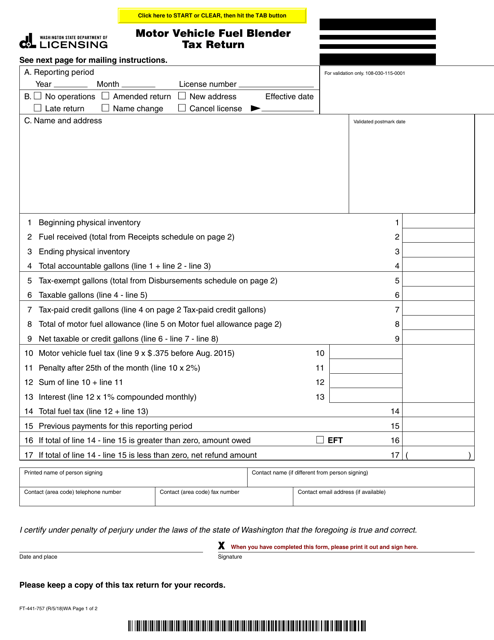

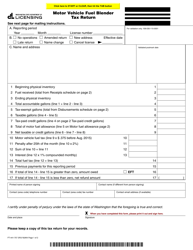

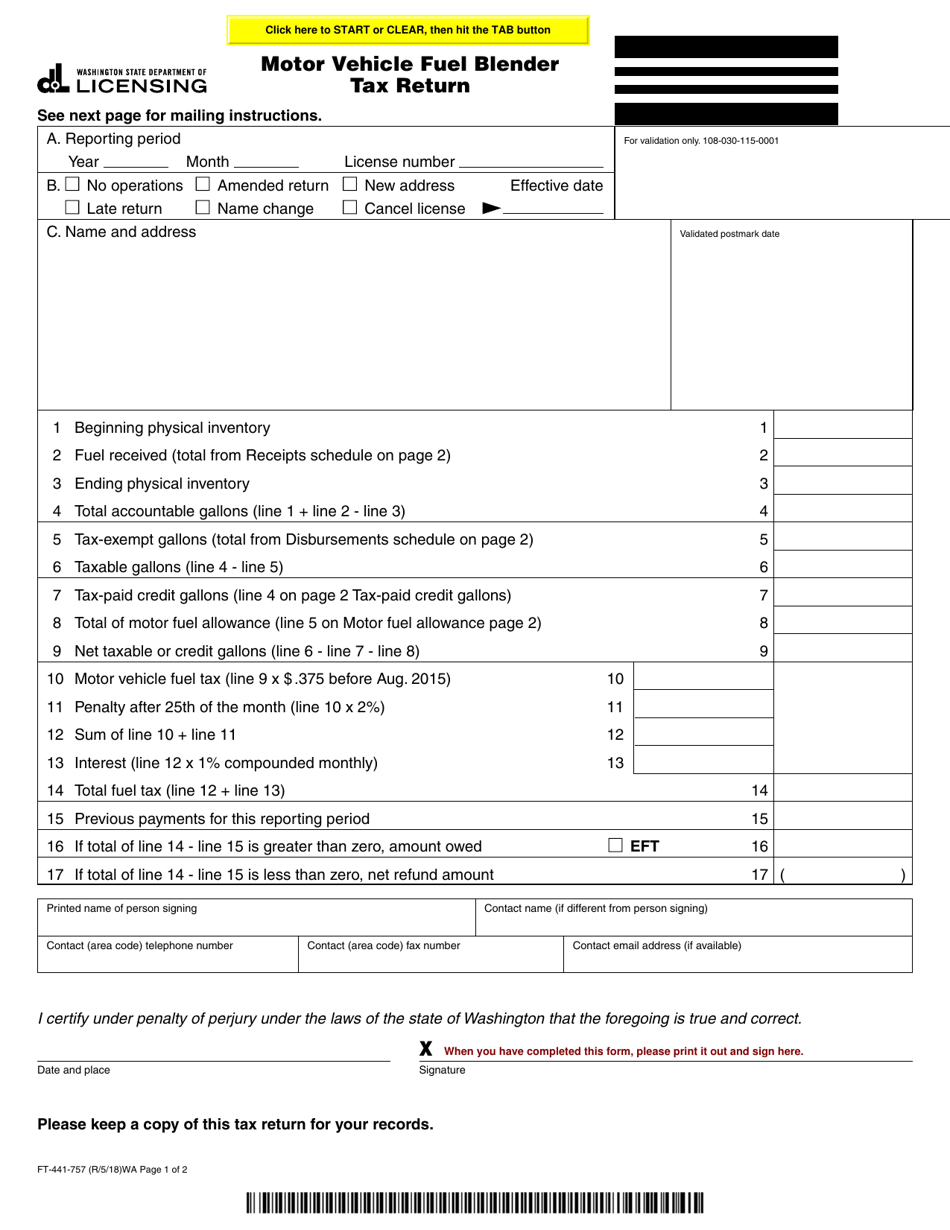

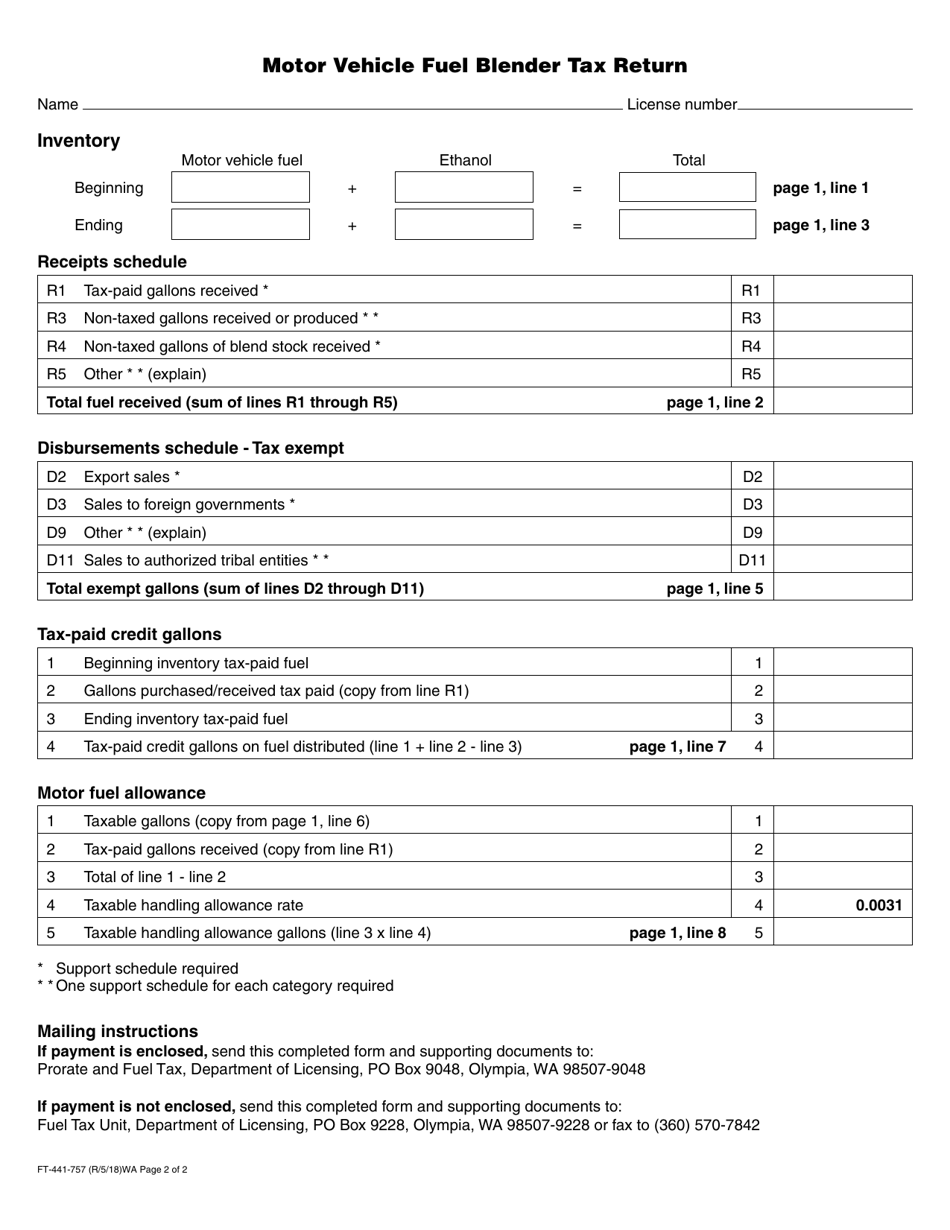

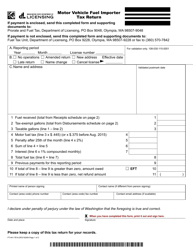

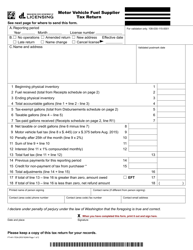

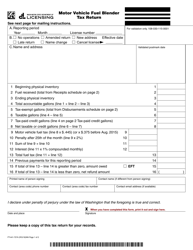

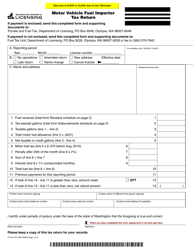

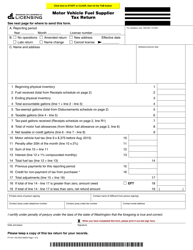

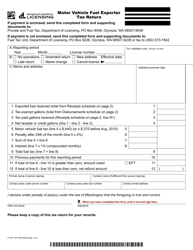

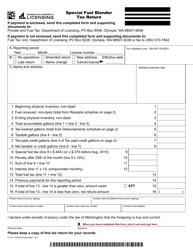

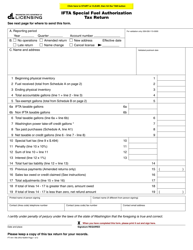

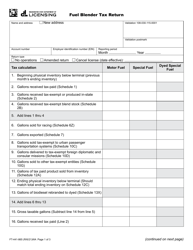

Form FT-441-757 Motor Vehicle Fuel Blender Tax Return - Washington

What Is Form FT-441-757?

This is a legal form that was released by the Washington State Department of Licensing - a government authority operating within Washington. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form FT-441-757?

