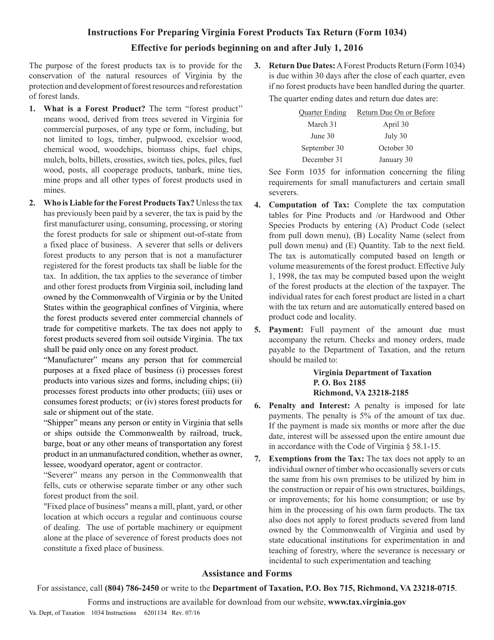

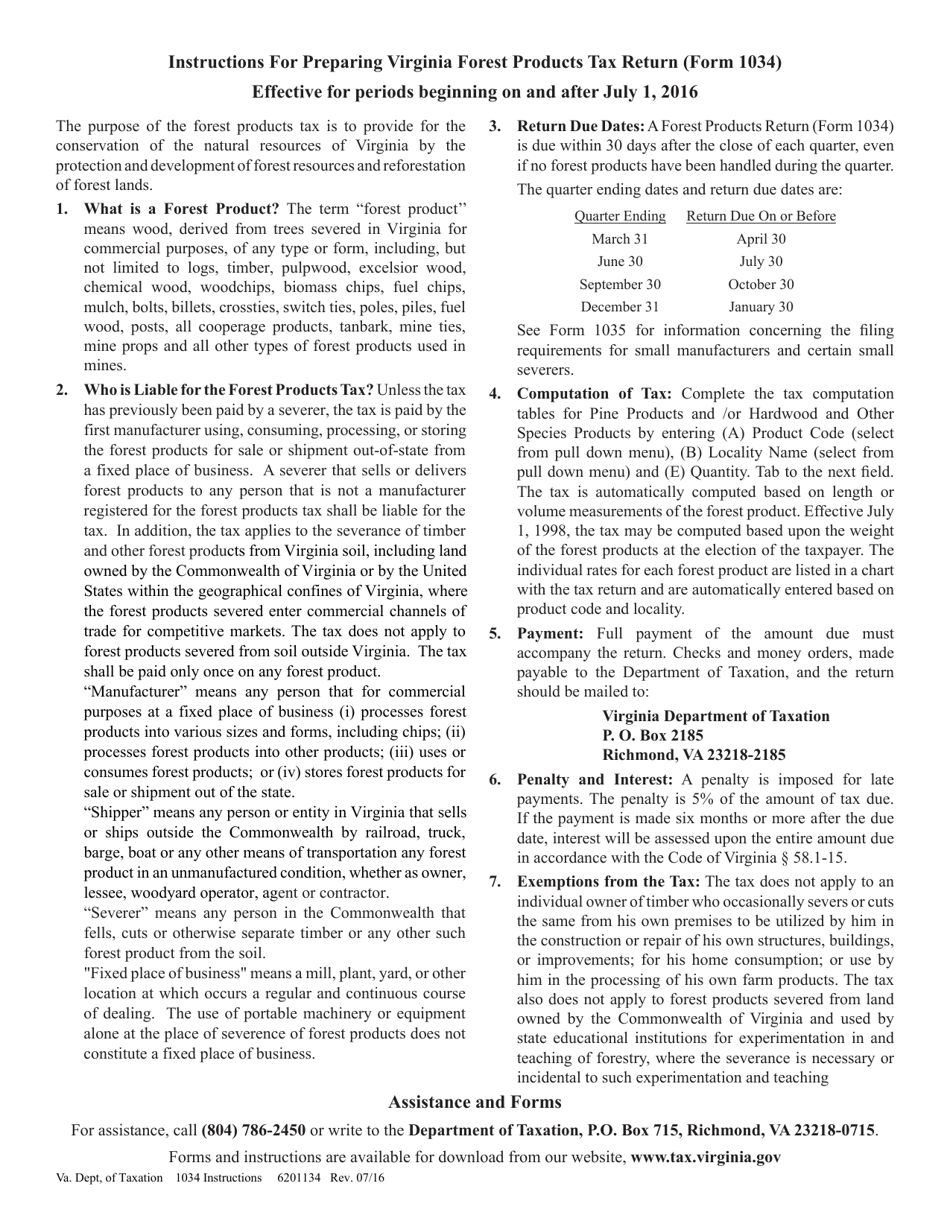

Instructions for Form 1034 Virginia Forest Products Tax Return - Virginia

This document contains official instructions for Form 1034 , Virginia Forest Products Tax Return - a form released and collected by the Virginia Department of Taxation.

FAQ

Q: What is Form 1034?

A: Form 1034 is the Virginia Forest Products Tax Return.

Q: Who needs to file Form 1034?

A: Any business or person engaged in the manufacturing, processing, or sale of forest products in Virginia needs to file Form 1034.

Q: What is the purpose of Form 1034?

A: Form 1034 is used to report and pay the Virginia Forest Products Tax.

Q: What are forest products?

A: Forest products include timber, logs, pulpwood, firewood, and other wood products harvested from Virginia forests.

Q: How often do I need to file Form 1034?

A: Form 1034 is filed quarterly. The due dates are April 30, July 31, October 31, and January 31.

Q: Are there any exemptions or deductions for the Virginia Forest Products Tax?

A: Yes, there are certain exemptions and deductions available for the Virginia Forest Products Tax. You should consult the instructions for Form 1034 for more information.

Q: What happens if I don't file Form 1034?

A: Failure to file Form 1034 or pay the required tax can result in penalties and interest.

Q: Who can I contact for help with Form 1034?

A: You can contact the Virginia Department of Taxation for assistance with Form 1034.

Instruction Details:

- This 1-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Virginia Department of Taxation.