This version of the form is not currently in use and is provided for reference only. Download this version of

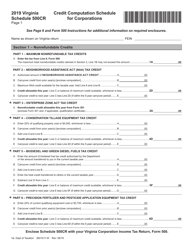

Instructions for Form 760, 760PY, 763, 765 Schedule CR

for the current year.

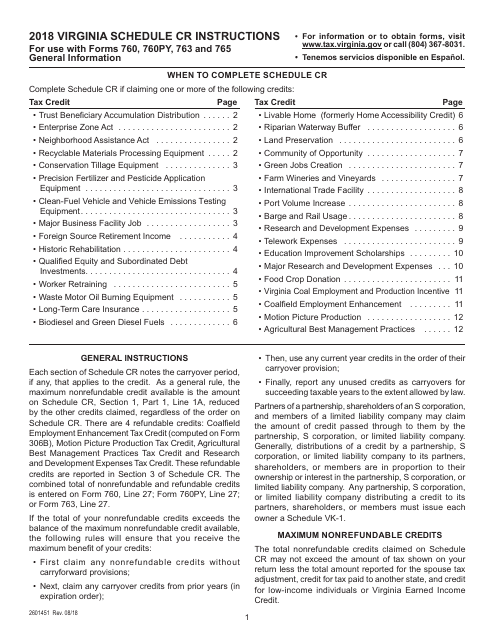

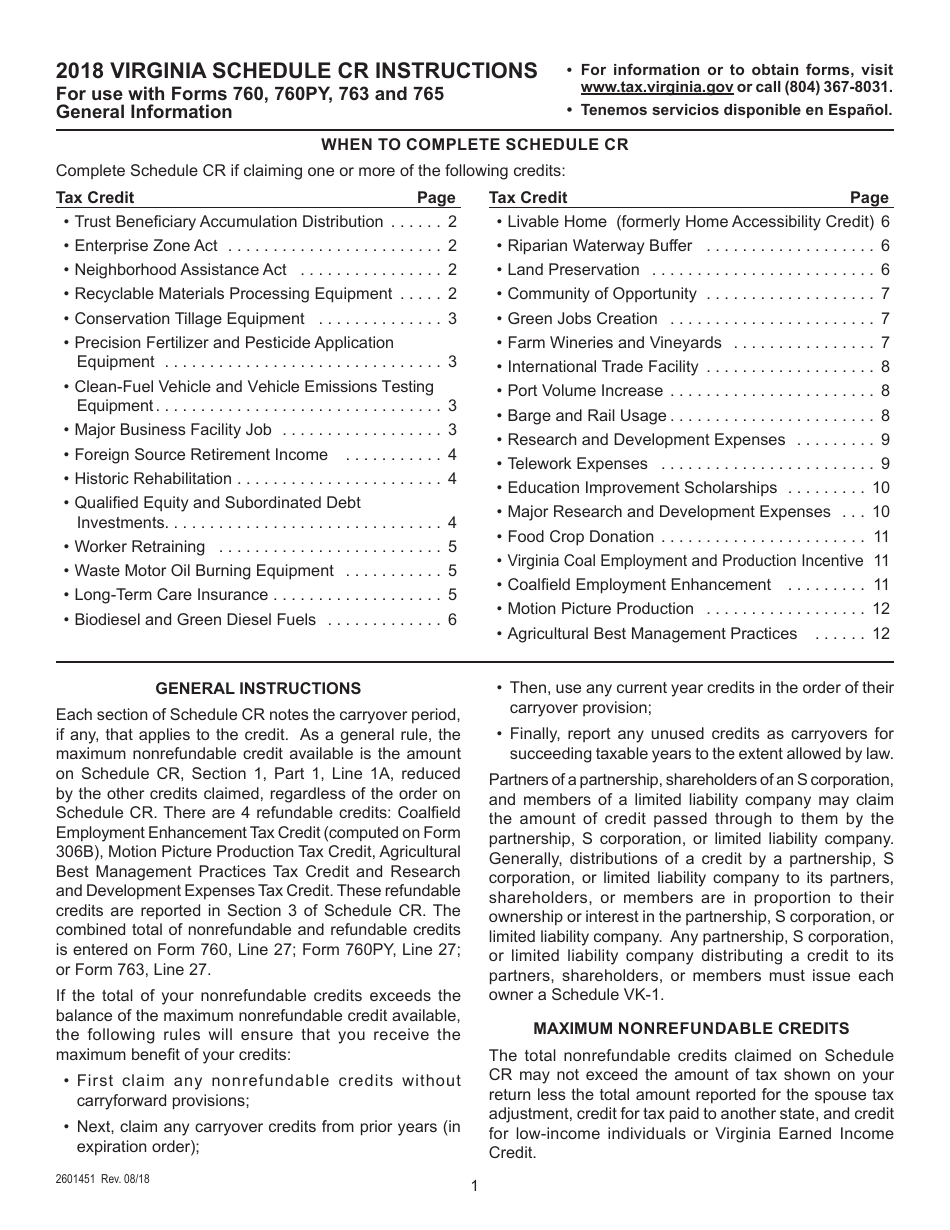

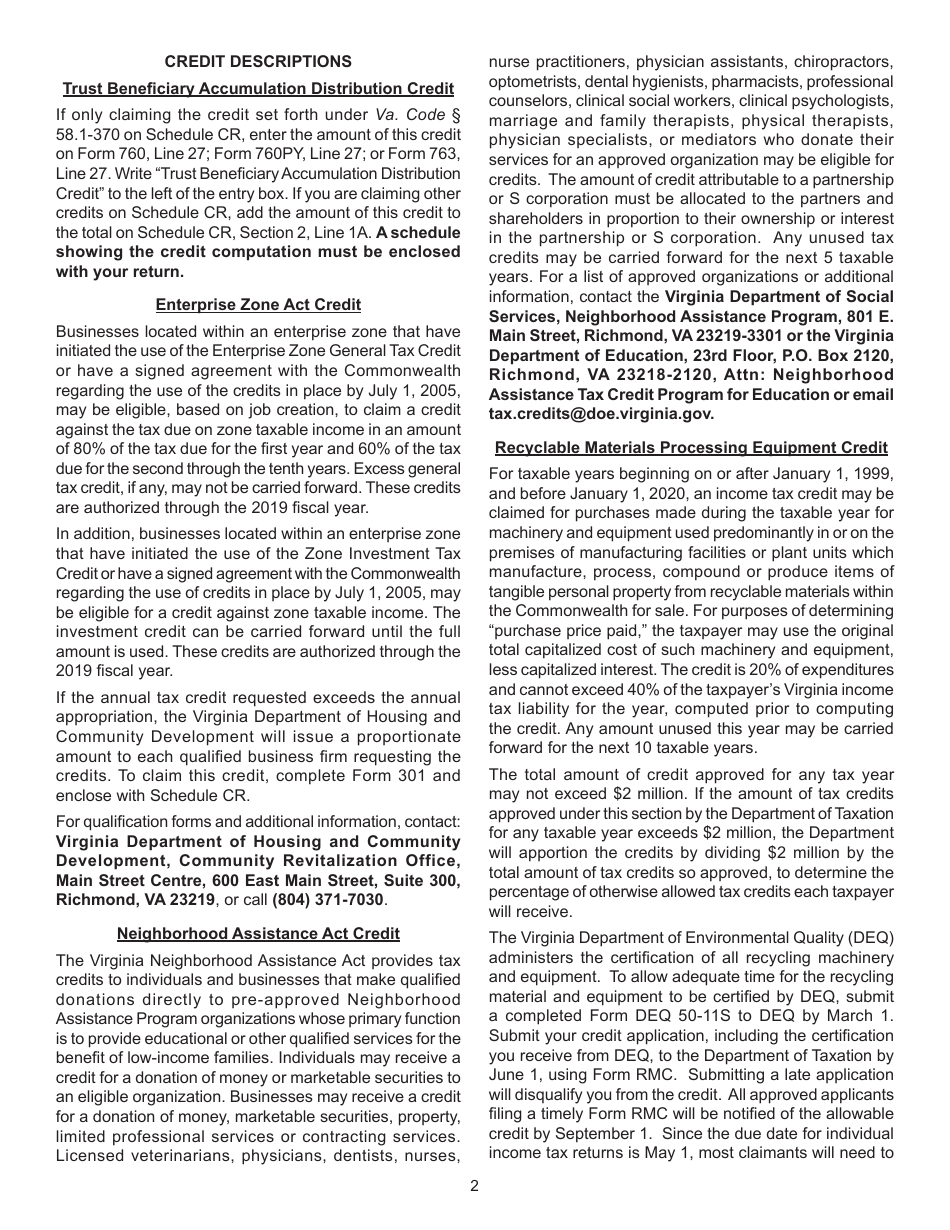

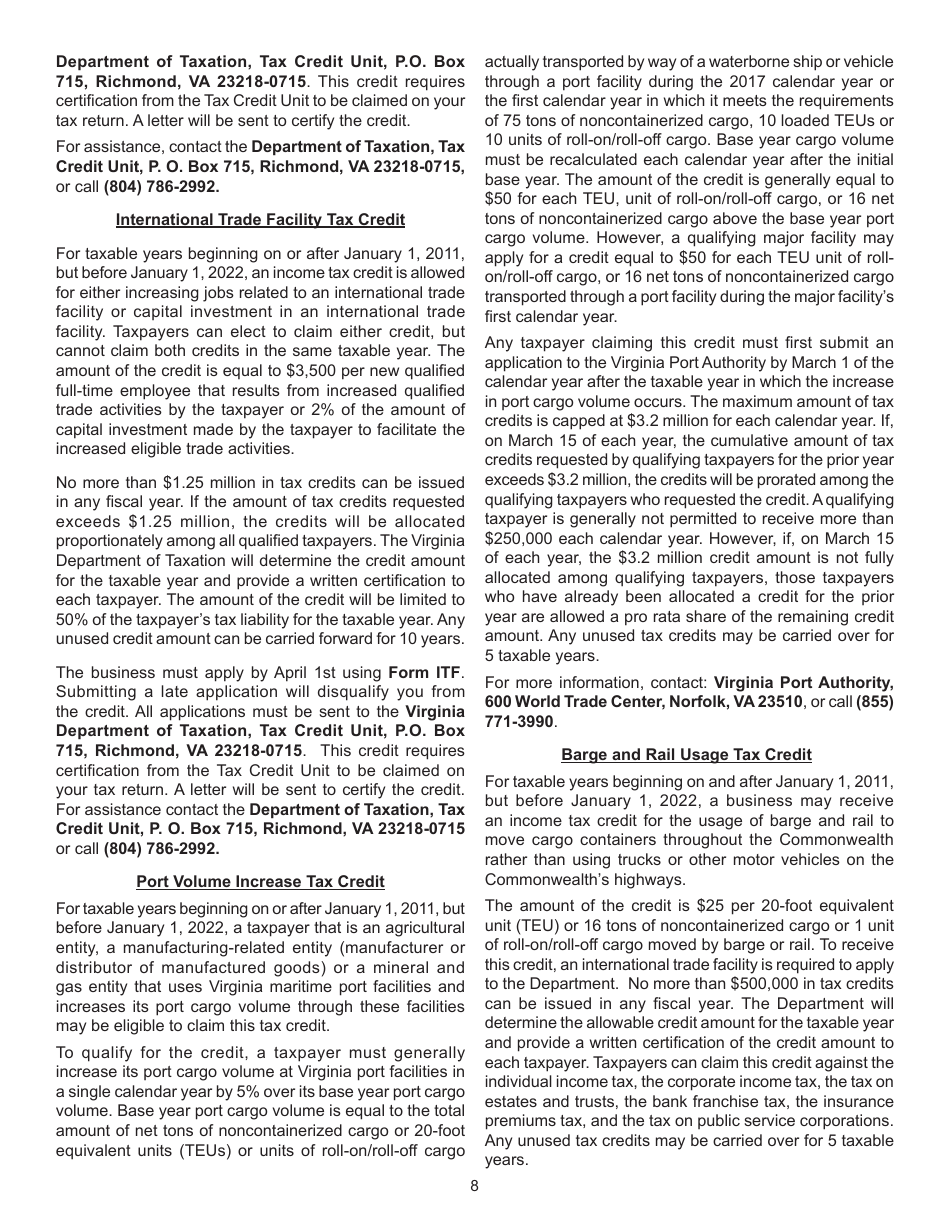

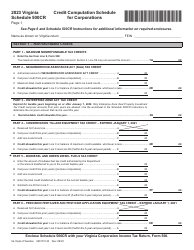

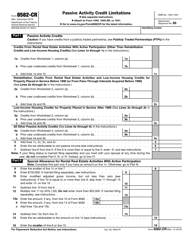

Instructions for Form 760, 760PY, 763, 765 Schedule CR Credit Computation Schedule - Virginia

This document contains official instructions for Schedule CR for Form 760 , Form 760PY , Form 763 , and Form 765 . . These documents are released and collected by