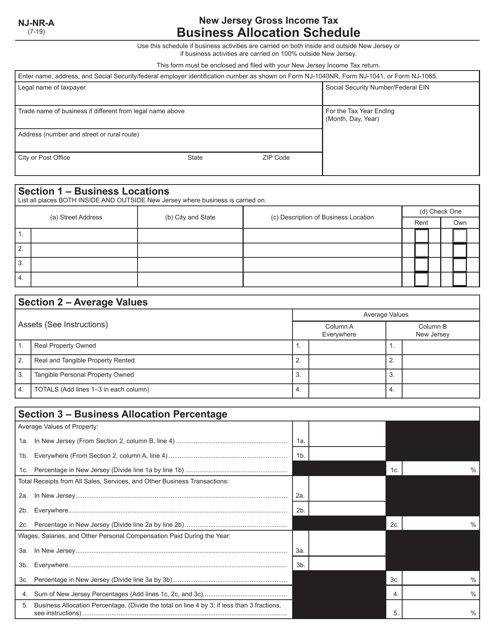

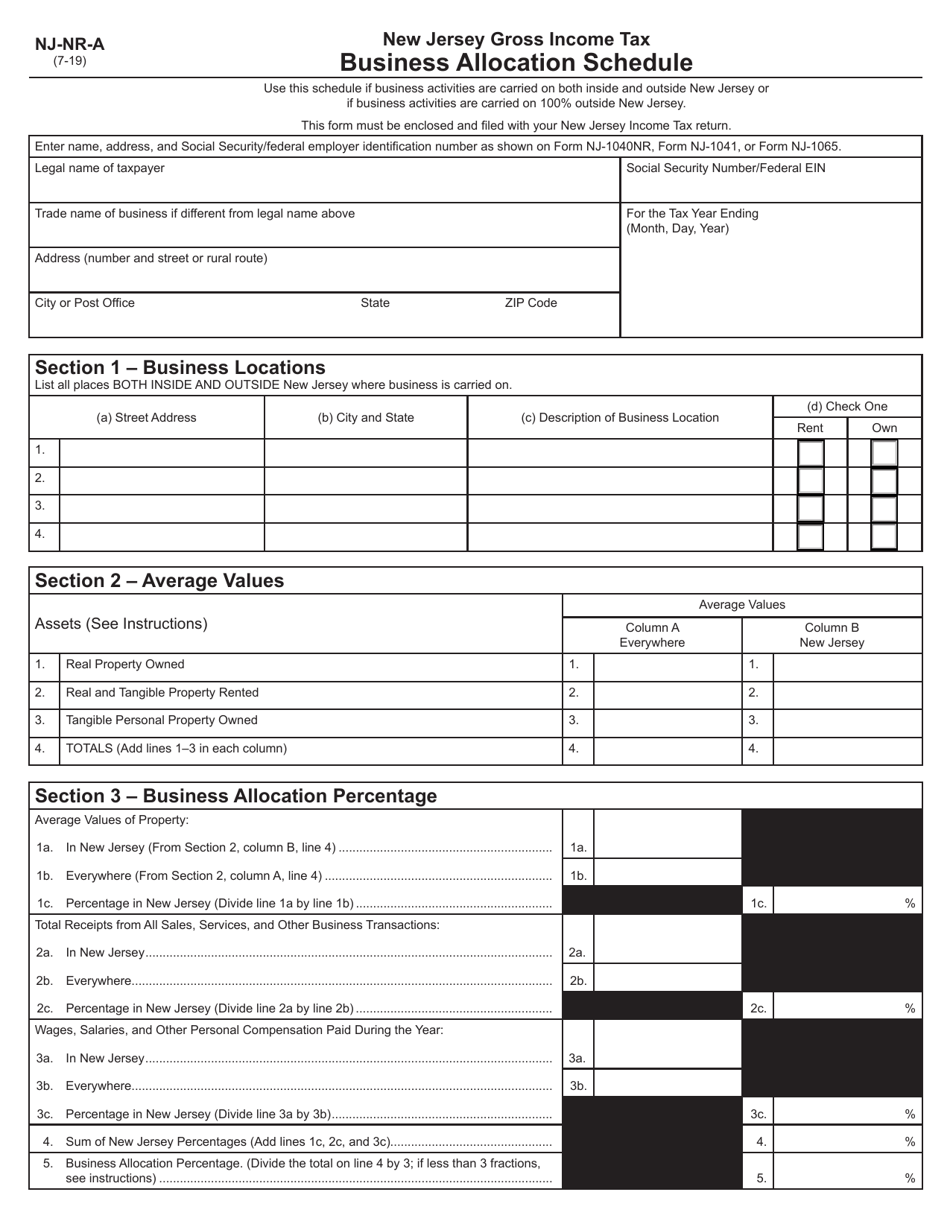

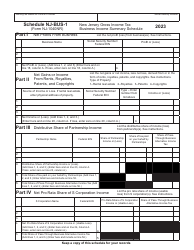

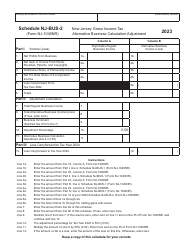

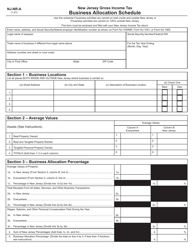

Schedule NJ-NR-A Business Allocation Schedule - New Jersey

What Is Schedule NJ-NR-A?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

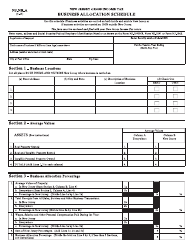

Q: What is the NJ-NR-A Business Allocation Schedule?

A: The NJ-NR-A Business Allocation Schedule is a tax schedule used in New Jersey to report income and allocate expenses for businesses.

Q: Who needs to file the NJ-NR-A Business Allocation Schedule?

A: Businesses that are required to file a New Jersey nonresident return must complete the NJ-NR-A Business Allocation Schedule.

Q: What is the purpose of the NJ-NR-A Business Allocation Schedule?

A: The purpose of the NJ-NR-A Business Allocation Schedule is to calculate the net income and apportionment factor for businesses with income from both New Jersey and other states.

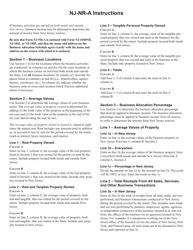

Q: What information is required to complete the NJ-NR-A Business Allocation Schedule?

A: To complete the NJ-NR-A Business Allocation Schedule, you will need information about your business income, expenses, and apportionment factors.

Q: When is the deadline to file the NJ-NR-A Business Allocation Schedule?

A: The deadline to file the NJ-NR-A Business Allocation Schedule is the same as the deadline for filing your New Jersey nonresident return, usually on or around April 15th.

Q: Are there any penalties for not filing the NJ-NR-A Business Allocation Schedule?

A: Yes, failure to file the NJ-NR-A Business Allocation Schedule can result in penalties and interest charges.

Q: Do I need to attach the NJ-NR-A Business Allocation Schedule to my tax return?

A: Yes, you will need to attach the NJ-NR-A Business Allocation Schedule to your New Jersey nonresident return when filing.

Form Details:

- Released on July 1, 2019;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Schedule NJ-NR-A by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.