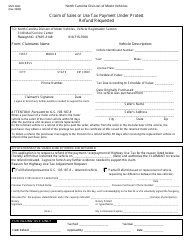

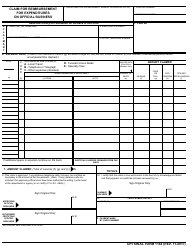

Instructions for Form E-588 Business Claim for Refund State, County and Transit Sales and Use Taxes - North Carolina

This document contains official instructions for Form E-588 , Business Claim for Refund State, County and Transit Sales and Use Taxes - a form released and collected by the North Carolina Department of Revenue. An up-to-date fillable Form E-588 is available for download through this link.

FAQ

Q: What is Form E-588?

A: Form E-588 is a form used in North Carolina for business to claim a refund on state, county, and transit sales and use taxes.

Q: Who can use Form E-588?

A: Any business that has paid sales and use taxes in North Carolina can use Form E-588 to claim a refund.

Q: What taxes can be refunded using Form E-588?

A: Form E-588 can be used to claim a refund on state, county, and transit sales and use taxes.

Q: What information is required on Form E-588?

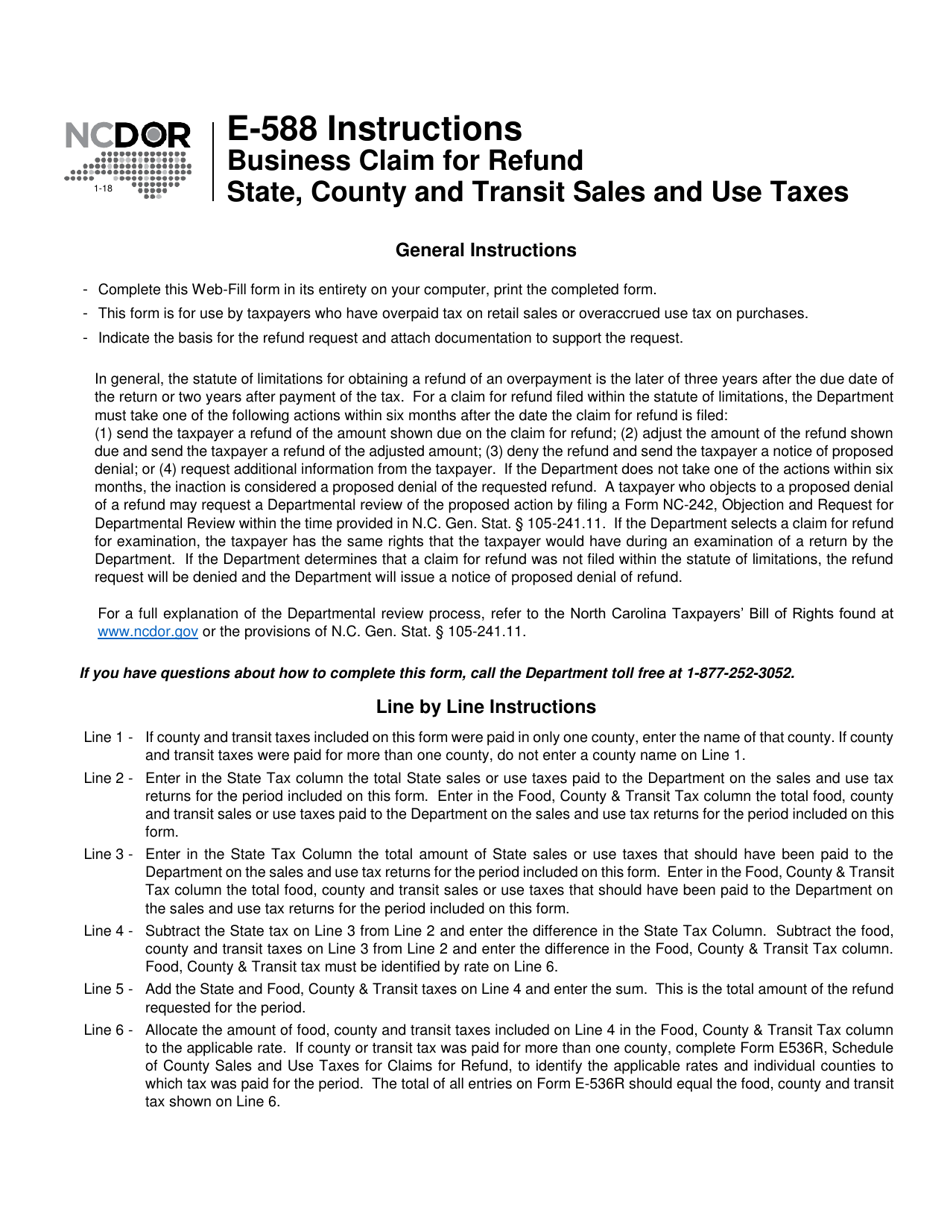

A: Form E-588 requires information such as the business name, address, tax identification number, and details of the taxes being claimed for refund.

Q: Are there any deadlines for submitting Form E-588?

A: Yes, Form E-588 must be submitted within three years from the due date of the tax return or within six months from the date the tax was paid, whichever is later.

Q: How long does it take to process a refund claim?

A: Processing times may vary, but the Department of Revenue aims to process refund claims within 90 days of receiving the complete and accurate form.

Q: What supporting documentation is required with Form E-588?

A: Supporting documentation, such as invoices, receipts, and proof of payment, should be included with Form E-588 to support the refund claim.

Q: Can multiple refund claims be filed on a single Form E-588?

A: No, each period being claimed for refund must have a separate Form E-588.

Q: What should I do if my refund claim is denied?

A: If your refund claim is denied, you have the option to appeal the decision with the North Carolina Department of Revenue.

Instruction Details:

- This 1-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the North Carolina Department of Revenue.