This version of the form is not currently in use and is provided for reference only. Download this version of

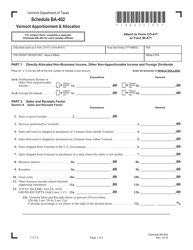

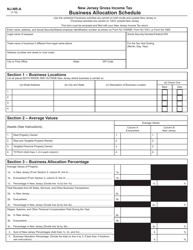

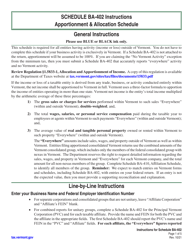

Instructions for Schedule BA-402

for the current year.

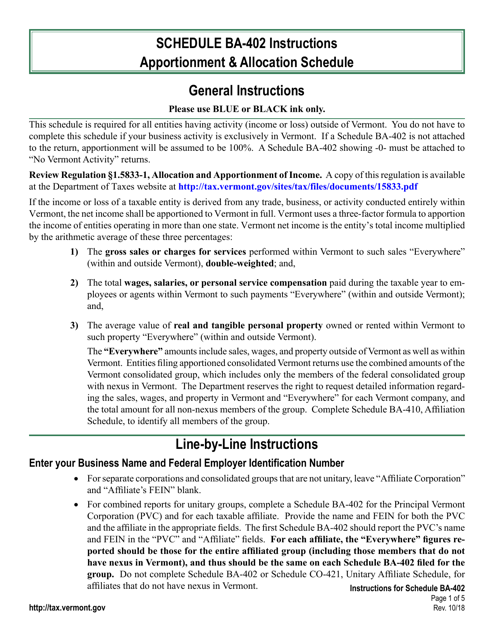

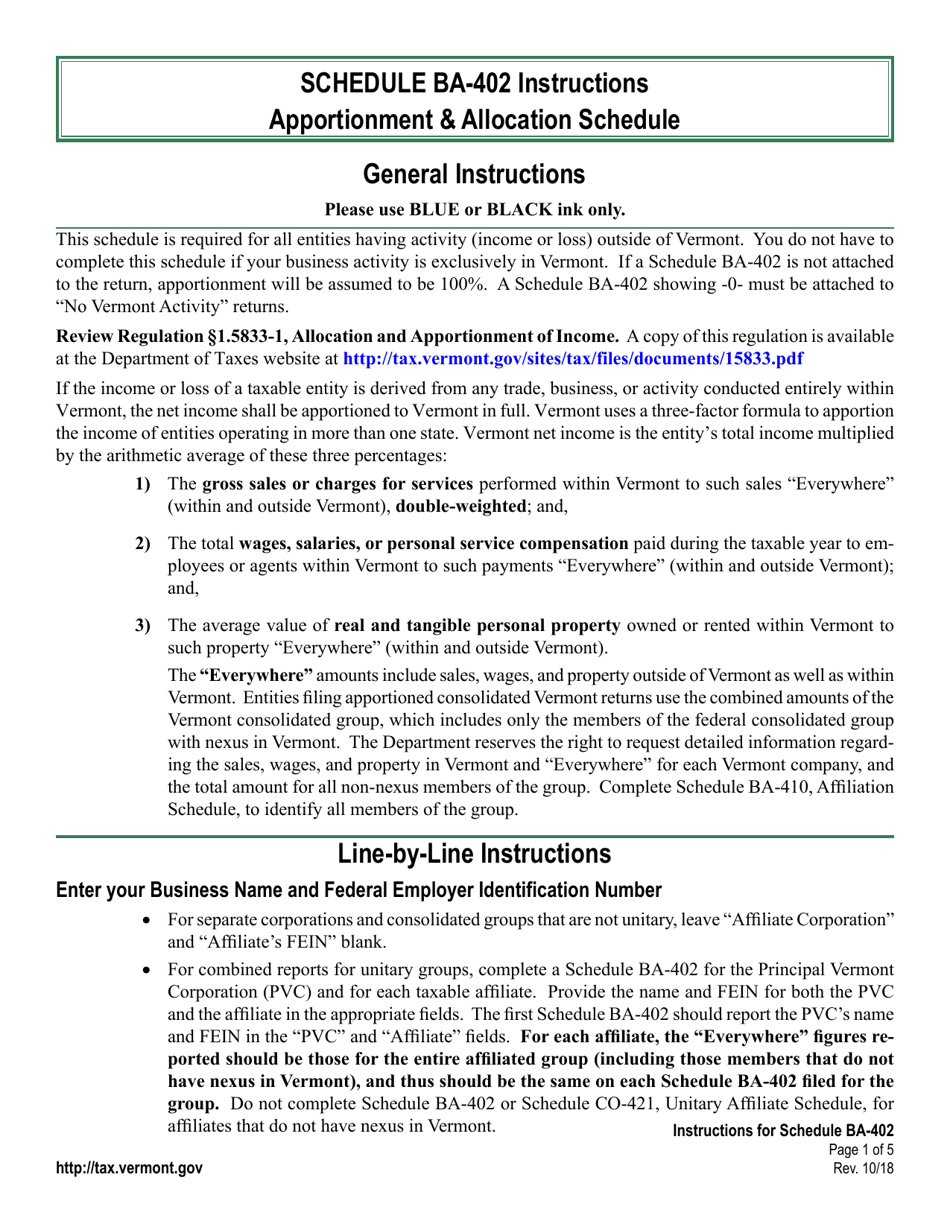

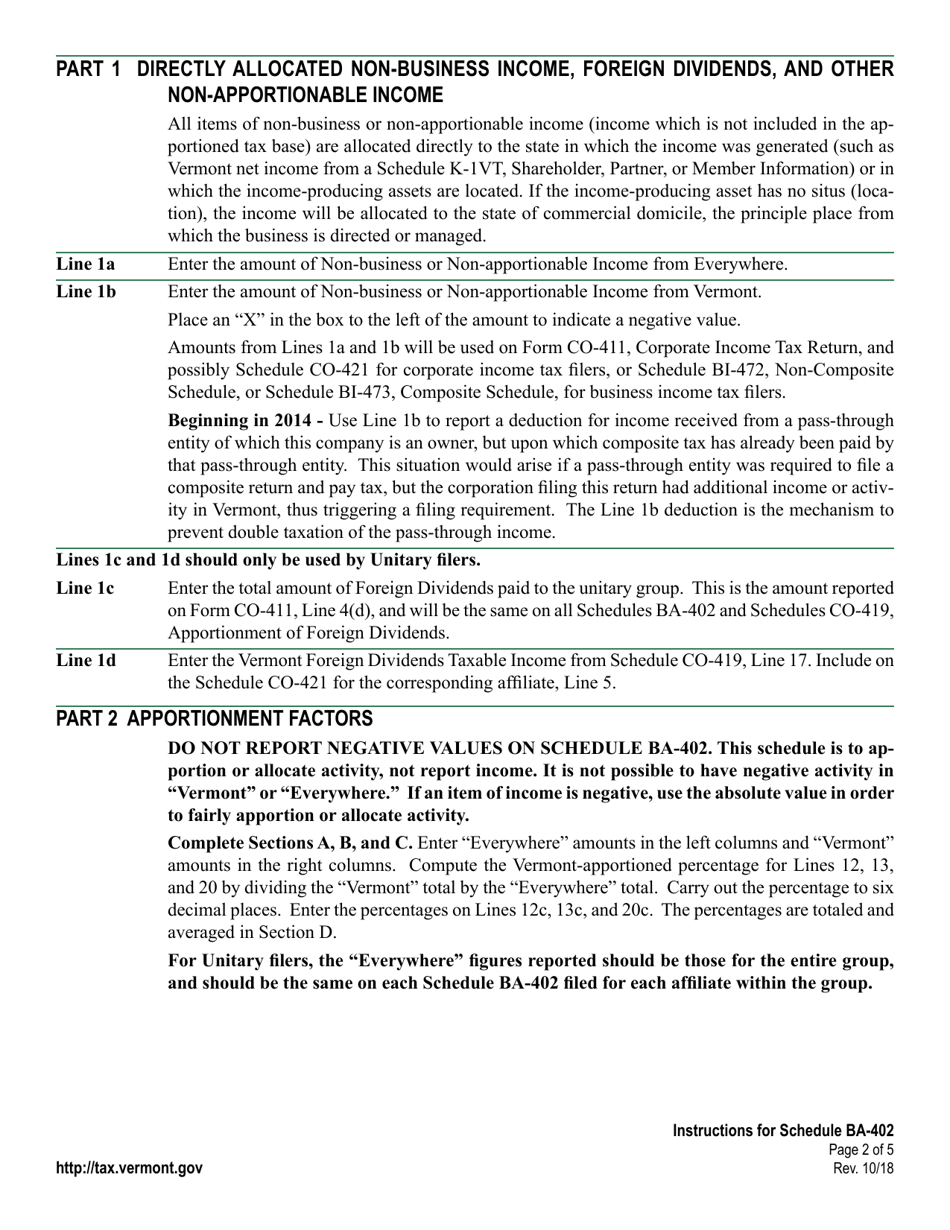

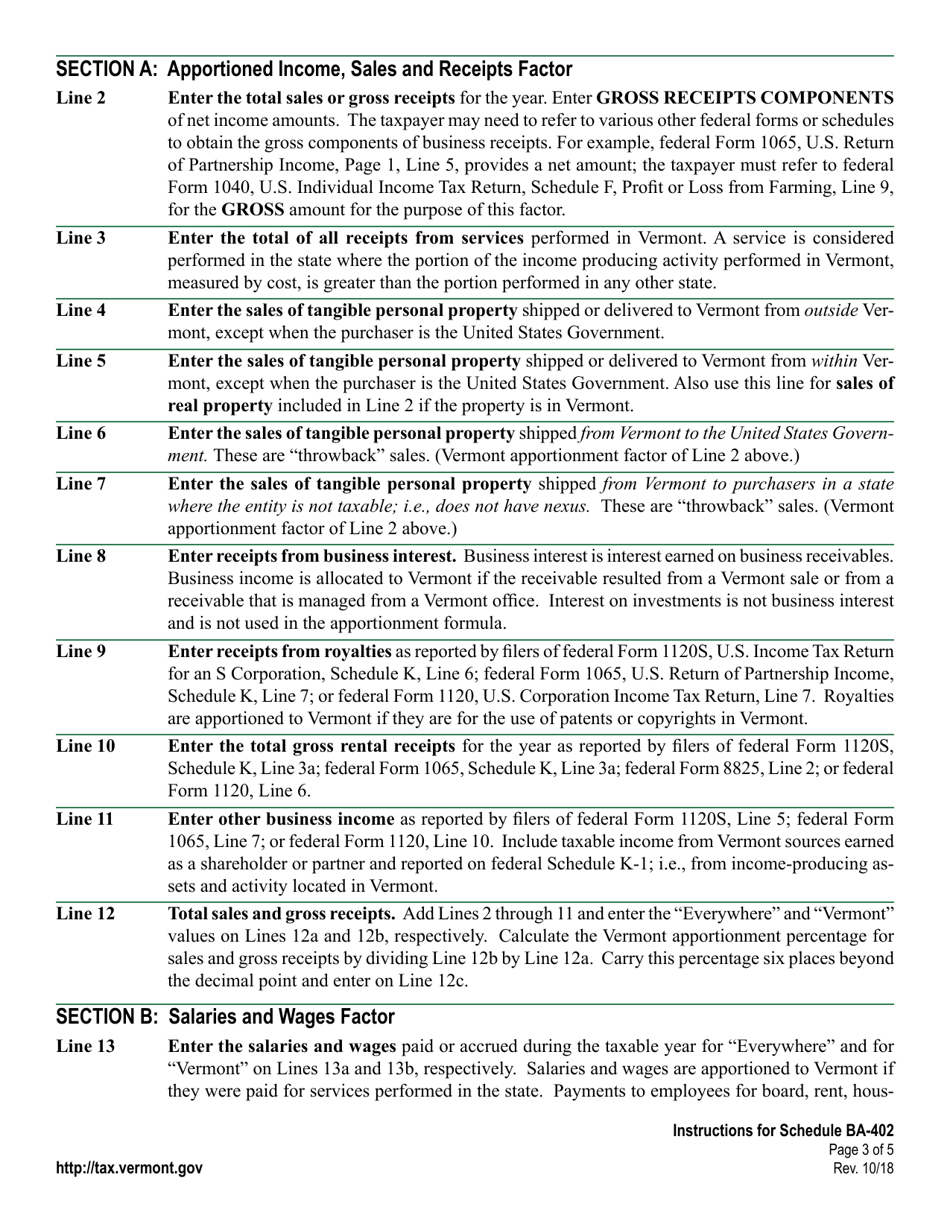

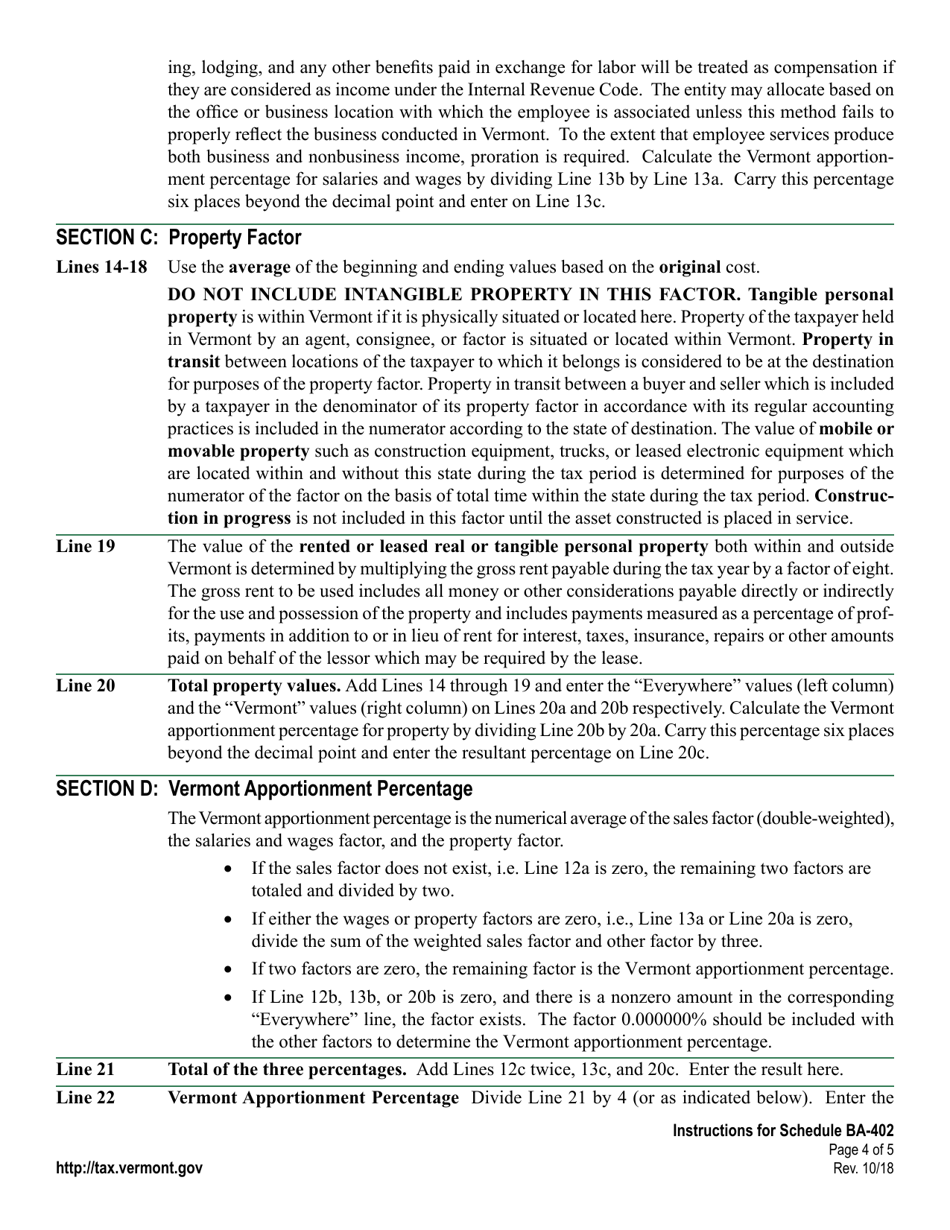

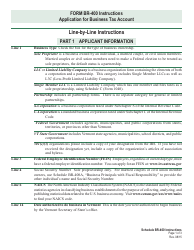

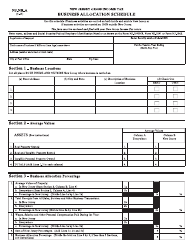

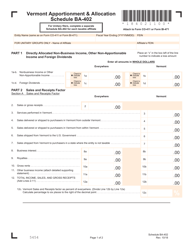

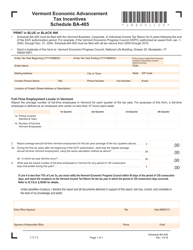

