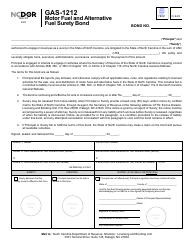

This version of the form is not currently in use and is provided for reference only. Download this version of

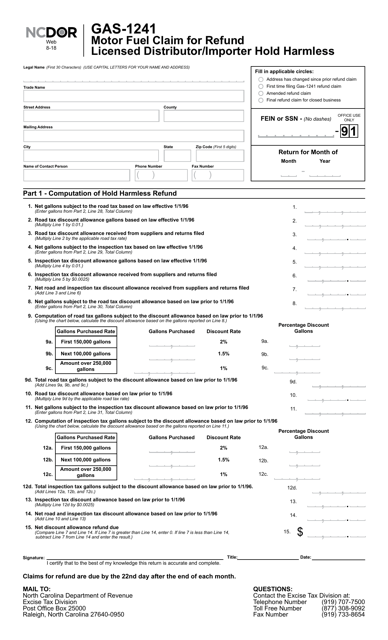

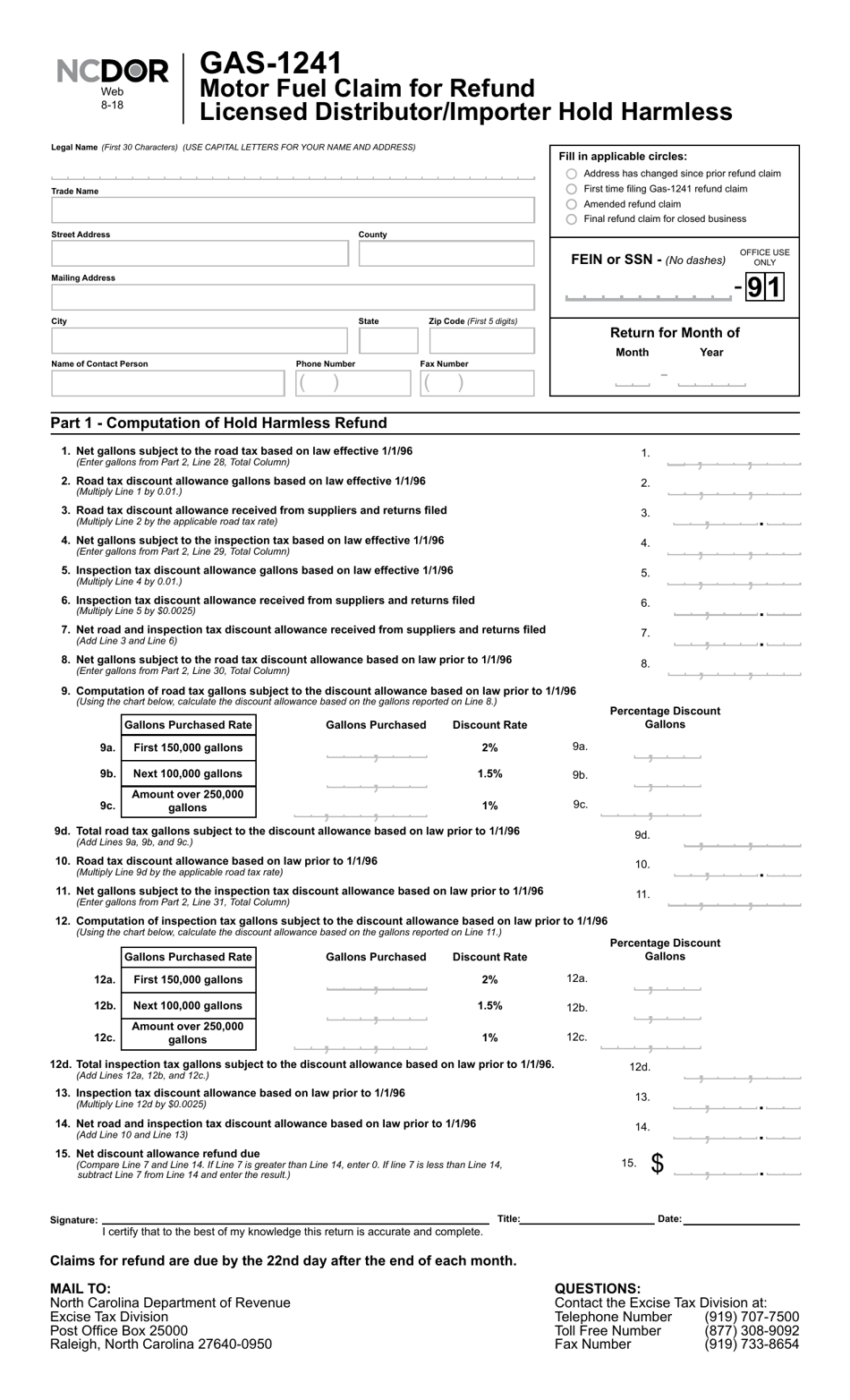

Form GAS-1241

for the current year.

