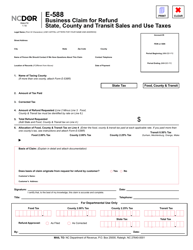

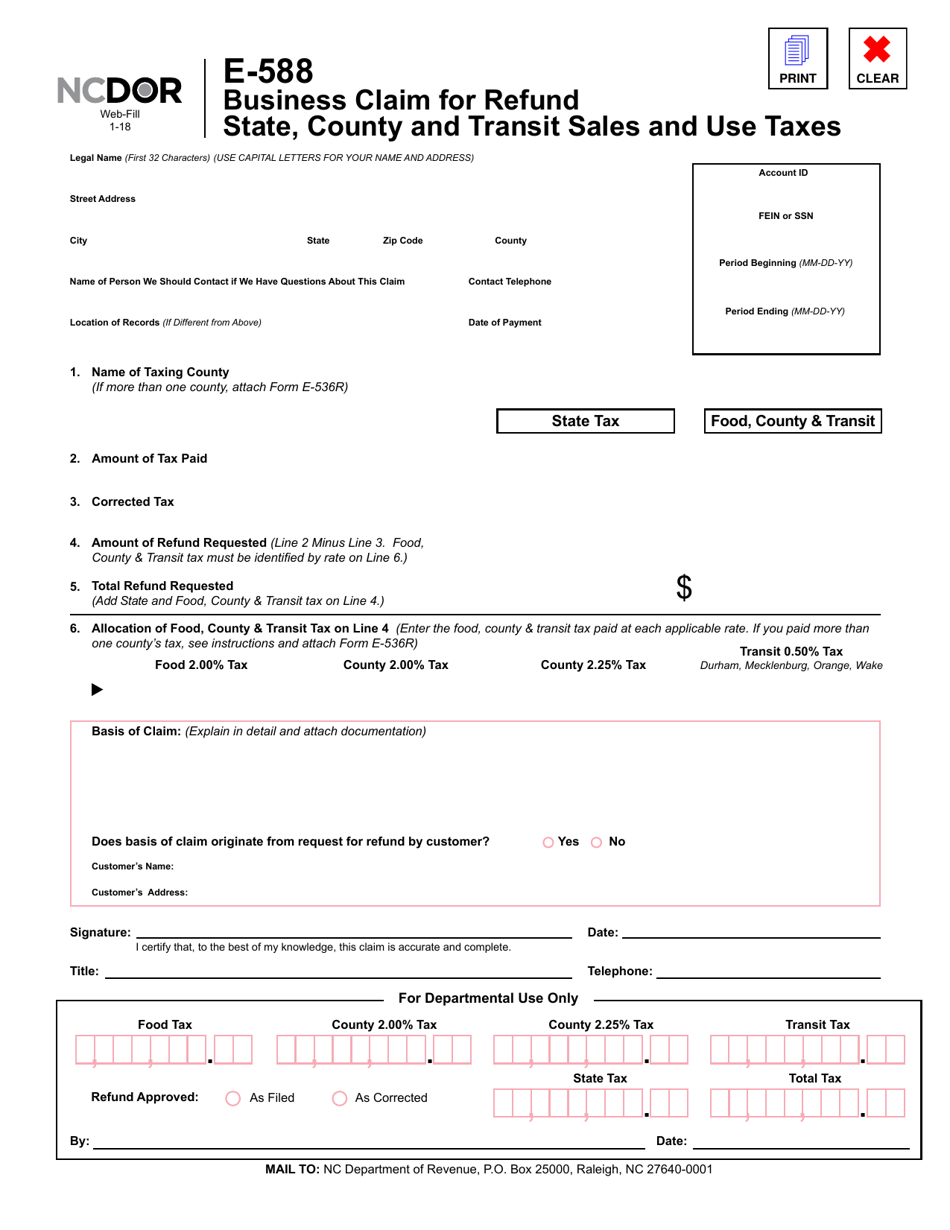

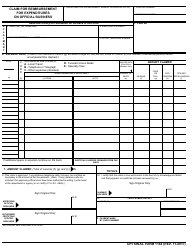

Form E-588 Business Claim for Refund State, County and Transit Sales and Use Taxes - North Carolina

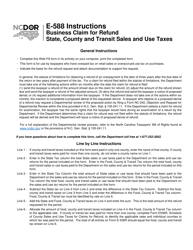

What Is Form E-588?

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form E-588?

A: Form E-588 is a business claim for refund for state, county, and transit sales and use taxes in North Carolina.

Q: Who can use Form E-588?

A: Form E-588 can be used by businesses in North Carolina who want to claim a refund for sales and use taxes.

Q: What taxes can be refunded with Form E-588?

A: Form E-588 can be used to claim a refund for state, county, and transit sales and use taxes.

Q: What documents do I need to file Form E-588?

A: You will need supporting documentation such as receipts and invoices to file Form E-588.

Q: What is the deadline for filing Form E-588?

A: Form E-588 must be filed within three years from the date the tax was paid or due, whichever is later.

