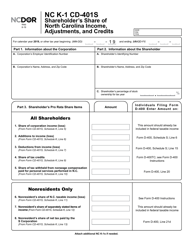

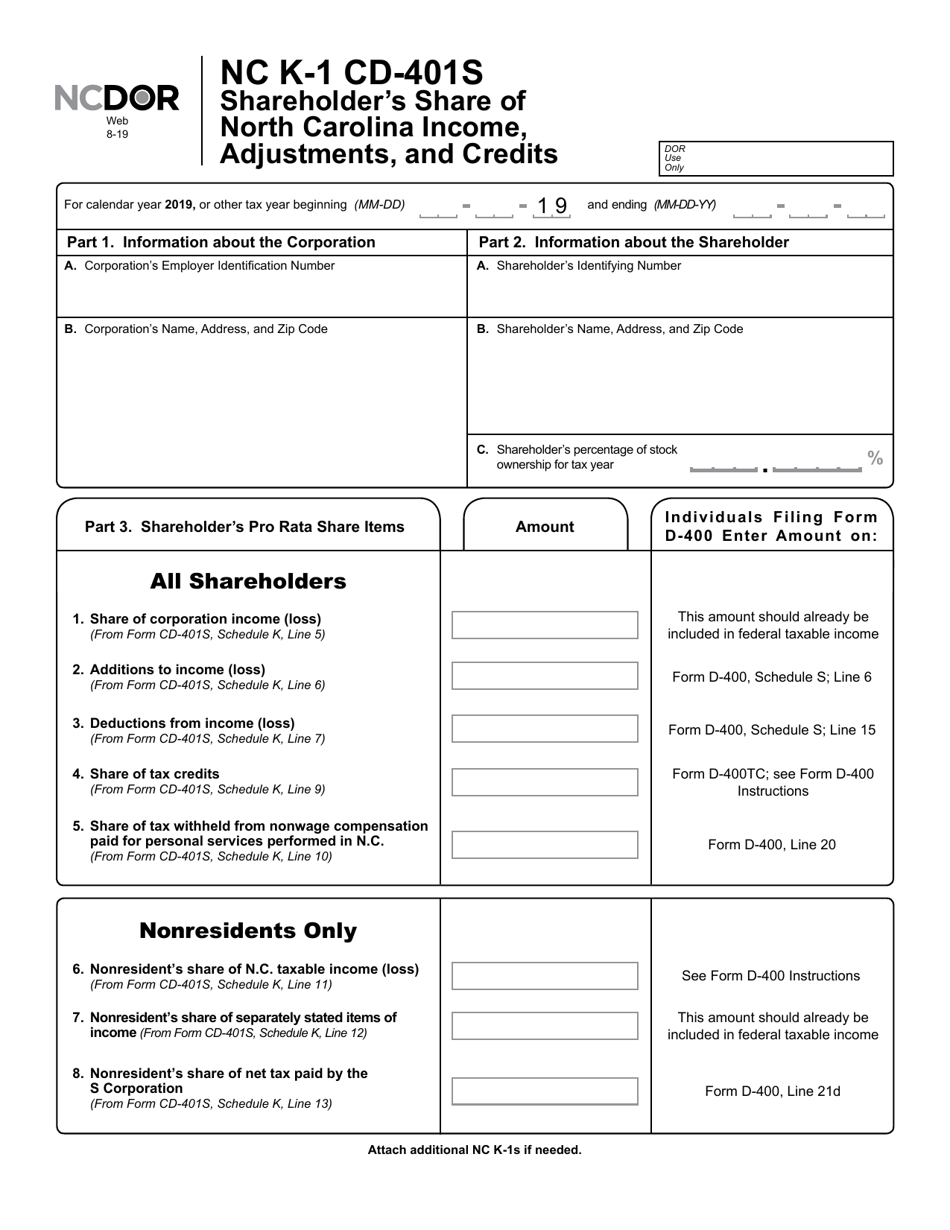

Form NC K-1 Shareholder's Share of North Carolina Income, Adjustments, and Credits (For Form Cd-401s) - North Carolina

What Is Form NC K-1?

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form NC K-1?

A: Form NC K-1 is a tax form that reports a shareholder's share of North Carolina income, adjustments, and credits.

Q: Who should file Form NC K-1?

A: Form NC K-1 should be filed by shareholders of North Carolina businesses or entities.

Q: What does Form NC K-1 report?

A: Form NC K-1 reports a shareholder's share of income, adjustments, and credits from a North Carolina business or entity.

Q: Do I need to file Form NC K-1 if I am not a North Carolina resident?

A: If you are a shareholder of a North Carolina business or entity, you may still need to file Form NC K-1 even if you are not a resident of North Carolina.

Q: Is Form NC K-1 the same as Form Cd-401s?

A: Yes, Form NC K-1 is also referred to as Form Cd-401s and serves the same purpose.

Q: What information do I need to fill out Form NC K-1?

A: You will need information about your share of the business's income, adjustments, and credits.

Q: When is the deadline for filing Form NC K-1?

A: The deadline for filing Form NC K-1 is the same as the deadline for filing your North Carolina income tax return.

Q: Can I file Form NC K-1 electronically?

