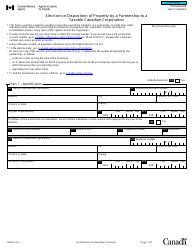

This version of the form is not currently in use and is provided for reference only. Download this version of

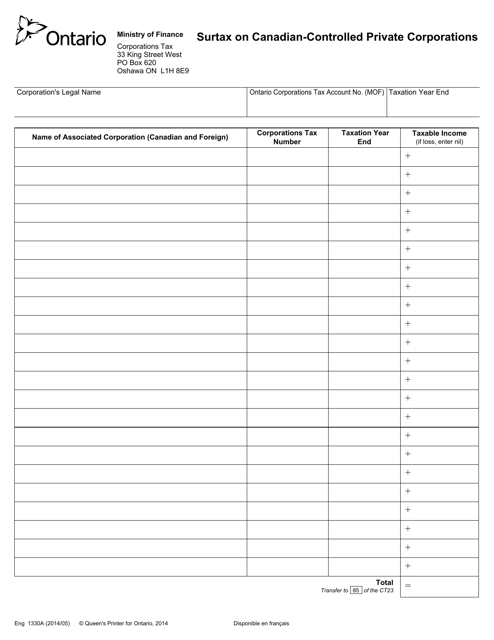

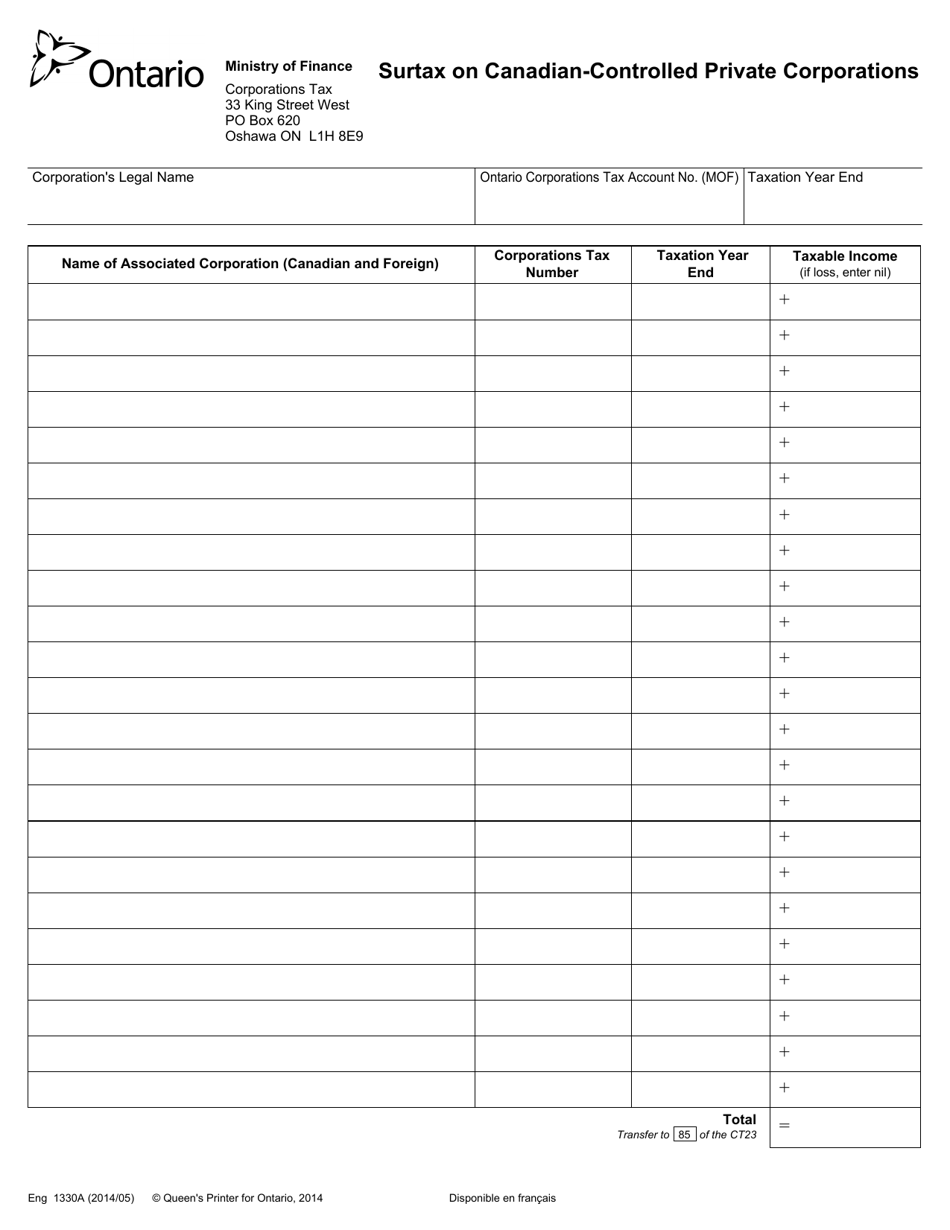

Form 1330A

for the current year.

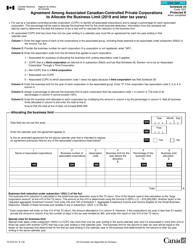

Form 1330A Surtax on Canadian-Controlled Private Corporations - Ontario, Canada

FAQ

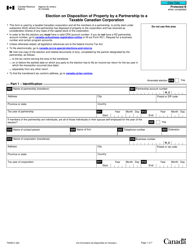

Q: What is Form 1330A?

A: Form 1330A is a tax form used to calculate the surtax on Canadian-Controlled Private Corporations in Ontario, Canada.

Q: What is a Canadian-Controlled Private Corporation?

A: A Canadian-Controlled Private Corporation is a corporation that is private and controlled by Canadian residents.

Q: What is surtax?

A: Surtax is an additional tax that is imposed on certain corporations in addition to their regular corporate income tax.

Q: Who needs to file Form 1330A?

A: Canadian-Controlled Private Corporations in Ontario, Canada need to file Form 1330A.

Q: What information is required on Form 1330A?

A: Form 1330A requires information about the corporation's income and deductions, as well as details about its ownership and control.

Q: What is the purpose of Form 1330A?

A: The purpose of Form 1330A is to calculate the surtax that a Canadian-Controlled Private Corporation owes in Ontario, Canada.

Q: When is the deadline to file Form 1330A?

A: The deadline to file Form 1330A is typically within six months from the end of the corporation's taxation year.