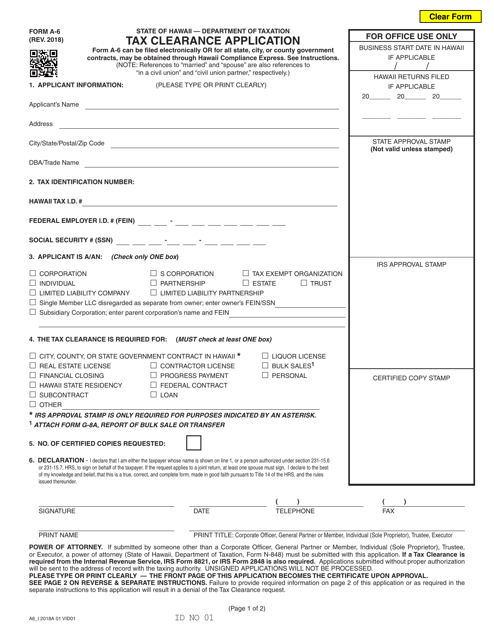

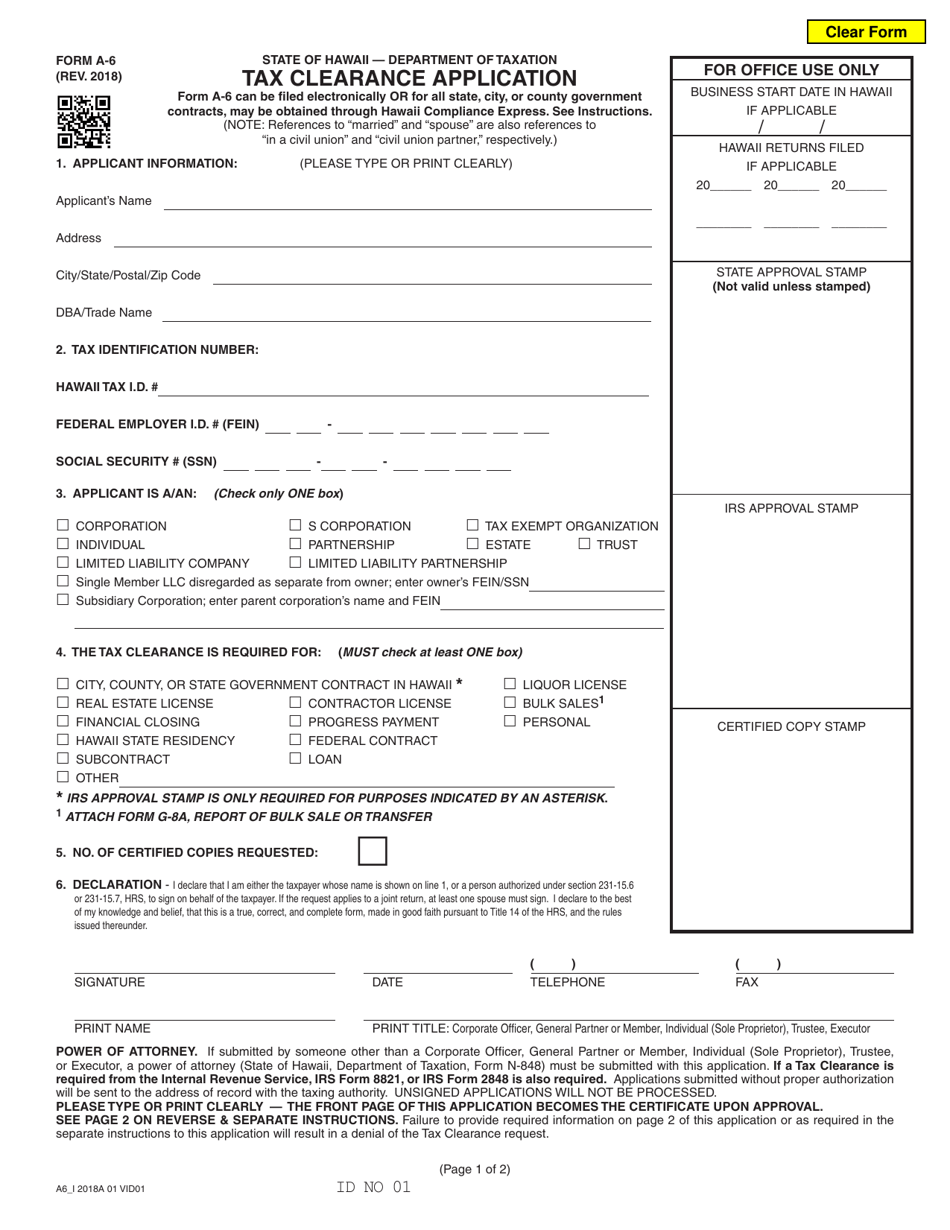

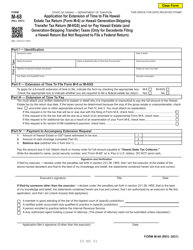

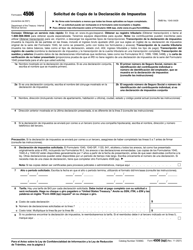

This version of the form is not currently in use and is provided for reference only. Download this version of

