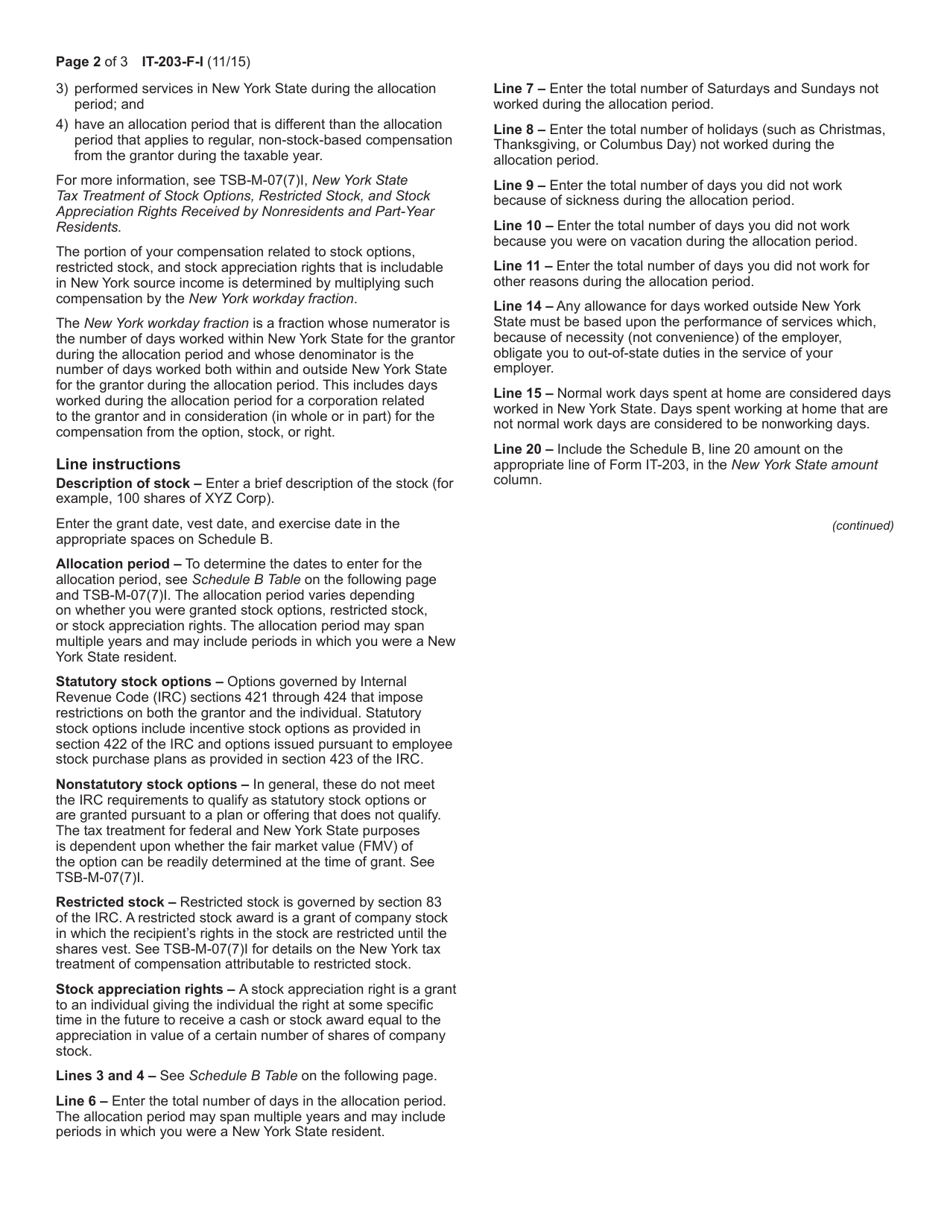

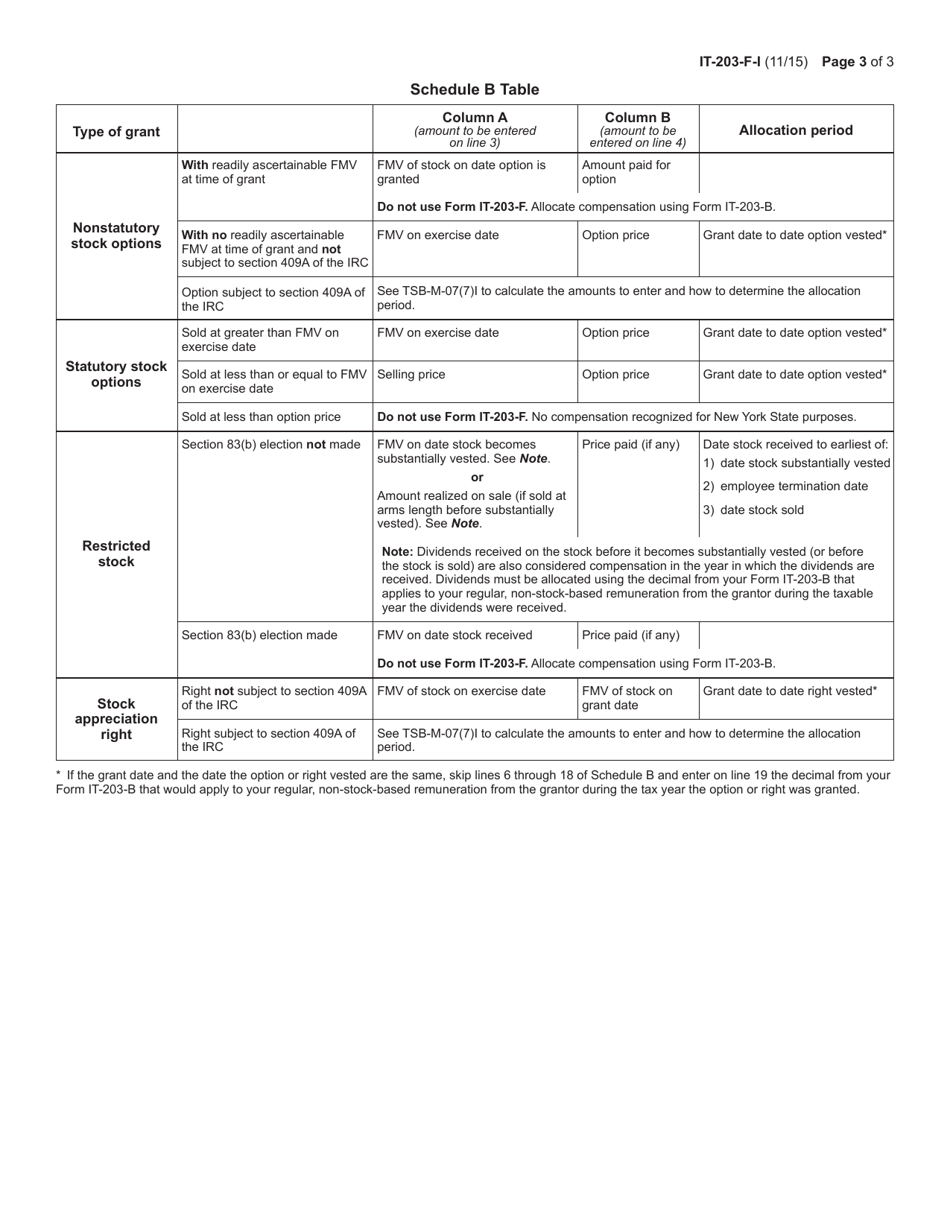

Instructions for Form IT-203-F Multi-Year Allocation Form - New York

This document contains official instructions for Form IT-203-F , Multi-Year Allocation Form - a form released and collected by the New York State Department of Taxation and Finance. An up-to-date fillable Form IT-203-F is available for download through this link.

FAQ

Q: What is Form IT-203-F?

A: Form IT-203-F is the Multi-Year Allocation Form for New York.

