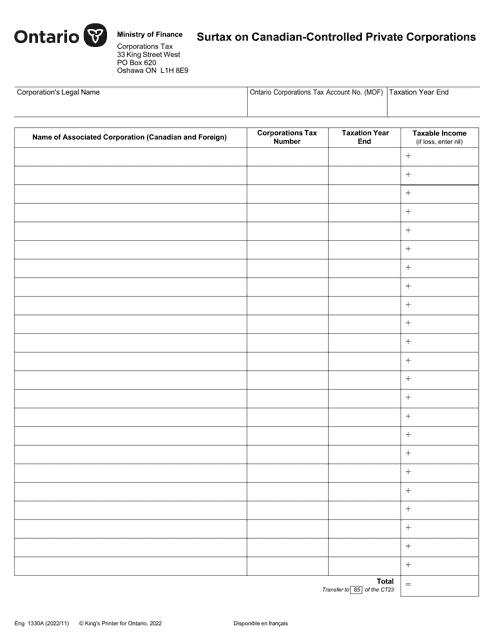

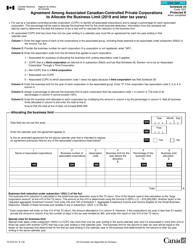

Form 1330A Surtax on Canadian-Controlled Private Corporations - Ontario, Canada

Form 1330A Surtax on Canadian-Controlled Private Corporations in Ontario, Canada is used to calculate and pay surtax by Canadian-controlled private corporations operating in Ontario. The surtax is an additional tax imposed on these corporations based on their income levels.

The Form 1330A Surtax on Canadian-Controlled Private Corporations in Ontario, Canada is filed by the corporation itself.

Form 1330A Surtax on Canadian-Controlled Private Corporations - Ontario, Canada - Frequently Asked Questions (FAQ)

Q: What is Form 1330A? A: Form 1330A is a tax form used to calculate and pay the surtax on Canadian-controlled private corporations in Ontario, Canada.

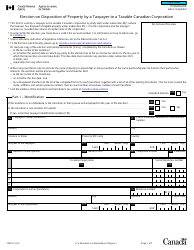

Q: What is a Canadian-controlled private corporation? A: A Canadian-controlled private corporation is a corporation that is resident in Canada and is not controlled directly or indirectly by non-residents.

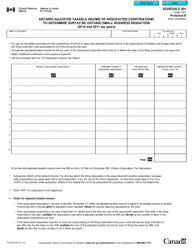

Q: What is the surtax on Canadian-controlled private corporations? A: The surtax is an additional tax imposed on the taxable income of Canadian-controlled private corporations in Ontario.

Q: How is the surtax calculated? A: The surtax is calculated based on a percentage of the taxable income of the Canadian-controlled private corporation.

Q: Who needs to file Form 1330A? A: Canadian-controlled private corporations in Ontario that are subject to the surtax need to file Form 1330A.

Q: When is Form 1330A due? A: Form 1330A is generally due on the same date as the corporation's tax return, which is normally within six months after the end of its taxation year.

Q: Are there any penalties for not filing Form 1330A? A: Yes, there may be penalties for not filing Form 1330A or for filing it late. It is important to meet the filing deadline to avoid these penalties.

Q: Is Form 1330A specific to Ontario, Canada? A: Yes, Form 1330A is specific to Canadian-controlled private corporations in Ontario, Canada. Other provinces and territories may have their own surtax forms.