This version of the form is not currently in use and is provided for reference only. Download this version of

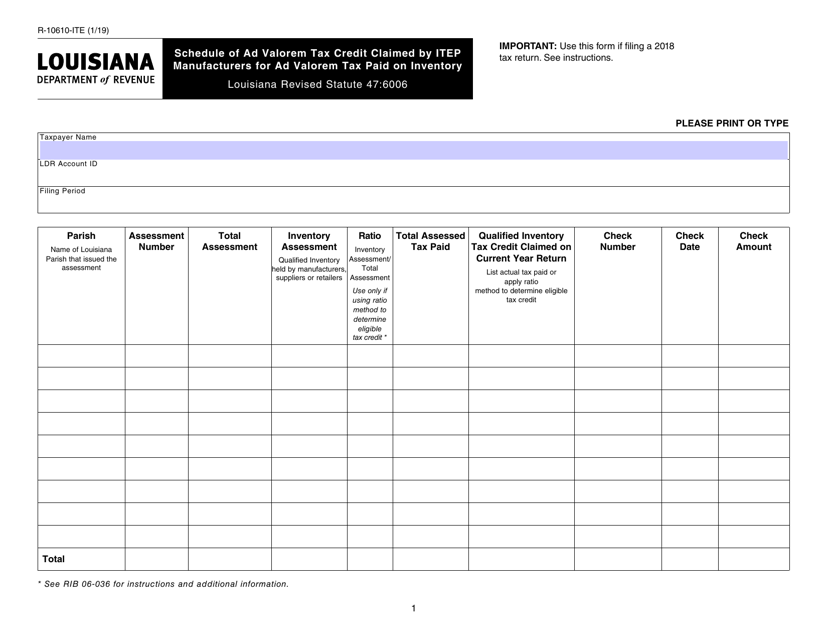

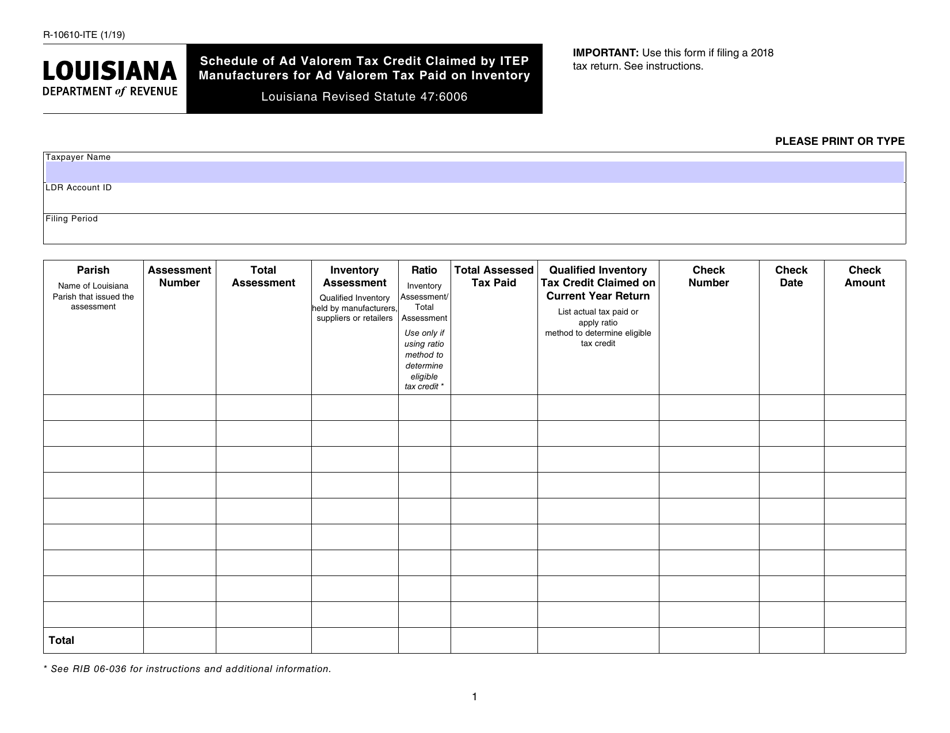

Form R-10610-ITE

for the current year.

