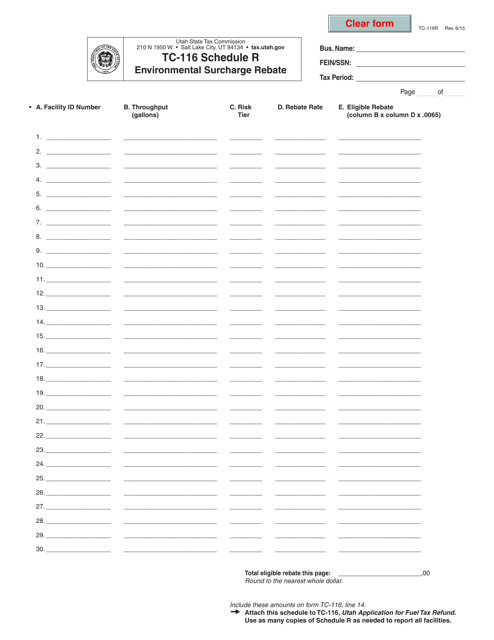

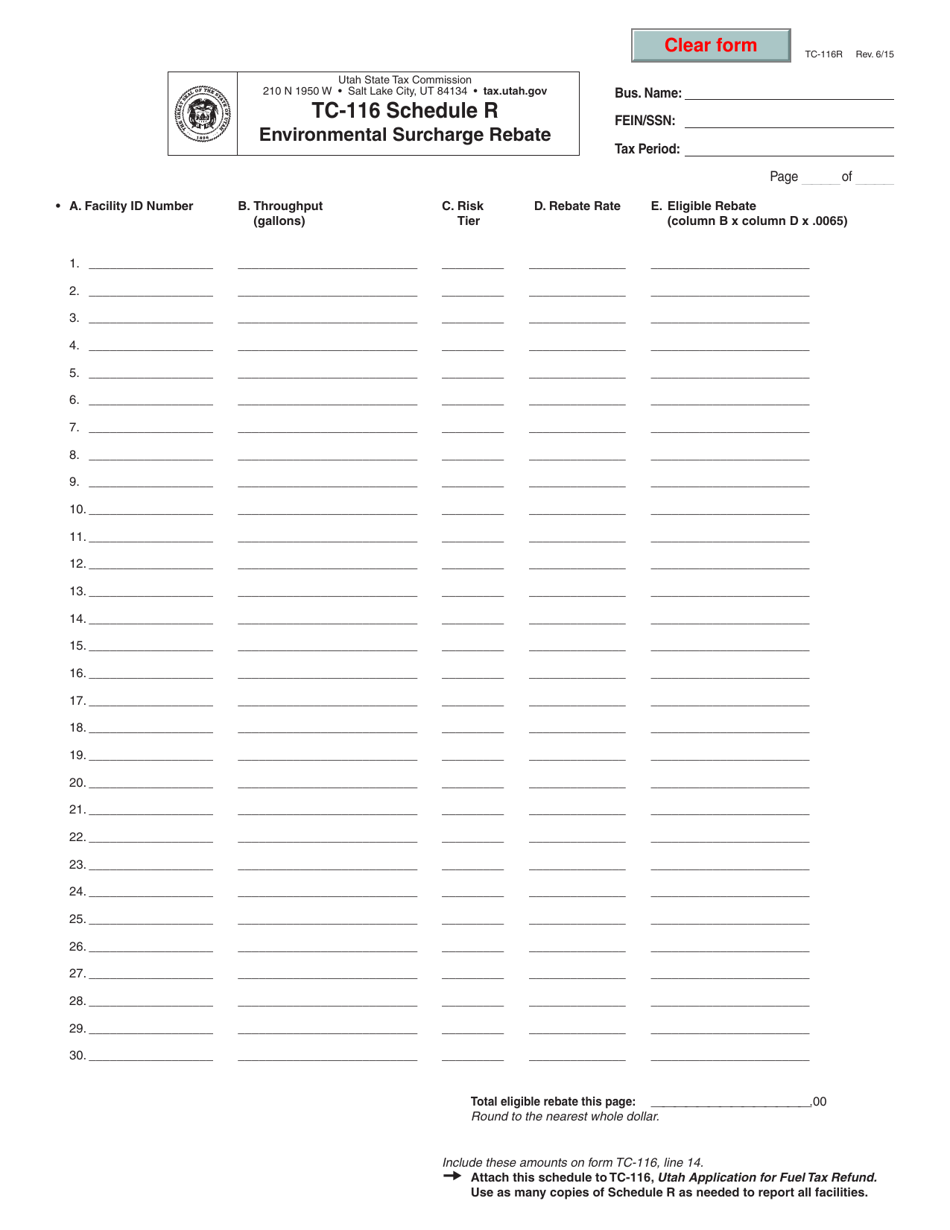

Form TC-116 Schedule R Environmental Surcharge Rebate - Utah

What Is Form TC-116 Schedule R?

This is a legal form that was released by the Utah State Tax Commission - a government authority operating within Utah. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form TC-116 Schedule R?

A: Form TC-116 Schedule R is a tax form used in the state of Utah.

Q: What is the purpose of Form TC-116 Schedule R?

A: The purpose of Form TC-116 Schedule R is to claim a rebate for the environmental surcharge paid on certain goods.

Q: Who needs to fill out Form TC-116 Schedule R?

A: Individuals or businesses in Utah who have paid an environmental surcharge on eligible items and wish to claim a rebate.

Q: What is the environmental surcharge rebate for?

A: The environmental surcharge rebate is for certain items that have an additional charge to help fund environmental programs in Utah.

Q: Is there a deadline to submit Form TC-116 Schedule R?

A: Yes, the deadline to submit Form TC-116 Schedule R is typically April 15th of the year following the calendar year in which the surcharge was paid.

Q: What documents do I need to include with Form TC-116 Schedule R?

A: You will need to attach the original receipts or invoices for the items on which you paid the environmental surcharge.

Q: Can I file Form TC-116 Schedule R electronically?

A: No, Form TC-116 Schedule R must be filed by mail.

Q: How long does it take to receive the environmental surcharge rebate?

A: The processing time for the rebate can vary, but it is typically around 8-12 weeks.

Form Details:

- Released on June 1, 2015;

- The latest edition provided by the Utah State Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form TC-116 Schedule R by clicking the link below or browse more documents and templates provided by the Utah State Tax Commission.