A: Form FT-441-757 is the Motor Vehicle Fuel Blender Tax Return specifically for the state of Washington.

Q: Who needs to file Form FT-441-757?

A: Anyone who is a motor vehicle fuel blender and operates in Washington needs to file Form FT-441-757.

Q: What is the purpose of Form FT-441-757?

A: The purpose of Form FT-441-757 is to report and pay the motor vehicle fuel blender tax in Washington.

Q: When is Form FT-441-757 due?

A: Form FT-441-757 is due on a monthly basis, with the due date being the last day of the following month.

Q: Is there any penalty for late filing of Form FT-441-757?

A: Yes, there may be penalties for late filing of Form FT-441-757, including interest on the unpaid tax amount.

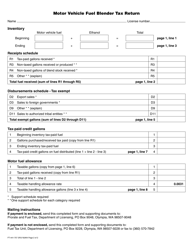

Q: Are there any exemptions or deductions available on Form FT-441-757?

A: Yes, there are certain exemptions and deductions available. It is recommended to refer to the instructions of the form for details.

Q: What if I have additional questions or need assistance with Form FT-441-757?

A: If you have additional questions or need assistance, you can contact the Washington Department of Revenue for guidance.

Form Details:

- Released on May 1, 2018;

- The latest edition provided by the Washington State Department of Licensing;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form FT-441-757 by clicking the link below or browse more documents and templates provided by the Washington State Department of Licensing.