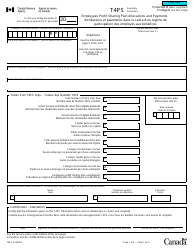

This version of the form is not currently in use and is provided for reference only. Download this version of

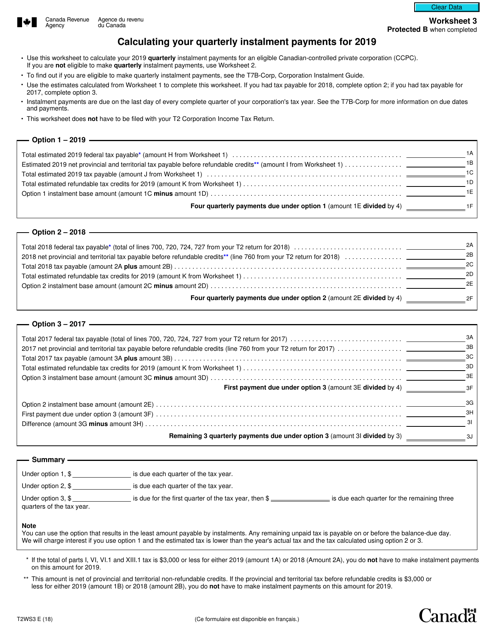

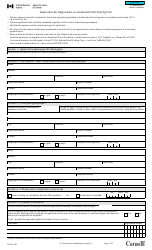

Form T2 Worksheet 3

for the current year.

Form T2 Worksheet 3 Calculating Your Quarterly Instalment Payments - Canada

Form T2 Worksheet 3 - Calculating Your Quarterly Instalment Payments is used by Canadian businesses to calculate and pay their quarterly instalment payments for corporate income tax. It helps businesses estimate their tax due for the year and make regular payments throughout the year.

The corporation/business files the Form T2 Worksheet 3 Calculating Your Quarterly Instalment Payments in Canada.

FAQ

Q: What is Form T2 Worksheet 3?

A: Form T2 Worksheet 3 is a form used in Canada to help businesses calculate their quarterly instalment payments.

Q: Who needs to use Form T2 Worksheet 3?

A: Businesses in Canada that are required to make quarterly instalment payments need to use Form T2 Worksheet 3.

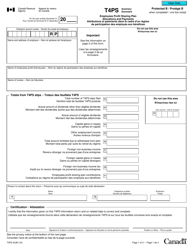

Q: What are quarterly instalment payments?

A: Quarterly instalment payments are prepayments of corporate income tax that businesses make throughout the year based on their estimated annual tax liability.

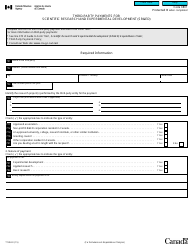

Q: How do I calculate my quarterly instalment payments using Form T2 Worksheet 3?

A: Form T2 Worksheet 3 provides a step-by-step calculation process to determine your quarterly instalment payments. It takes into account your estimated net tax owing and the applicable tax rates.

Q: What happens if I don't make quarterly instalment payments?

A: If you are required to make quarterly instalment payments and fail to do so, you may be subject to interest and penalties on the unpaid amount.

Q: Are there any exceptions to making quarterly instalment payments?

A: There are certain exceptions to making quarterly instalment payments, such as if your net tax owing for the year is below a certain threshold or if you are a new corporation.

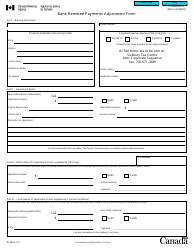

Q: Can I make additional payments if my business's income changes during the year?

A: Yes, you can make additional payments or adjust your instalment amounts if your business's income changes during the year. This can help avoid interest and penalties at the end of the year.