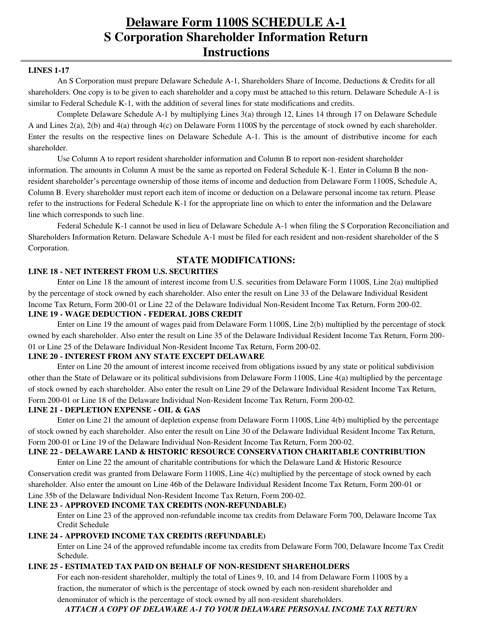

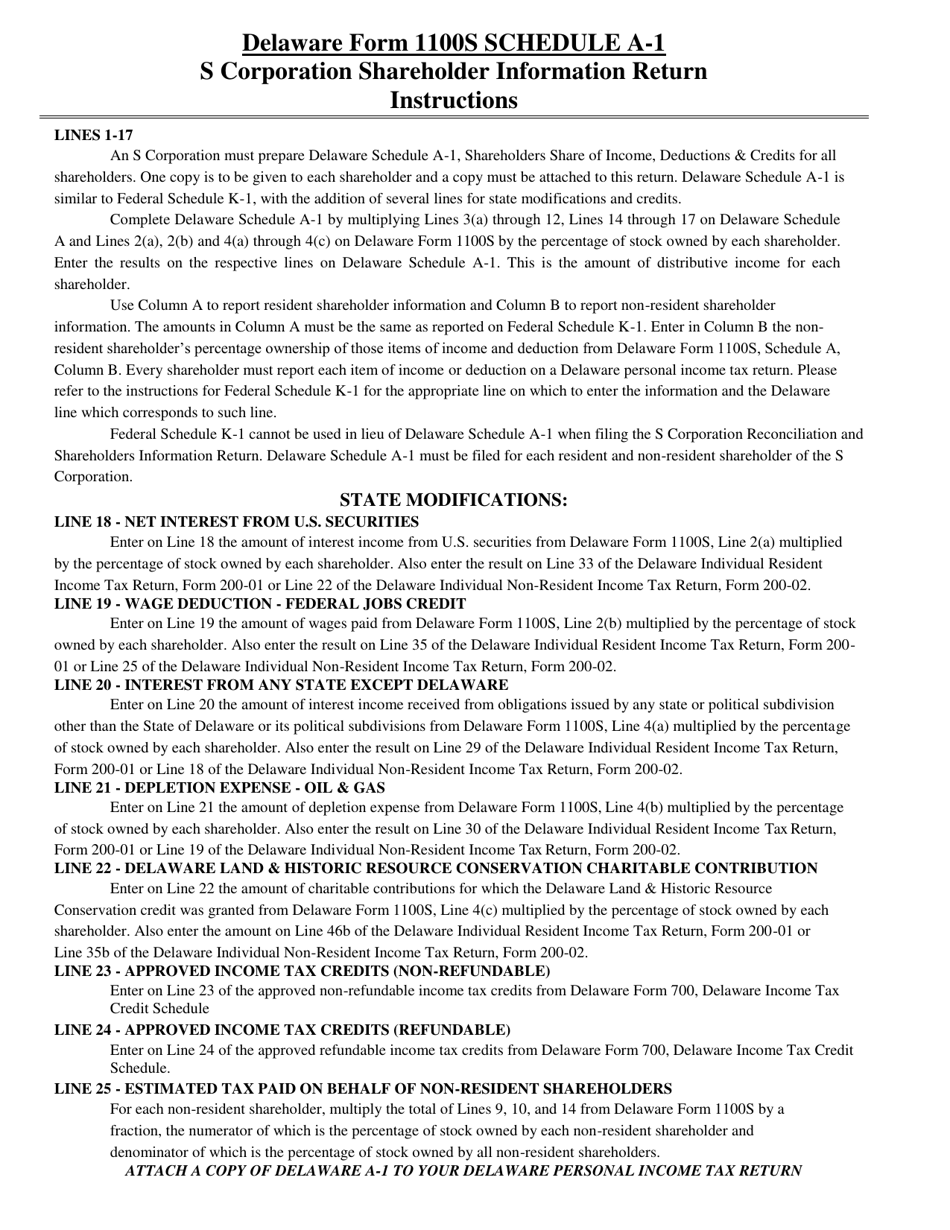

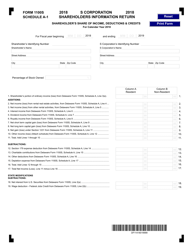

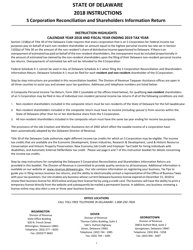

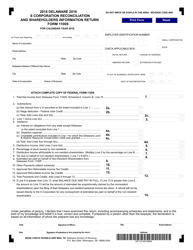

Instructions for Form 1100S Schedule A-1 S Corporation Shareholder Information Return - Delaware

This document contains official instructions for Form 1100S Schedule A-1, S Corporation Shareholder Information Return - a form released and collected by the Delaware Department of State - Division of Corporations.

FAQ

Q: What is Form 1100S Schedule A-1?

A: Form 1100S Schedule A-1 is an S Corporation Shareholder Information Return specific to the state of Delaware.

Q: Who needs to file Form 1100S Schedule A-1?

A: S Corporation shareholders in Delaware need to file Form 1100S Schedule A-1.

Q: What is the purpose of Form 1100S Schedule A-1?

A: Form 1100S Schedule A-1 is used to provide information about the shareholders of an S Corporation in Delaware.

Q: When is the deadline for filing Form 1100S Schedule A-1?

A: Form 1100S Schedule A-1 is due on or before March 1st of each year.

Q: What happens if I don't file Form 1100S Schedule A-1?

A: Failure to file Form 1100S Schedule A-1 or filing late may result in penalties and interest charges.

Q: Can I e-file Form 1100S Schedule A-1?

A: Yes, Delaware allows for electronic filing of Form 1100S Schedule A-1.

Q: What supporting documents do I need to include with Form 1100S Schedule A-1?

A: You may need to include copies of federal S Corporation tax returns and schedules with Form 1100S Schedule A-1.

Instruction Details:

- This 1-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Delaware Department of State - Division of Corporations.