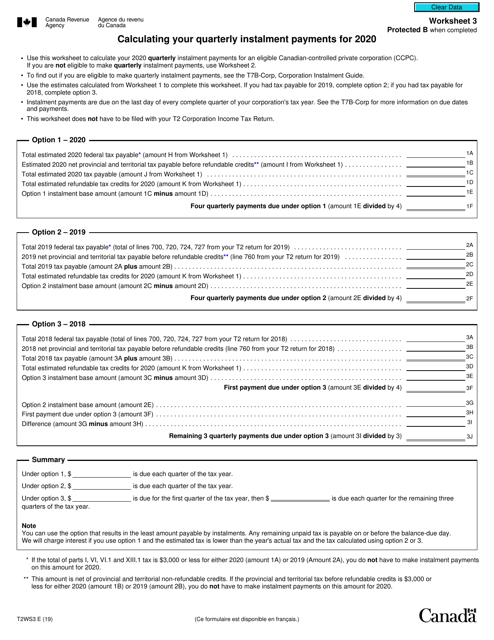

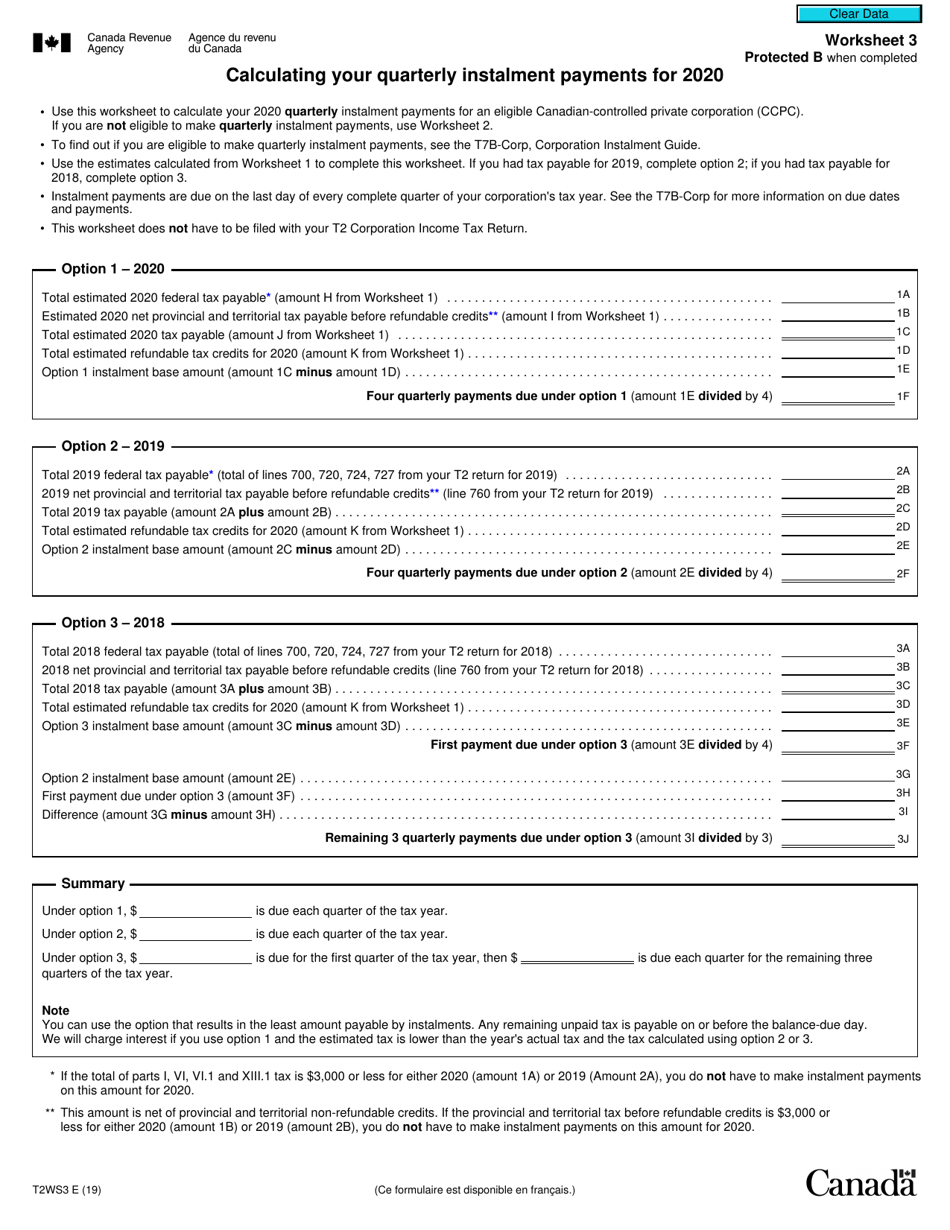

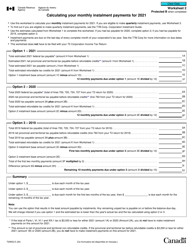

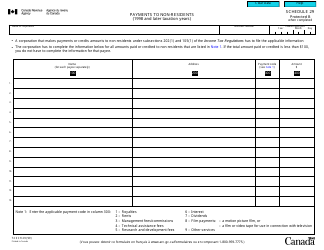

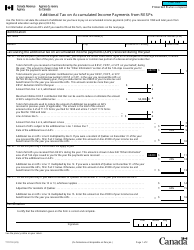

Form T2 Worksheet 3 Calculating Your Quarterly Instalment Payments - Canada

Form T2 Worksheet 3 - Calculating Your Quarterly Instalment Payments is used by Canadian corporations to calculate their quarterly instalment payments for income tax. It helps businesses estimate and pay their taxes in installments throughout the year, rather than in a lump sum at year-end.

The Form T2 Worksheet 3 for calculating quarterly instalment payments in Canada is typically filed by corporations who need to make instalment payments of taxes throughout the year.

Form T2 Worksheet 3 Calculating Your Quarterly Instalment Payments - Canada - Frequently Asked Questions (FAQ)

Q: What is Form T2 Worksheet 3?

A: Form T2 Worksheet 3 is a tool used by Canadian businesses to calculate their quarterly instalment payments.

Q: What are quarterly instalment payments?

A: Quarterly instalment payments are payments made by businesses to the Canadian government throughout the year to cover their estimated income tax for the year.

Q: Why do businesses need to calculate quarterly instalment payments?

A: Businesses need to calculate quarterly instalment payments to avoid interest and penalties from the Canadian government for underpayment of income tax.

Q: How do I use Form T2 Worksheet 3?

A: To use Form T2 Worksheet 3, you need to enter your estimated taxable income, the applicable tax rates, and any deductions or credits that apply to your business.