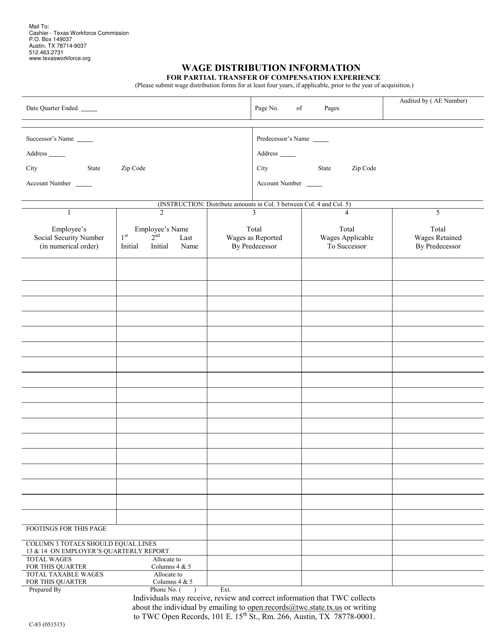

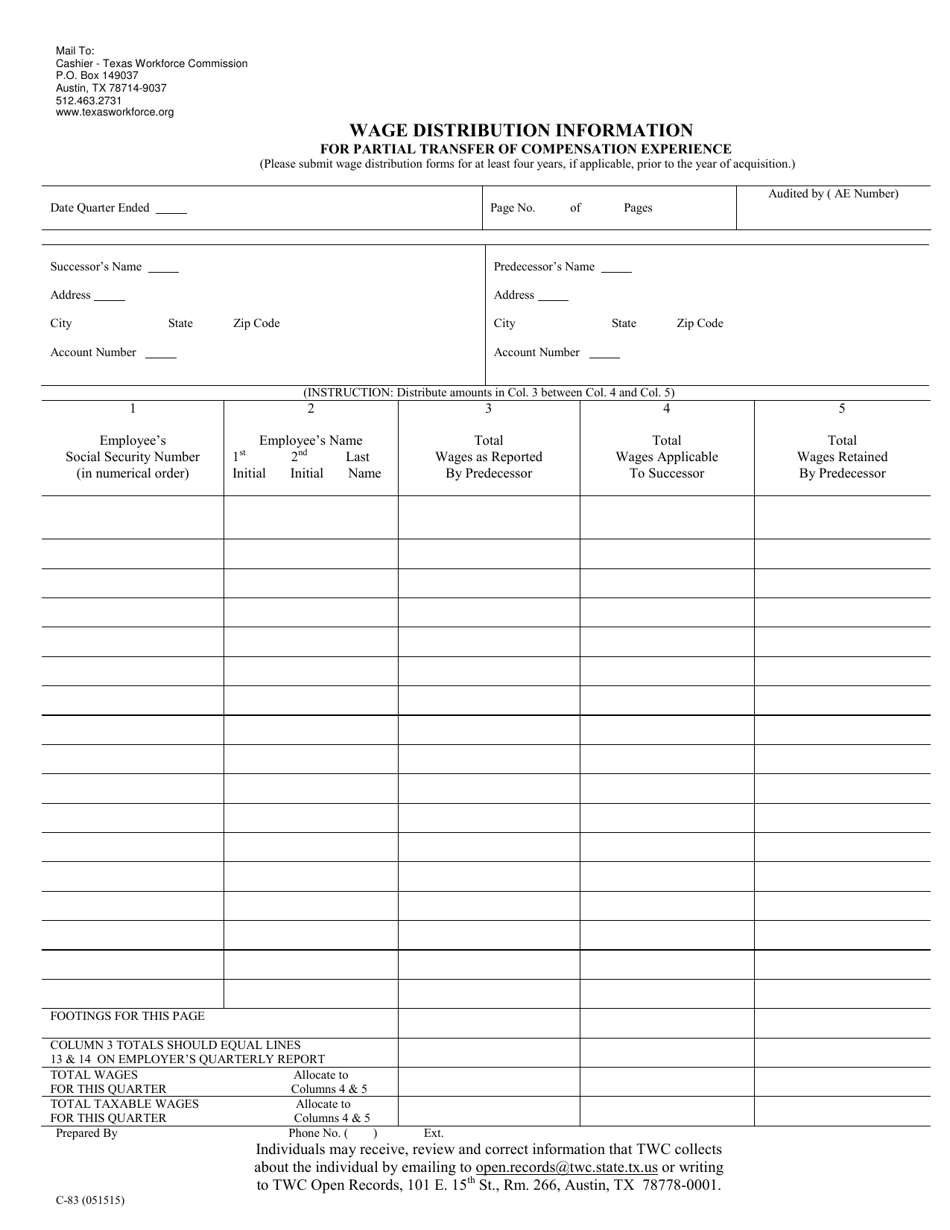

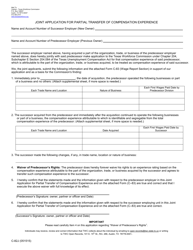

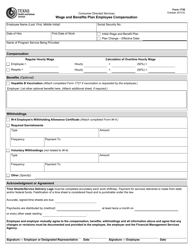

Form C-83 Wage Distribution Information for Partial Transfer of Compensation Experience - Texas

What Is Form C-83?

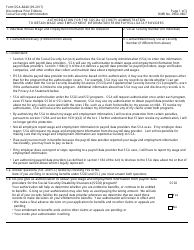

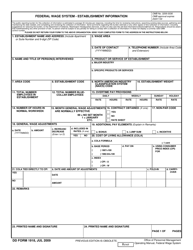

This is a legal form that was released by the Texas Workforce Commission - a government authority operating within Texas. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form C-83?

A: Form C-83 is the Wage Distribution Information for Partial Transfer of Compensation Experience form in Texas.

Q: What is the purpose of Form C-83?

A: The purpose of Form C-83 is to report the wage distribution information for a partial transfer of compensation experience.

Q: Who needs to fill out Form C-83?

A: Employers who are transferring a portion of their workers' compensation experience to another employer in Texas need to fill out Form C-83.

Q: When should Form C-83 be filed?

A: Form C-83 should be filed within 30 days of the effective date of the transfer of compensation experience.

Q: Are there any fees associated with filing Form C-83?

A: No, there are no fees associated with filing Form C-83.

Q: What information do I need to provide on Form C-83?

A: You need to provide the employer's name, address, tax ID number, along with the detailed wage distribution information for the transfer of compensation experience.

Q: What if there are errors on Form C-83 after it has been filed?

A: If errors are found on Form C-83 after it has been filed, an amended form should be filed immediately to correct the errors.

Q: Who can I contact for help with Form C-83?

A: You can contact the Texas Department of Insurance or your workers' compensation insurance carrier for assistance with Form C-83.

Form Details:

- Released on May 15, 2015;

- The latest edition provided by the Texas Workforce Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form C-83 by clicking the link below or browse more documents and templates provided by the Texas Workforce Commission.