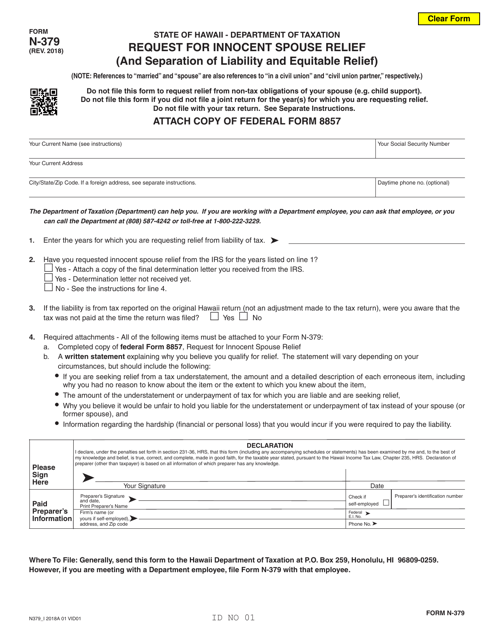

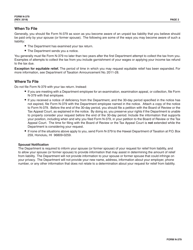

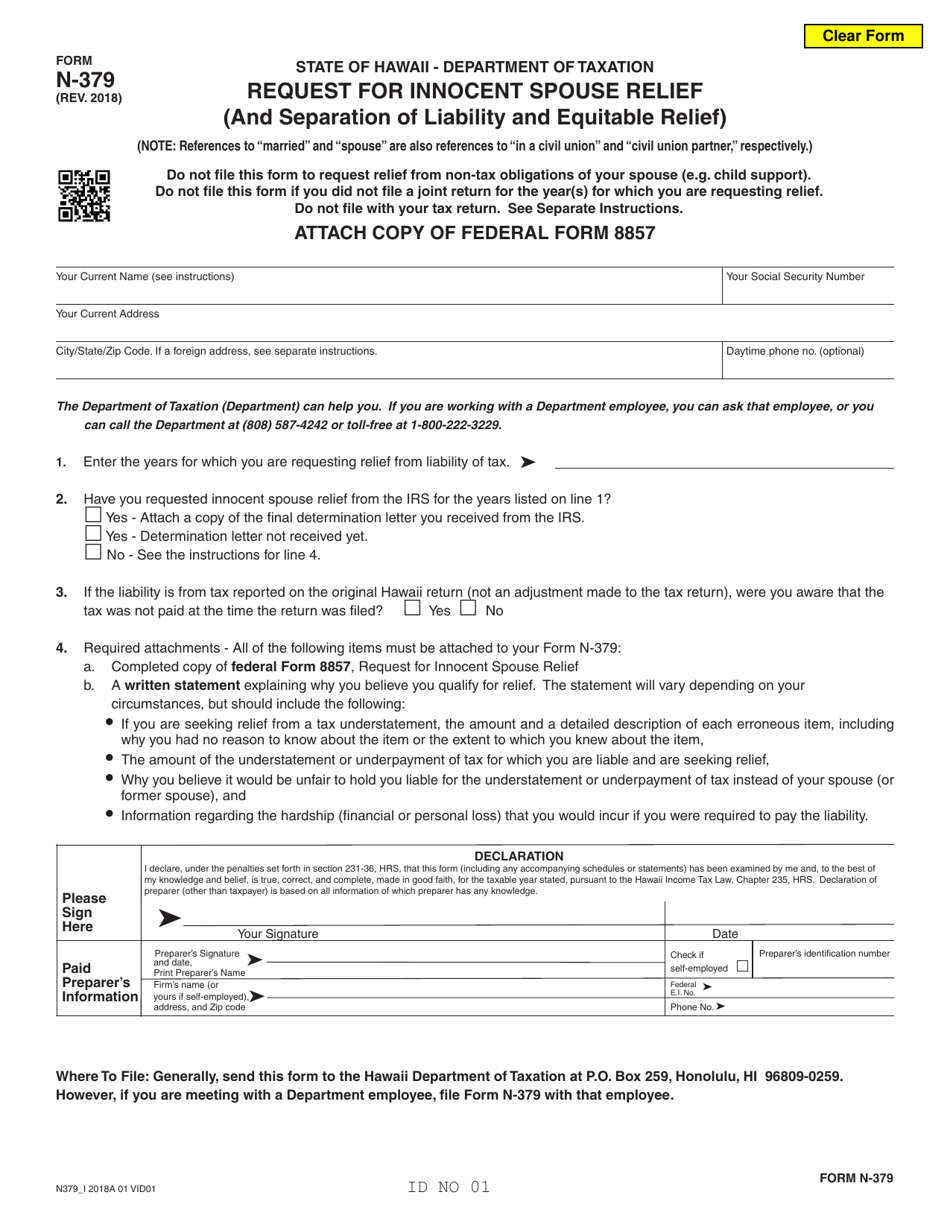

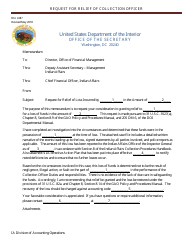

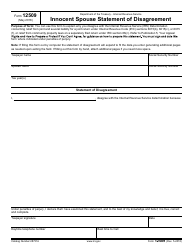

Form N-379 Request for Innocent Spouse Relief (And Separation of Liability and Equitable Relief) - Hawaii

What Is Form N-379?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form N-379?

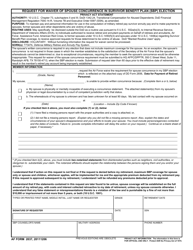

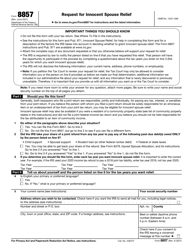

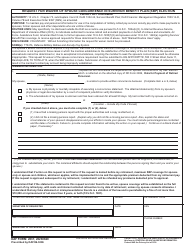

A: Form N-379 is a request forInnocent Spouse Relief, Separation of Liability, and Equitable Relief.

Q: What is Innocent Spouse Relief?

A: Innocent Spouse Relief is a way to avoid being held responsible for your spouse's or former spouse's tax debt.

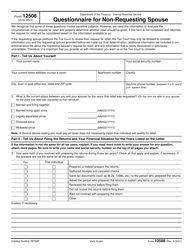

Q: What is Separation of Liability?

A: Separation of Liability allocates the tax debt between you and your spouse or former spouse.

Q: What is Equitable Relief?

A: Equitable Relief provides relief from tax debt if you do not qualify for Innocent Spouse Relief or Separation of Liability.

Q: Who can file Form N-379?

A: You can file Form N-379 if you are seeking Innocent Spouse Relief, Separation of Liability, or Equitable Relief for tax debts incurred by your spouse or former spouse.

Form Details:

- Released on January 1, 2018;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form N-379 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.