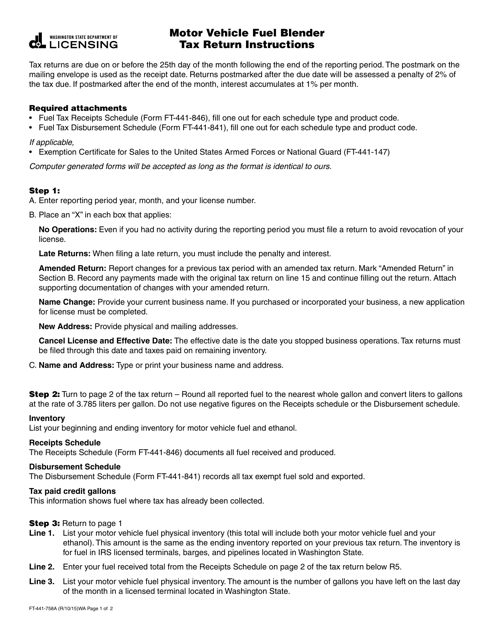

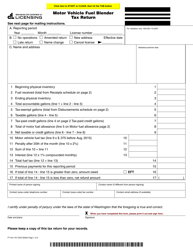

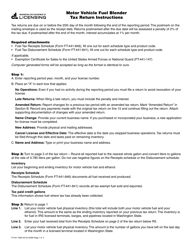

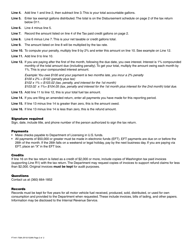

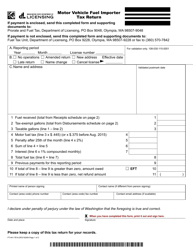

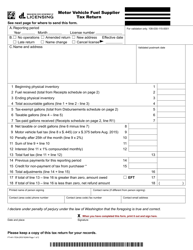

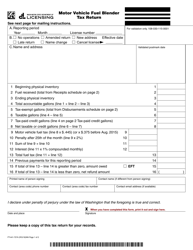

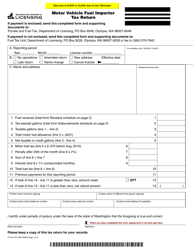

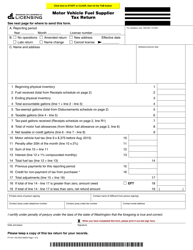

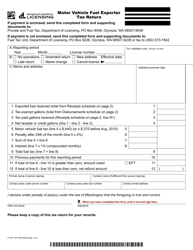

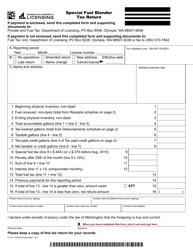

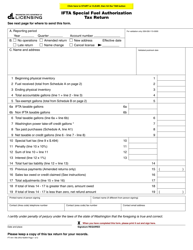

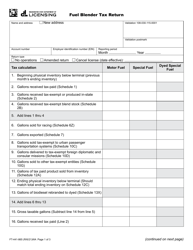

Instructions for Form FT-441-757 Motor Vehicle Fuel Blender Tax Return - Washington

This document contains official instructions for Form FT-441-757 , Motor Vehicle Fuel Blender Tax Return - a form released and collected by the Washington State Department of Licensing. An up-to-date fillable Form FT-441-757 is available for download through this link.

FAQ

Q: What is Form FT-441-757?

A: Form FT-441-757 is the Motor Vehicle Fuel Blender Tax Return.

Q: Who needs to file Form FT-441-757?

A: Fuel blenders in Washington need to file the Motor Vehicle Fuel Blender Tax Return.

Q: What is motor vehicle fuel blending?

A: Motor vehicle fuel blending is the process of combining taxable and nontaxable motor vehicle fuels to produce a blended fuel.

Q: What is the purpose of Form FT-441-757?

A: The purpose of Form FT-441-757 is to report and pay the motor vehicle fuel blender tax on blended fuels.

Q: When is Form FT-441-757 due?

A: Form FT-441-757 is due on a quarterly basis and must be filed by the last day of the month following the end of the quarter.

Q: Is there a penalty for late filing?

A: Yes, there is a penalty for late filing of Form FT-441-757. The penalty is a percentage of the tax due, based on the number of days late.

Q: How should I pay the tax due?

A: The tax due can be paid through electronic funds transfer or by mailing a check or money order with the completed form.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Washington State Department of Licensing.