This version of the form is not currently in use and is provided for reference only. Download this version of

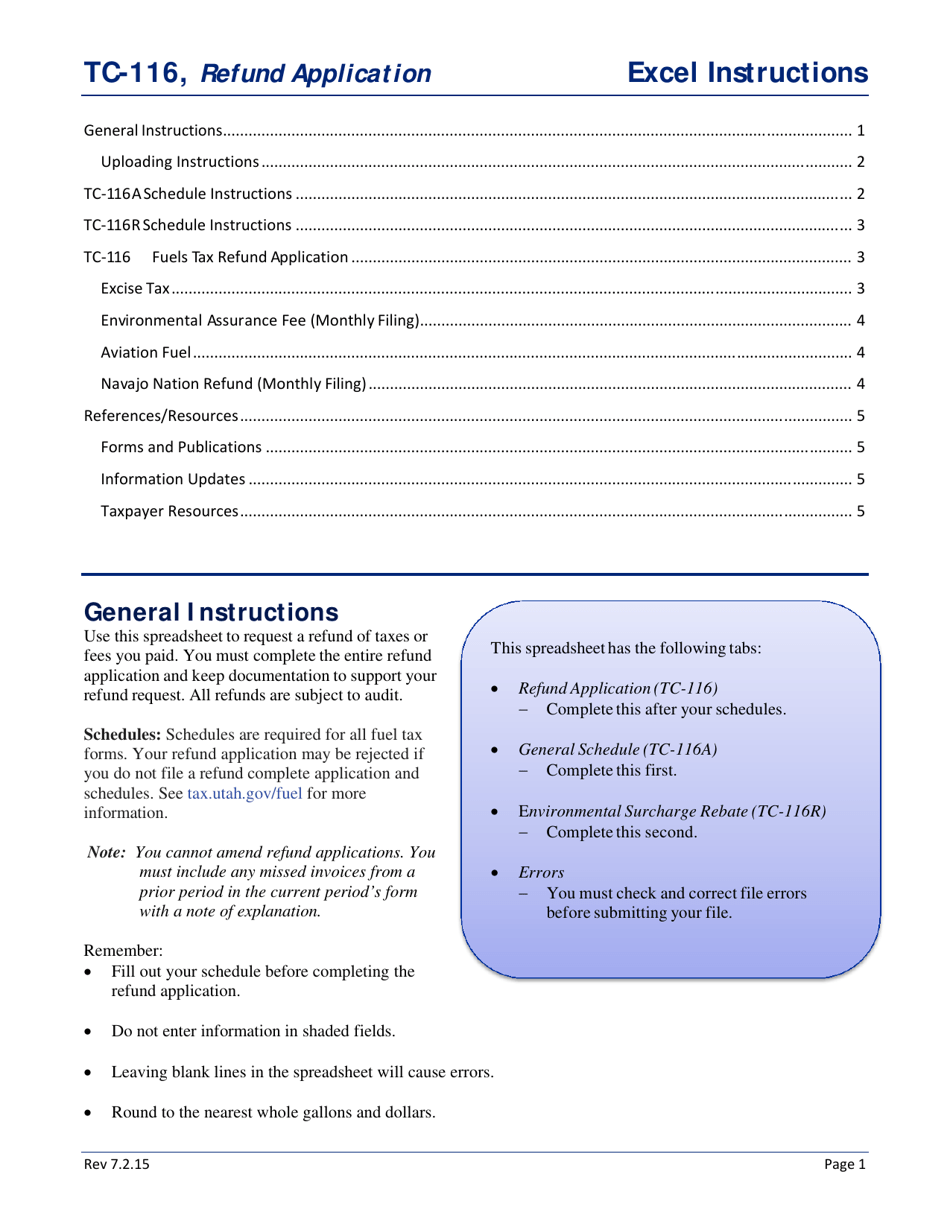

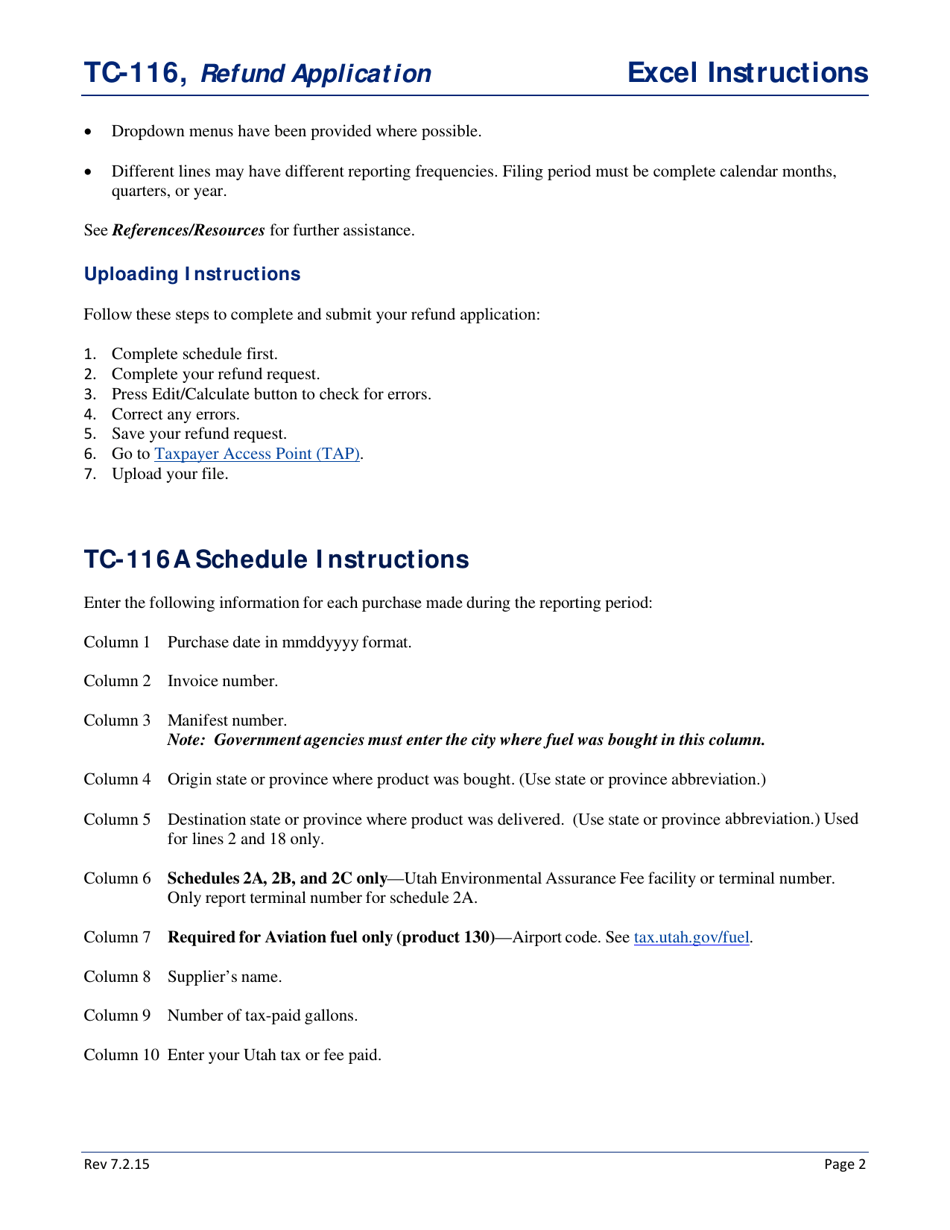

Instructions for Form TC-116

for the current year.

Instructions for Form TC-116 Fuels Tax Refund Application - Utah

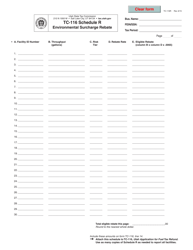

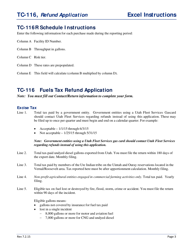

This document contains official instructions for Form TC-116 , Fuels Tax Refund Application - a form released and collected by the Utah State Tax Commission. An up-to-date fillable Form TC-116 Schedule R is available for download through this link.

FAQ

Q: What is Form TC-116?

A: Form TC-116 is the Fuels Tax Refund Application for Utah.

Q: Who can use Form TC-116?

A: Any individual, business, or government entity who purchased fuel in Utah may use Form TC-116.

Q: What is the purpose of Form TC-116?

A: The purpose of Form TC-116 is to apply for a refund of fuels tax paid on fuel purchased in Utah.

Q: What information do I need to complete Form TC-116?

A: You will need to provide detailed information about each fuel purchase, including the date of purchase, the type and quantity of fuel purchased, and the amount of fuels tax paid.

Q: When is the deadline to submit Form TC-116?

A: Form TC-116 must be submitted within 12 months from the end of the month in which the fuel was purchased.

Q: How long does it take to process a refund application?

A: Processing times for refund applications vary, but it generally takes about 4 to 6 weeks for a refund to be processed.

Q: Are there any specific eligibility requirements for the fuels tax refund?

A: Yes, there are specific eligibility requirements outlined in the instructions for Form TC-116. These requirements include providing proof of payment for the fuel, meeting minimum purchase thresholds, and ensuring the fuel was not used for exempt purposes.

Q: Can I e-file Form TC-116?

A: No, Form TC-116 must be submitted by mail or in person.

Q: Who do I contact if I have questions about Form TC-116?

A: If you have questions about Form TC-116 or need assistance with your fuels tax refund application, you can contact the Utah State Tax Commission.

Instruction Details:

- This 5-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Utah State Tax Commission.