This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for Form NC-REHAB

for the current year.

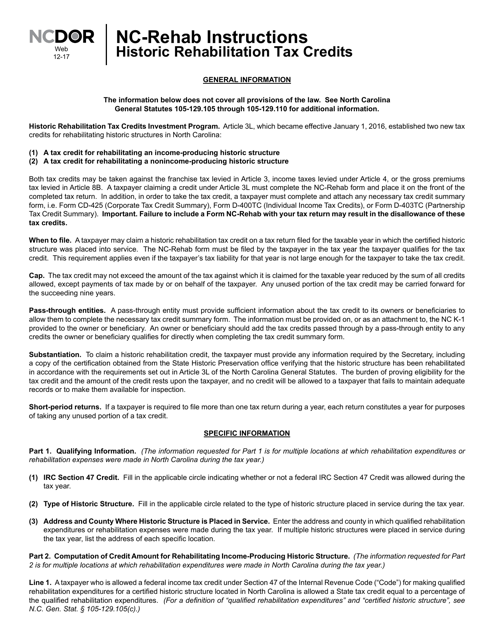

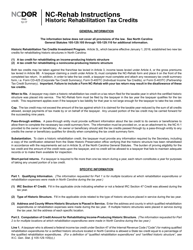

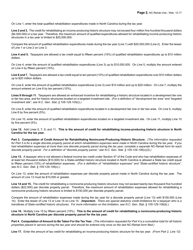

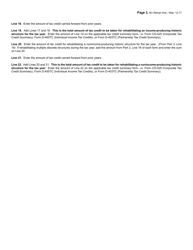

Instructions for Form NC-REHAB Historic Rehabilitation Tax Credits - North Carolina

This document contains official instructions for Form NC-REHAB , Historic Rehabilitation Tax Credits - a form released and collected by the North Carolina Department of Revenue.

FAQ

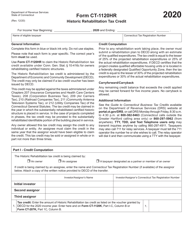

Q: What is Form NC-REHAB?

A: Form NC-REHAB is a tax form used in North Carolina for claiming Historic RehabilitationTax Credits.

Q: What are Historic Rehabilitation Tax Credits?

A: Historic Rehabilitation Tax Credits are tax incentives provided to individuals and businesses for the rehabilitation of historic properties.

Q: Who can use Form NC-REHAB?

A: Individuals and businesses in North Carolina who have rehabilitated historic properties may use Form NC-REHAB.

Q: What information is required on Form NC-REHAB?

A: Form NC-REHAB requires information about the property being rehabilitated, the cost of the rehabilitation, and other related expenses.

Q: How do I claim Historic Rehabilitation Tax Credits in North Carolina?

A: To claim Historic Rehabilitation Tax Credits in North Carolina, you must complete Form NC-REHAB and submit it with your tax return.

Instruction Details:

- This 3-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the North Carolina Department of Revenue.