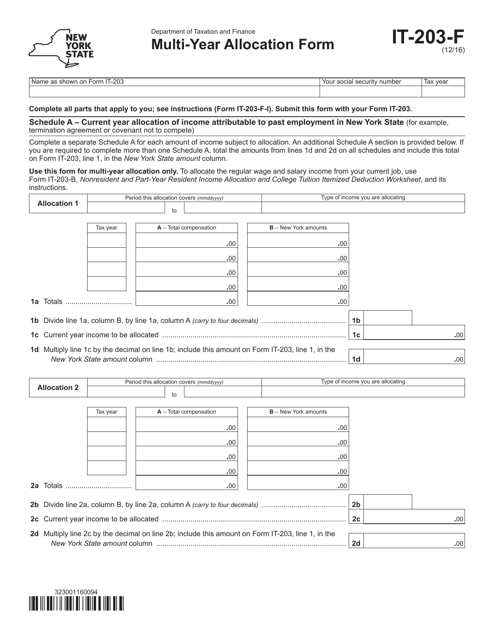

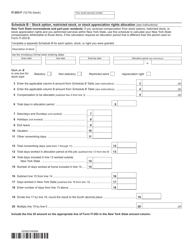

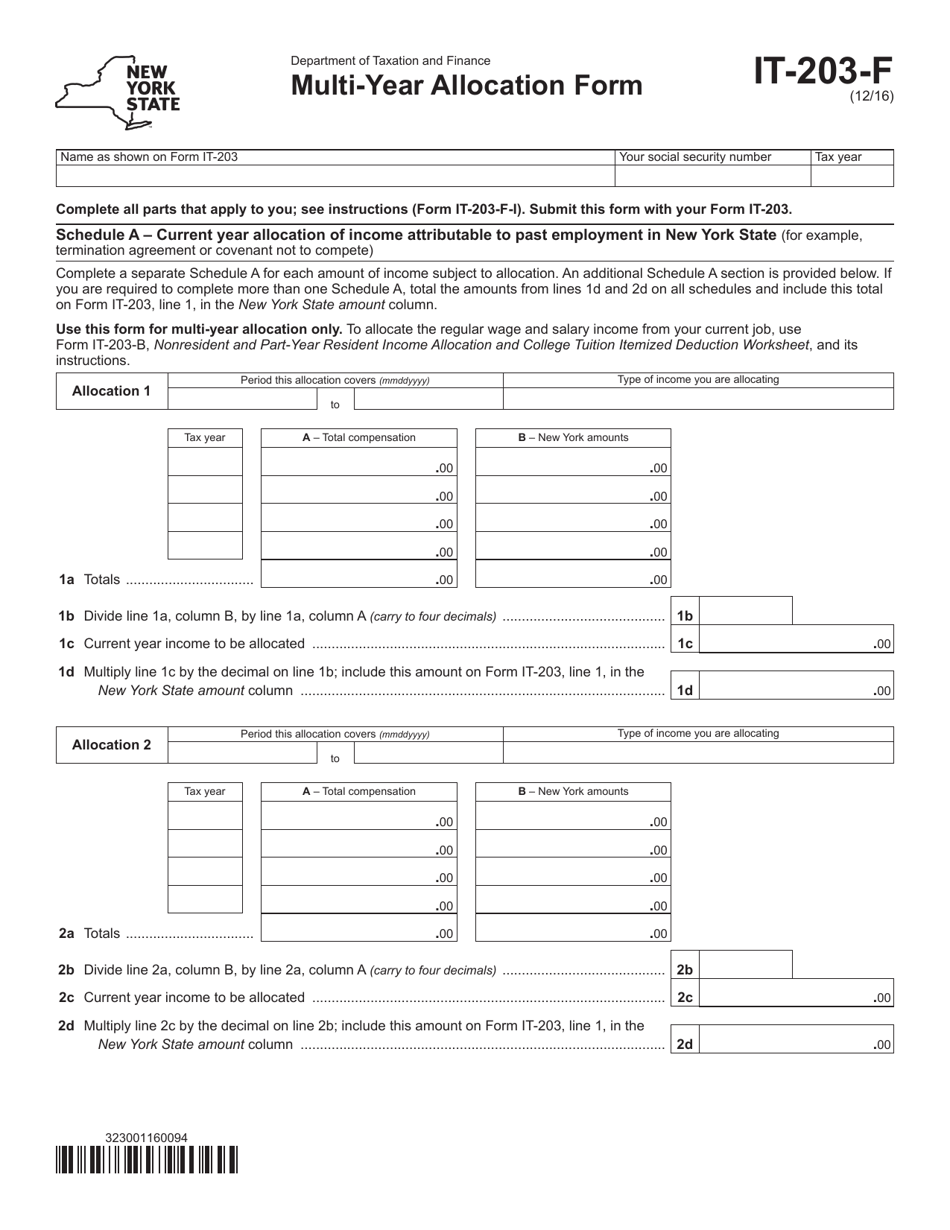

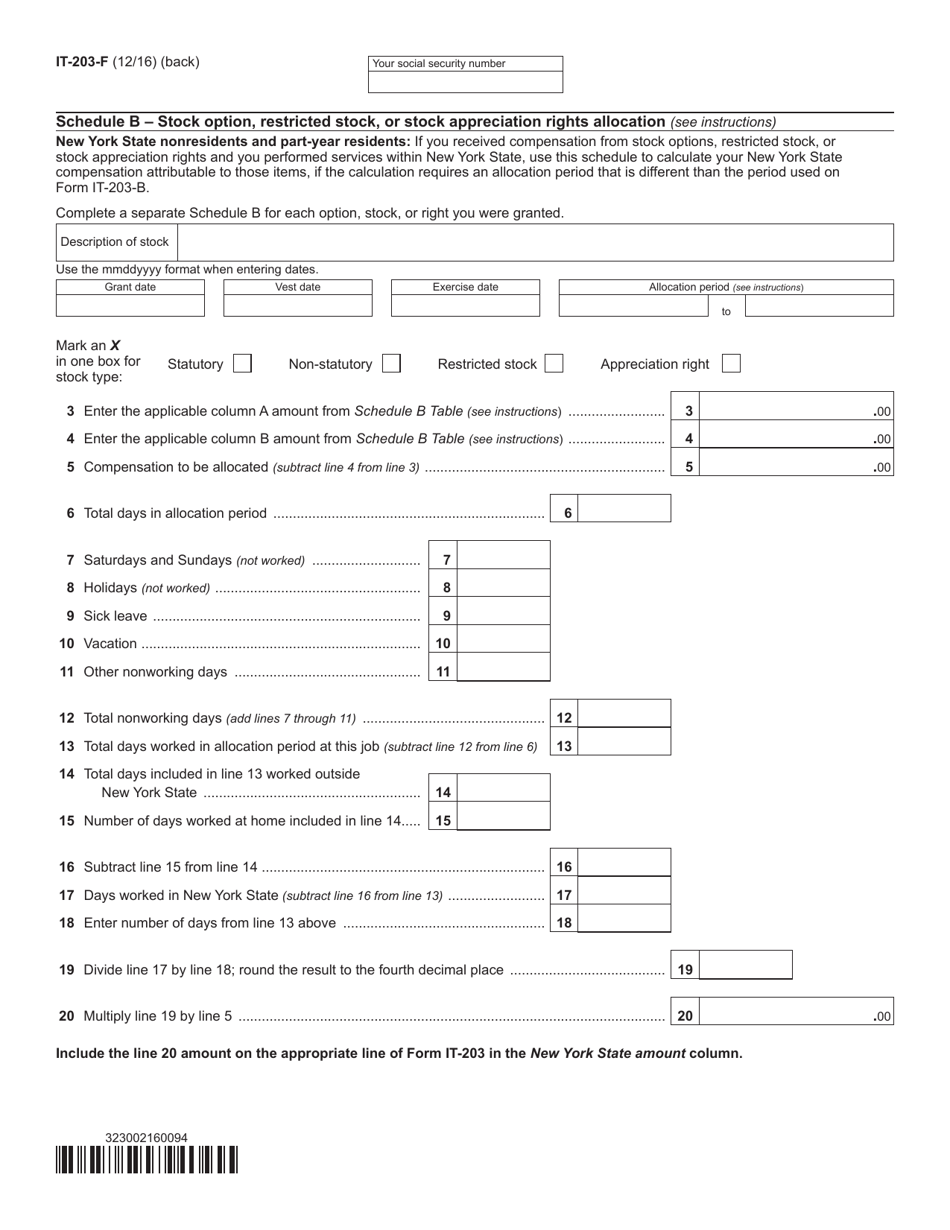

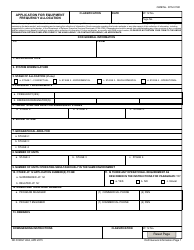

Form IT-203-F Multi-Year Allocation Form - New York

What Is Form IT-203-F?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-203-F?

A: Form IT-203-F is the Multi-Year Allocation Form for New York State taxes.

Q: Who needs to file Form IT-203-F?

A: Form IT-203-F is filed by individuals who are part-year residents of New York State.

Q: What is a part-year resident?

A: A part-year resident is someone who lived in New York State for only part of the year.

Q: What is the purpose of Form IT-203-F?

A: Form IT-203-F is used to allocate income, deductions, and credits between New York State and another state for part-year residents.

Q: Do I need to file Form IT-203-F if I was a full-year resident of New York State?

A: No, Form IT-203-F is only for part-year residents.

Q: When is Form IT-203-F due?

A: Form IT-203-F is due on the same date as your New York State income tax return, typically April 15th.

Q: Can I e-file Form IT-203-F?

A: Yes, you can e-file Form IT-203-F using approved tax software.

Q: What if I need help with Form IT-203-F?

A: If you need assistance with Form IT-203-F, you can contact the New York State Department of Taxation and Finance.

Form Details:

- Released on December 1, 2016;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-203-F by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.