Instructions for Form VEC FC-34 Combined Amended Quarterly Tax and Wage Reports - Virginia

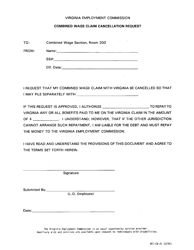

This document contains official instructions for Form VEC FC-34 , Combined Amended Quarterly Tax and Wage Reports - a form released and collected by the Virginia Employment Commission. An up-to-date fillable Form VEC FC-34 is available for download through this link.

FAQ

Q: What is Form VEC FC-34?

A: Form VEC FC-34 is a combined amended quarterly tax and wage report for Virginia.

Q: What is the purpose of Form VEC FC-34?

A: The purpose of Form VEC FC-34 is to report amended quarterly tax and wage information to the Virginia Employment Commission (VEC).

Q: Who needs to file Form VEC FC-34?

A: Employers in Virginia who need to correct or update their quarterly tax and wage information should file Form VEC FC-34.

Q: How often should Form VEC FC-34 be filed?

A: Form VEC FC-34 should be filed on a quarterly basis, along with the regular quarterly tax and wage reports.

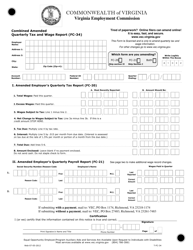

Q: What information do I need to provide on Form VEC FC-34?

A: You will need to provide your employer account number, the quarter being amended, and details of the changes to your tax and wage information.

Q: Is there a deadline for filing Form VEC FC-34?

A: Yes, Form VEC FC-34 must be filed by the due date for the corresponding regular quarterly tax and wage report.

Q: Are there any penalties for late or incorrect filing of Form VEC FC-34?

A: Yes, there may be penalties for late or incorrect filing of Form VEC FC-34. It is important to ensure accurate and timely submission.

Q: Can I make changes to Form VEC FC-34 after it has been filed?

A: Yes, you can make changes to Form VEC FC-34 by filing an additional amended report if needed.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Virginia Employment Commission.