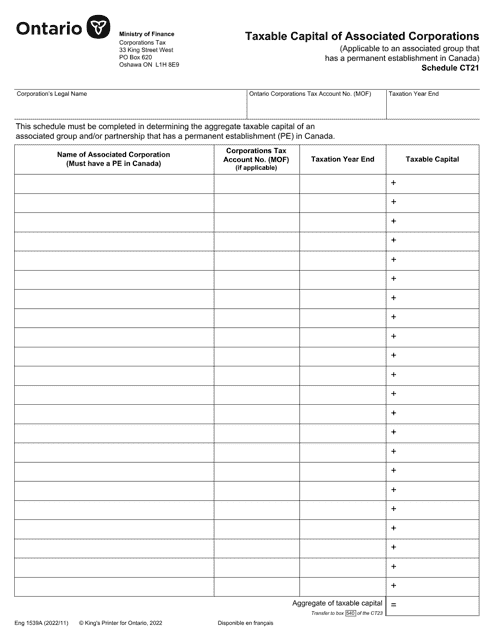

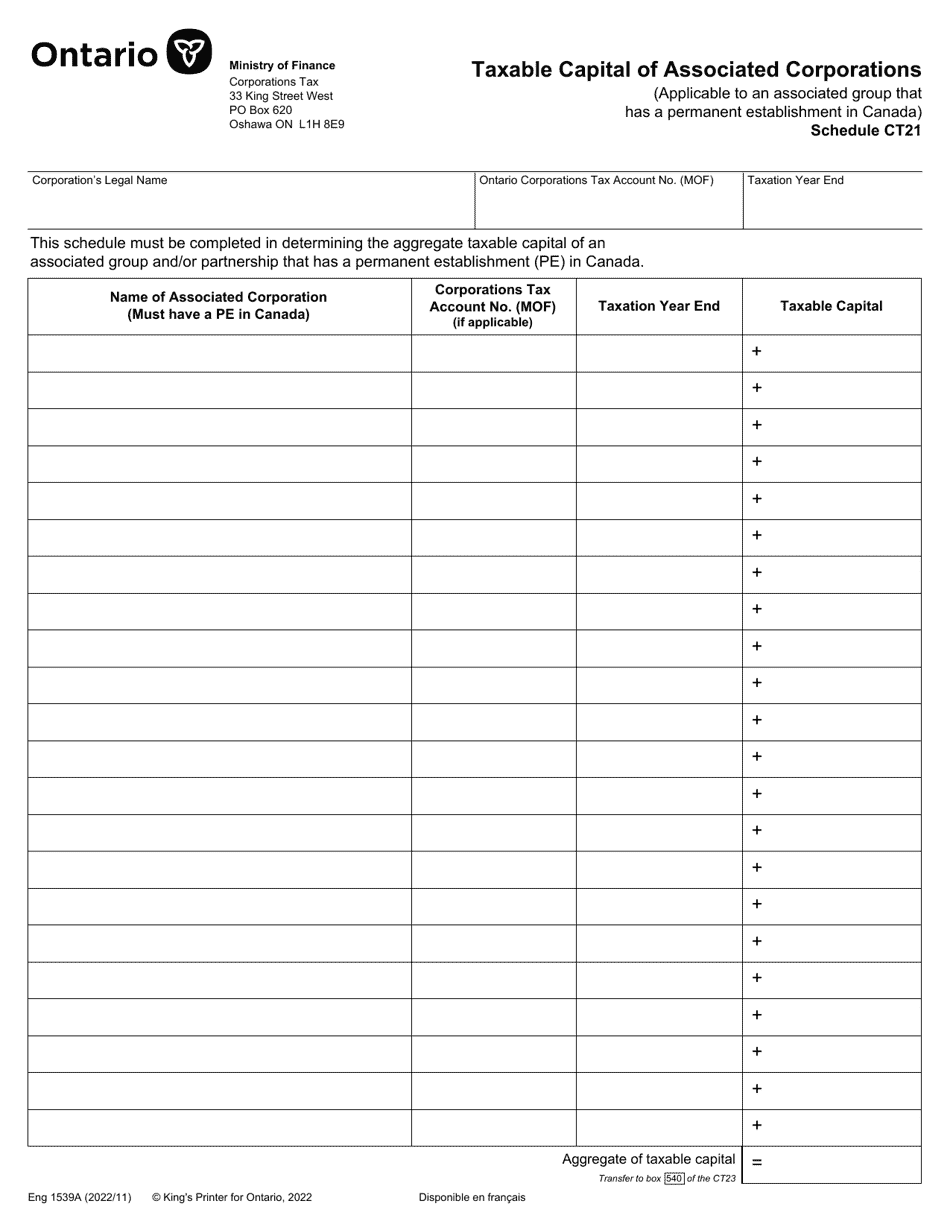

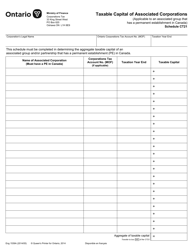

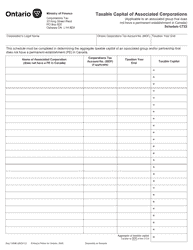

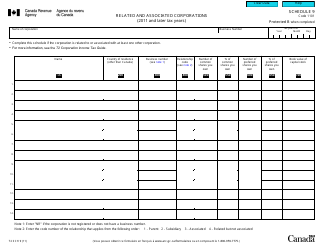

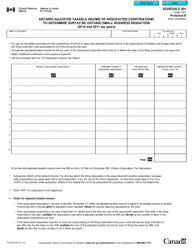

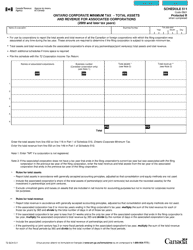

Form 1539A Schedule CT21 Taxable Capital of Associated Corporations - Ontario, Canada

Form 1539A Schedule CT21 is used to calculate the taxable capital of associated corporations in Ontario, Canada for tax purposes.

A corporation that is a resident of Ontario, Canada files Form 1539A Schedule CT21 for reporting the taxable capital of associated corporations.

Form 1539A Schedule CT21 Taxable Capital of Associated Corporations - Ontario, Canada - Frequently Asked Questions (FAQ)

Q: What is Form 1539A Schedule CT21? A: Form 1539A Schedule CT21 is a tax form used to calculate the taxable capital of associated corporations in Ontario, Canada.

Q: Who needs to fill out Form 1539A Schedule CT21? A: Corporations in Ontario, Canada that are associated with other corporations and have taxable capital need to fill out Form 1539A Schedule CT21.

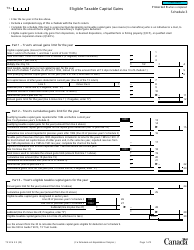

Q: What is taxable capital? A: Taxable capital refers to the total value of a corporation's assets, minus certain deductions, that are subject to taxation.

Q: What information is required to fill out Form 1539A Schedule CT21? A: To fill out Form 1539A Schedule CT21, you will need information about the associated corporations, their taxable capital, and any deductions that may apply.