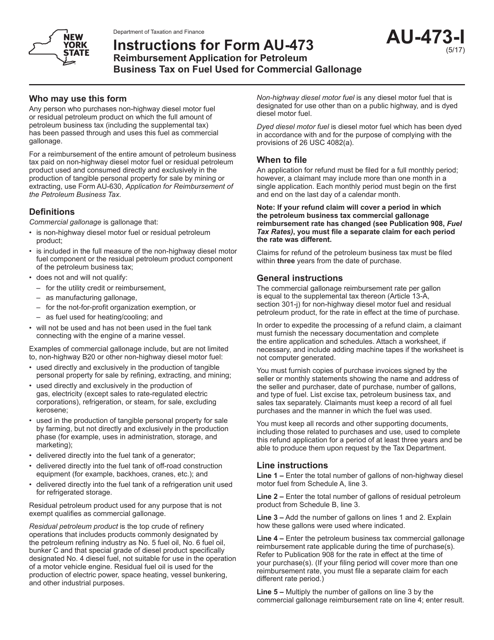

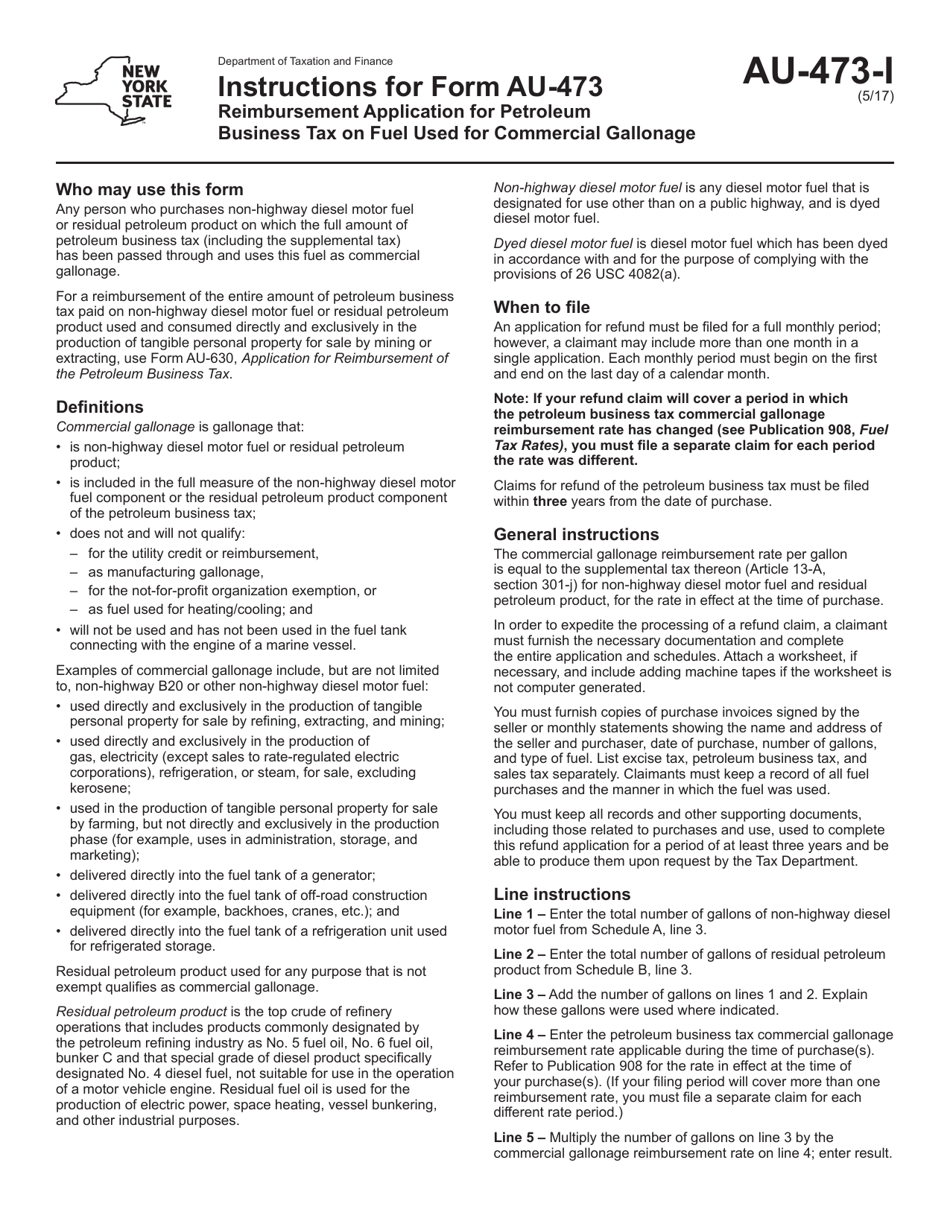

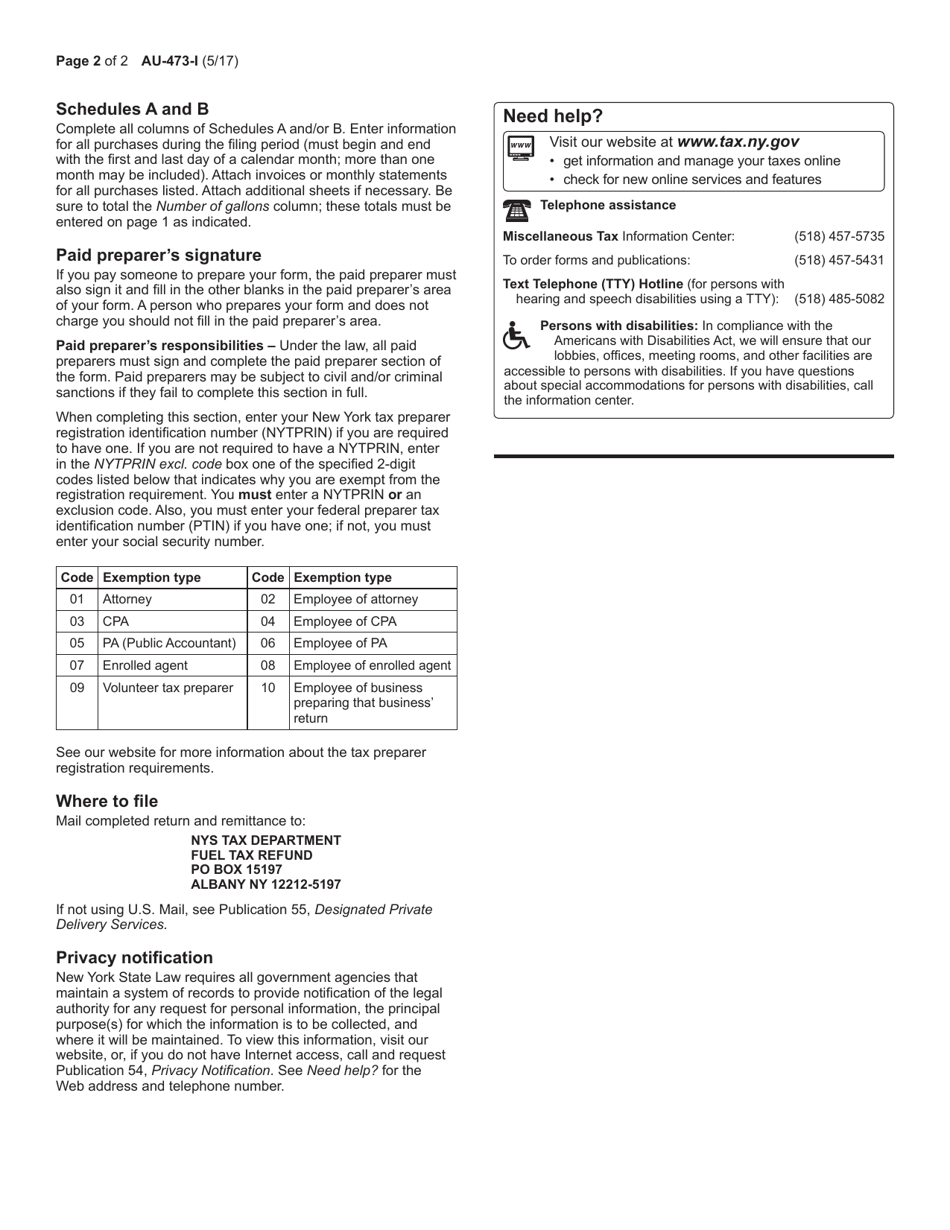

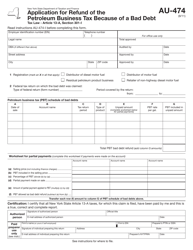

Instructions for Form AU-473 Reimbursement Application for Petroleum Business Tax on Fuel Used for Commercial Gallonage - New York

This document contains official instructions for Form AU-473 , Reimbursement Application for Petroleum Business Tax on Fuel Used for Commercial Gallonage - a form released and collected by the New York State Department of Taxation and Finance. An up-to-date fillable Form AU-473 is available for download through this link.

FAQ

Q: What is Form AU-473?

A: Form AU-473 is an application for reimbursement of Petroleum Business Tax on fuel used for commercial gallonage in the state of New York.

Q: Who can use Form AU-473?

A: Businesses engaged in commercial operations in New York that use fuel subject to Petroleum Business Tax can use Form AU-473.

Q: What is the purpose of Form AU-473?

A: The purpose of Form AU-473 is to apply for a reimbursement of the Petroleum Business Tax paid on fuel used for commercial gallonage.

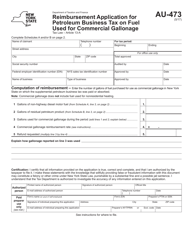

Q: What information is required on Form AU-473?

A: Form AU-473 requires information about the applicant's business, the amount of fuel used for commercial gallonage, and the amount of Petroleum Business Tax paid.

Q: What is the deadline for filing Form AU-473?

A: The deadline for filing Form AU-473 varies depending on the reimbursement period. It is generally due within two years from the end of the calendar year in which the fuel was used.

Q: Is there a fee for filing Form AU-473?

A: There is no fee for filing Form AU-473.

Q: Can I submit Form AU-473 electronically?

A: No, Form AU-473 cannot be submitted electronically. It must be mailed to the New York State Department of Taxation and Finance.

Q: How long does it take to receive a reimbursement after filing Form AU-473?

A: The processing time for Form AU-473 varies, but it generally takes several weeks to receive a reimbursement.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the New York State Department of Taxation and Finance.