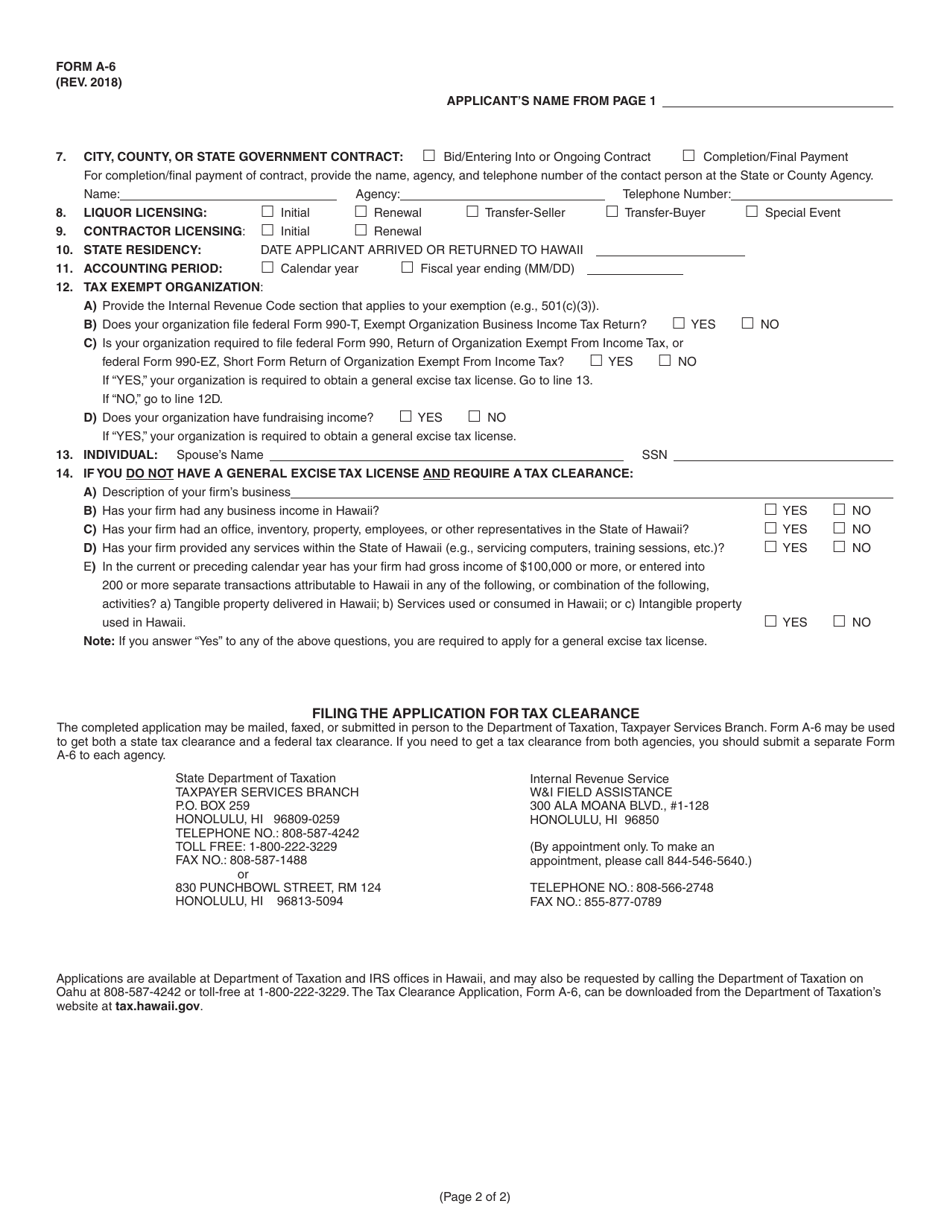

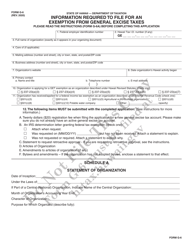

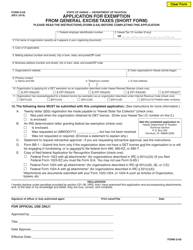

Form A-6

for the current year.

Form A-6 Tax Clearance Application - Hawaii

What Is Form A-6?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. Check the official instructions before completing and submitting the form.

FAQ

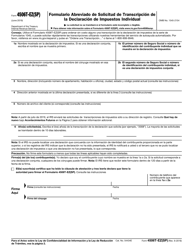

Q: What is Form A-6?

A: Form A-6 is a tax clearance application form for the state of Hawaii.

Q: Who needs to fill out Form A-6?

A: Any individual or business entity that wishes to obtain a tax clearance certificate from the state of Hawaii.

Q: What is a tax clearance certificate?

A: A tax clearance certificate is a document that confirms that the applicant has no outstanding tax liabilities with the state of Hawaii.

Q: Why would I need a tax clearance certificate?

A: A tax clearance certificate may be required for various purposes, such as obtaining a business license, selling real estate, or participating in certain government contracts in the state of Hawaii.

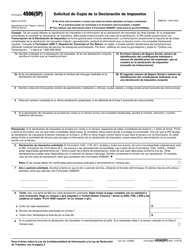

Q: How do I fill out Form A-6?

A: The form requires basic information about the applicant and their tax identification number, as well as a certification of compliance with Hawaii tax laws.

Q: Is there a fee for filing Form A-6?

A: No, there is no fee for filing Form A-6.

Q: How long does it take to receive a tax clearance certificate?

A: The processing time for a tax clearance certificate can vary, but it is typically issued within 10 business days.

Q: What happens if I have outstanding tax liabilities?

A: If you have outstanding tax liabilities, you will not be issued a tax clearance certificate until those liabilities are resolved.

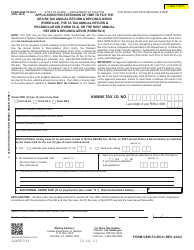

Form Details:

- Released on January 1, 2018;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form A-6 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.