the Virginia Department of Taxation. An up-to-date fillable Form 760 (760PY; 763; 765) Schedule CR is available for download through this link.

FAQ

Q: What is Form 760?

A: Form 760 is a tax form used in the state of Virginia to file individual income tax returns.

Q: Who should file Form 760?

A: Virginia residents who need to report their income and pay state taxes should file Form 760.

Q: What is Form 760PY?

A: Form 760PY is a tax form used by part-year residents of Virginia to report their income and taxes.

Q: What is Form 763?

A: Form 763 is a tax form used by residents of Virginia who are 65 years or older to report their income and taxes.

Q: What is Form 765?

A: Form 765 is a tax form used by individuals in Virginia who want to claim the credit for tax paid to another state.

Q: What is Schedule CR?

A: Schedule CR is a credit computation schedule that accompanies Form 760, 760PY, and 763 to calculate the credit for taxes paid to another state.

Q: Why would I need to use Schedule CR?

A: You would need to use Schedule CR if you paid taxes to another state and want to claim a credit on your Virginia tax return.

Q: Is there a deadline for filing these forms?

A: Yes, the deadline for filing these forms is usually April 15th, unless it falls on a weekend or holiday, in which case the deadline is extended to the next business day.

Instruction Details:

- This 12-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Virginia Department of Taxation.