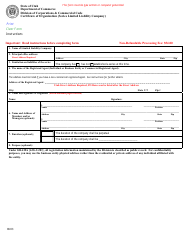

This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for

for the current year.

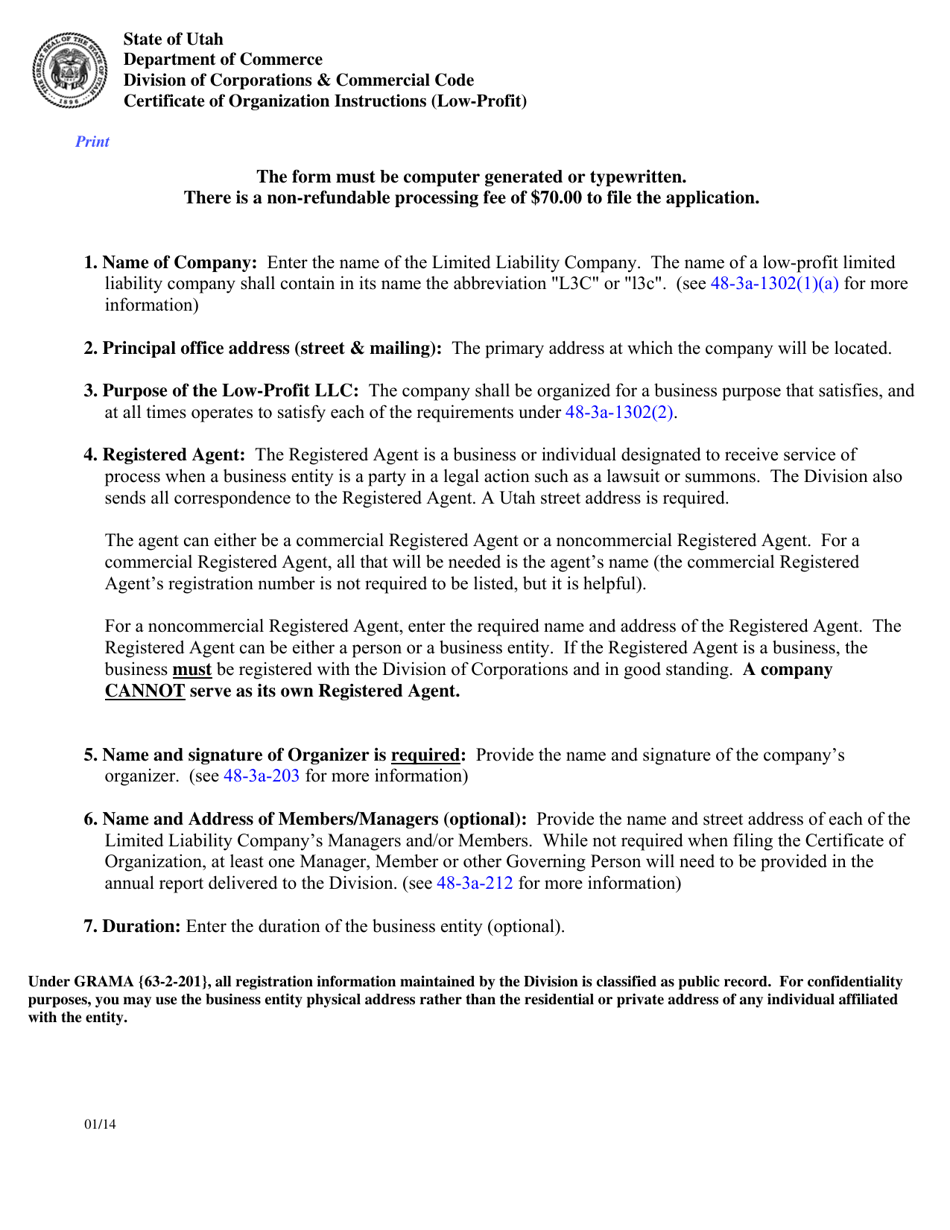

Instructions for Certificate of Organization (Low-Profit Limited Liability Company) - Utah

This document was released by Utah Department of Commerce and contains official instructions for Certificate of Organization (Low-Profit Limited Liability Company) . The up-to-date fillable form is available for download through this link.

FAQ

Q: What is a Certificate of Organization?

A: A Certificate of Organization is a legal document that creates a low-profit limited liability company (LLC) in the state of Utah.

Q: What is a low-profit limited liability company?

A: A low-profit limited liability company, or L3C, is a specific type of LLC that has a primary charitable or educational purpose.

Q: How do I file a Certificate of Organization?

A: To file a Certificate of Organization, you need to complete the required form and submit it to the Utah Division of Corporations and Commercial Code.

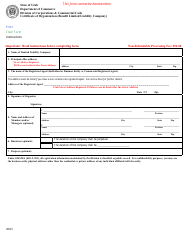

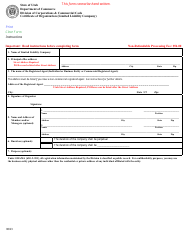

Q: What information is required in the Certificate of Organization?

A: The Certificate of Organization requires information such as the LLC's name, purpose, principal office address, registered agent, and organizer's name and address.

Q: How much does it cost to file a Certificate of Organization in Utah?

A: The filing fee for a Certificate of Organization in Utah is $70.

Q: How long does it take to process a Certificate of Organization?

A: The processing time for a Certificate of Organization in Utah is typically 5-10 business days.

Q: Do I need to have an operating agreement for my L3C?

A: While not required by law, it is recommended to have an operating agreement that outlines the management and operation of the L3C.

Q: Can a foreign LLC form an L3C in Utah?

A: Yes, a foreign LLC can form an L3C in Utah by filing a Certificate of Authority with the Utah Division of Corporations and Commercial Code.

Q: What are the benefits of forming an L3C?

A: Forming an L3C can provide certain tax advantages and allow your organization to attract investments from foundations and other philanthropic entities.

Q: Can an L3C convert to a regular LLC?

A: Yes, an L3C can convert to a regular LLC by filing a Certificate of Conversion with the Utah Division of Corporations and Commercial Code.

Instruction Details:

- This 1-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library legal documents released by the Utah Department of Commerce.