This version of the form is not currently in use and is provided for reference only. Download this version of

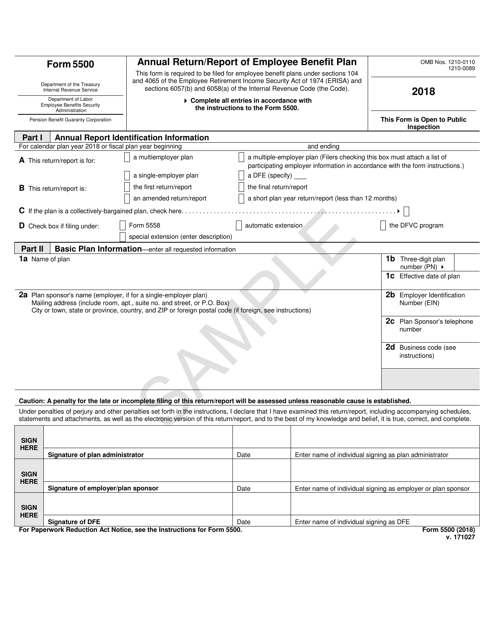

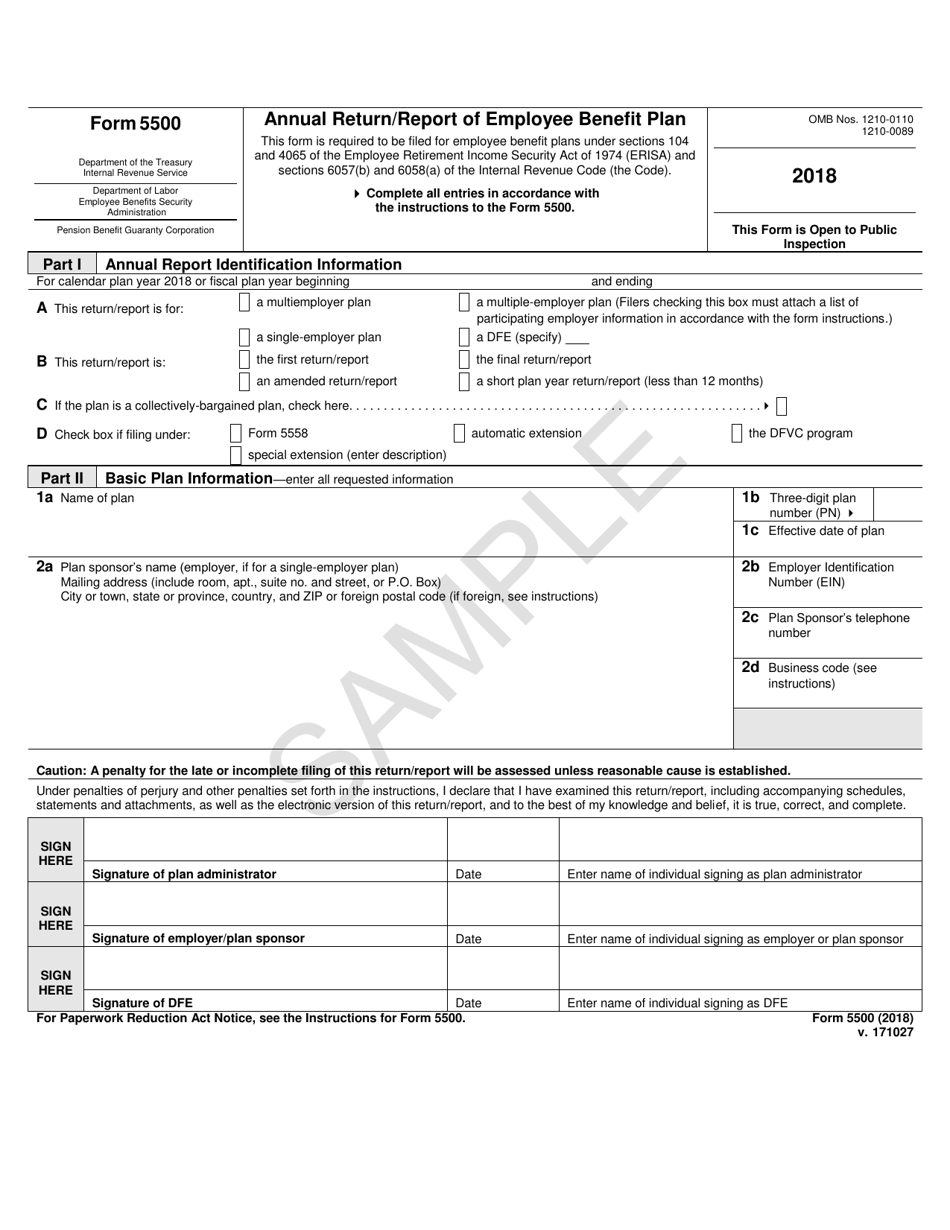

Form 5500

for the current year.

