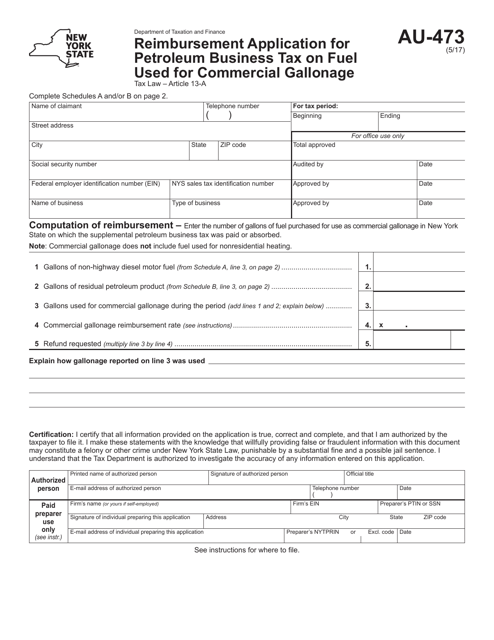

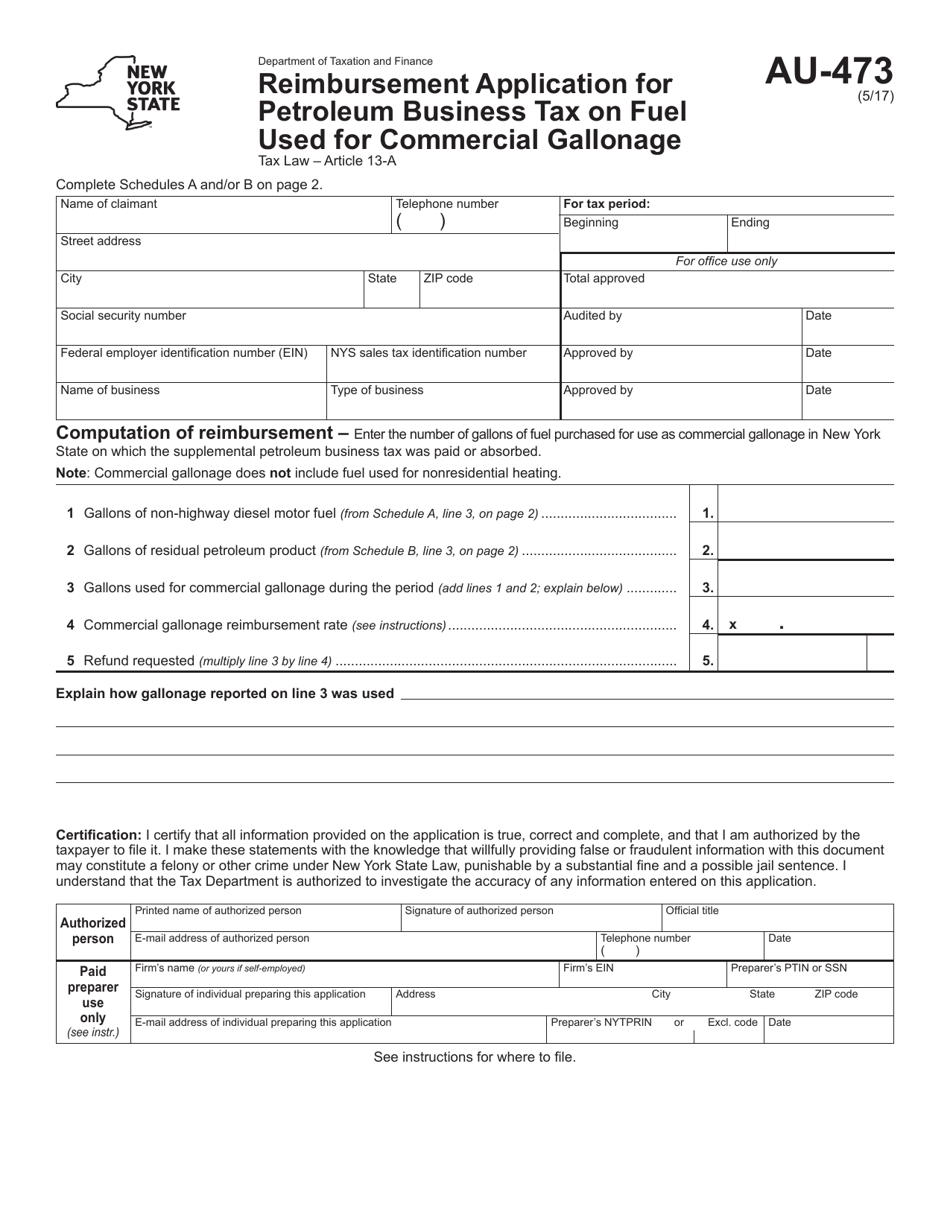

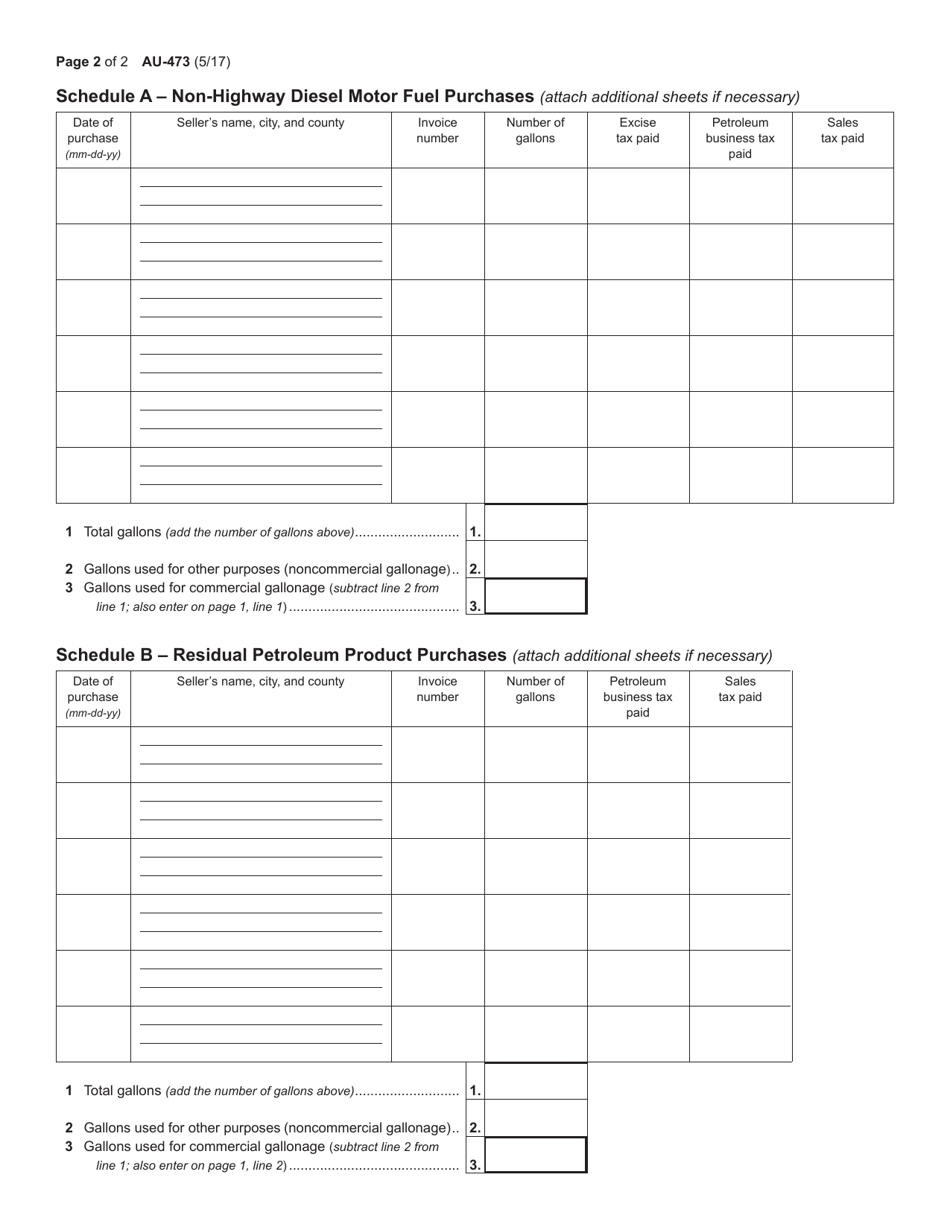

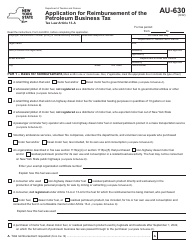

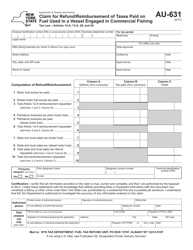

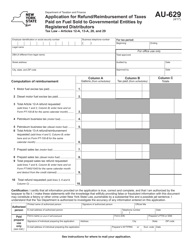

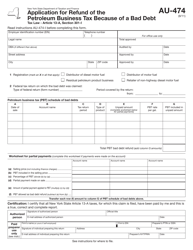

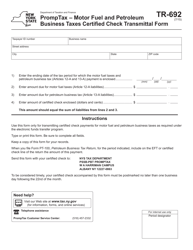

Form AU-473 Reimbursement Application for Petroleum Business Tax on Fuel Used for Commercial Gallonage - New York

What Is Form AU-473?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form AU-473?

A: Form AU-473 is an application for reimbursement of Petroleum Business Tax (PBT) on fuel used for commercial gallonage.

Q: Who can use Form AU-473?

A: This form is used by businesses in New York who want to apply for reimbursement of Petroleum Business Tax on fuel used for commercial purposes.

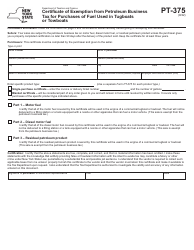

Q: What is Petroleum Business Tax (PBT)?

A: Petroleum Business Tax (PBT) is a tax imposed on motor fuel and diesel motor fuel in New York State.

Q: What is commercial gallonage?

A: Commercial gallonage refers to the amount of motor fuel or diesel motor fuel used in commercial activities, such as operating machinery or vehicles for business purposes.

Q: How do I apply for reimbursement of Petroleum Business Tax?

A: To apply for reimbursement, you need to complete and submit Form AU-473 along with supporting documentation to the New York State Department of Taxation and Finance.

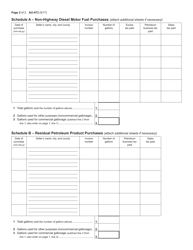

Q: What supporting documentation do I need to submit with Form AU-473?

A: You may need to provide invoices, receipts, or other records that show the amount of fuel used for commercial purposes and the amount of Petroleum Business Tax paid.

Q: Is there a deadline for submitting Form AU-473?

A: Yes, you must submit the form within three years from the date of payment of the Petroleum Business Tax for the fuel.

Q: Can I file Form AU-473 electronically?

A: No, you cannot file Form AU-473 electronically. It must be submitted by mail with original signatures and supporting documentation.

Form Details:

- Released on May 1, 2017;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form AU-473 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.