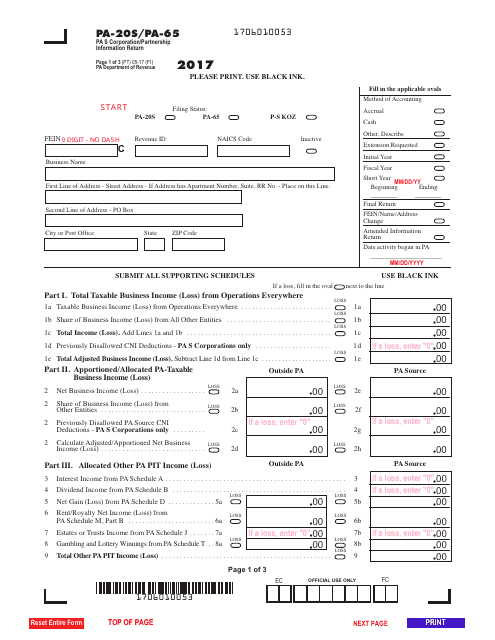

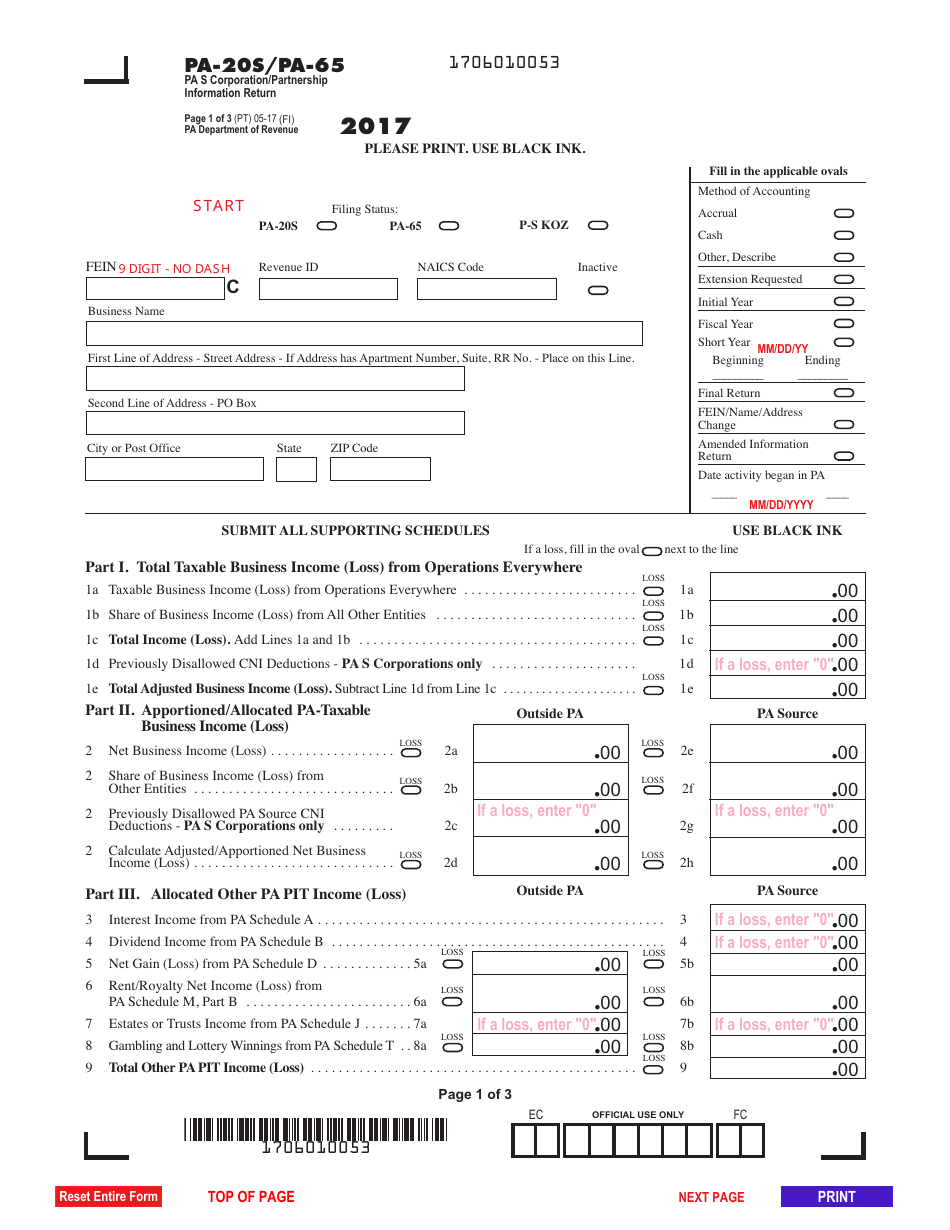

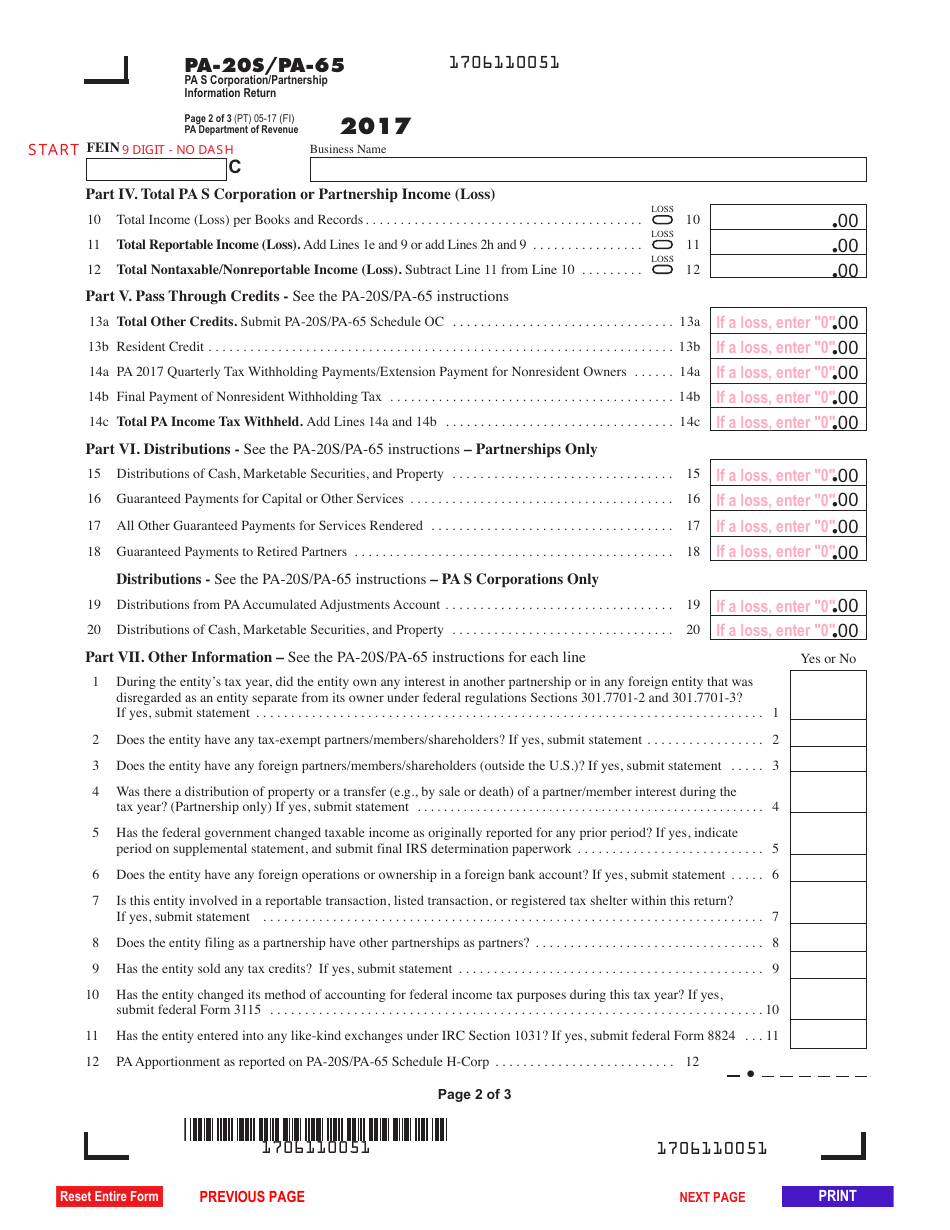

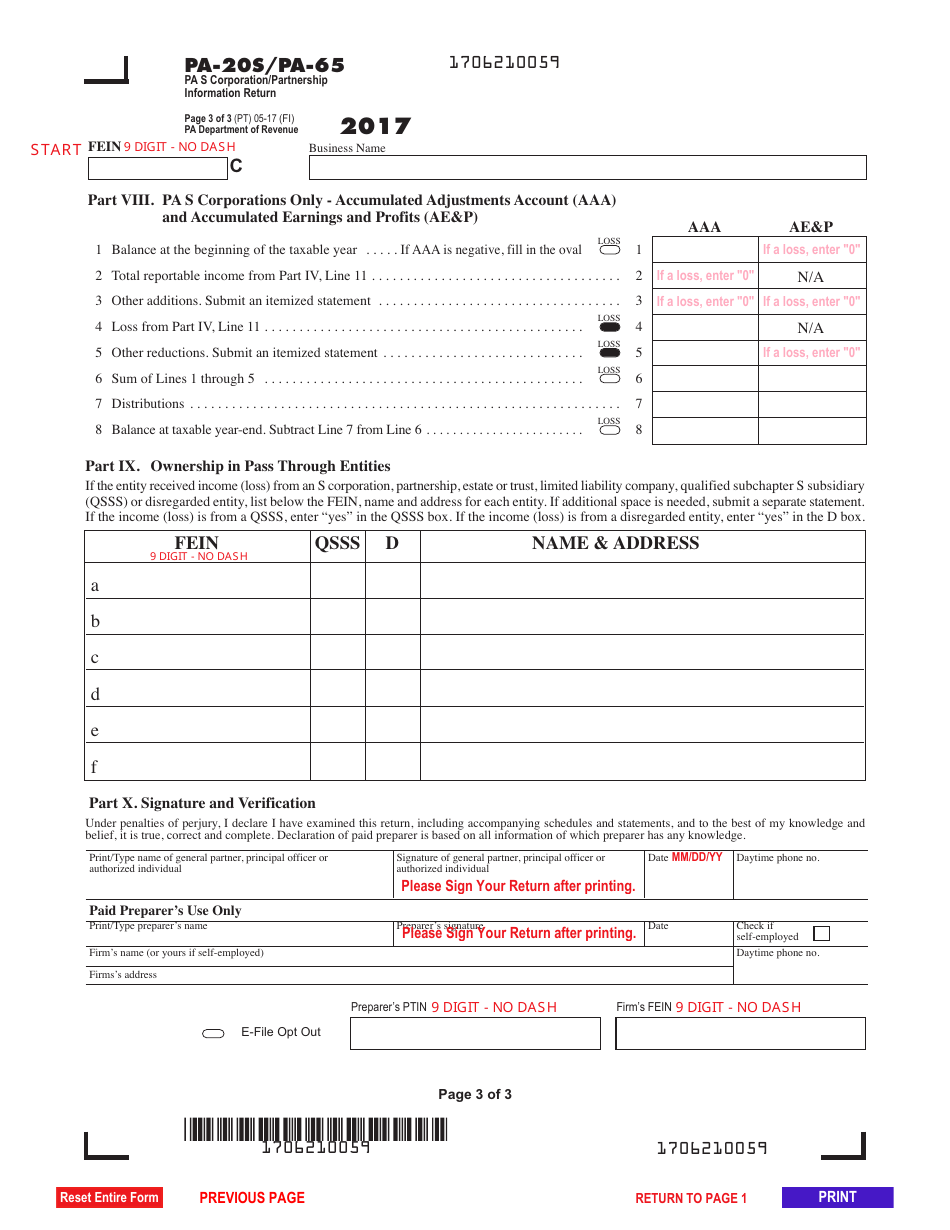

