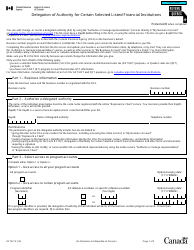

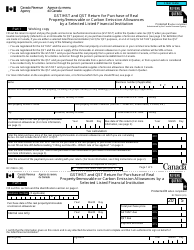

This version of the form is not currently in use and is provided for reference only. Download this version of

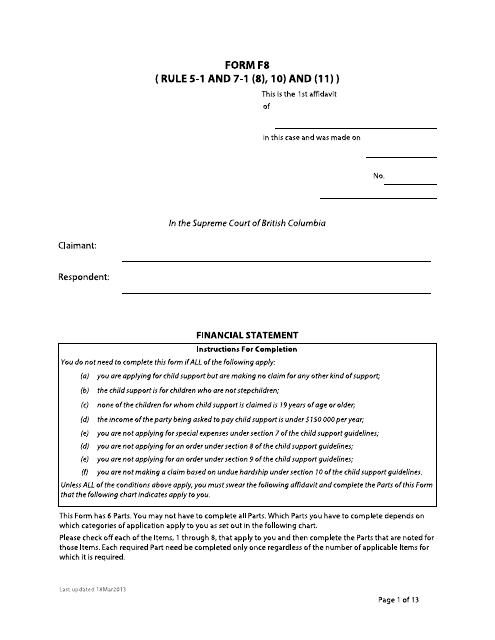

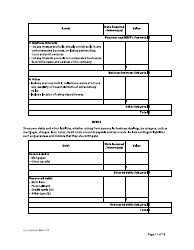

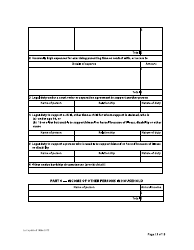

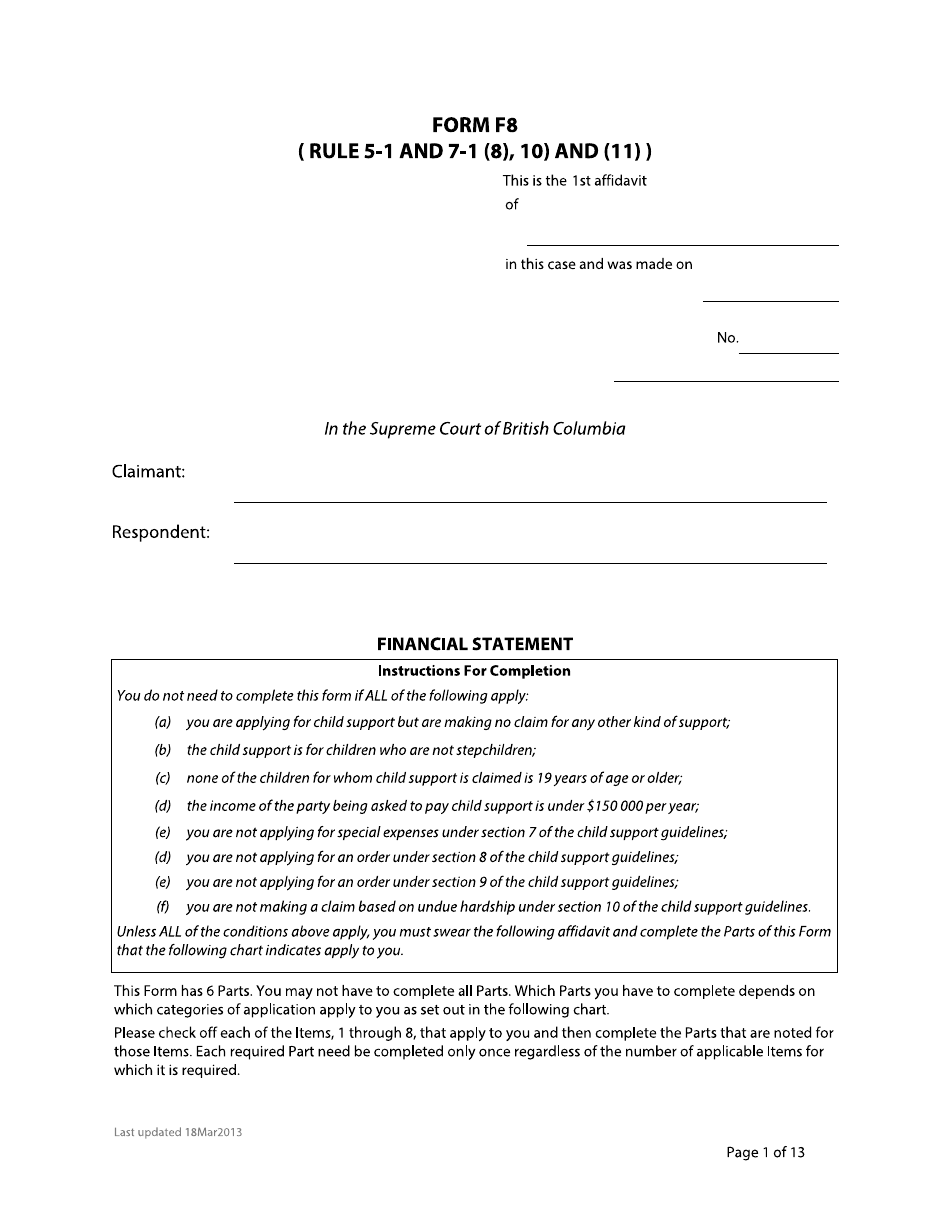

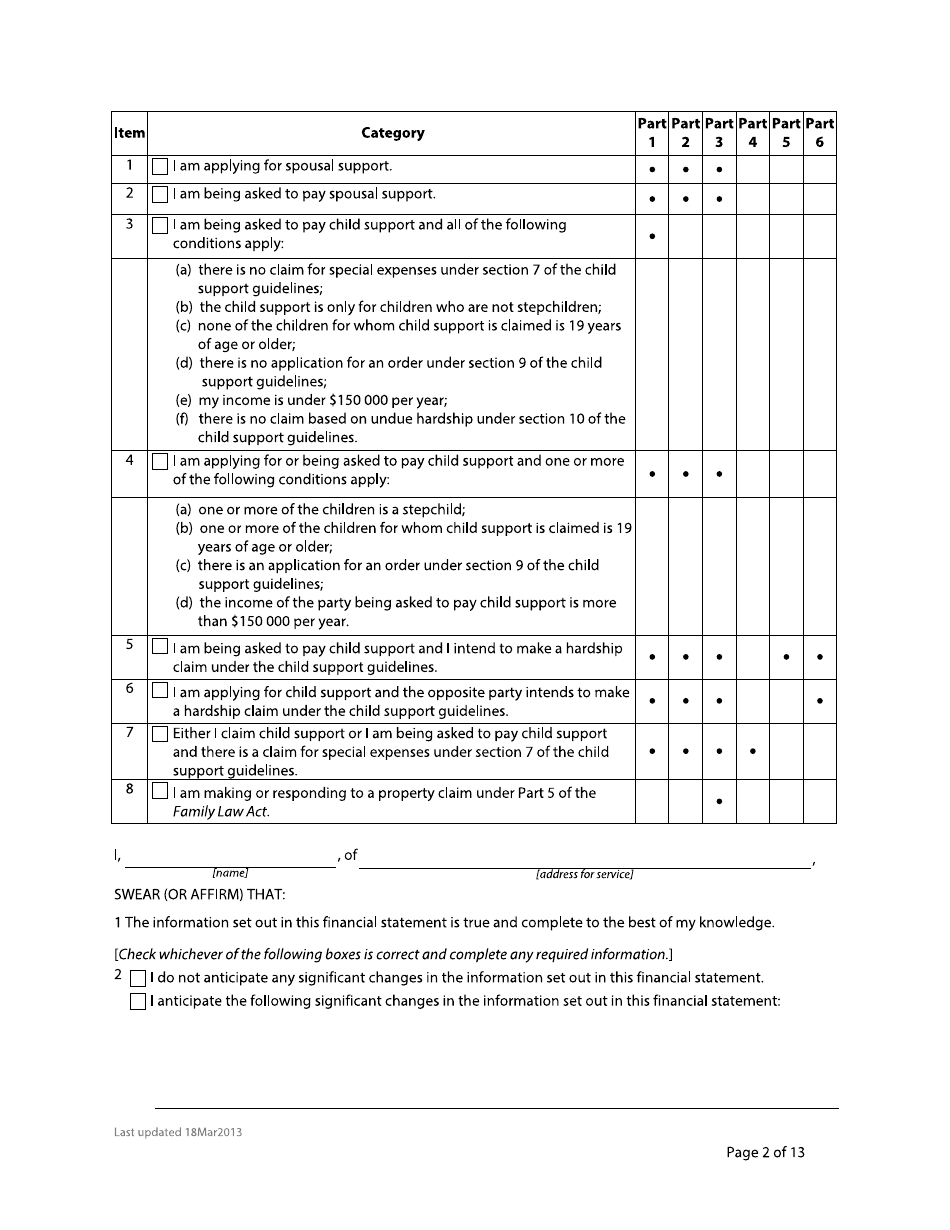

Form F8

for the current year.

