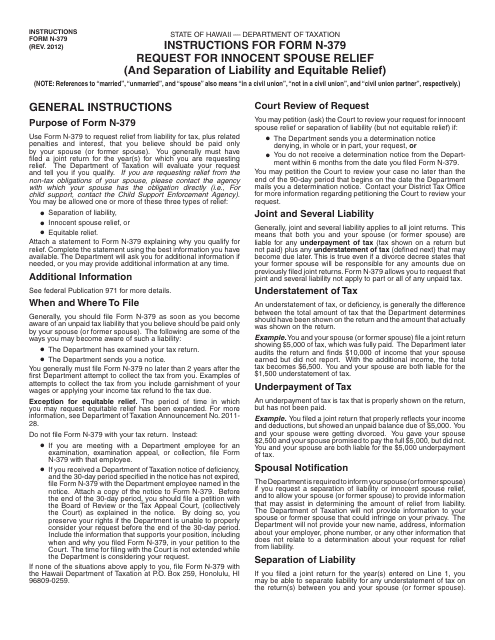

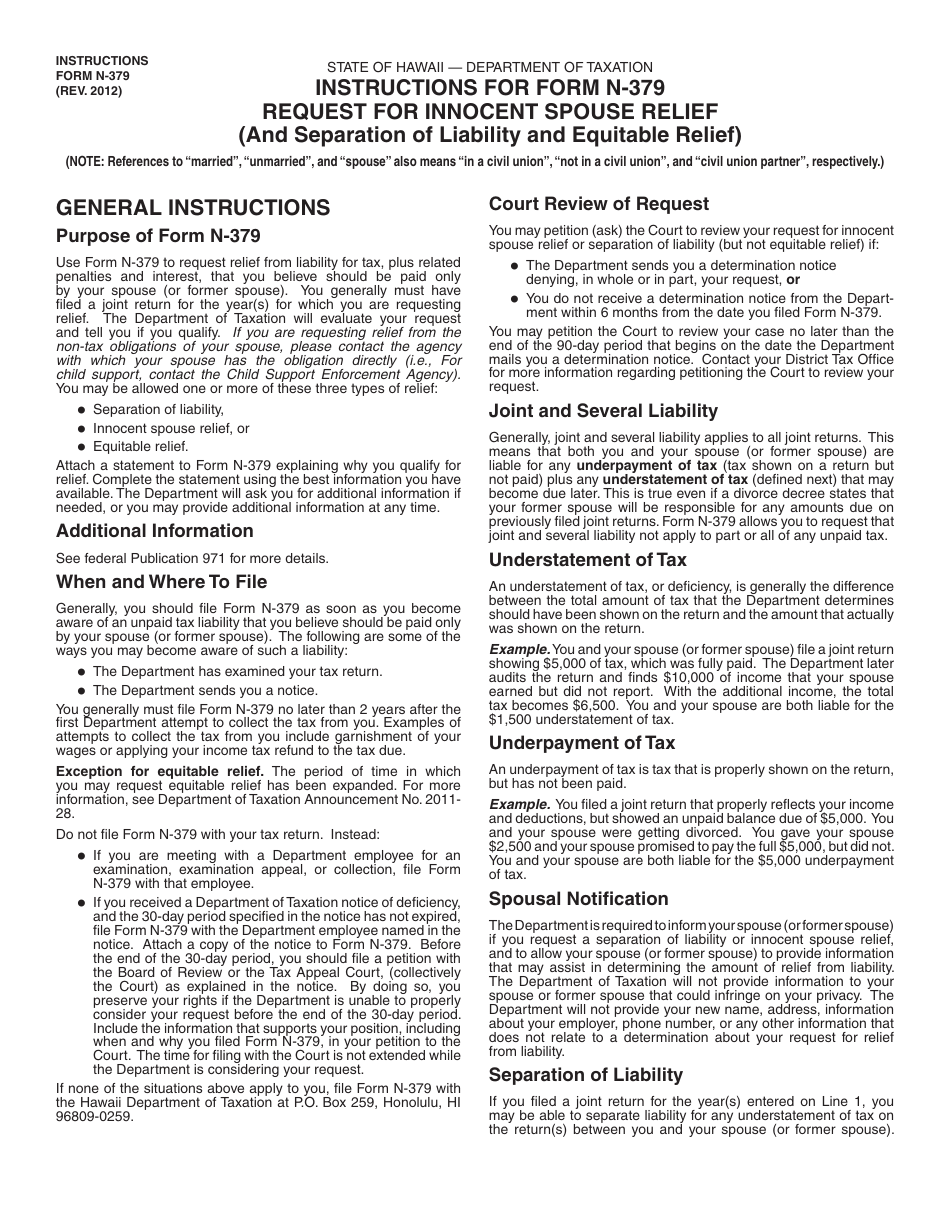

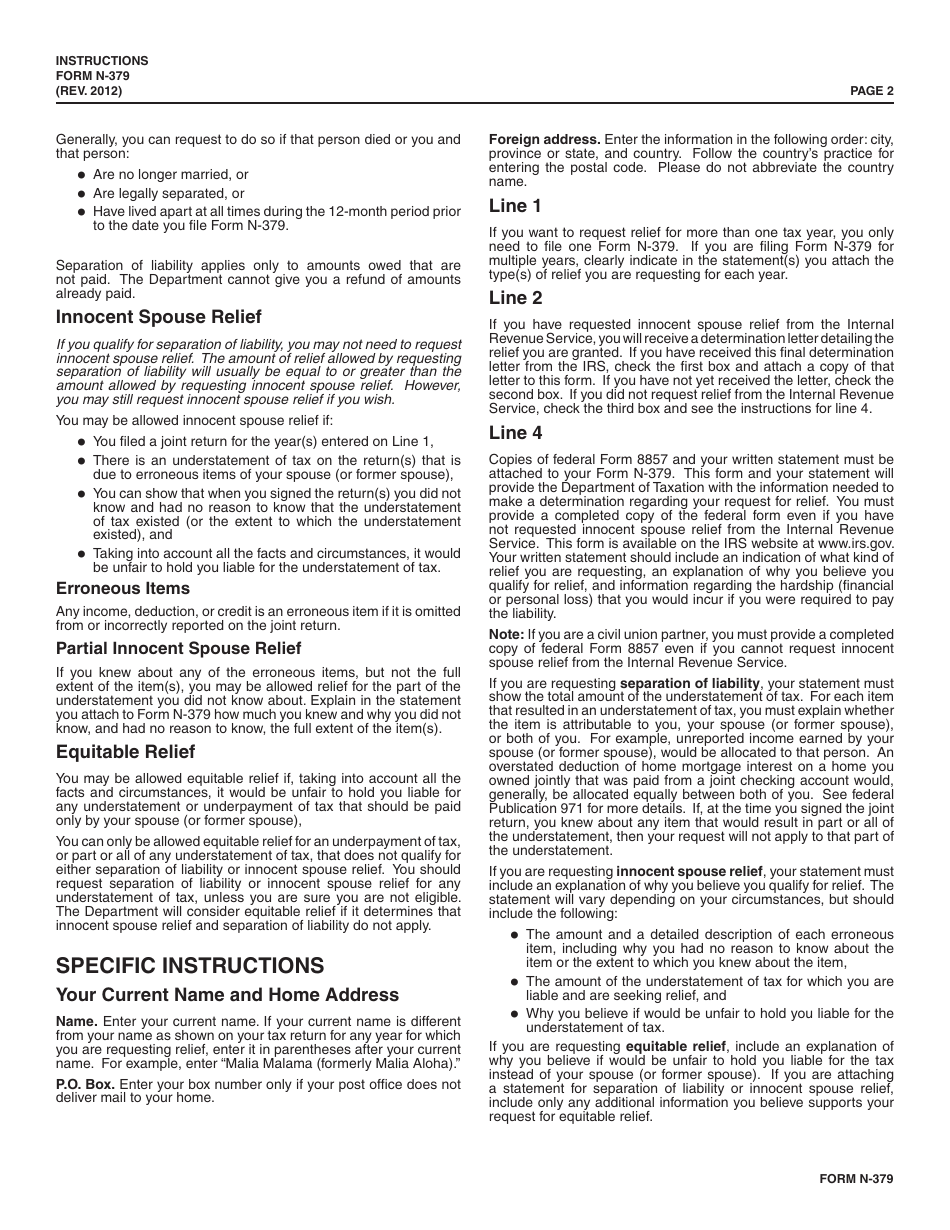

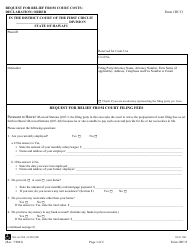

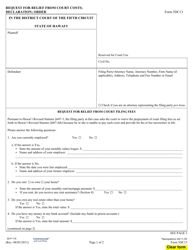

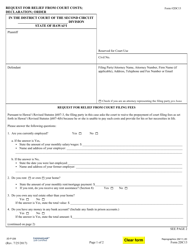

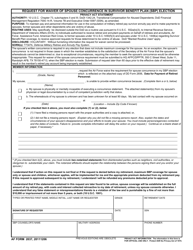

Instructions for Form N-379 Request for Innocent Spouse Relief - Hawaii

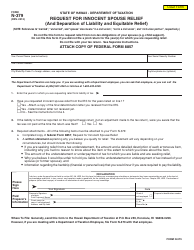

This document contains official instructions for Form N-379 , Request for Innocent Spouse Relief - a form released and collected by the Hawaii Department of Taxation. An up-to-date fillable Form N-379 is available for download through this link.

FAQ

Q: What is Form N-379?

A: Form N-379 is the Request for Innocent Spouse Relief form in Hawaii.

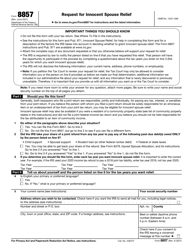

Q: What is Innocent Spouse Relief?

A: Innocent Spouse Relief is a way for an individual to be relieved of joint tax liability for a tax year.

Q: Who can file Form N-379?

A: An individual who is seeking Innocent Spouse Relief in Hawaii can file Form N-379.

Q: What information is required on Form N-379?

A: Form N-379 requires information about both spouses, the tax years in question, and reasons for seeking Innocent Spouse Relief.

Q: Are there any fees to file Form N-379?

A: No, there are no fees required to file Form N-379.

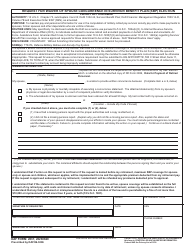

Q: What happens after I submit Form N-379?

A: After you submit Form N-379, the Hawaii Department of Taxation will review your request and make a determination on your eligibility for Innocent Spouse Relief.

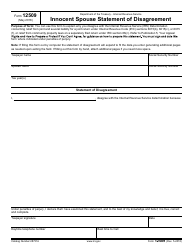

Q: Can I appeal if my request for Innocent Spouse Relief is denied?

A: Yes, if your request for Innocent Spouse Relief is denied, you have the right to appeal the decision.

Q: How long does it take to process Form N-379?

A: The processing time for Form N-379 may vary, but it is typically several weeks to several months.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Hawaii Department of Taxation.