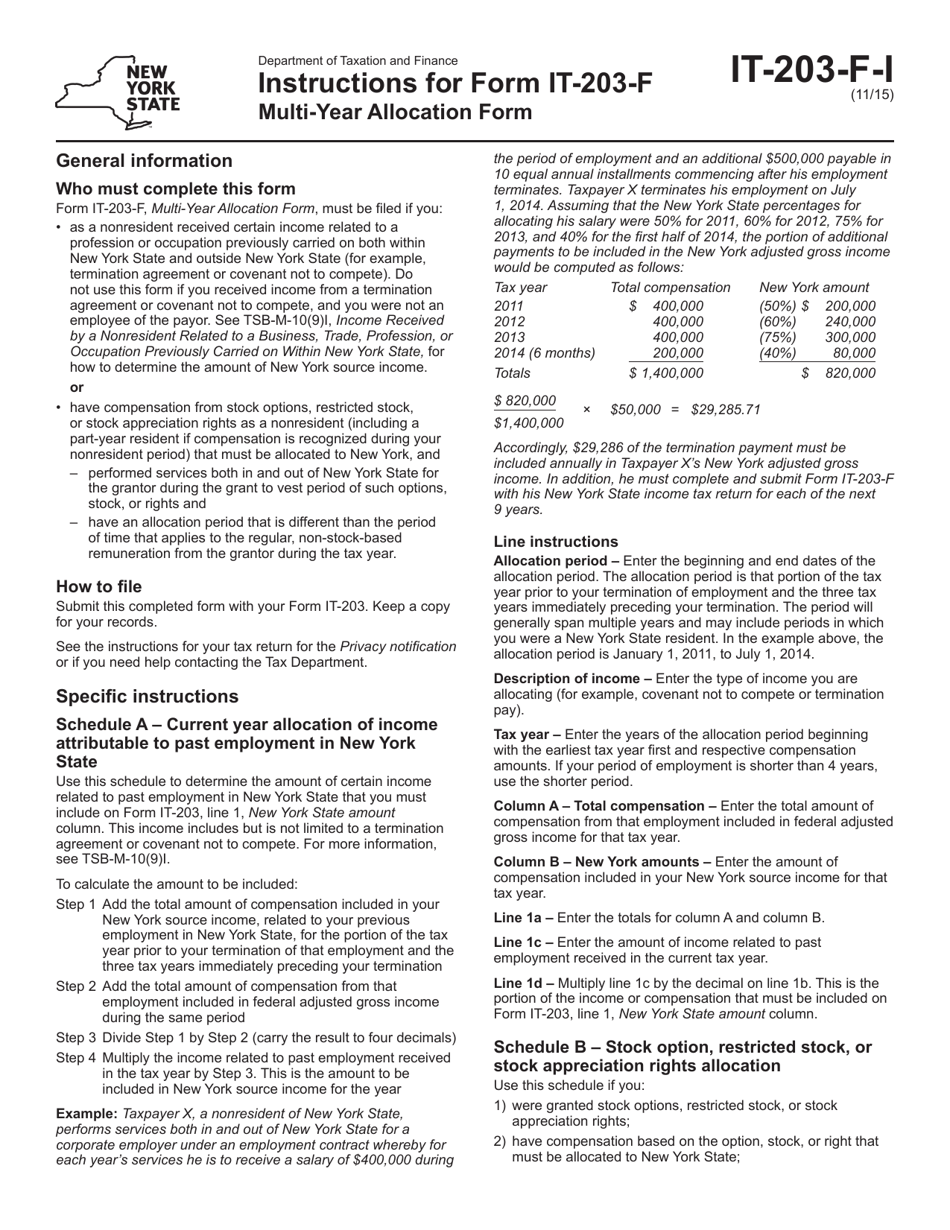

Q: Who needs to file Form IT-203-F?

A: Taxpayers who want to allocate their income or deductions over multiple years in New York need to file Form IT-203-F.

Q: What is the purpose of Form IT-203-F?

A: The purpose of Form IT-203-F is to allocate income or deductions from a New York S corporation, partnership, or trust over multiple years.

Q: When should Form IT-203-F be filed?

A: Form IT-203-F should be filed with the taxpayer's New York State income tax return for the applicable year.

Q: Can I e-file Form IT-203-F?

A: Currently, Form IT-203-F cannot be e-filed. It must be filed by mail.

Q: Are there any special instructions for completing Form IT-203-F?

A: Yes, you must follow the specific instructions provided with the form to correctly allocate your income or deductions over multiple years.

Q: Is there a deadline for filing Form IT-203-F?

A: Form IT-203-F must be filed by the due date of the taxpayer's New York State income tax return for the applicable year.

Instruction Details:

- This 3-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the New York State Department of Taxation and Finance.