This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for Form CHAR500-C

for the current year.

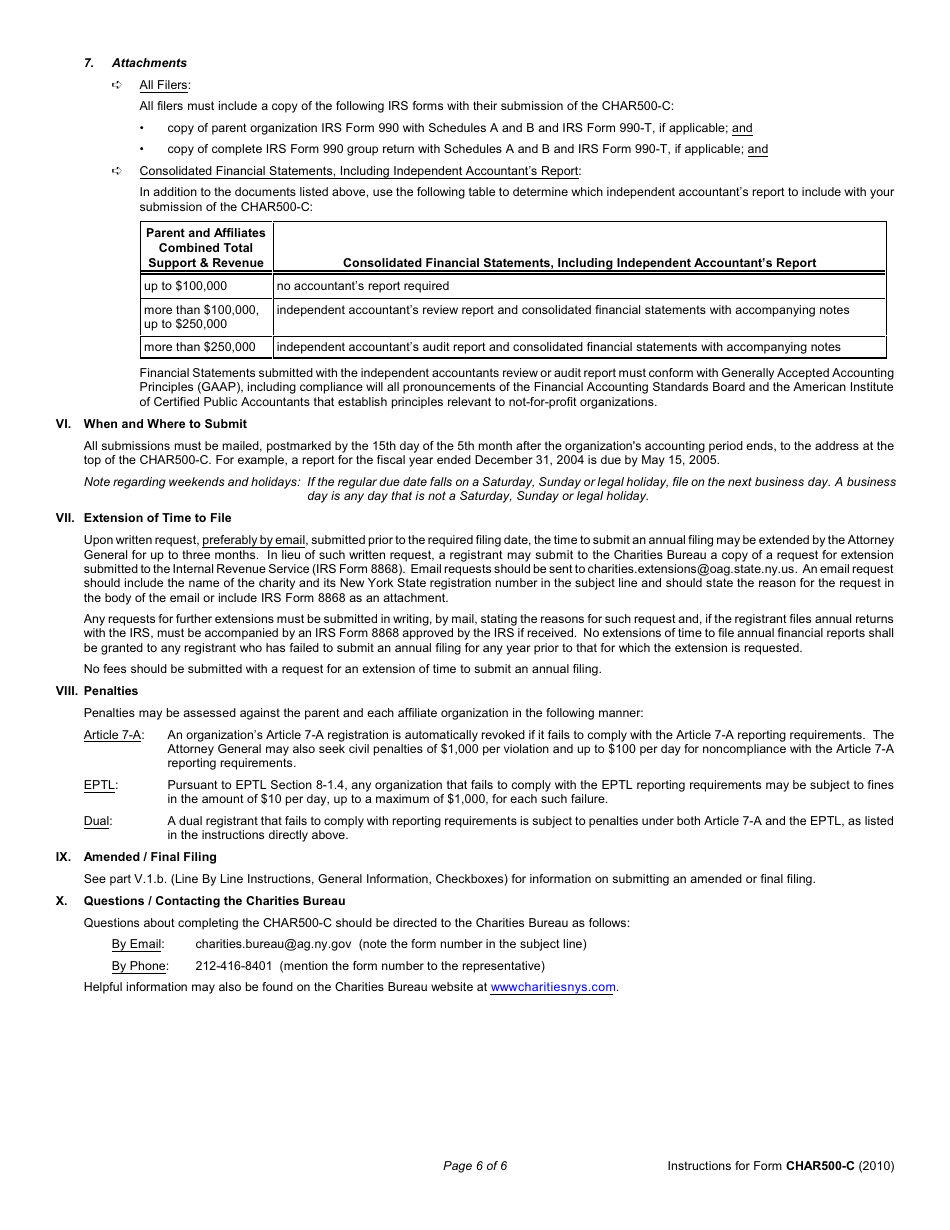

Instructions for Form CHAR500-C Combined Annual Financial Report - New York

This document contains official instructions for Form CHAR500-C , Combined Annual Financial Report - a form released and collected by the New York State Attorney General. An up-to-date fillable Form CHAR500-C is available for download through this link.

FAQ

Q: What is Form CHAR500-C Combined Annual Financial Report?

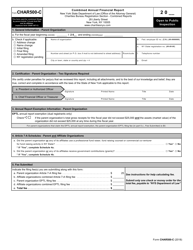

A: Form CHAR500-C Combined Annual Financial Report is a financial reporting form required by the New York Attorney General's Charities Bureau.

Q: Who needs to file Form CHAR500-C Combined Annual Financial Report?

A: Nonprofit organizations registered with the New York Attorney General's Charities Bureau and whose annual revenues exceed $250,000 are required to file Form CHAR500-C Combined Annual Financial Report.

Q: When is Form CHAR500-C Combined Annual Financial Report due?

A: Form CHAR500-C Combined Annual Financial Report is typically due within 5 months after the end of the organization's fiscal year.

Q: What information is required to be included in Form CHAR500-C Combined Annual Financial Report?

A: Form CHAR500-C Combined Annual Financial Report requires information about the organization's revenue and expenses, assets and liabilities, as well as other financial and programmatic information.

Q: Are there any penalties for not filing Form CHAR500-C Combined Annual Financial Report?

A: Failure to file Form CHAR500-C Combined Annual Financial Report may result in penalties, including fines and potential loss of the organization's tax-exempt status.

Instruction Details:

- This 6-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the New York State Attorney General.