Q: How long does it take to receive a refund after filing Form E-588?

A: The processing time for refunds can vary, but generally it takes about 90 days to receive a refund after filing Form E-588.

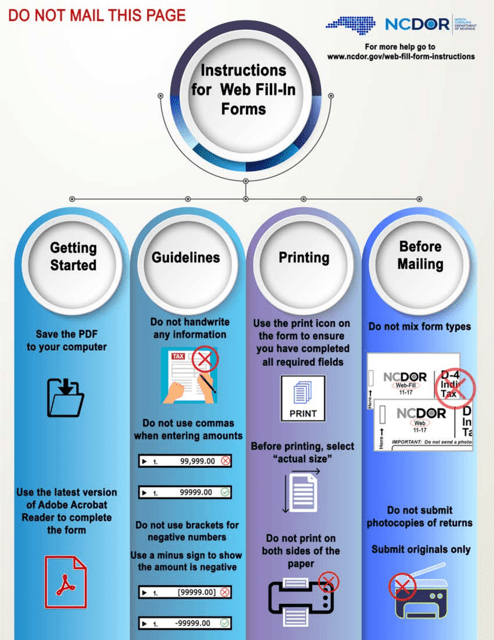

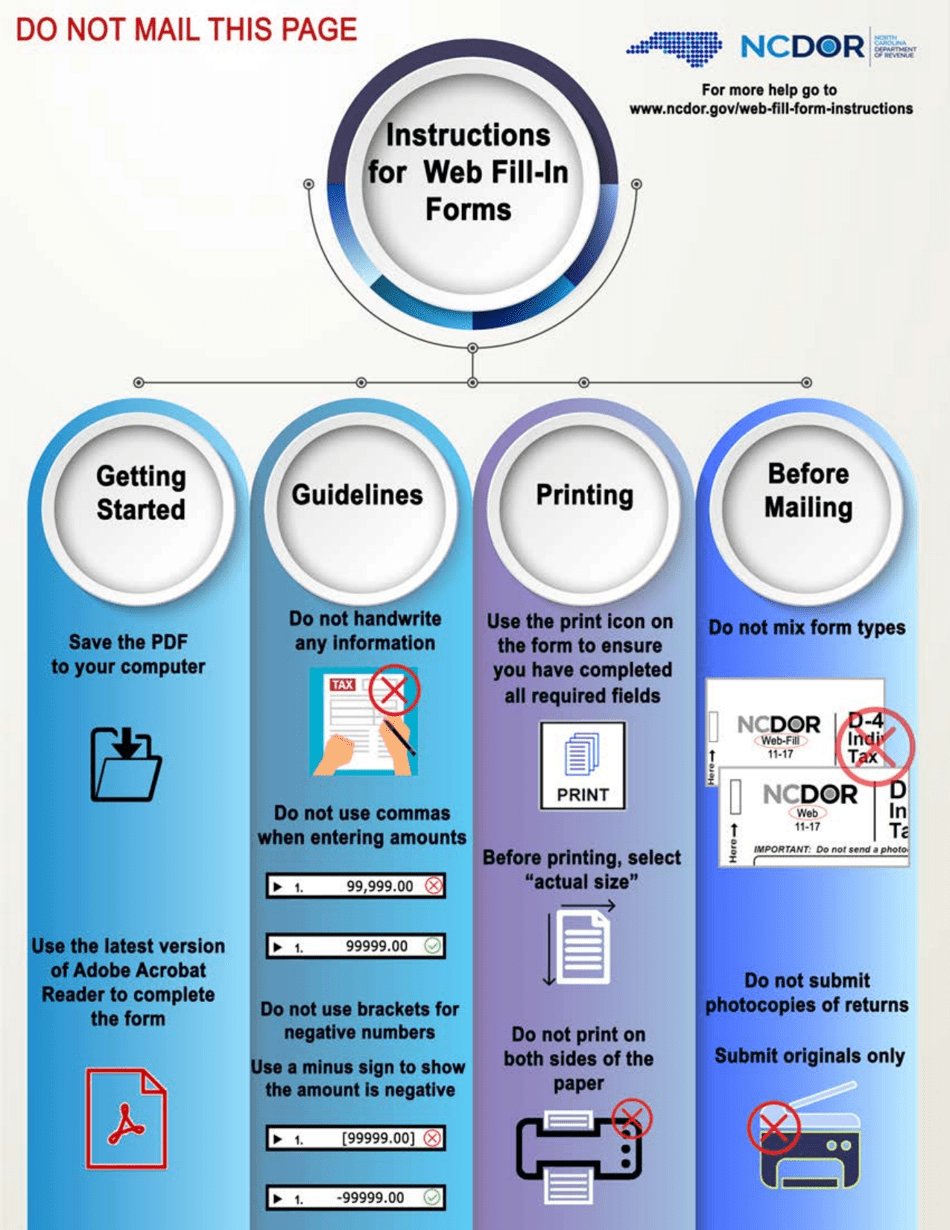

Form Details:

- Released on January 1, 2018;

- The latest edition provided by the North Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form E-588 by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.