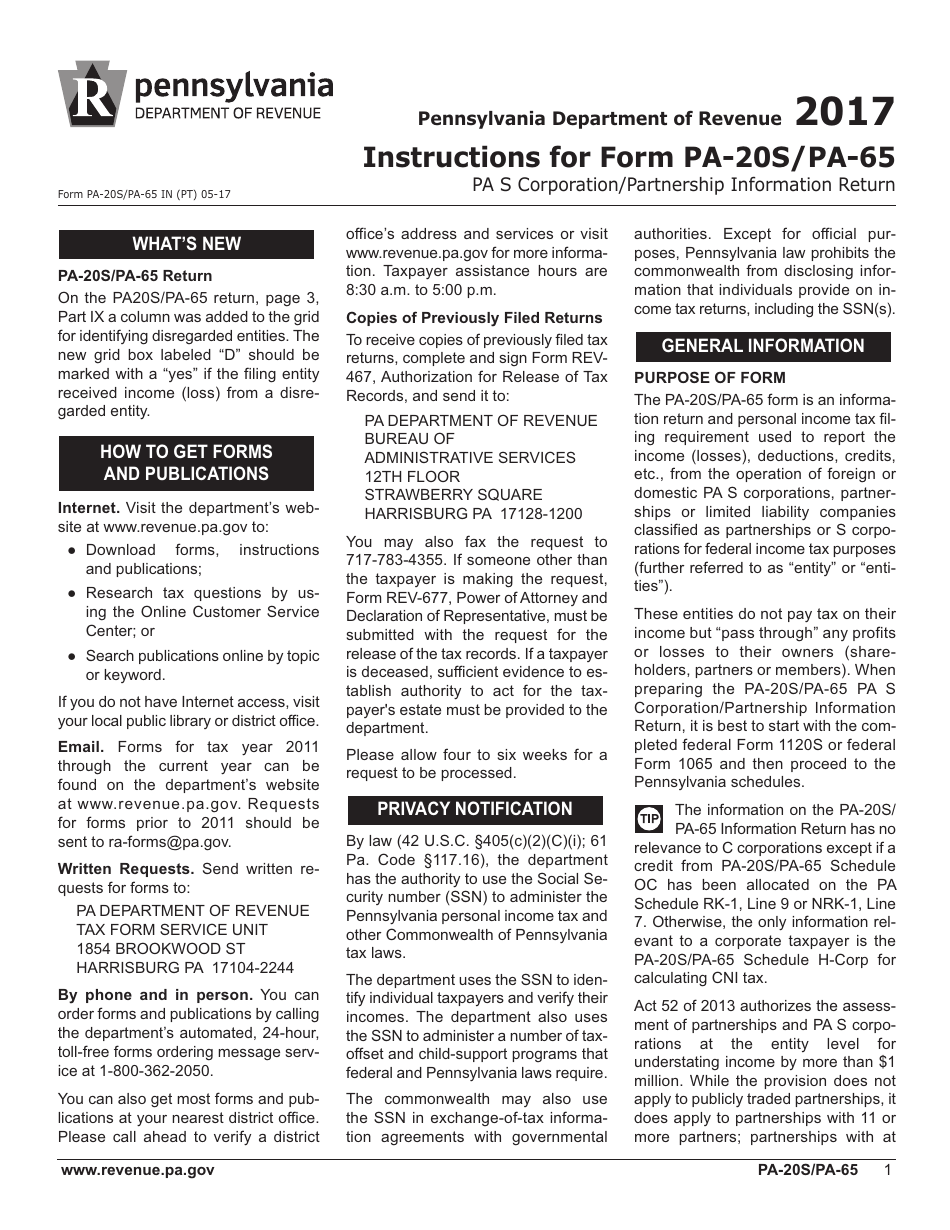

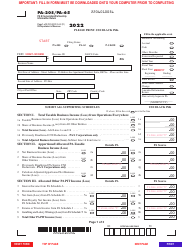

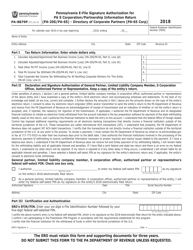

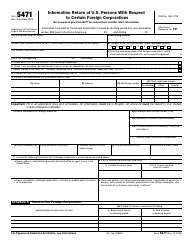

Form PA-20s / 65 Pa S Corporation / Partnership Information Return - Pennsylvania

What Is Form PA-20s/65?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

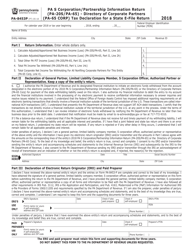

Q: What is Form PA-20s/65?

A: Form PA-20s/65 is the Pennsylvania S Corporation/Partnership Information Return.

