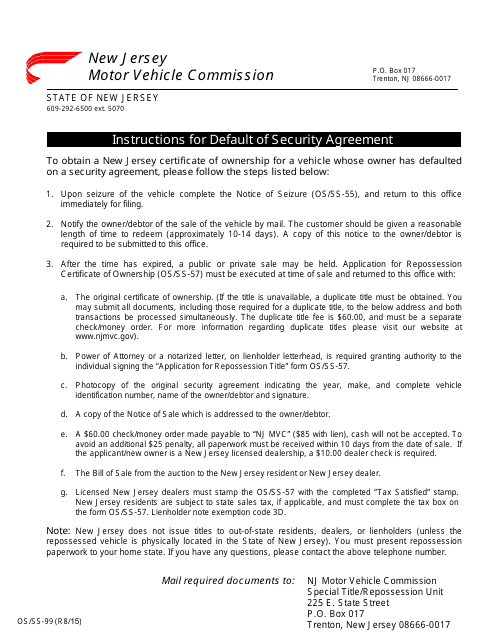

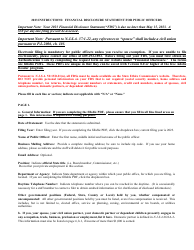

Instructions for Default of Security Agreement - New Jersey

This document was released by New Jersey Motor Vehicle Commission and contains the most recent official instructions for Default of Security Agreement .

FAQ

Q: What is a default of security agreement?

A: A default of security agreement occurs when a borrower fails to fulfill their obligations outlined in the agreement.

Q: What happens when a borrower defaults on a security agreement?

A: When a borrower defaults on a security agreement, the lender has the right to take possession of the collateral that was pledged as security for the loan.

Q: What can a lender do with the collateral after a default?

A: After a default, the lender can sell the collateral to recover the amount owed on the loan.

Q: What are the consequences of defaulting on a security agreement?

A: Defaulting on a security agreement can result in the loss of the collateral and potential legal action by the lender to recover the outstanding balance.

Q: How can a borrower avoid defaulting on a security agreement?

A: To avoid defaulting, borrowers should make sure to fulfill their obligations outlined in the agreement, such as making payments on time and maintaining insurance coverage on the collateral.

Q: What is the role of the state of New Jersey in relation to security agreements?

A: The state of New Jersey provides laws and regulations that govern the enforcement of security agreements and the rights of borrowers and lenders during the default process.

Instruction Details:

- This 1-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library legal documents released by the New Jersey Motor Vehicle Commission.