This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

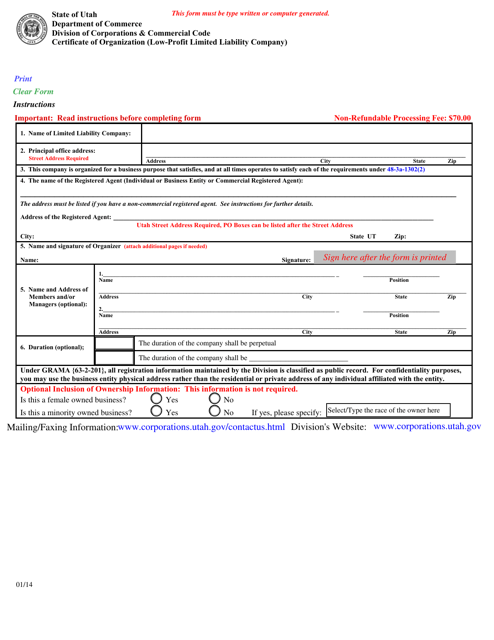

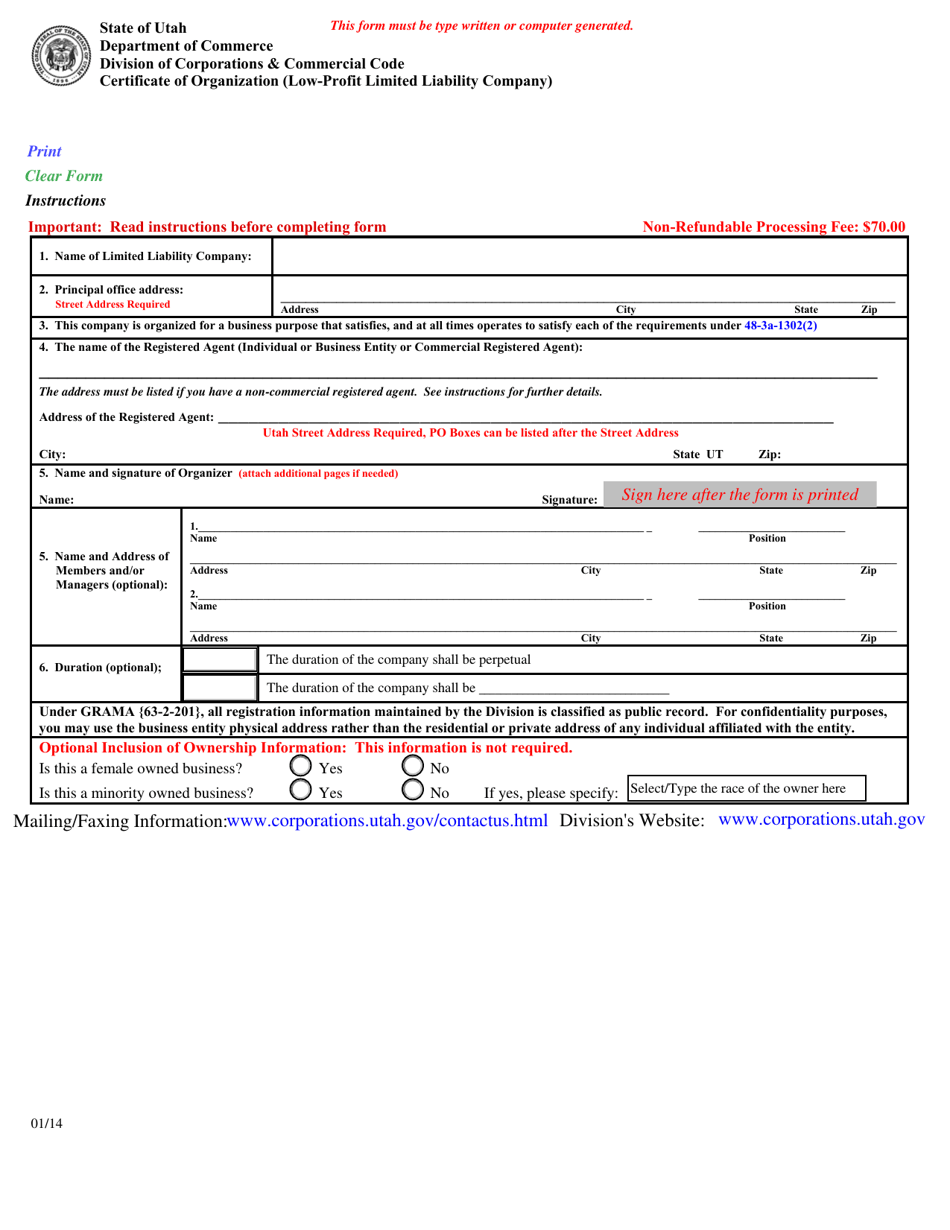

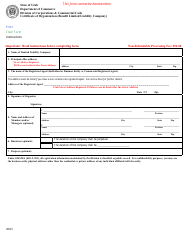

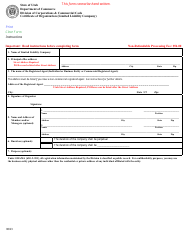

Certificate of Organization (Low-Profit Limited Liability Company) - Utah

Certificate of Organization (Low-Profit Limited Liability Company) is a legal document that was released by the Utah Department of Commerce - a government authority operating within Utah.

FAQ

Q: What is a Certificate of Organization?

A: A Certificate of Organization is a legal document that establishes a Low-Profit Limited Liability Company (LLC) in Utah.

Q: What is a Low-Profit Limited Liability Company (LLC)?

A: A Low-Profit Limited Liability Company (LLC) is a type of business entity that allows for both profit-making and socially beneficial activities.

Q: How do I file a Certificate of Organization for a Low-Profit LLC in Utah?

A: To file a Certificate of Organization for a Low-Profit LLC in Utah, you need to submit the necessary forms and pay the required fees to the Utah Division of Corporations and Commercial Code.

Q: What information is required for a Certificate of Organization?

A: The Certificate of Organization requires information such as the LLC's name, purpose, duration, registered agent, and the names and addresses of the LLC's organizers.

Q: What is the fee for filing a Certificate of Organization in Utah?

A: As of 2021, the fee for filing a Certificate of Organization for a Low-Profit LLC in Utah is $70.

Q: Do I need an attorney to file a Certificate of Organization?

A: While not required, it is recommended to consult with an attorney or a business professional familiar with Utah's LLC laws to ensure the accuracy of your filing.

Q: What types of activities can a Low-Profit LLC engage in?

A: A Low-Profit LLC can engage in activities that have both a financial return and a beneficial social or charitable impact.

Q: Can a Low-Profit LLC distribute profits to its members?

A: Yes, a Low-Profit LLC can distribute profits to its members, but it must prioritize its social or charitable purposes over maximum profit generation.

Q: Are there any ongoing reporting requirements for a Low-Profit LLC in Utah?

A: Yes, a Low-Profit LLC in Utah is required to file an Annual Report with the Utah Division of Corporations and Commercial Code and pay the associated fee.

Q: What is the difference between a Low-Profit LLC and a regular LLC?

A: The main difference is that a Low-Profit LLC has a primary purpose of engaging in activities that provide social or charitable benefits, while a regular LLC is primarily focused on maximizing profits.

Form Details:

- Released on January 1, 2014;

- The latest edition currently provided by the Utah Department of Commerce;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Utah Department of Commerce.