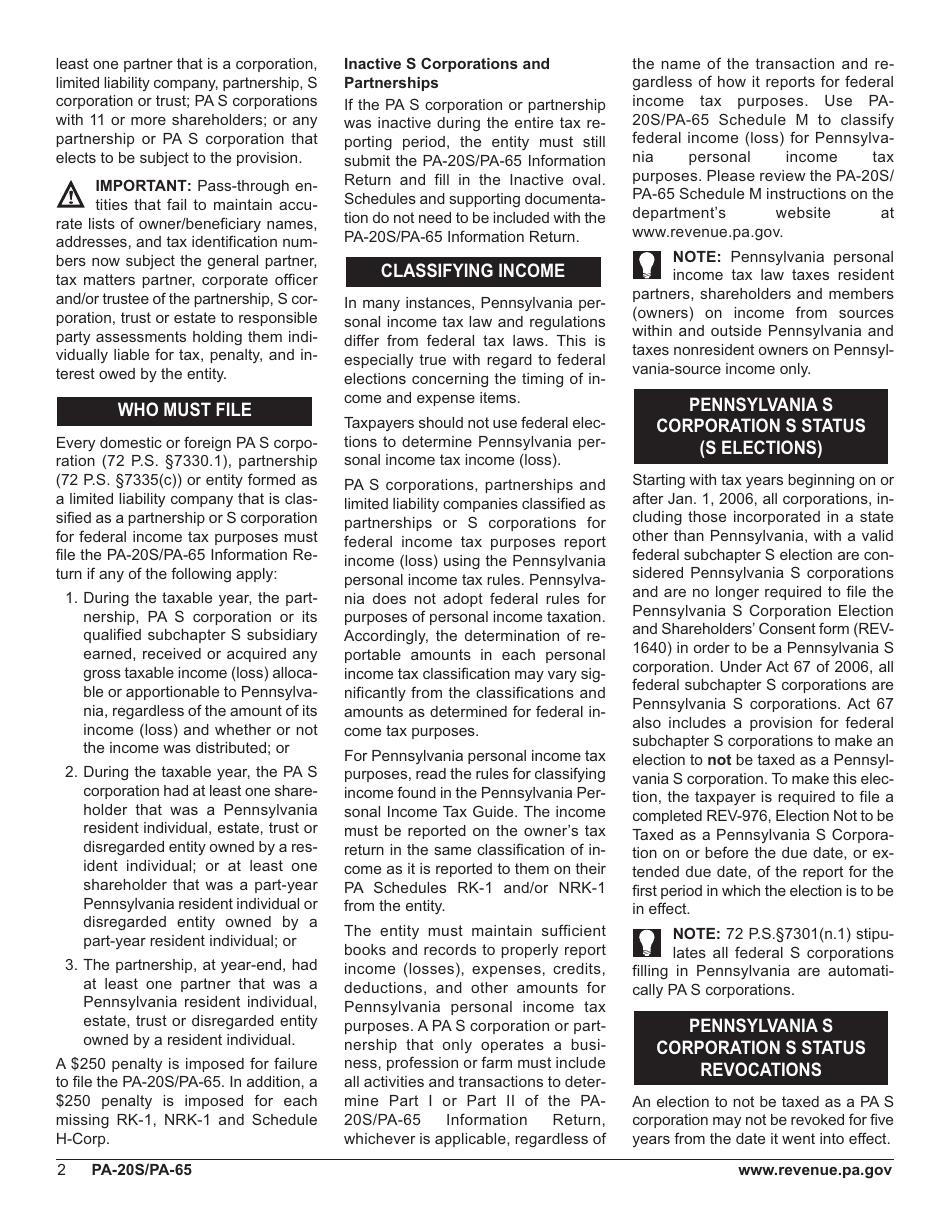

Q: Who needs to file Form PA-20s/65?

A: Form PA-20s/65 must be filed by S corporations and partnerships doing business in Pennsylvania.

Q: When is Form PA-20s/65 due?

A: Form PA-20s/65 is due on or before the 15th day of the 4th month following the close of the tax year.

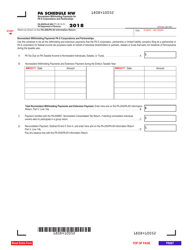

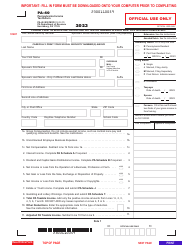

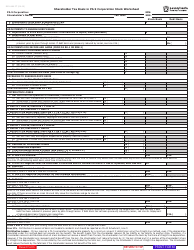

Q: What information is required on Form PA-20s/65?

A: Form PA-20s/65 requires information about the business's income, deductions, credits, and other relevant details.

Q: Are there any penalties for late filing of Form PA-20s/65?

A: Yes, there are penalties for late filing of Form PA-20s/65. It is best to file the return on time to avoid these penalties.

Form Details:

- Released on May 1, 2017;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PA-20s/65 by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.