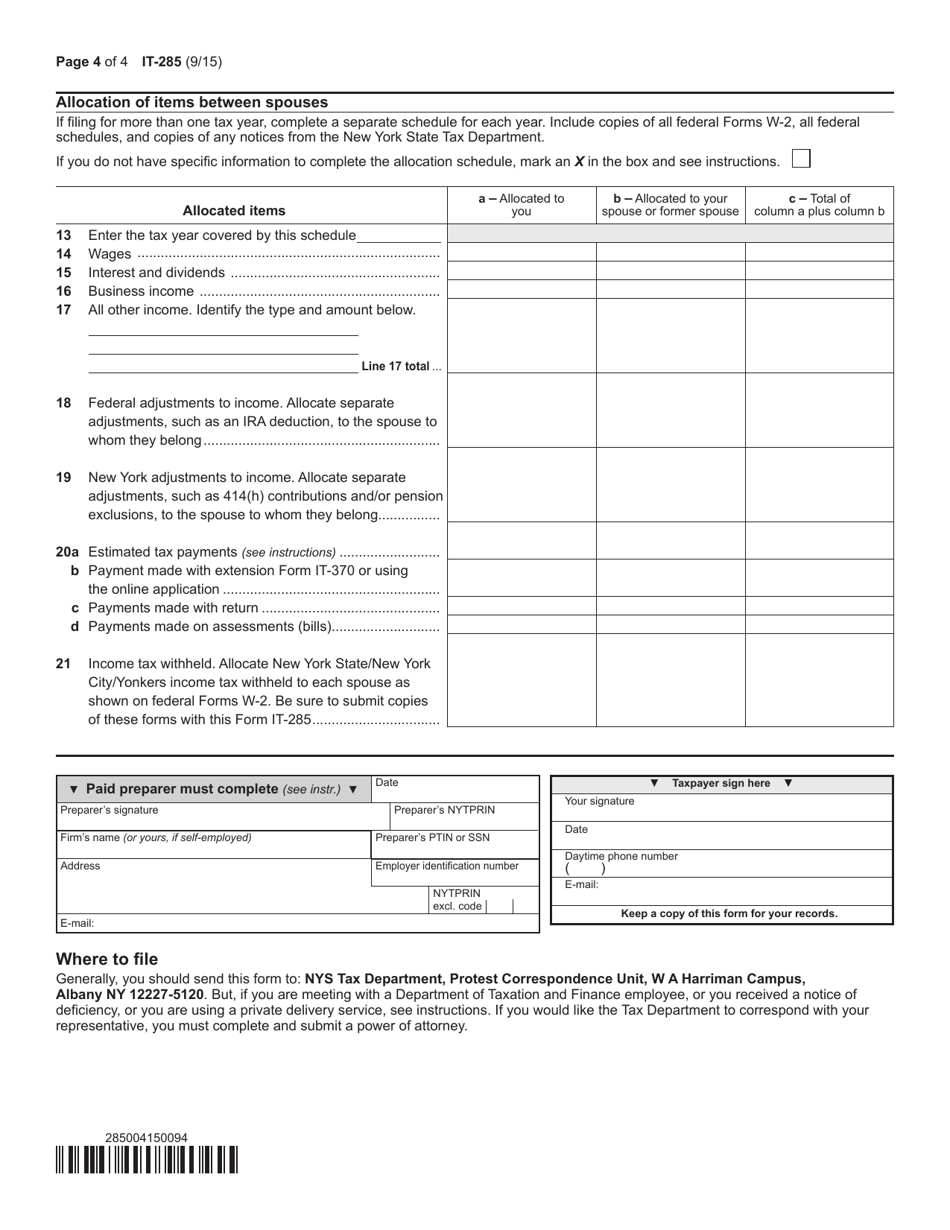

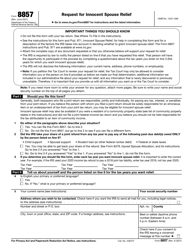

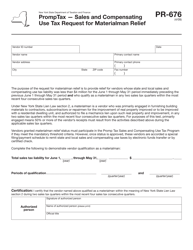

Form IT-285 Request for Innocent Spouse Relief (And Separation of Liability and Equitable Relief) - New York

What Is Form IT-285?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-285?

A: Form IT-285 is a request forInnocent Spouse Relief (And Separation of Liability and Equitable Relief) in New York.

