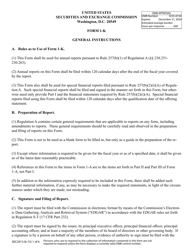

This version of the form is not currently in use and is provided for reference only. Download this version of

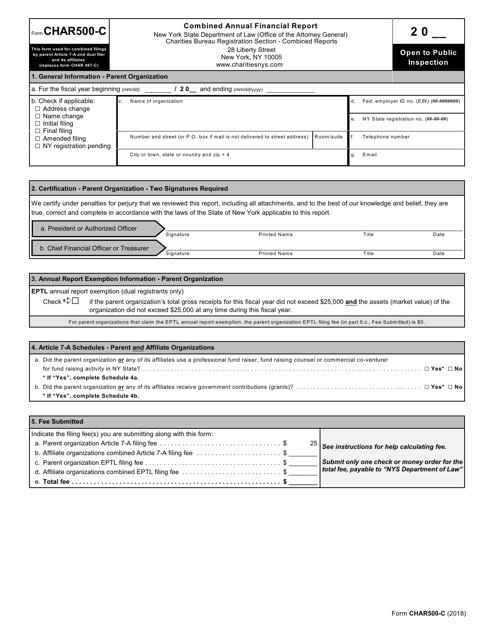

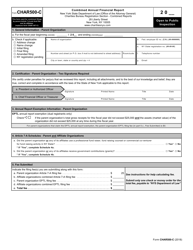

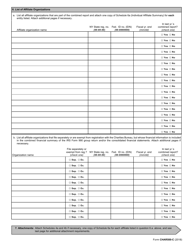

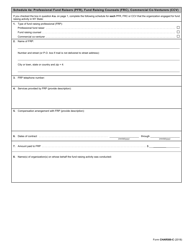

Form CHAR500-C

for the current year.