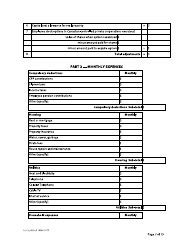

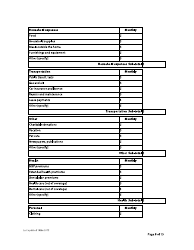

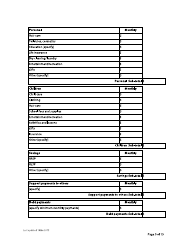

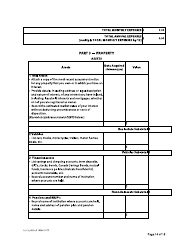

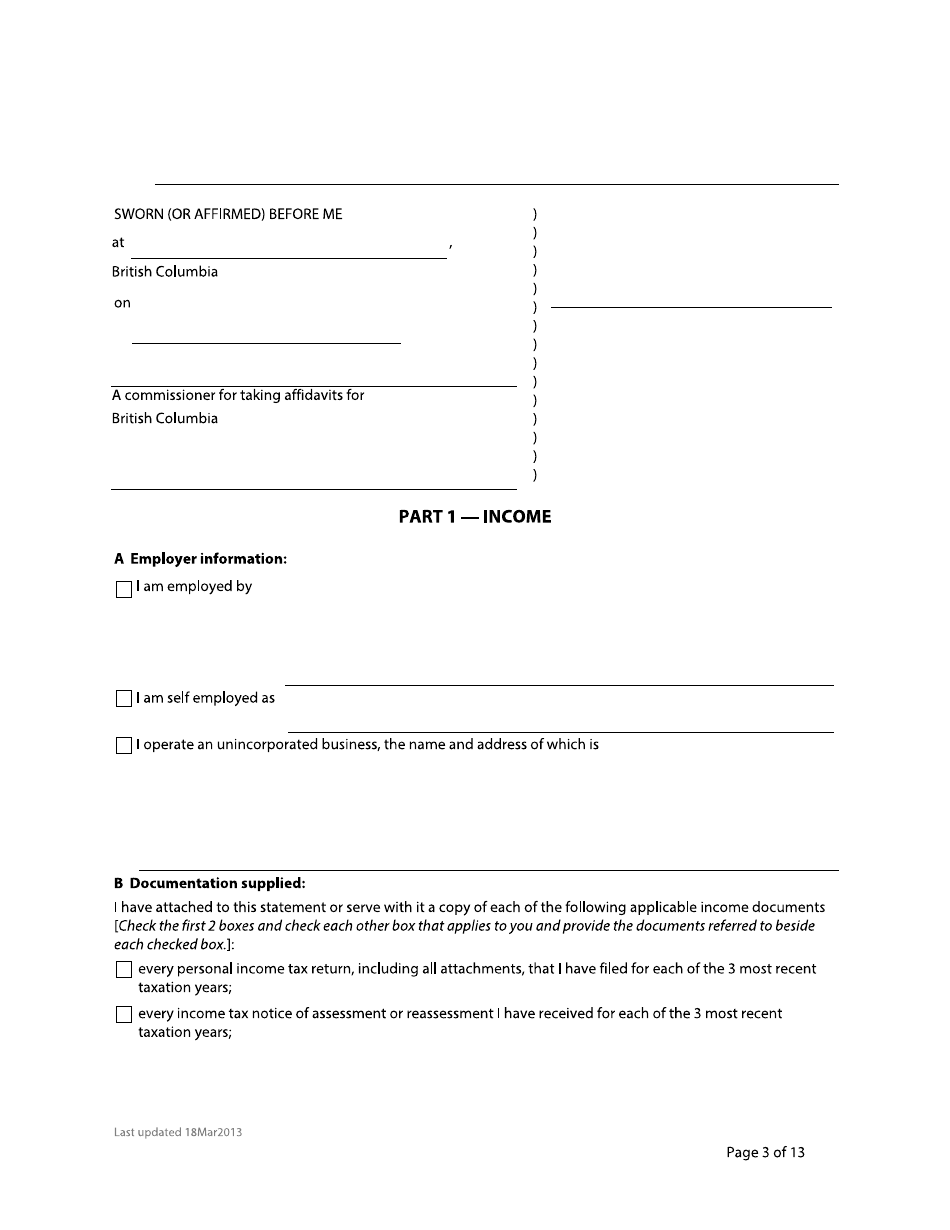

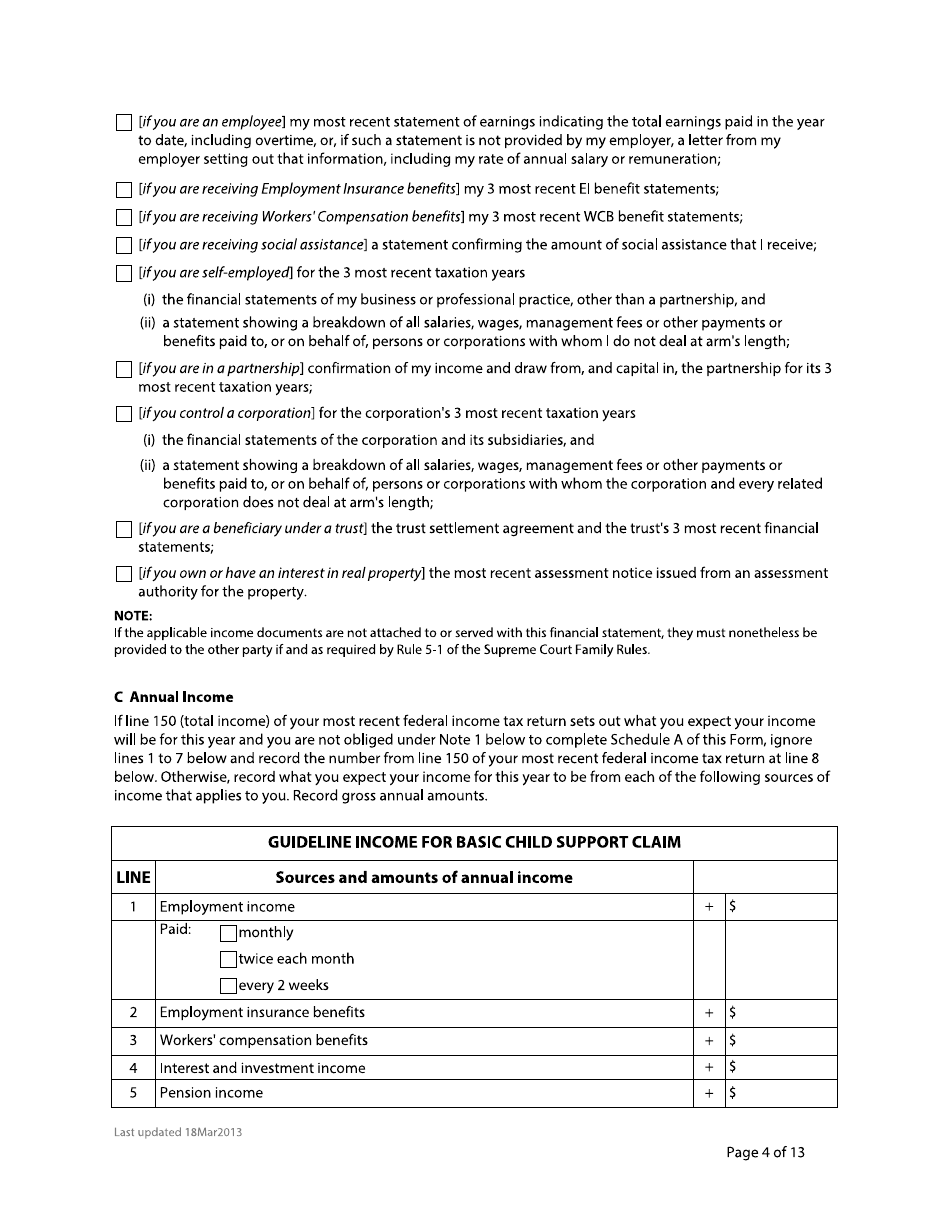

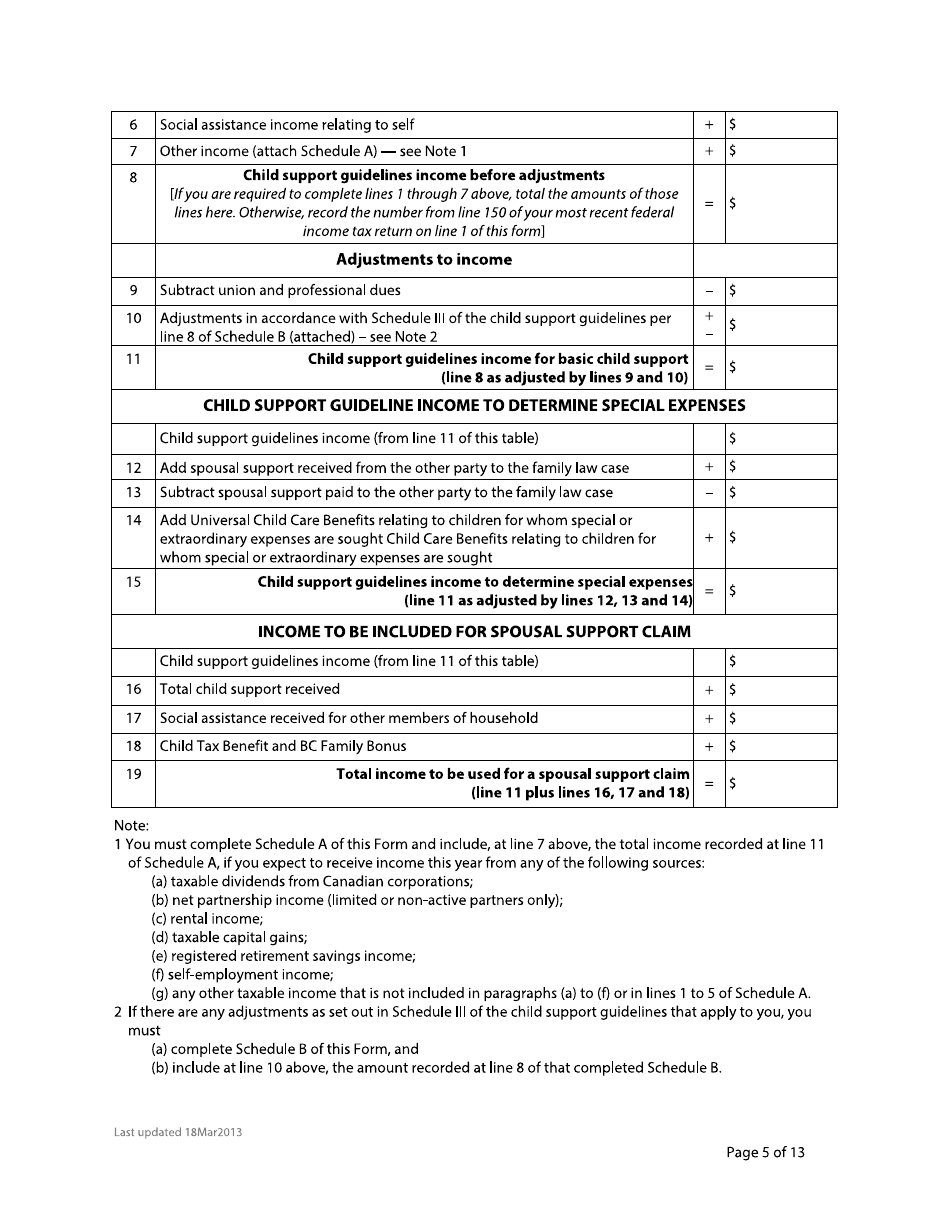

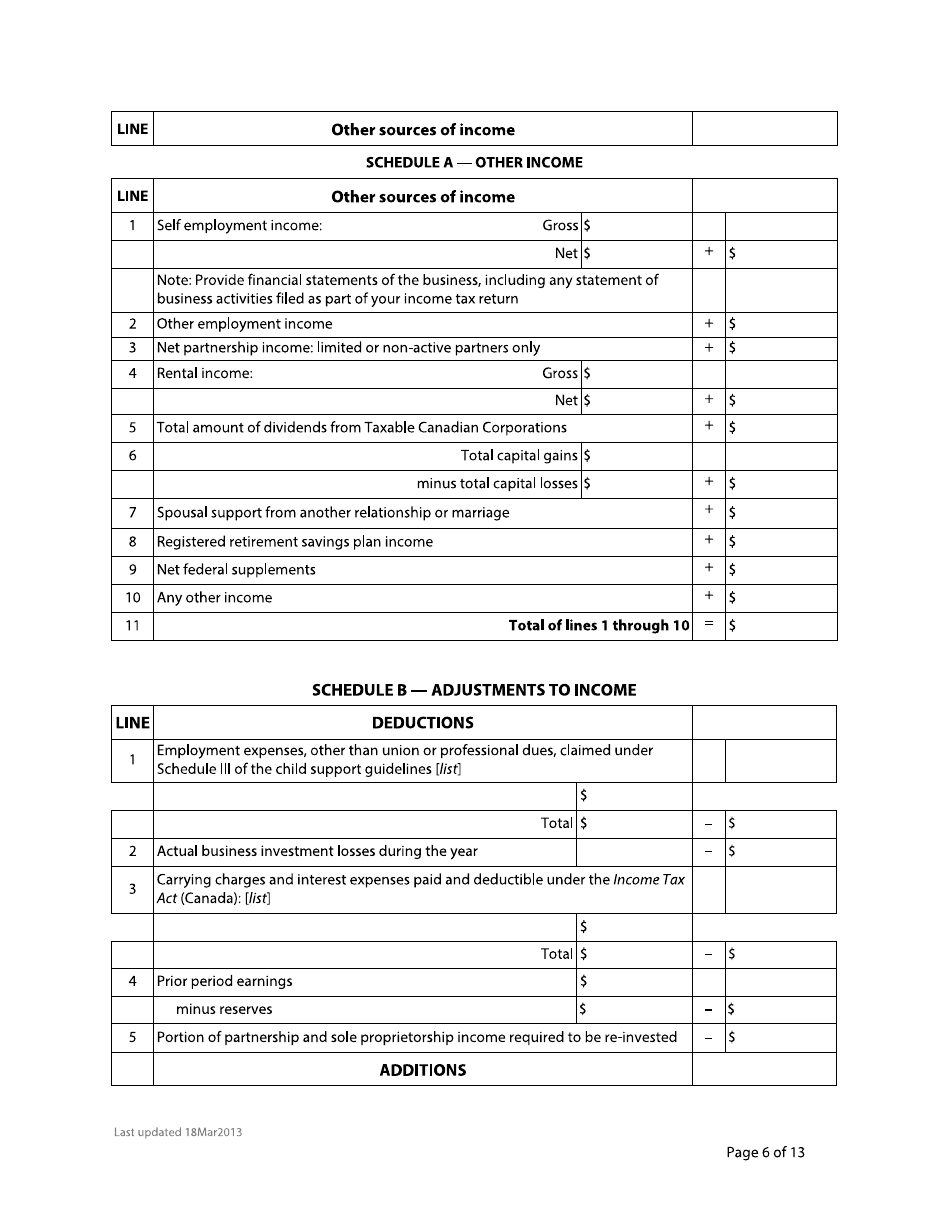