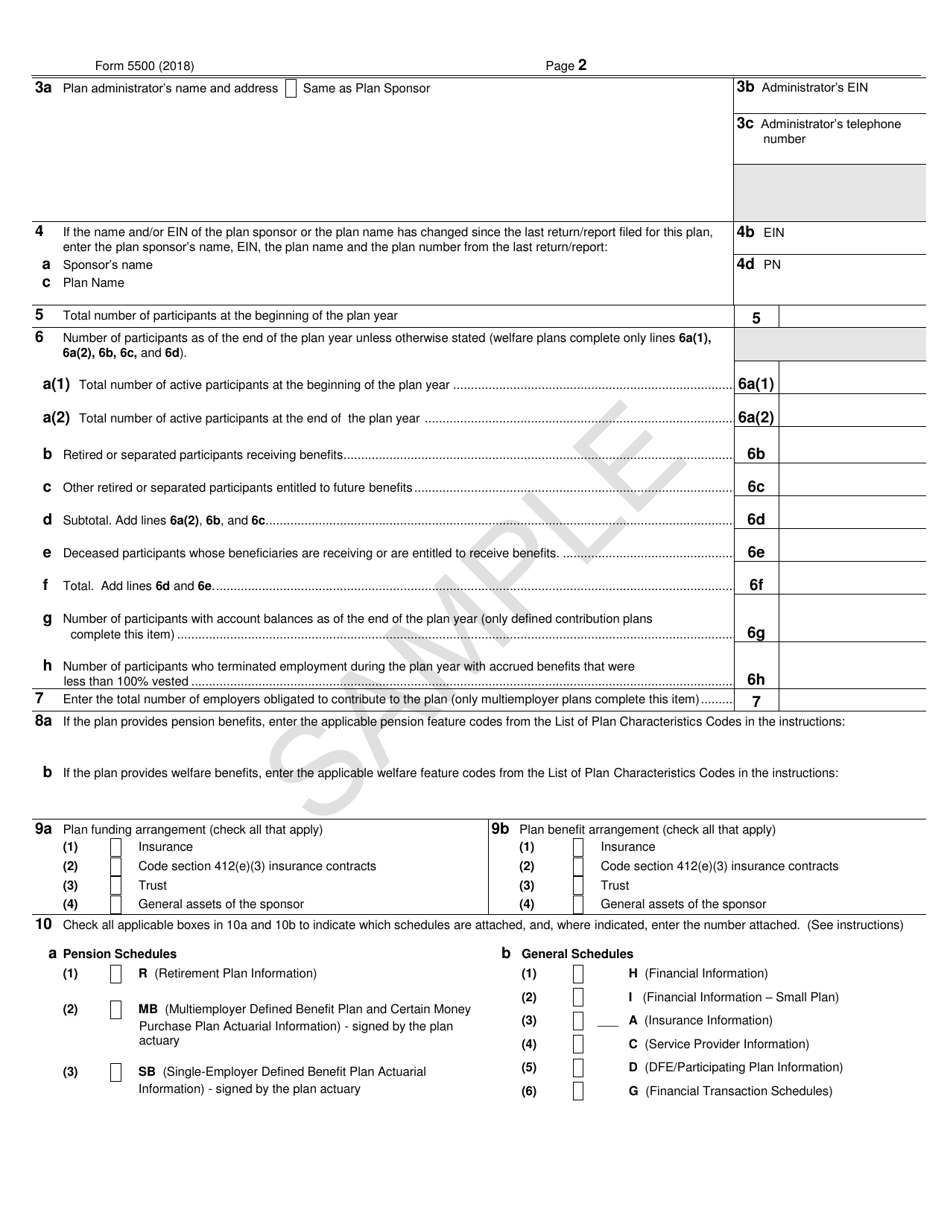

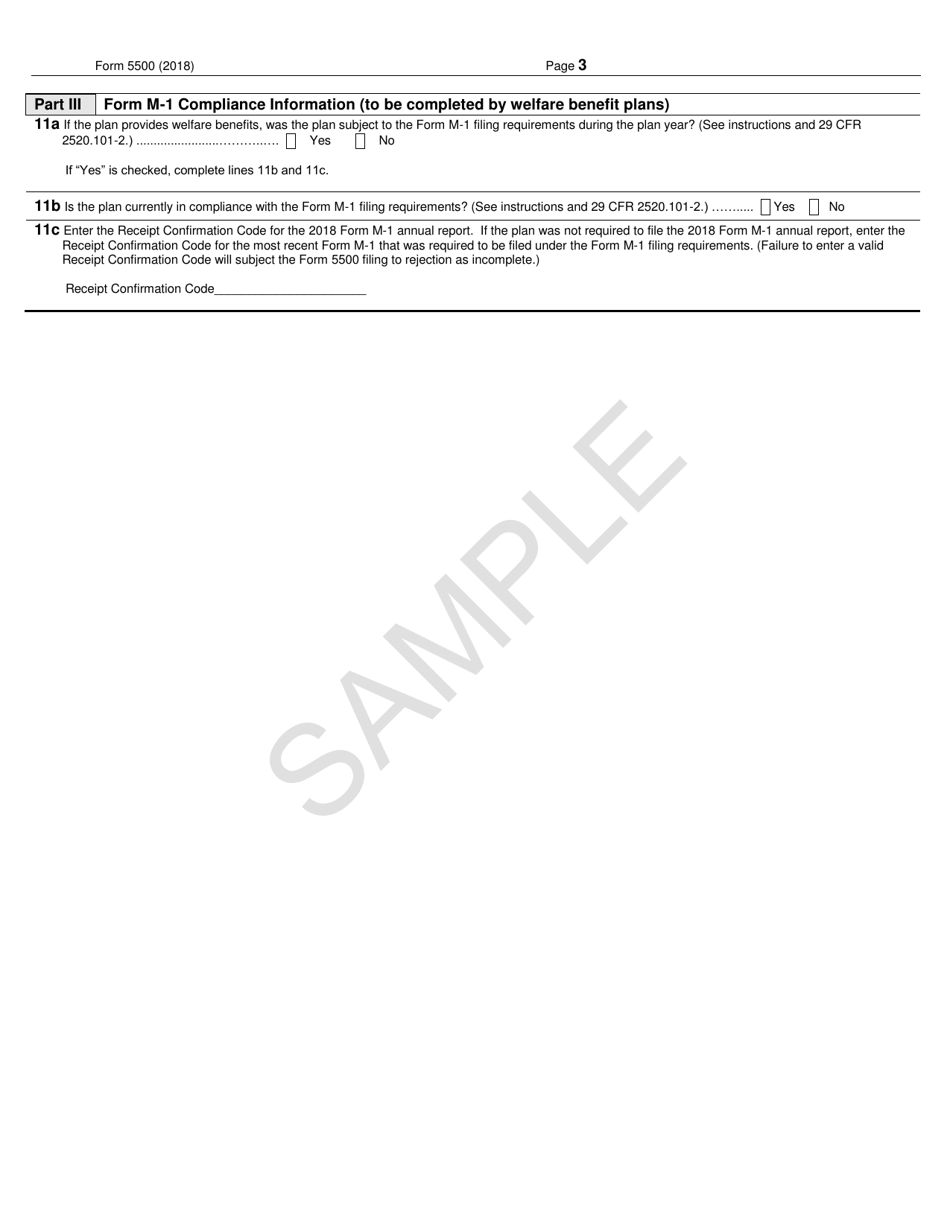

Form 5500 Annual Return / Report of Employee Benefit Plan

What Is IRS Form 5500?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 5500?

A: IRS Form 5500 is an annual return/report that must be filed by employee benefit plans.

Q: Who needs to file IRS Form 5500?

A: Generally, employee benefit plans with 100 or more participants are required to file IRS Form 5500.

Q: When is the deadline to file IRS Form 5500?

A: The deadline to file IRS Form 5500 is the last day of the seventh month after the end of the plan year.

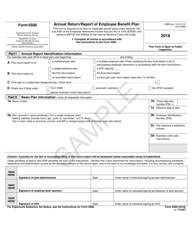

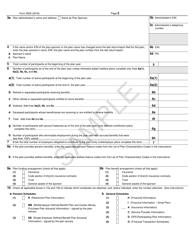

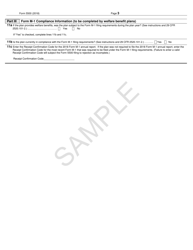

Q: What information is required to be reported on IRS Form 5500?

A: IRS Form 5500 requires reporting information about the plan's financial condition, investments, and operations.

Q: Is there a penalty for not filing IRS Form 5500?

A: Yes, there can be penalties for not filing IRS Form 5500 or for filing the form late.

Q: Do all employee benefit plans need to file IRS Form 5500?

A: No, there are certain types of employee benefit plans that are exempt from filing IRS Form 5500.

Form Details:

- A 3-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 5500 through the link below or browse more documents in our library of IRS Forms.