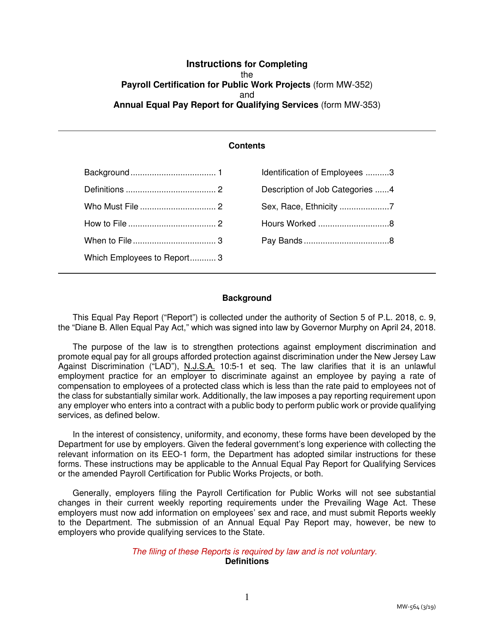

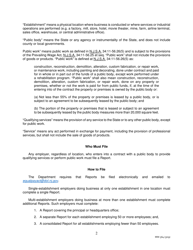

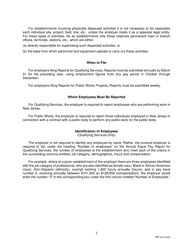

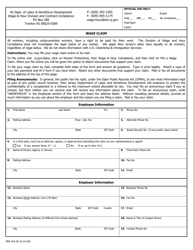

Instructions for Form MW-352, MW-353 - New Jersey

This document contains official instructions for Form MW-352 , and Form MW-353 . Both forms are released and collected by the New Jersey Department of Labor & Workforce Development.

FAQ

Q: What is Form MW-352?

A: Form MW-352 is a withholding tax return used by employers in New Jersey to report and remit taxes withheld from employees' wages.

Q: What is Form MW-353?

A: Form MW-353 is a quarterly reconciliation return used by employers in New Jersey to reconcile the withholding tax reported on Form MW-352 with the amount of tax withheld.

Q: Who needs to file Form MW-352?

A: Employers in New Jersey who withhold taxes from their employees' wages are required to file Form MW-352.

Q: Who needs to file Form MW-353?

A: Employers in New Jersey who file Form MW-352 are also required to file Form MW-353 to reconcile the withholding tax.

Q: When is Form MW-352 due?

A: Form MW-352 is due on a quarterly basis, with the due dates falling on the last day of the month following the end of each quarter.

Q: When is Form MW-353 due?

A: Form MW-353 is due on a quarterly basis, with the due dates falling on the last day of the month following the end of each quarter.

Q: Do I need to file Form MW-352 and Form MW-353 if I don't have any employees?

A: If you do not have any employees or you have not withheld any taxes from employees' wages, you do not need to file Form MW-352 or Form MW-353.

Q: What should I do if I made a mistake on Form MW-352 or Form MW-353?

A: If you made a mistake on either form, you should correct the error and resubmit the form as soon as possible.

Q: Are there any penalties for late filing of Form MW-352 or Form MW-353?

A: Yes, there are penalties for late filing of both forms. It is important to file the forms by the due dates to avoid penalties.

Instruction Details:

- This 8-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the New Jersey Department of Labor & Workforce Development.