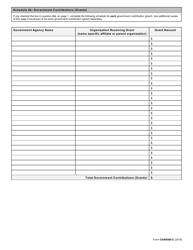

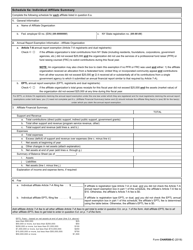

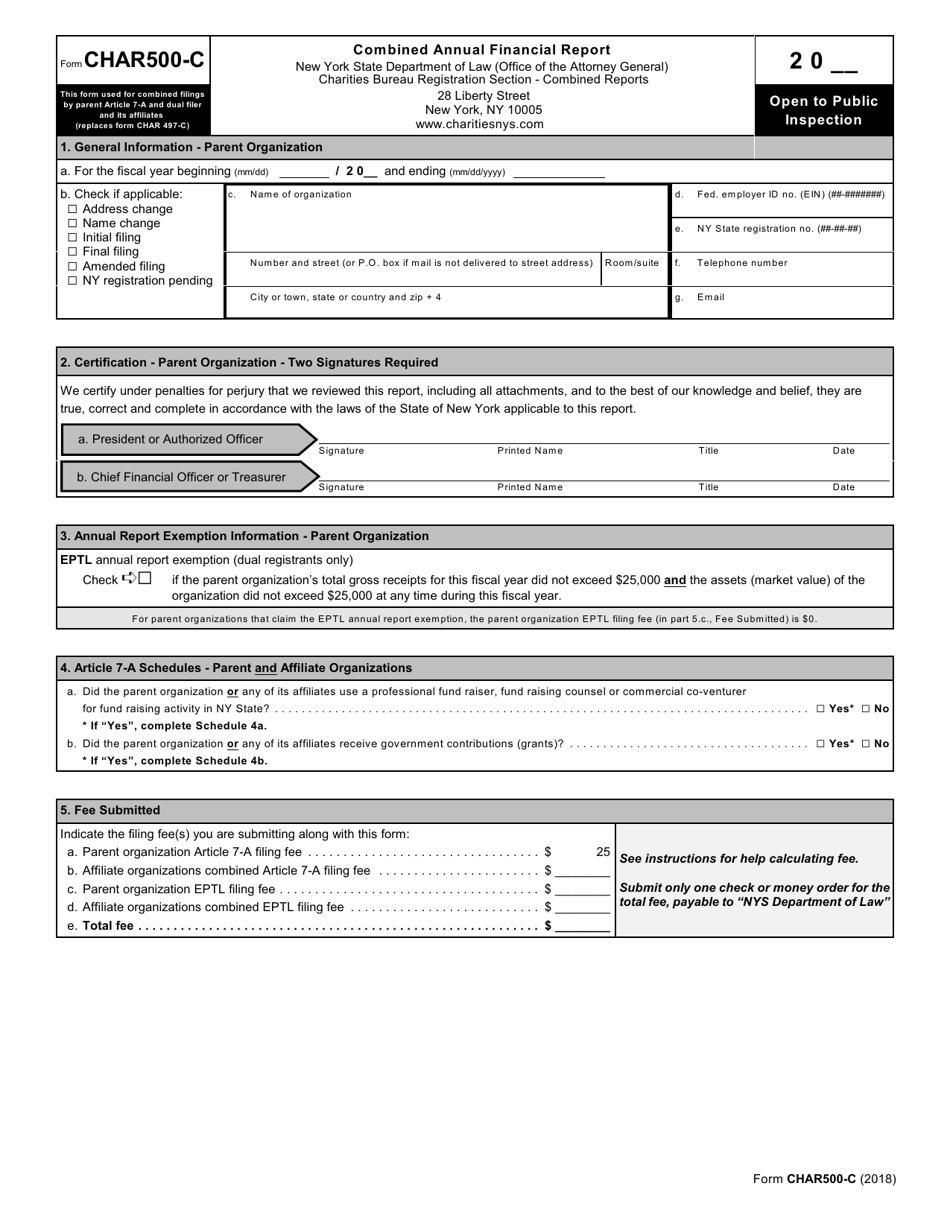

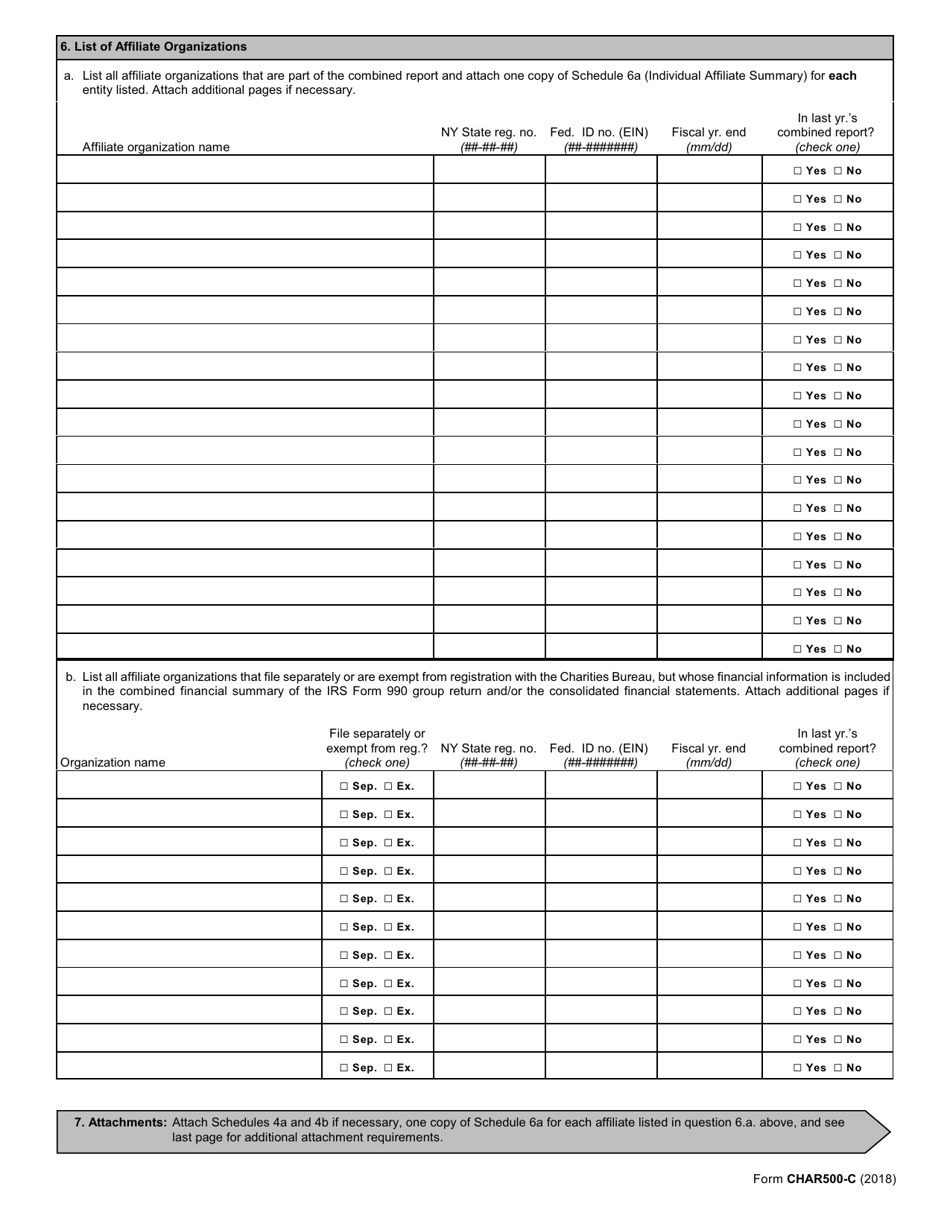

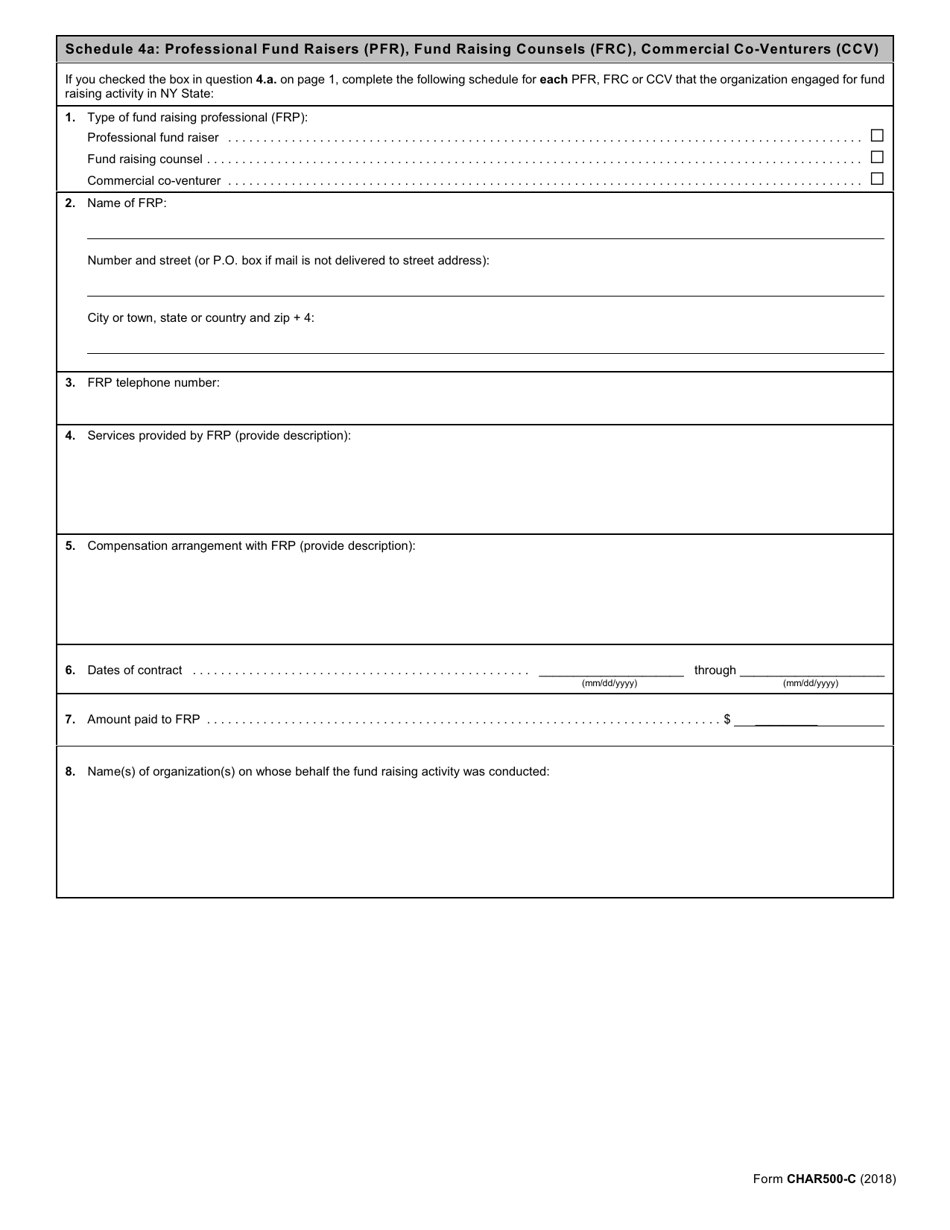

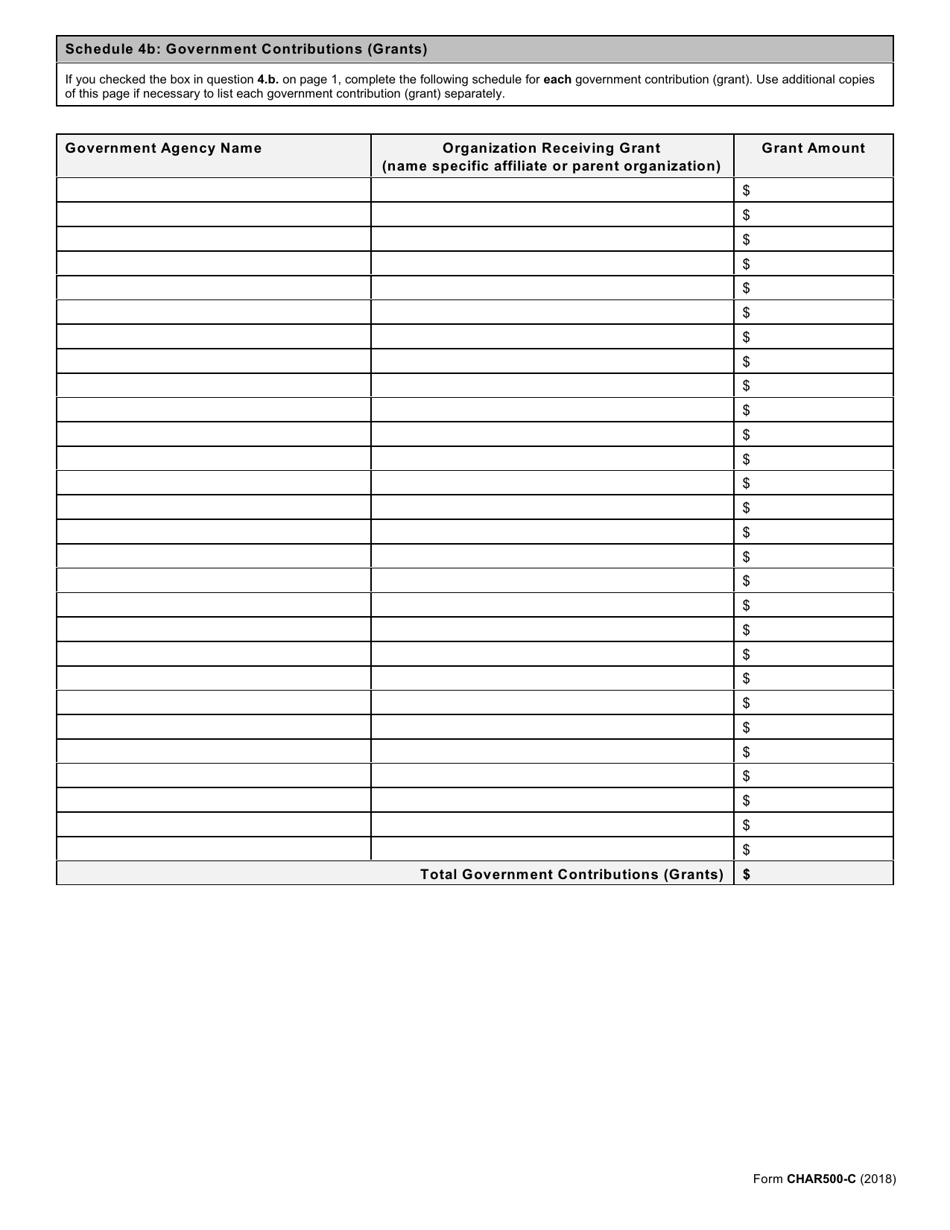

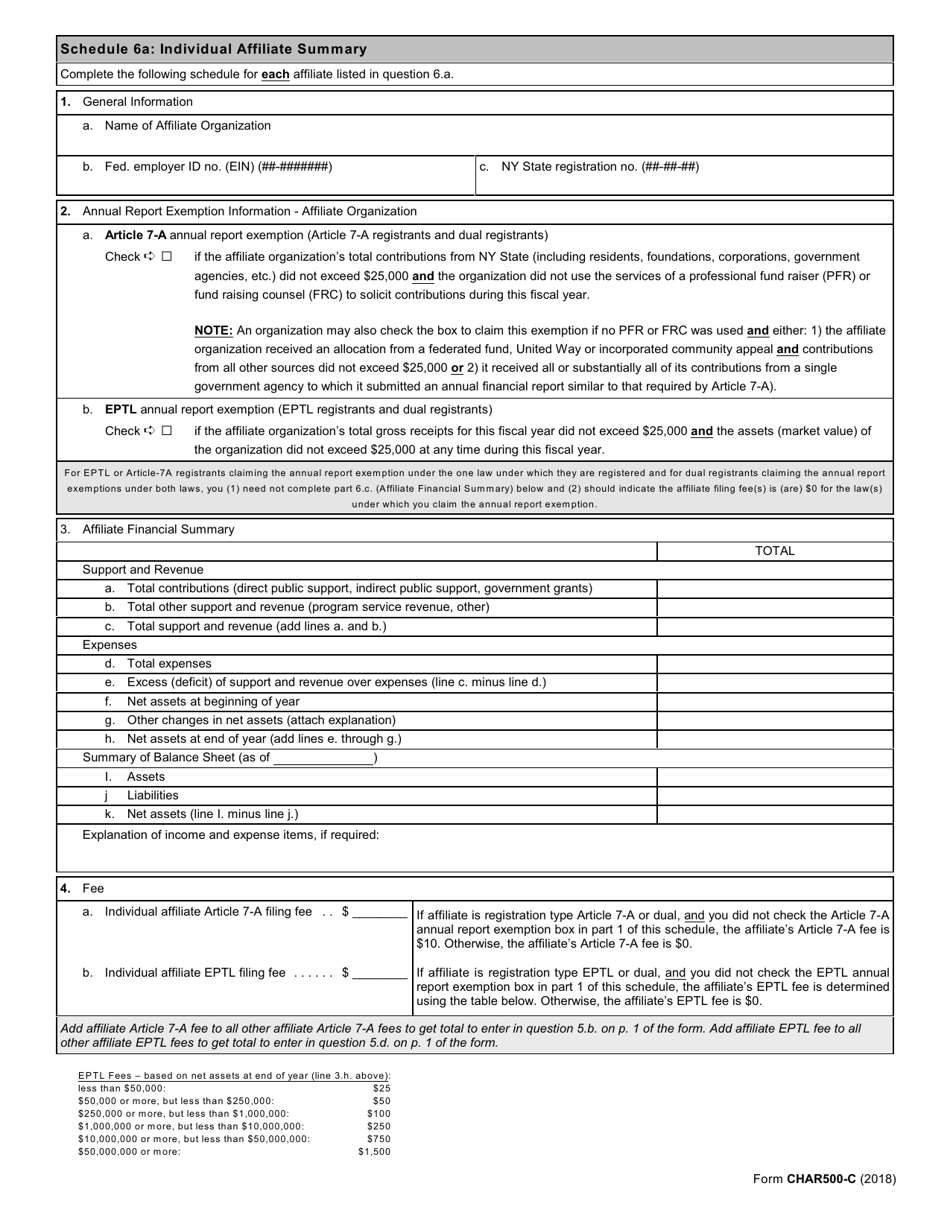

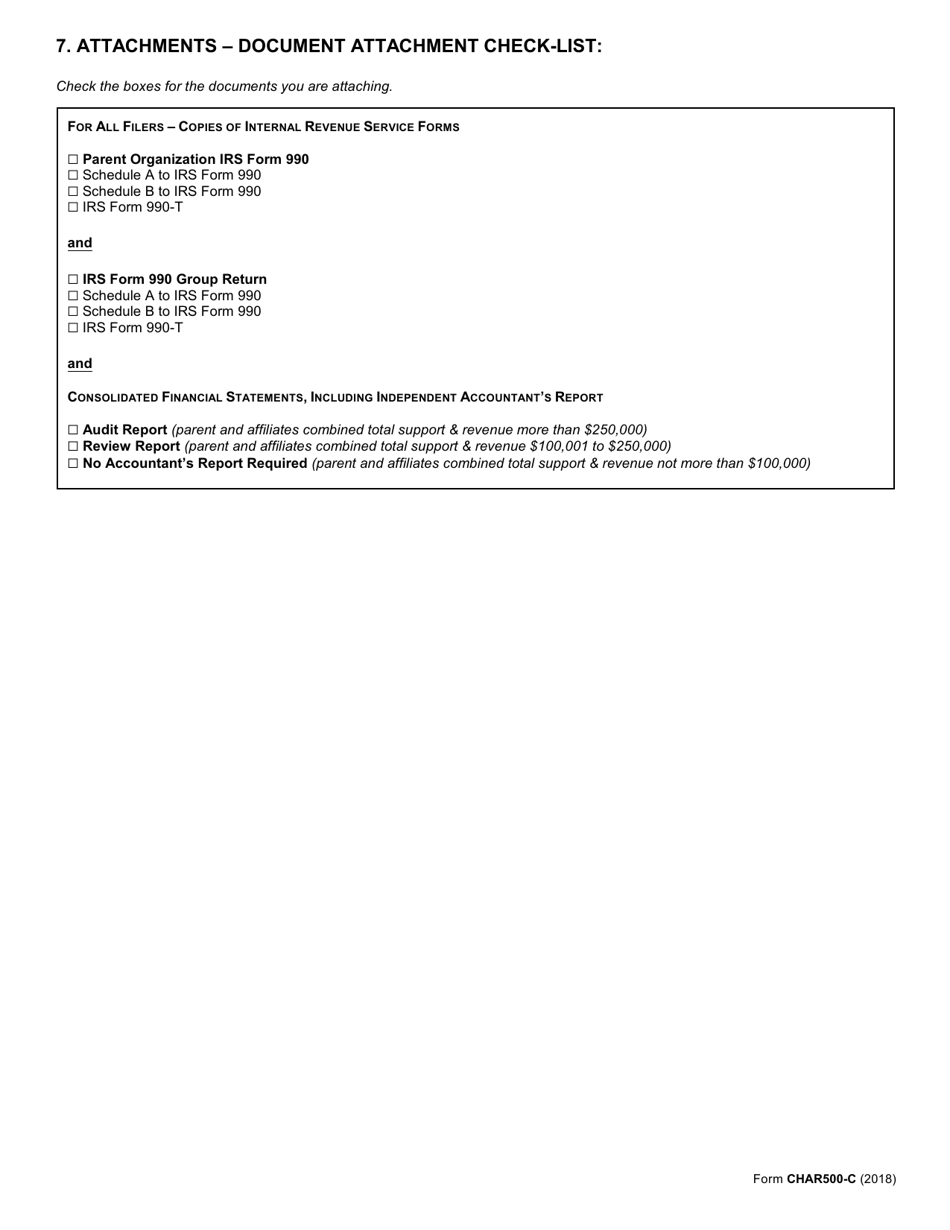

