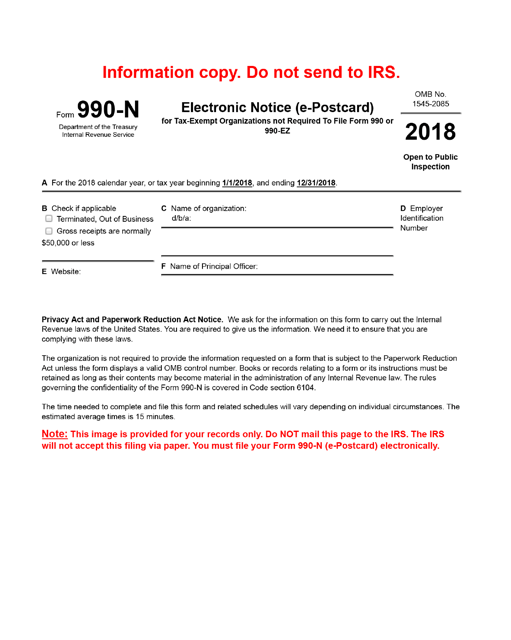

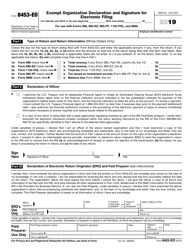

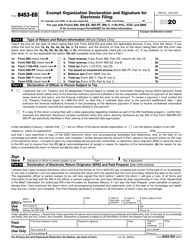

This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 990-N

for the current year.

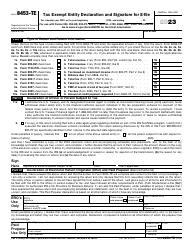

IRS Form 990-N Electronic Notice (E-Postcard)

What Is IRS Form 990-N?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

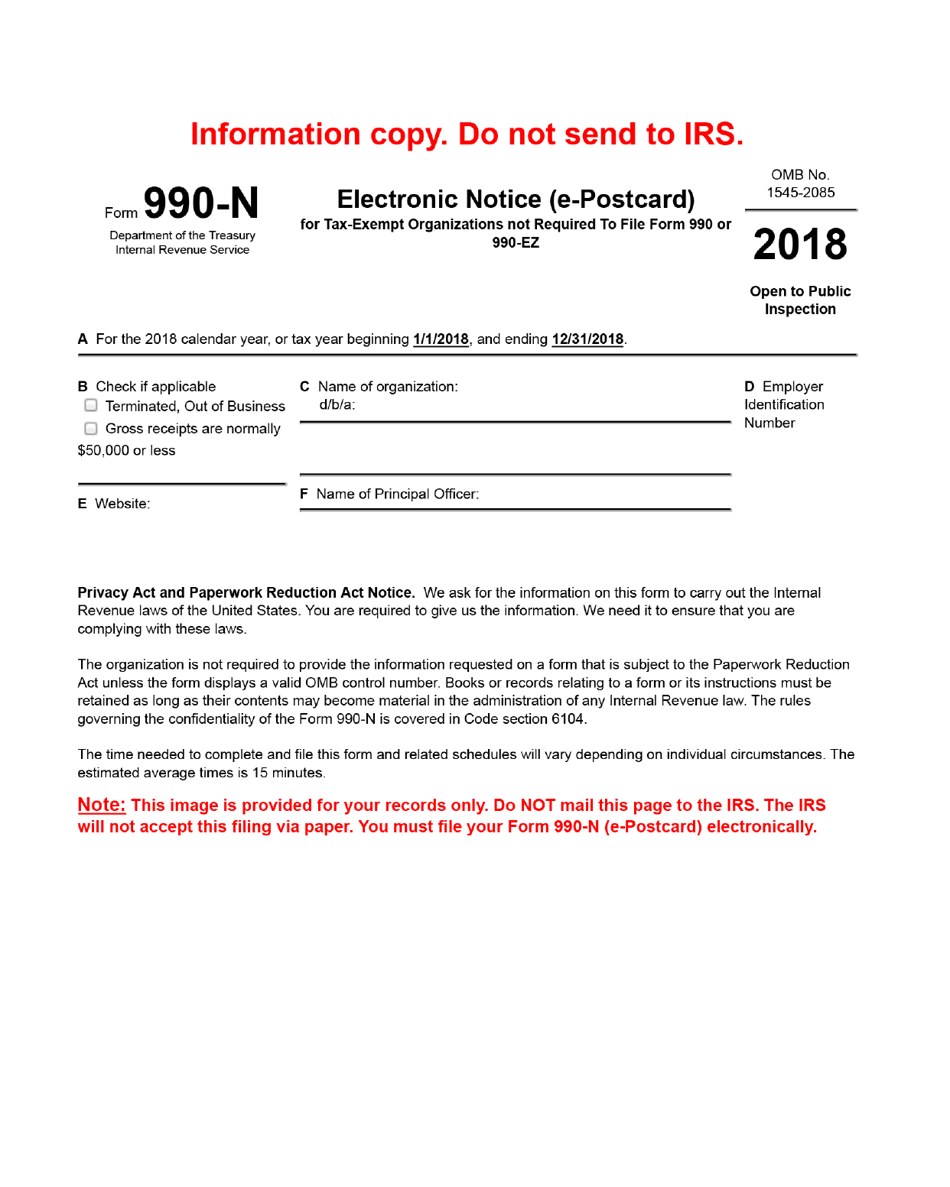

Q: What is IRS Form 990-N?

A: IRS Form 990-N is an electronic notice or e-postcard that small tax-exempt organizations can use to provide the IRS with basic information about their activities and finances.

Q: Who is eligible to file Form 990-N?

A: Small tax-exempt organizations with gross receipts less than $50,000 can file Form 990-N.

Q: What information is required on Form 990-N?

A: Form 990-N requires basic information such as the organization's name, address, tax year, and a statement that the organization's gross receipts are below $50,000.

Q: What is the deadline to file Form 990-N?

A: Form 990-N is due by the 15th day of the 5th month after the end of the organization's tax year.

Form Details:

- A 1-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a printable version of IRS Form 990-N through the link below or browse more documents in our library of IRS Forms.