Instructions for Form C-82M, C-83 - Texas

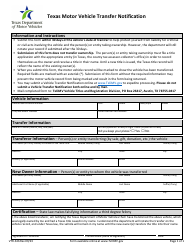

This document contains official instructions for Form C-82M , and Form C-83 . Both forms are released and collected by the Texas Workforce Commission. An up-to-date fillable Form C-82M is available for download through this link. The latest available Form C-83 can be downloaded through this link.

FAQ

Q: What is Form C-82M?

A: Form C-82M is a document used in Texas for reporting motor vehicle sales tax.

Q: What is Form C-83?

A: Form C-83 is a document used in Texas for reporting boat and outboard motor sales tax.

Q: Do I need to fill out both Form C-82M and C-83?

A: No, you only need to fill out the form that corresponds to the type of vehicle you are reporting sales tax for. If you are reporting sales tax for a motor vehicle, use Form C-82M. If you are reporting sales tax for a boat or outboard motor, use Form C-83.

Q: What information do I need to provide on Form C-82M or C-83?

A: You will need to provide information such as the buyer's name and address, seller's name and address, vehicle identification number (VIN), purchase price, and the amount of sales tax due.

Q: Are there any deadlines for filing Form C-82M or C-83?

A: Yes, you are required to file and pay any sales tax due within 30 days of the date of purchase.

Q: What happens if I fail to file Form C-82M or C-83?

A: Failure to file Form C-82M or C-83 and pay the required sales tax may result in penalties and interest.

Instruction Details:

- This 1-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Texas Workforce Commission.