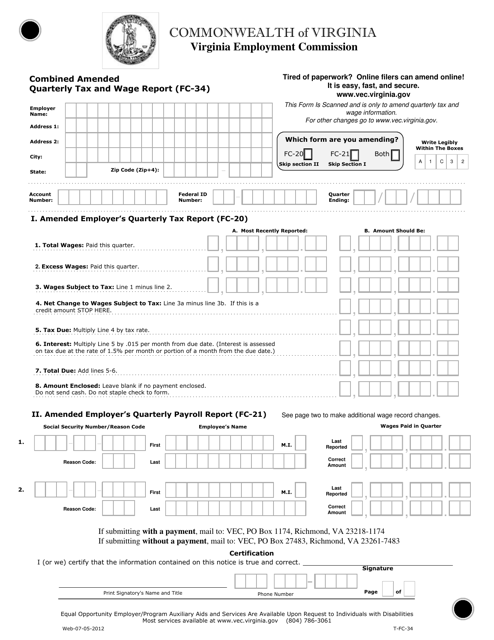

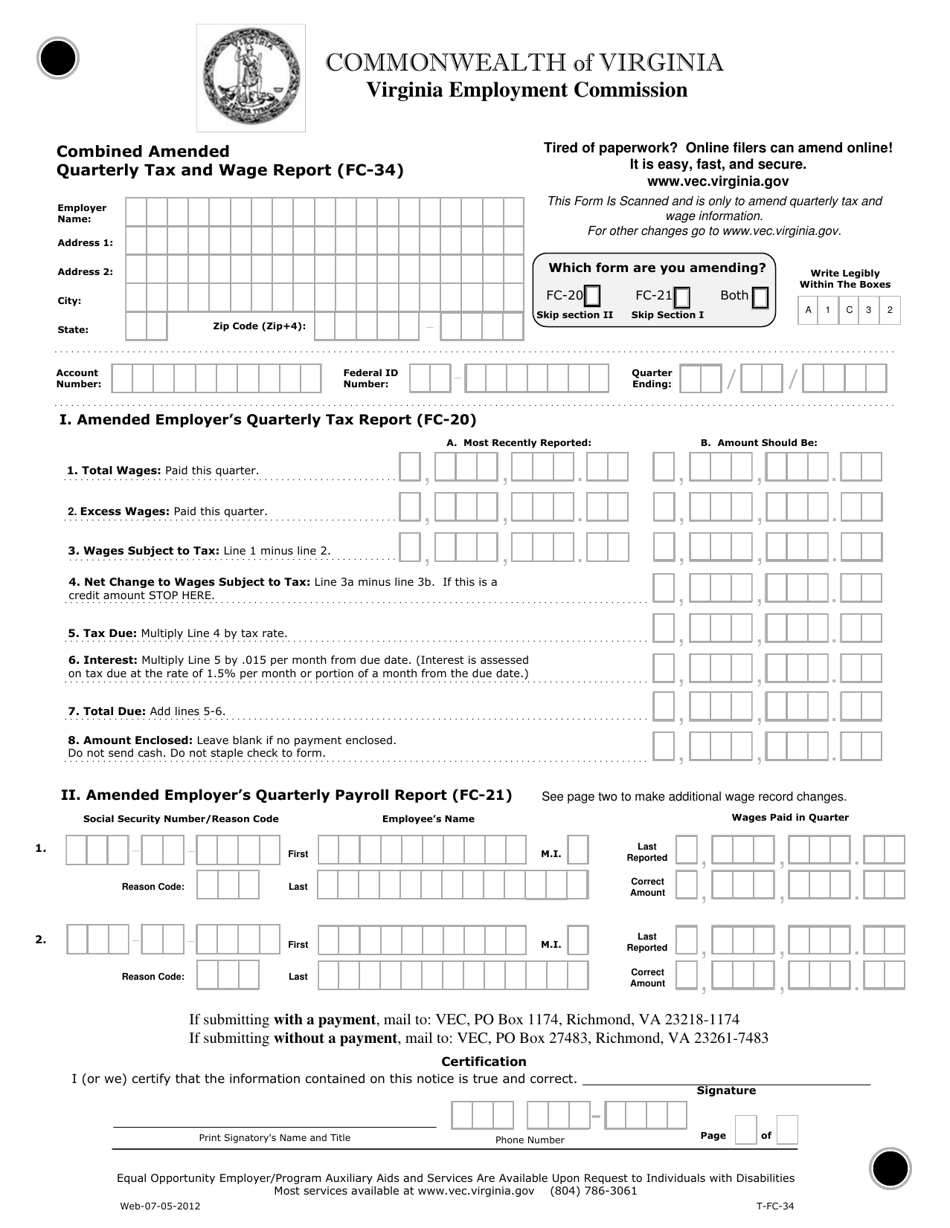

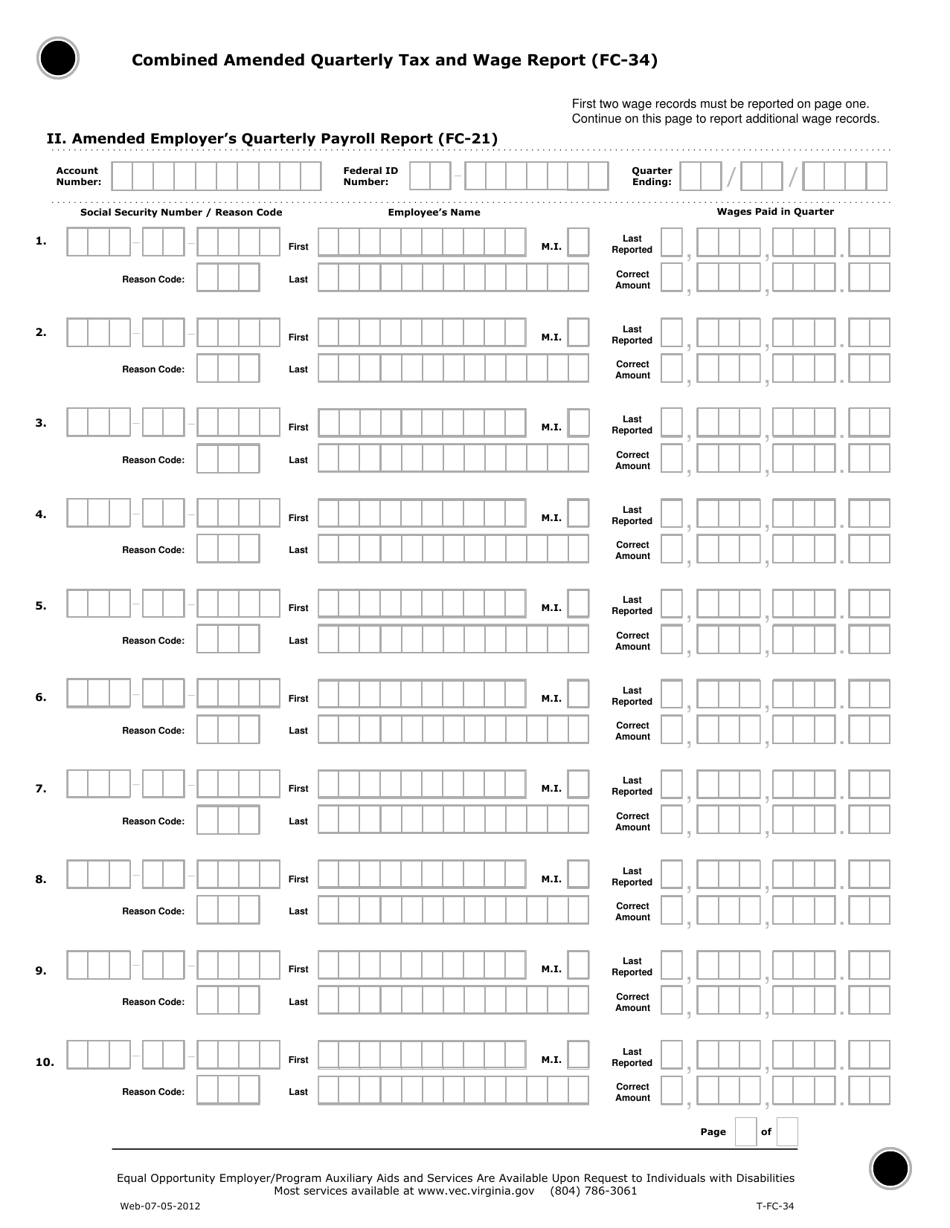

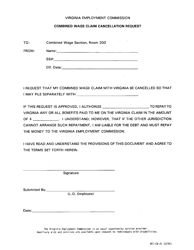

Form VEC FC-34 Combined Amended Quarterly Tax and Wage Report - Virginia

What Is Form VEC FC-34?

This is a legal form that was released by the Virginia Employment Commission - a government authority operating within Virginia. Check the official instructions before completing and submitting the form.

FAQ

Q: What is VEC FC-34?

A: VEC FC-34 is a Combined Amended Quarterly Tax and Wage Report form for employers in Virginia.

Q: What is the purpose of the VEC FC-34 form?

A: The purpose of the VEC FC-34 form is to report and amend quarterly tax and wage information for employers in Virginia.

Q: Who needs to fill out the VEC FC-34 form?

A: Employers in Virginia who need to report and amend their quarterly tax and wage information should fill out the VEC FC-34 form.

Q: When is the deadline to submit the VEC FC-34 form?

A: The deadline to submit the VEC FC-34 form is the last day of the month following the end of the quarter.

Q: What information is required on the VEC FC-34 form?

A: The VEC FC-34 form requires information such as the employer's name, contact information, employment details, wages paid, and taxes withheld.

Q: Are there any penalties for not submitting the VEC FC-34 form?

A: Yes, there may be penalties for not submitting the VEC FC-34 form or for submitting inaccurate or incomplete information. It is important to meet the deadlines and provide accurate information.

Q: Can I make amendments to a previously filed VEC FC-34 form?

A: Yes, the VEC FC-34 form allows for amendments to be made to previously filed reports. You can indicate the amendments on the form and submit it accordingly.

Form Details:

- Released on July 5, 2012;

- The latest edition provided by the Virginia Employment Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form VEC FC-34 by clicking the link below or browse more documents and templates provided by the Virginia Employment Commission.