A: Yes, you can file Form NC K-1 electronically through the North Carolina Department of Revenue's eFile system.

Q: Are there any penalties for not filing Form NC K-1?

A: Failure to file Form NC K-1 may result in penalties imposed by the North Carolina Department of Revenue.

Form Details:

- Released on August 1, 2019;

- The latest edition provided by the North Carolina Department of Revenue;

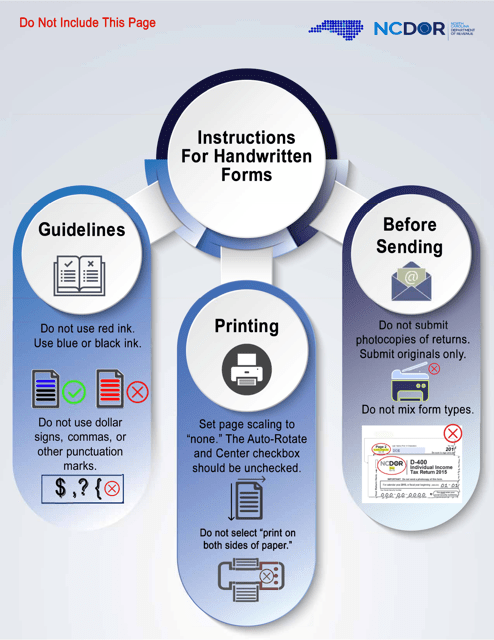

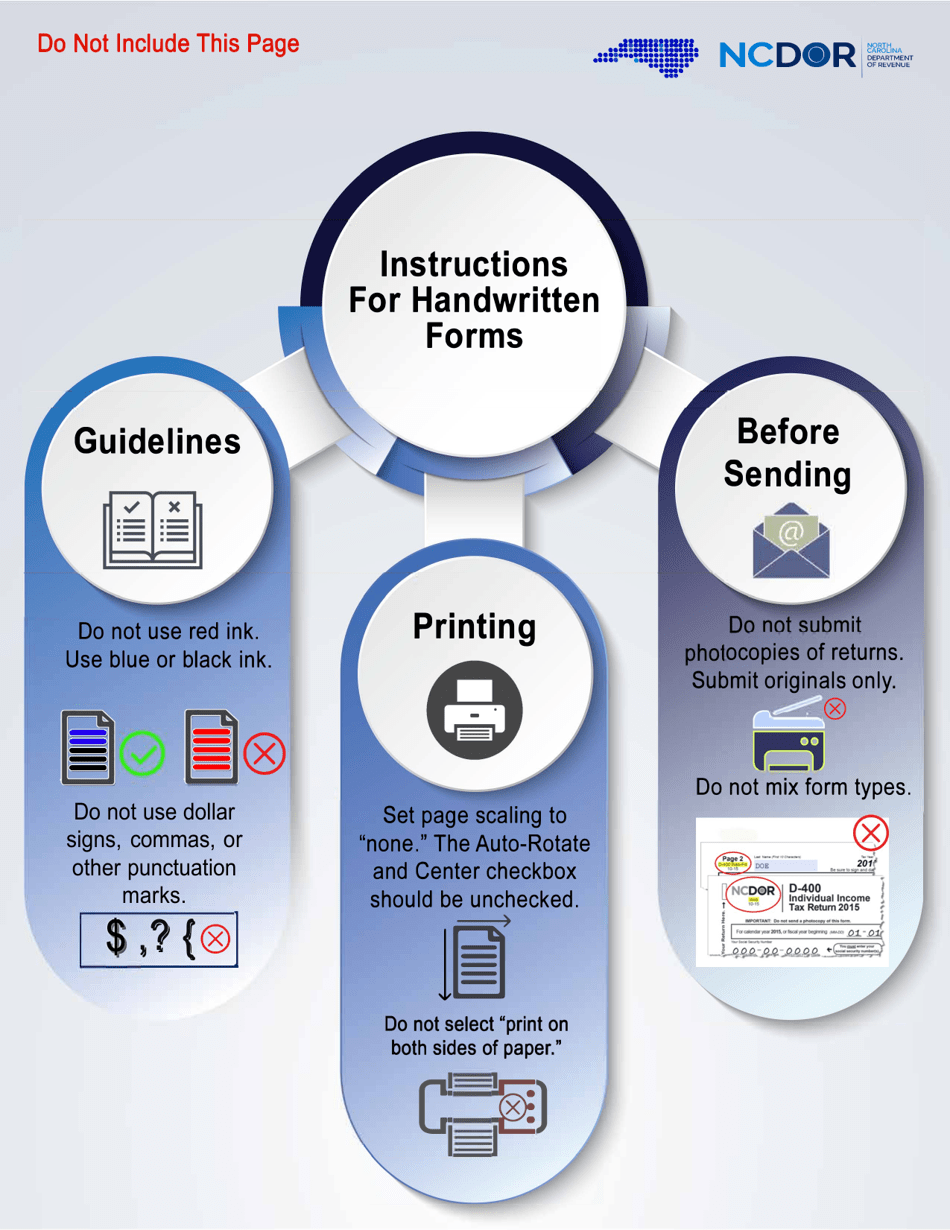

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form NC K-1 by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.