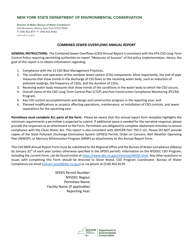

Form CHAR500-C Combined Annual Financial Report - New York

What Is Form CHAR500-C?

This is a legal form that was released by the New York State Attorney General - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is CHAR500-C?

A: CHAR500-C is the Combined Annual Financial Report for New York.

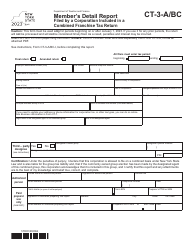

Q: Who should file the CHAR500-C?

A: The CHAR500-C should be filed by organizations required to provide a combined financial report for New York.

Q: What is the purpose of the CHAR500-C?

A: The purpose of the CHAR500-C is to report the organization's combined financial information to the state of New York.

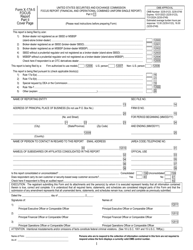

Q: When is the deadline to file the CHAR500-C?

A: The deadline to file the CHAR500-C is determined by the New York State Department of Taxation and Finance and can vary each year.

Q: Are there any penalties for late filing of the CHAR500-C?

A: Yes, there may be penalties for late filing of the CHAR500-C. It is important to file the form by the deadline to avoid any potential penalties.

Form Details:

- Released on January 1, 2018;

- The latest edition provided by the New York State Attorney General;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CHAR500-C by clicking the link below or browse more documents and templates provided by the New York State Attorney General.