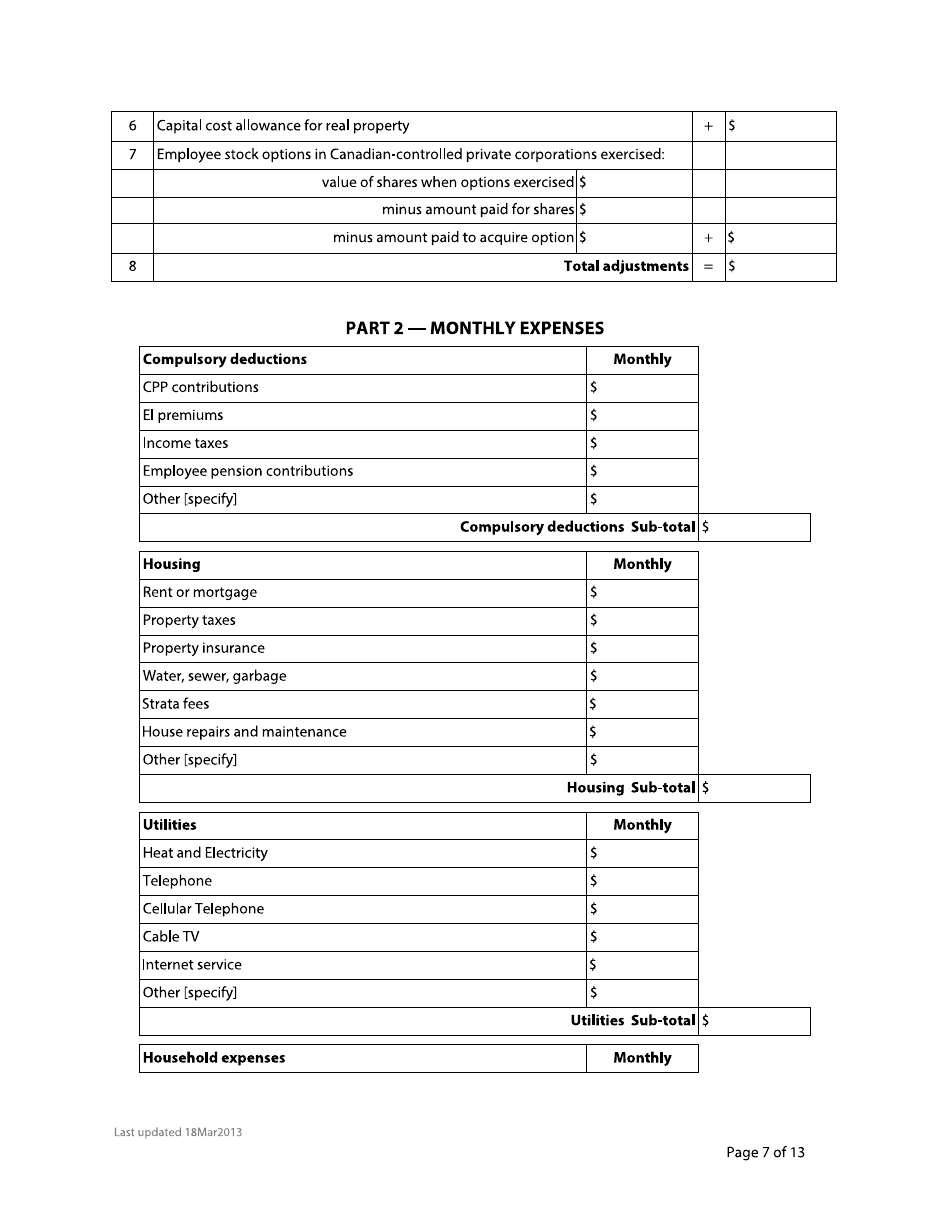

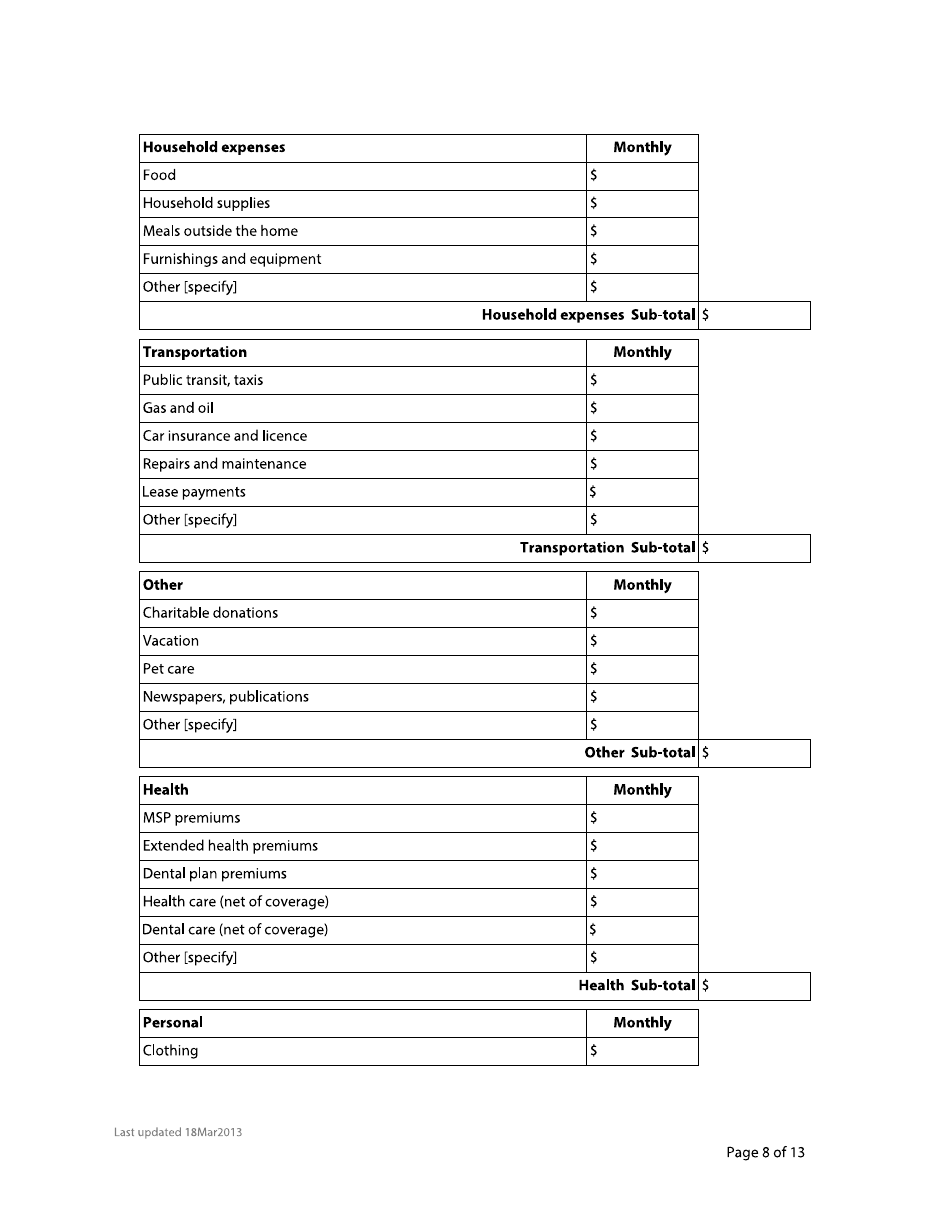

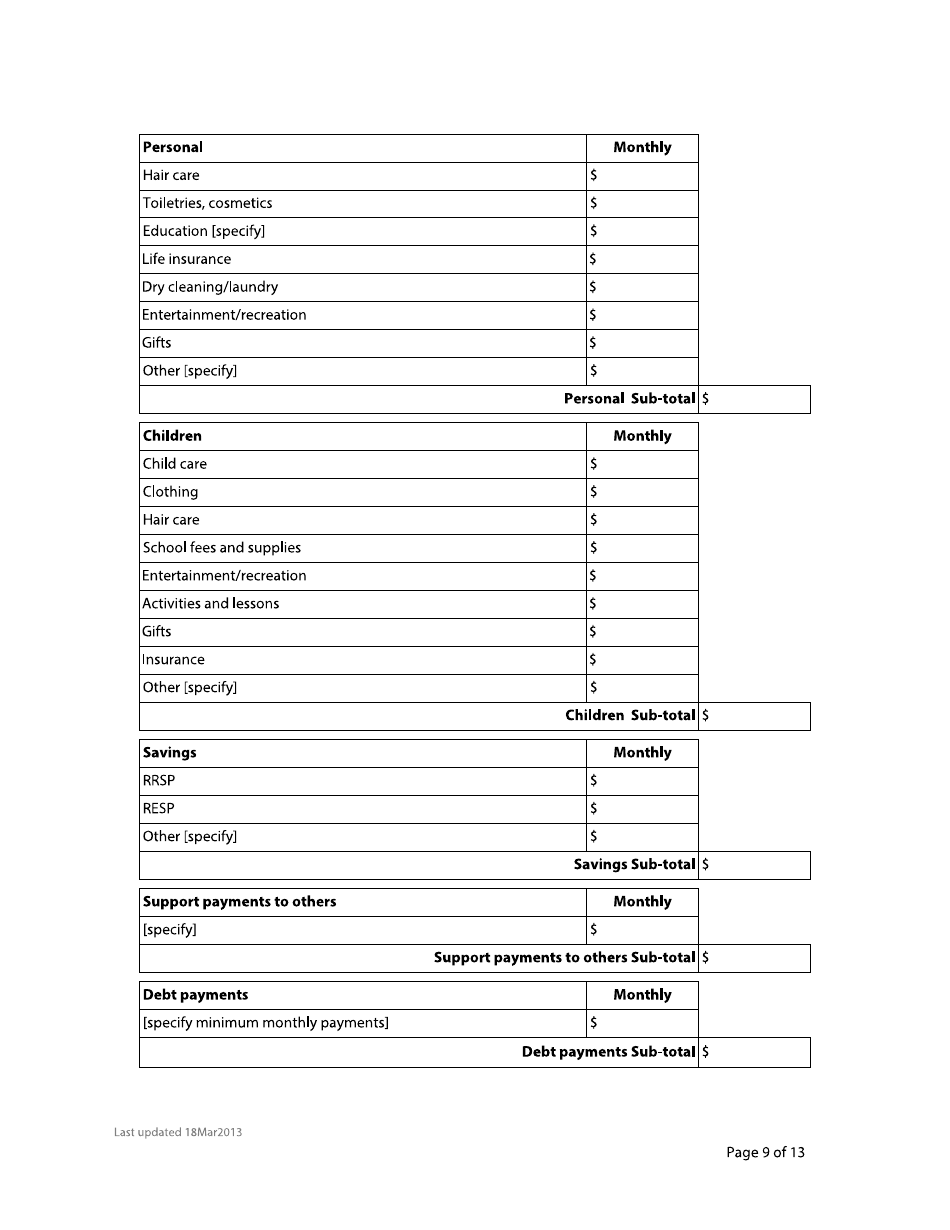

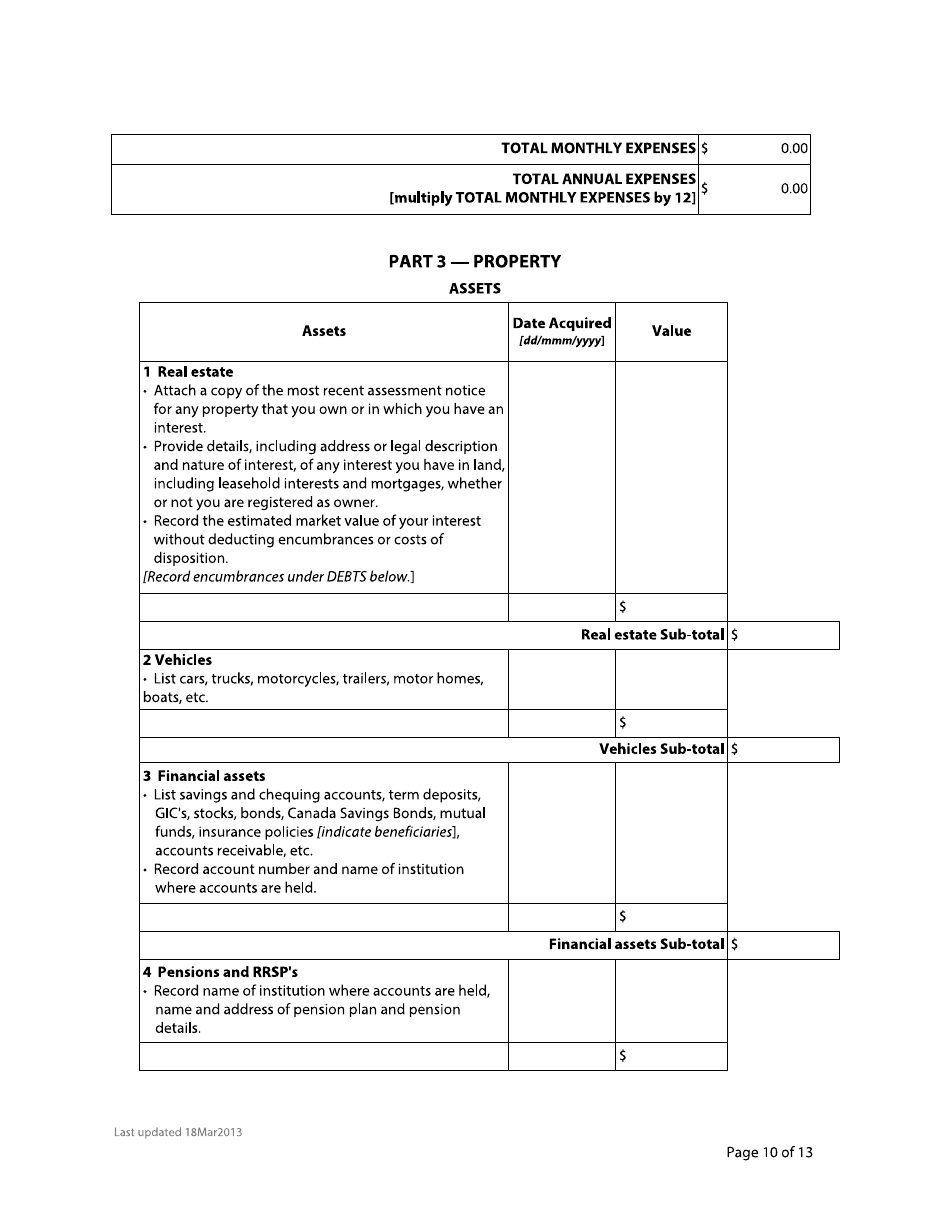

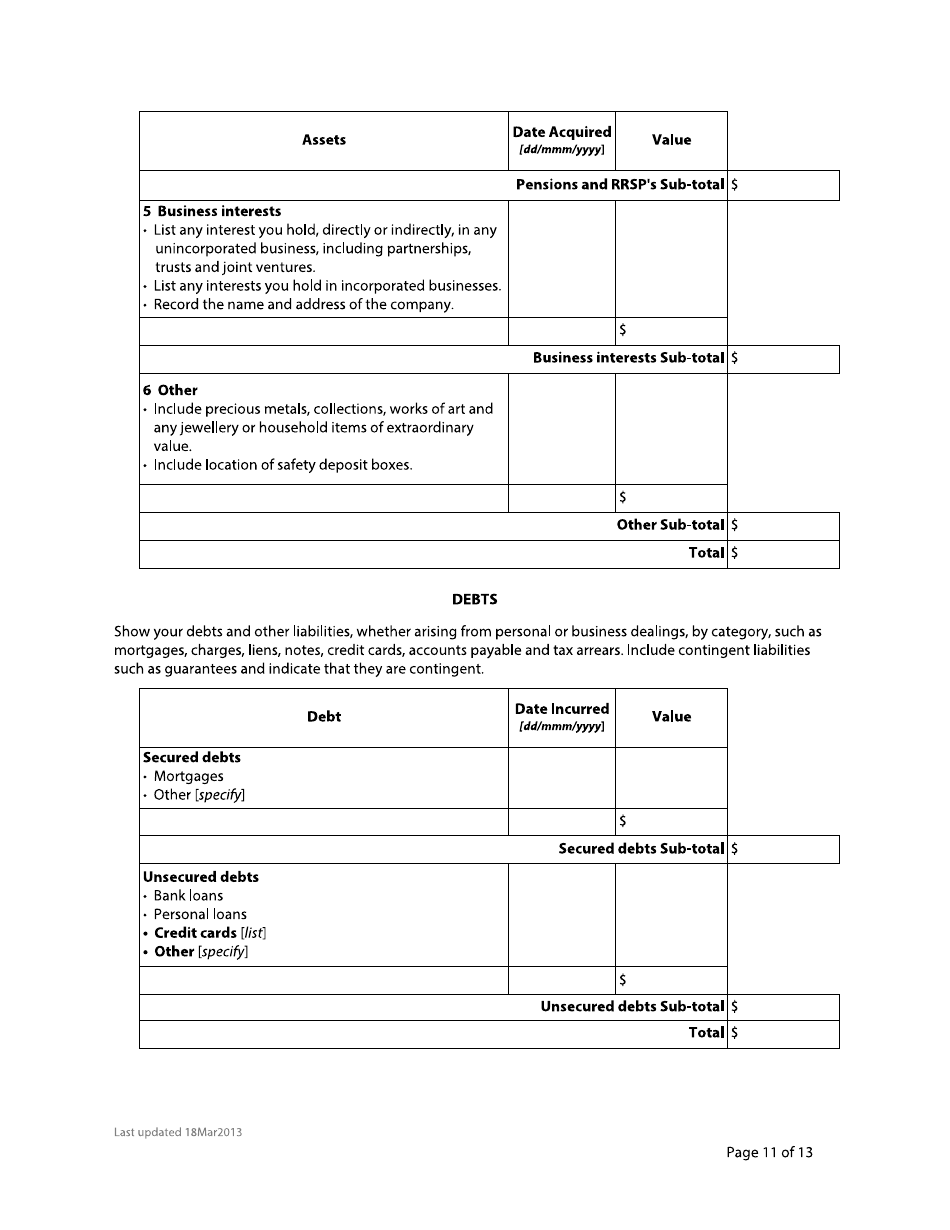

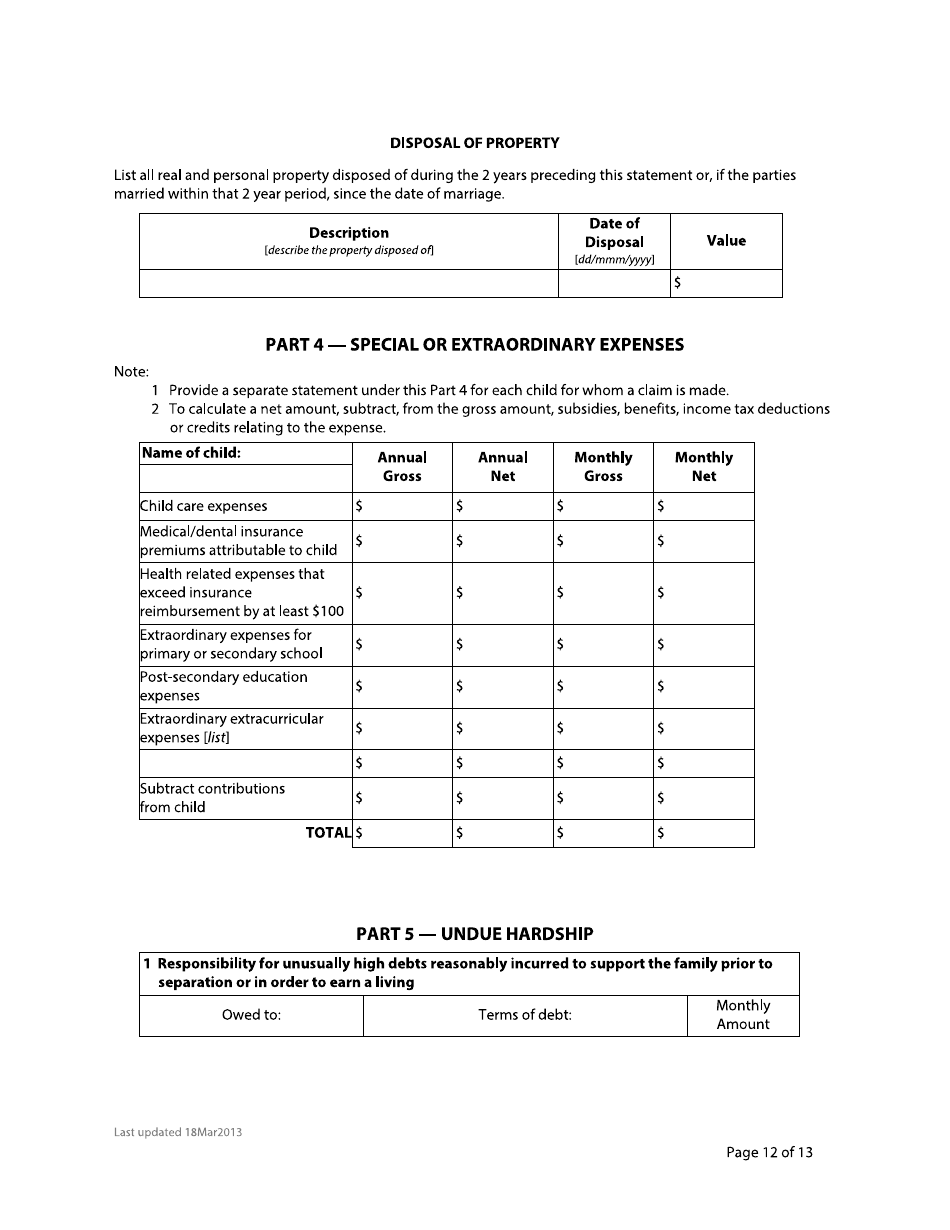

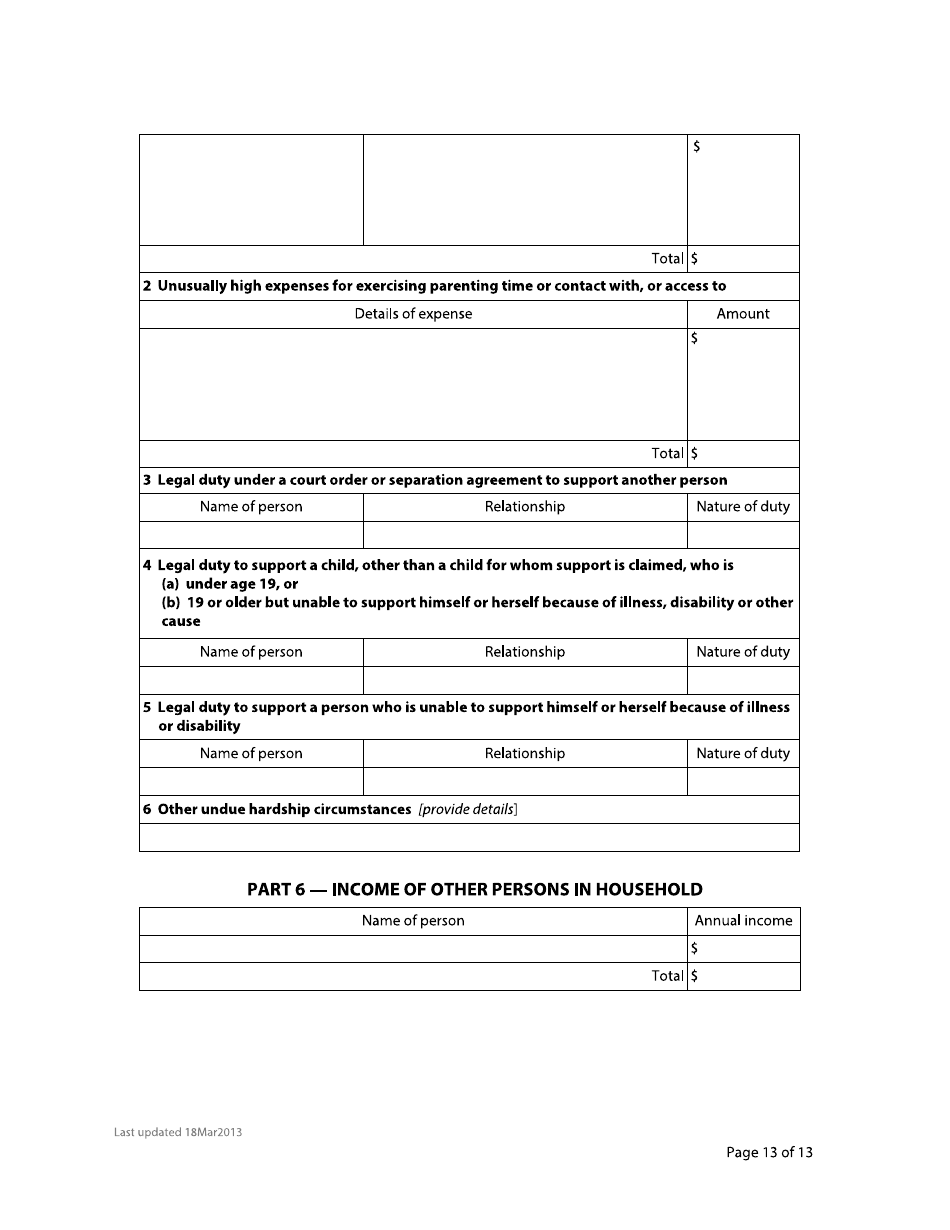