Instructions for Schedule BA-402 Apportionment & Allocation Schedule - Vermont

This document contains official instructions for Schedule BA-402 , Apportionment & Allocation Schedule - a form released and collected by the Vermont Department of Taxes.

FAQ

Q: What is Schedule BA-402?

A: Schedule BA-402 is the Apportionment & Allocation Schedule used for reporting business income in Vermont.

Q: Why do I need to fill out Schedule BA-402?

A: You need to fill out Schedule BA-402 if you have business income from multiple states and need to apportion and allocate that income to Vermont.

Q: What does apportionment and allocation mean?

A: Apportionment is the division of business income among different states based on a formula. Allocation is the assignment of a portion of that income to a specific state.

Q: Can I use Schedule BA-402 for personal income?

A: No, Schedule BA-402 is specifically for reporting business income and cannot be used for personal income.

Q: How do I fill out Schedule BA-402?

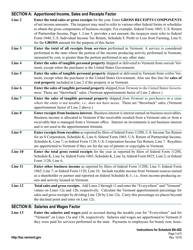

A: You will need to follow the instructions provided on the form and enter the required information, including the amounts of business income from each state and the apportionment factors.

Q: When is Schedule BA-402 due?

A: Schedule BA-402 is due on the same date as your Vermont tax return, generally April 15th.

Q: Do I need to attach supporting documentation to Schedule BA-402?

A: You may need to attach supporting documentation, such as federal Form 1120 or 1065, depending on the nature of your business.

Q: Can I file Schedule BA-402 electronically?

A: Yes, you can file Schedule BA-402 electronically if you are filing your Vermont tax return electronically.

Q: What happens if I don't file Schedule BA-402?

A: If you have business income from multiple states and fail to file Schedule BA-402, it may result in incorrect reporting of your Vermont tax liability and possible penalties or fines.

Instruction Details:

- This 5-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Vermont Department of Taxes.