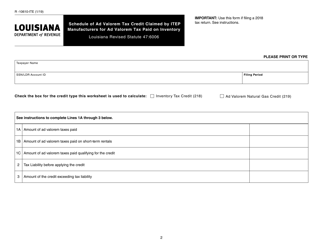

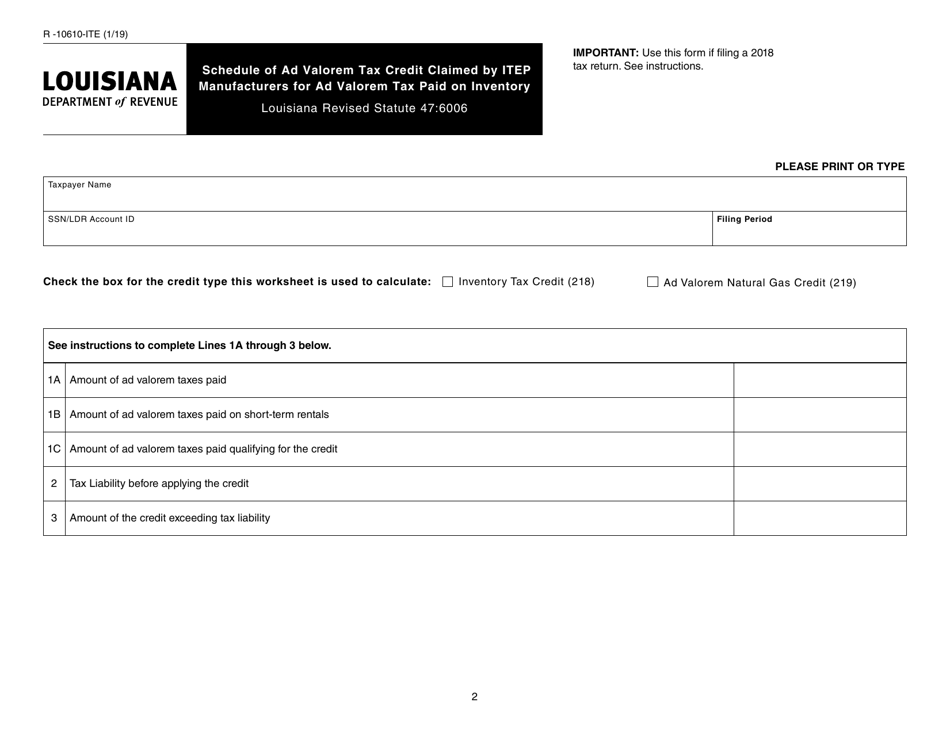

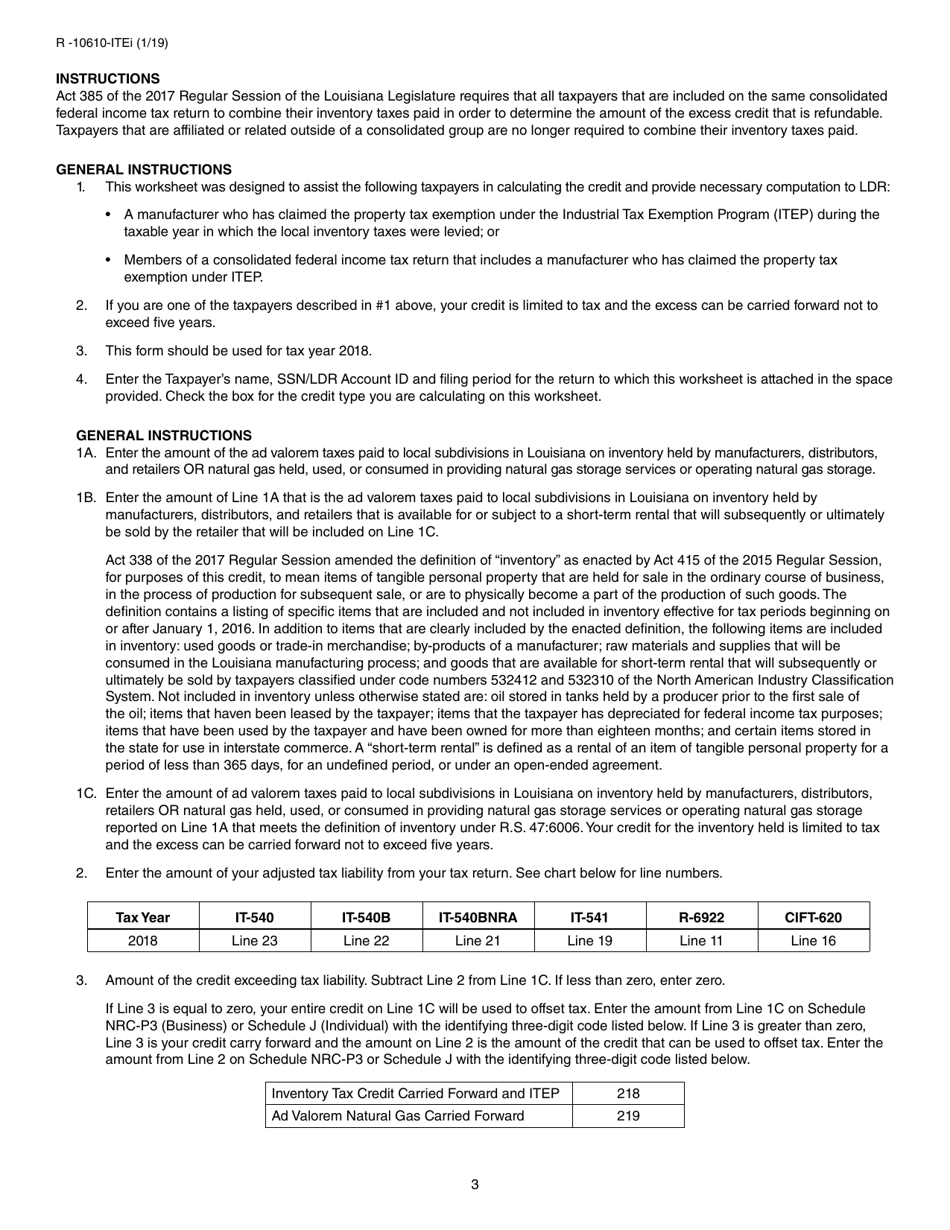

Form R-10610-ITE Schedule of Ad Valorem Tax Credit Claimed by Itepmanufacturers for Ad Valorem Tax Paid on Inventory - Louisiana

What Is Form R-10610-ITE?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form R-10610-ITE?

A: Form R-10610-ITE is a schedule used for claiming ad valorem tax credit by Itep manufacturers in Louisiana.

Q: What is an ad valorem tax?

A: Ad valorem tax is a tax levied on the value of real estate or personal property.

Q: Who can use Form R-10610-ITE?

A: Form R-10610-ITE is used by Itep manufacturers in Louisiana.

Q: What is an Itep manufacturer?

A: An Itep manufacturer is a manufacturer who is participating in the Industrial Tax Exemption Program (ITEP) in Louisiana.

Q: What is the purpose of claiming ad valorem tax credit?

A: The purpose of claiming ad valorem tax credit is to offset or reduce the amount of ad valorem tax paid on inventory by Itep manufacturers.

Q: How is the ad valorem tax credit claimed?

A: The ad valorem tax credit is claimed by filling out and submitting Form R-10610-ITE.

Q: Is the ad valorem tax credit applicable to all types of businesses?

A: No, the ad valorem tax credit is specifically available to the Itep manufacturers participating in ITEP.

Q: What other forms or documents are required along with Form R-10610-ITE?

A: Along with Form R-10610-ITE, a copy of the ad valorem tax assessment or bill and supporting documentation of the ad valorem tax paid on inventory must be submitted.

Q: Are there any deadlines for submitting Form R-10610-ITE?

A: Yes, the form must be submitted on or before the due date for filing the annual Louisiana corporation income and franchise tax return.

Form Details:

- Released on January 1, 2019;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-10610-ITE by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.