Form F8 Financial Statement - British Columbia, Canada

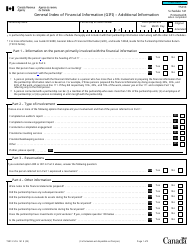

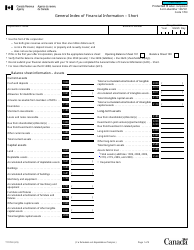

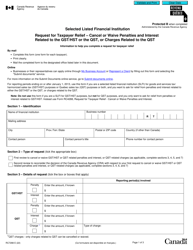

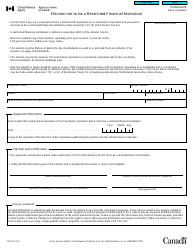

Form F8 Financial Statement - British Columbia, Canada is used for disclosing financial information during legal proceedings, such as divorce or separation cases. It allows individuals to provide details about their income, expenses, assets, and debts.

In British Columbia, Canada, the Form F8 Financial Statement is filed by both parties involved in a family law case. It is typically filed during divorce, separation, or child custody proceedings.

FAQ

Q: What is Form F8?

A: Form F8 is a financial statement document in British Columbia, Canada.

Q: Which province is Form F8 used in?

A: Form F8 is used in British Columbia, Canada.

Q: What is the purpose of Form F8?

A: The purpose of Form F8 is to disclose financial information in legal proceedings.

Q: Who needs to complete Form F8?

A: Individuals involved in legal proceedings in British Columbia may need to complete Form F8.

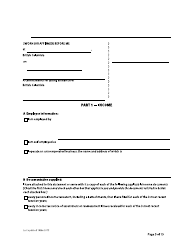

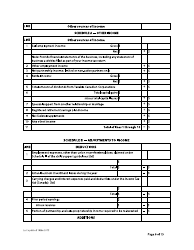

Q: What information is required in Form F8?

A: Form F8 requires details about income, expenses, assets, and debts.

Q: Is Form F8 specific to a certain type of legal proceeding?

A: No, Form F8 can be used in various types of legal proceedings, such as family law or civil litigation.

Q: Are there any filing fees associated with submitting Form F8?

A: Filing fees may apply when submitting Form F8, depending on the specific court and type of proceeding.