This version of the form is not currently in use and is provided for reference only. Download this version of

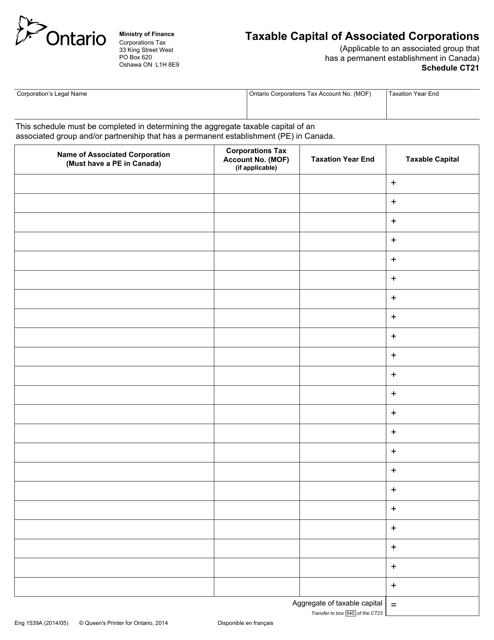

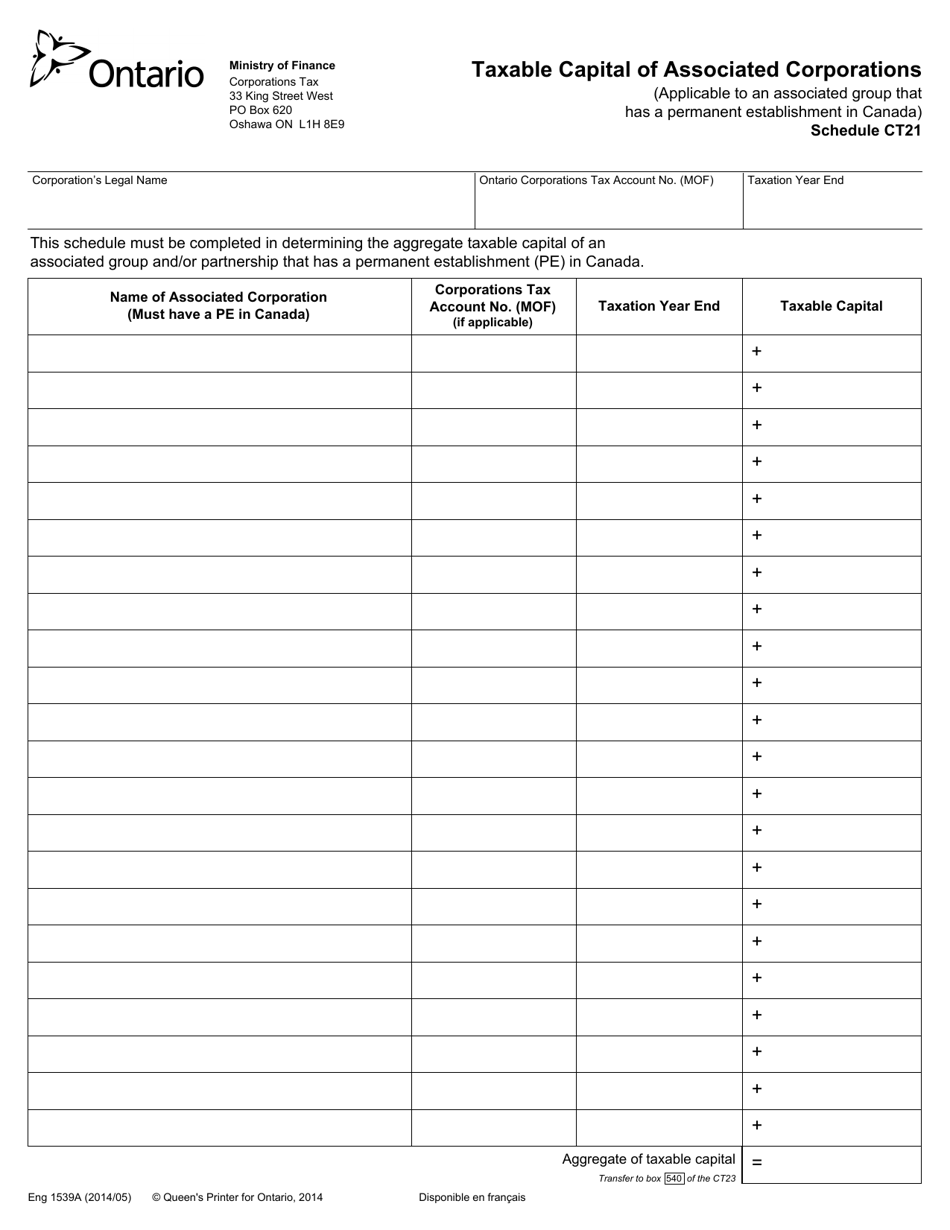

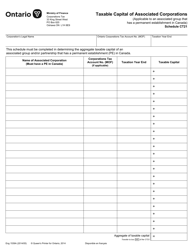

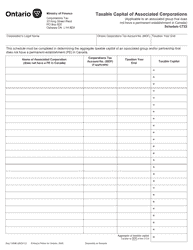

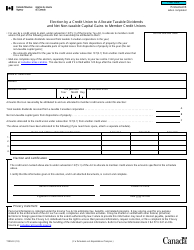

Form 1539A Schedule CT21

for the current year.

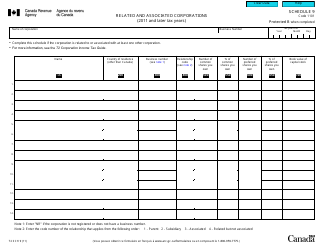

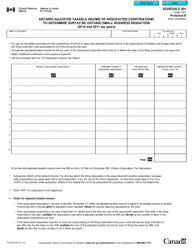

Form 1539A Schedule CT21 Taxable Capital of Associated Corporations - Ontario, Canada

Form 1539A Schedule CT21 is used to calculate the taxable capital of associated corporations in the province of Ontario, Canada.

The corporation that is associated with the Ontario, Canada business is responsible for filing the Form 1539A Schedule CT21 for taxable capital.

FAQ

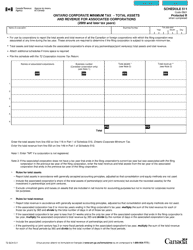

Q: What is Form 1539A Schedule CT21?

A: Form 1539A Schedule CT21 is a tax form used in Ontario, Canada.

Q: What is the purpose of Form 1539A Schedule CT21?

A: The purpose of Form 1539A Schedule CT21 is to calculate the taxable capital of associated corporations in Ontario.

Q: Who needs to file Form 1539A Schedule CT21?

A: Corporations in Ontario that have associated corporations need to file Form 1539A Schedule CT21.

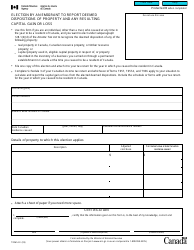

Q: What is taxable capital?

A: Taxable capital is the value of a corporation's assets, including share capital, retained earnings, and certain debt, minus specified deductions.

Q: How do I fill out Form 1539A Schedule CT21?

A: To fill out Form 1539A Schedule CT21, you need to provide the required information about the associated corporations and calculate the taxable capital.