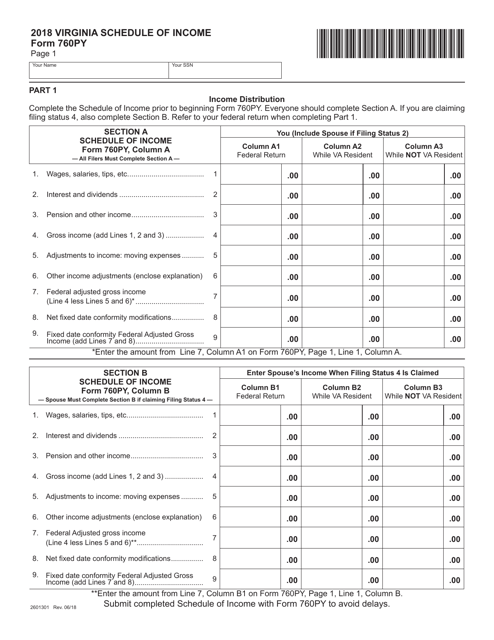

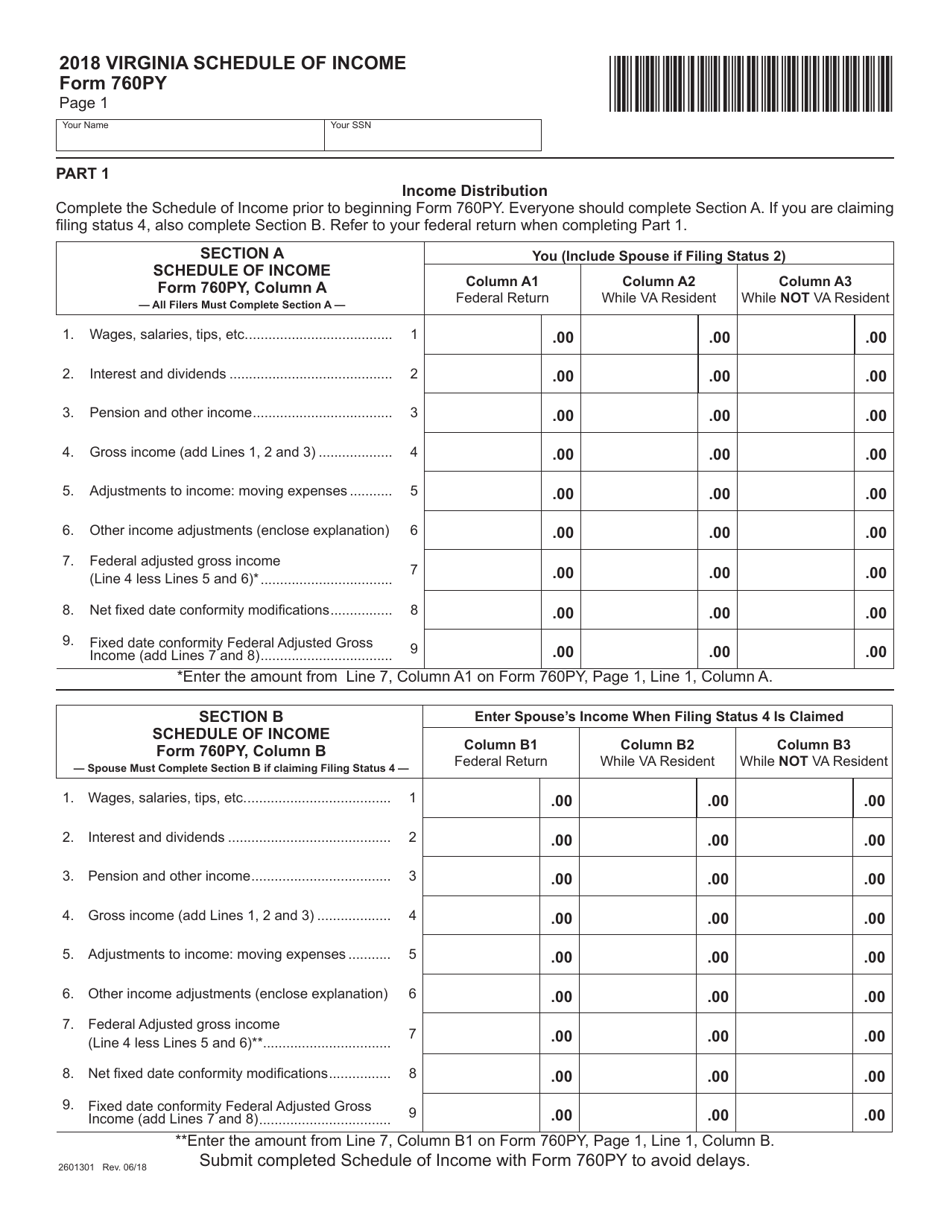

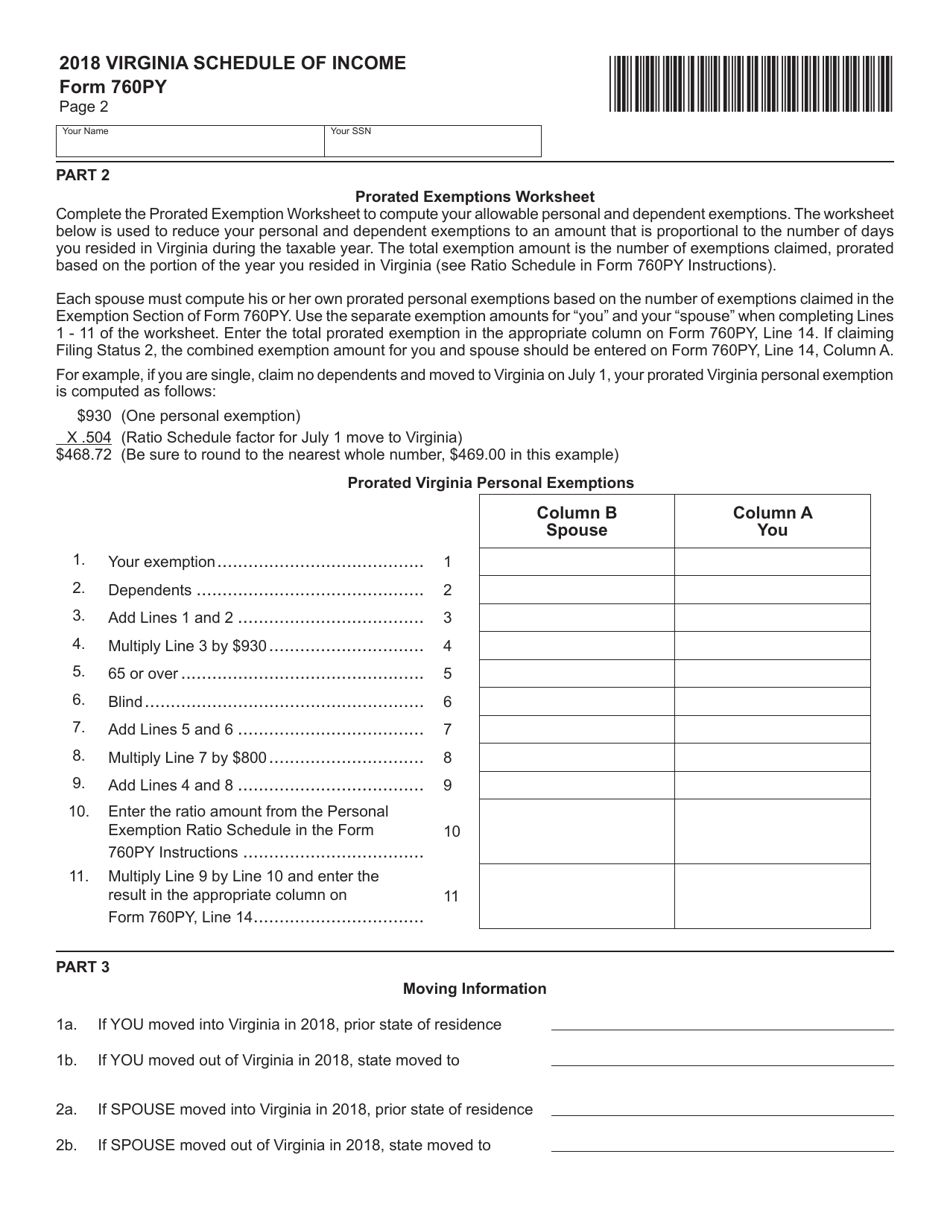

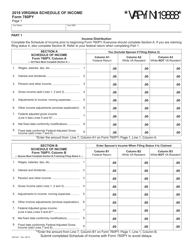

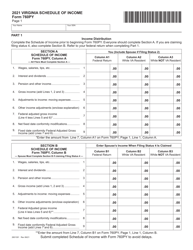

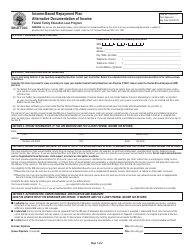

Form 760PY Schedule of Income - Virginia

What Is Form 760PY?

This is a legal form that was released by the Virginia Department of Taxation - a government authority operating within Virginia. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form 760PY?

A: Form 760PY is a schedule of income form used in the state of Virginia.

Q: Who needs to file Form 760PY?

A: Form 760PY is for individuals who are part-year residents of Virginia.

Q: What is the purpose of Form 760PY?

A: The purpose of Form 760PY is to report income earned during the time you were a resident of Virginia.

Q: What information is required on Form 760PY?

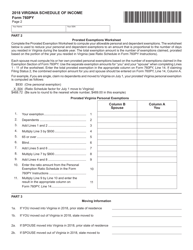

A: Form 760PY requires information about your income, deductions, and any credits or payments you may have.

Q: When is Form 760PY due?

A: Form 760PY is generally due on May 1st following the end of the tax year.

Q: What happens if I don't file Form 760PY?

A: If you are required to file Form 760PY and fail to do so, you may face penalties and interest on any unpaid taxes.

Form Details:

- Released on June 1, 2018;

- The latest edition provided by the Virginia Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 760PY by clicking the link below or browse more documents and templates provided by the Virginia Department of Taxation.