Q: Who can use Form IT-285?

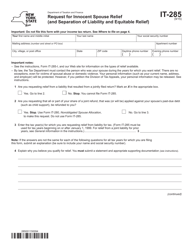

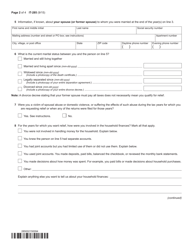

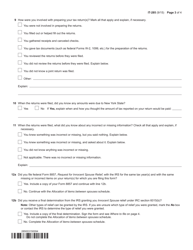

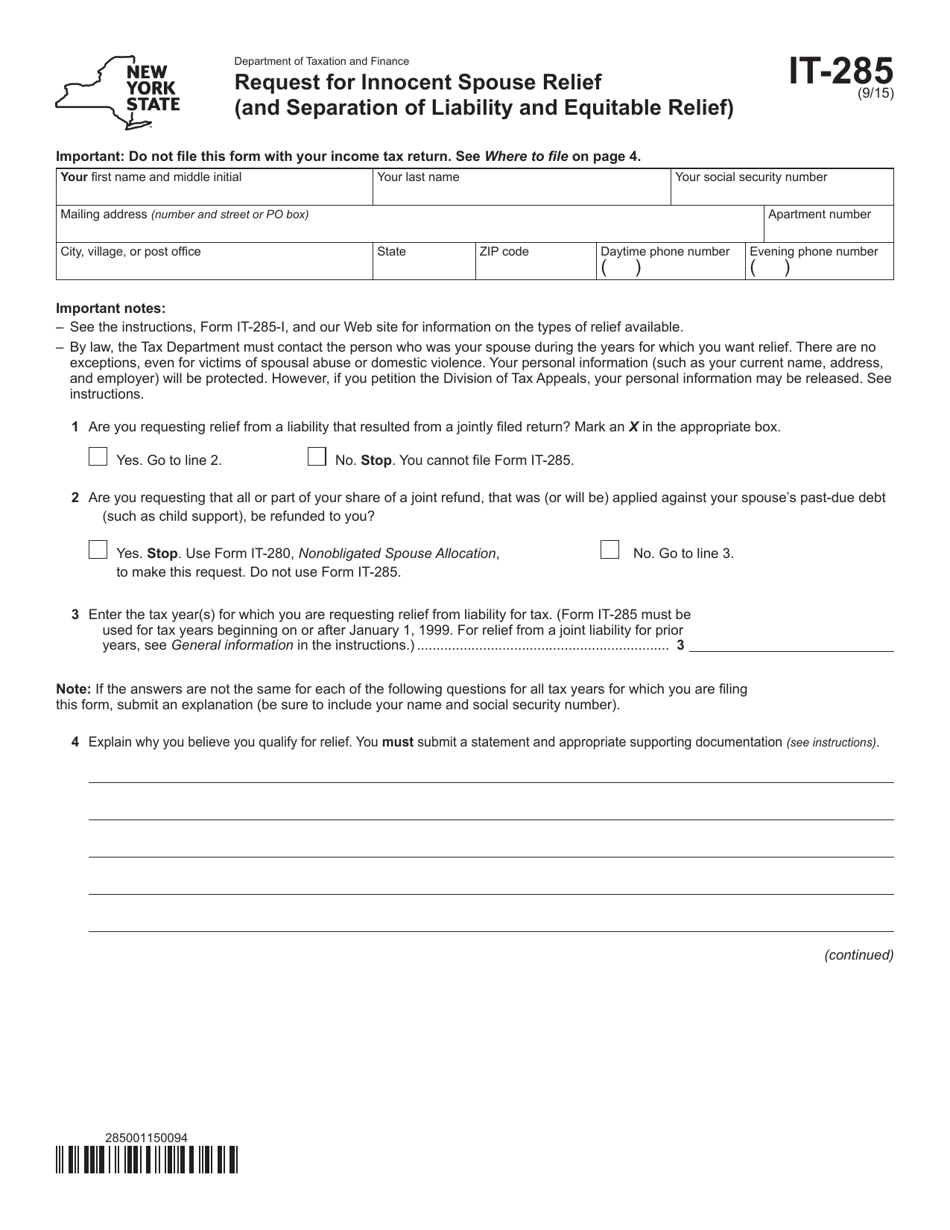

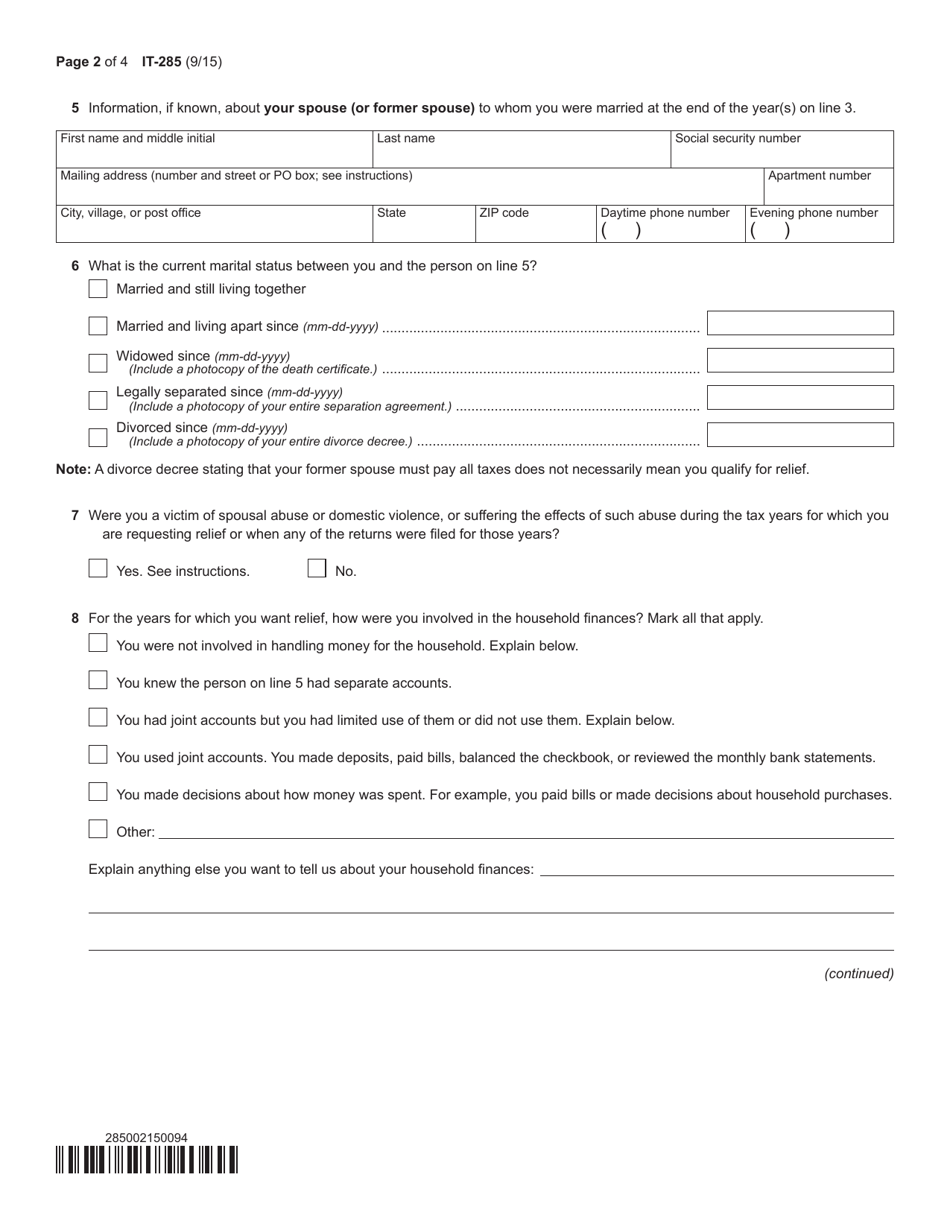

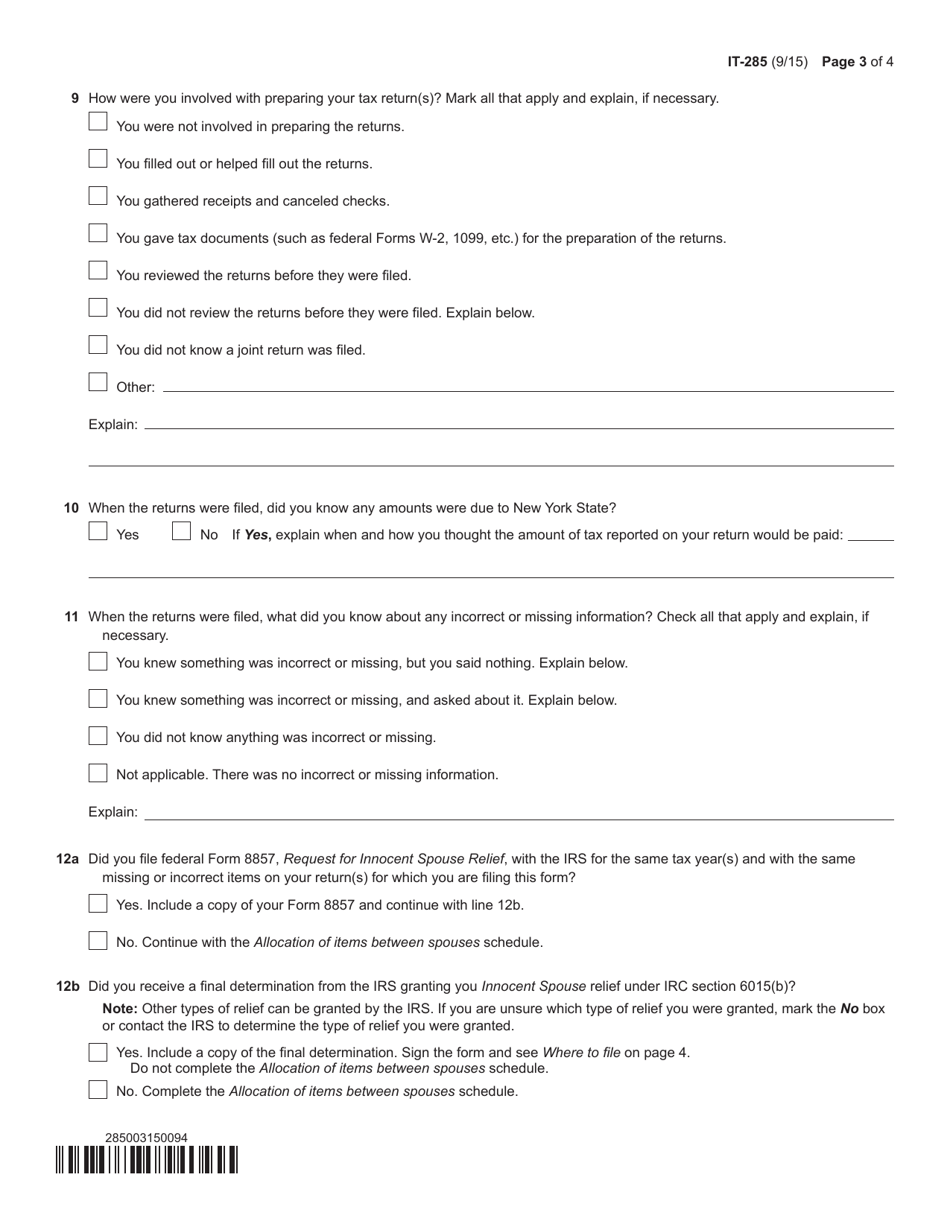

A: Form IT-285 can be used by individuals who believe they qualify for innocent spouse relief or separation of liability and equitable relief.

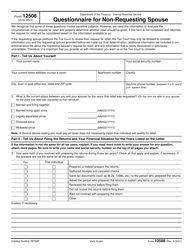

Q: What is Innocent Spouse Relief?

A: Innocent Spouse Relief provides relief from joint and several liability for taxes owed when your spouse or former spouse is solely responsible for the debt.

Q: What is Separation of Liability and Equitable Relief?

A: Separation of Liability and Equitable Relief allows for allocation of the tax liability between you and your spouse or former spouse.

Q: Are there any fees associated with filing Form IT-285?

A: There are no fees required to file Form IT-285.

Q: Do I need to include any supporting documents with Form IT-285?

A: Yes, you need to include supporting documents such as copies of tax returns, financial statements, and any other relevant documents.

Q: How long does it take to process Form IT-285?

A: The processing time for Form IT-285 can vary, but it typically takes several weeks to months.

Q: What should I do if I have more questions about Form IT-285?

A: If you have more questions about Form IT-285, you can contact the New York State Department of Taxation and Finance for assistance.

Form Details:

- Released on September 1, 2015;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-285 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.