Form GAS-1241 Motor Fuel Claim for Refund Licensed Distributor / Importer Hold Harmless - North Carolina

What Is Form GAS-1241?

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. Check the official instructions before completing and submitting the form.

FAQ

Q: What is GAS-1241?

A: GAS-1241 is a form used for claiming a refund of motor fuel taxes by licensed distributors/importers in North Carolina.

Q: Who can use GAS-1241?

A: Licensed distributors or importers of motor fuel in North Carolina can use the GAS-1241 form.

Q: What is the purpose of GAS-1241?

A: The purpose of GAS-1241 is to facilitate the process of claiming a refund of motor fuel taxes paid by licensed distributors or importers.

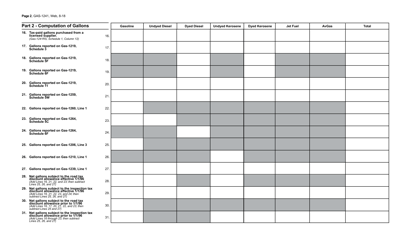

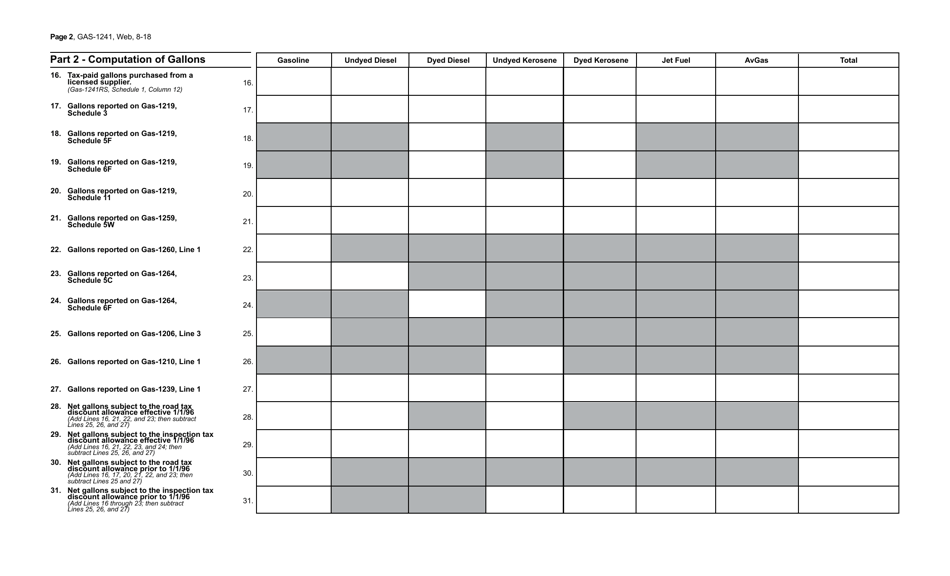

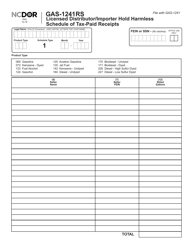

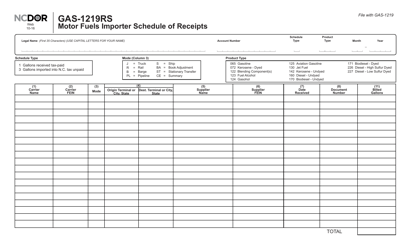

Q: What information is needed on GAS-1241?

A: GAS-1241 requires the licensee's name and address, the amount of motor fuel taxes paid, and other relevant details related to the refund claim.

Q: Are there any requirements or conditions for claiming a refund with GAS-1241?

A: Yes, there are specific requirements and conditions that must be met to claim a refund with GAS-1241. These include maintaining proper records, timely filing the form, and meeting the eligibility criteria set by the North Carolina Department of Revenue.

Form Details:

- Released on August 1, 2018;

- The latest edition provided by the North Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form GAS-1241 by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.