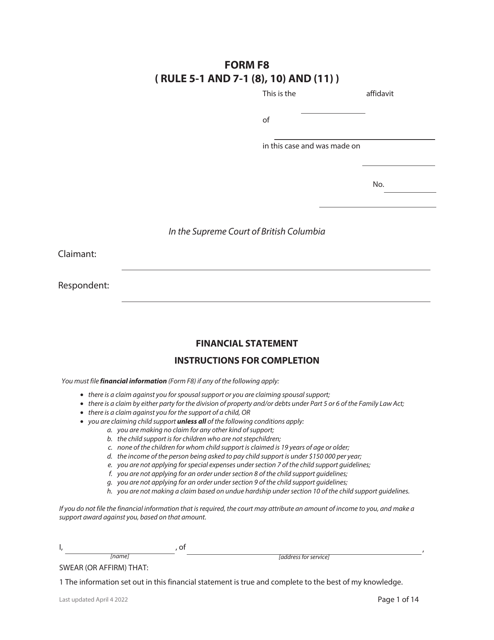

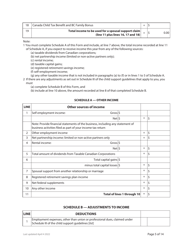

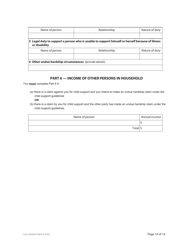

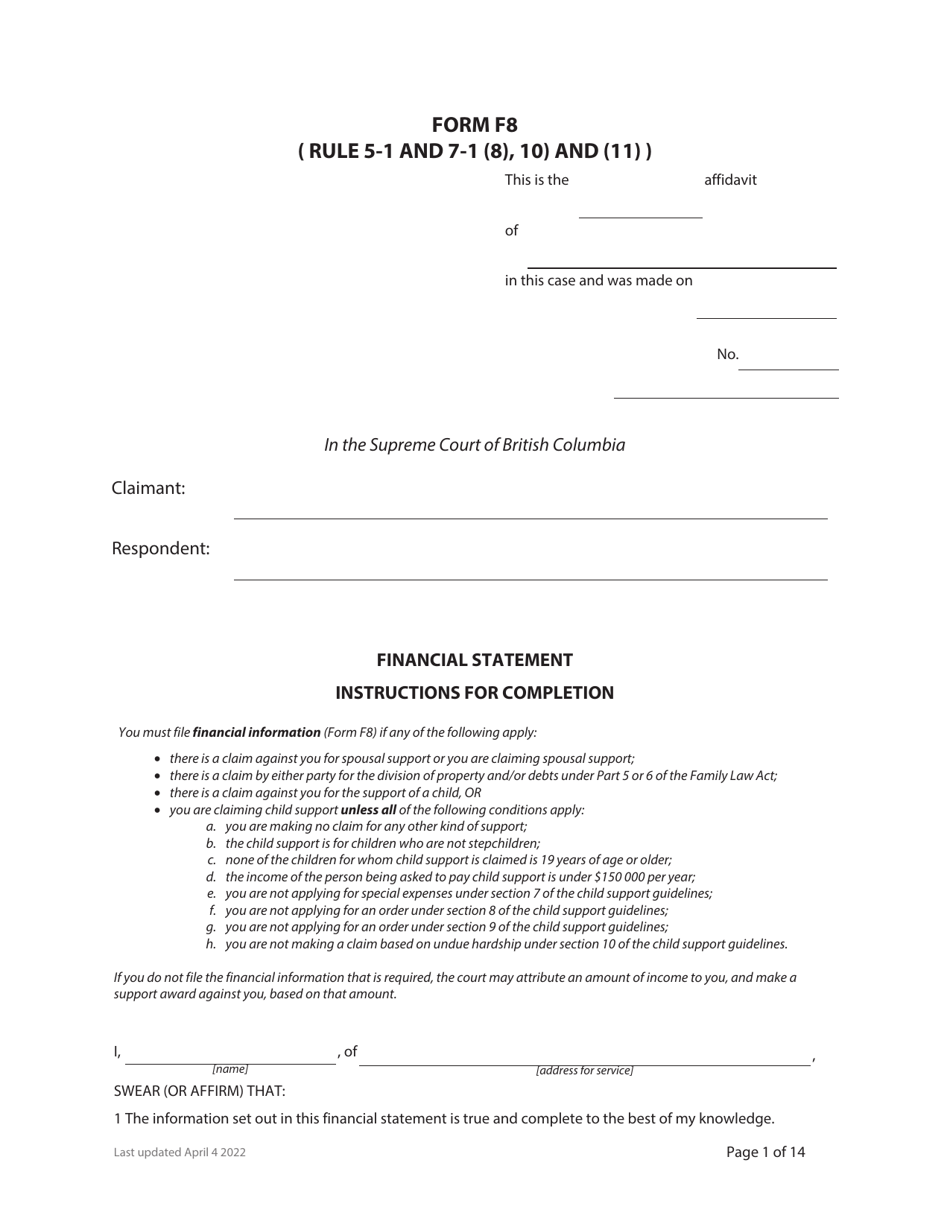

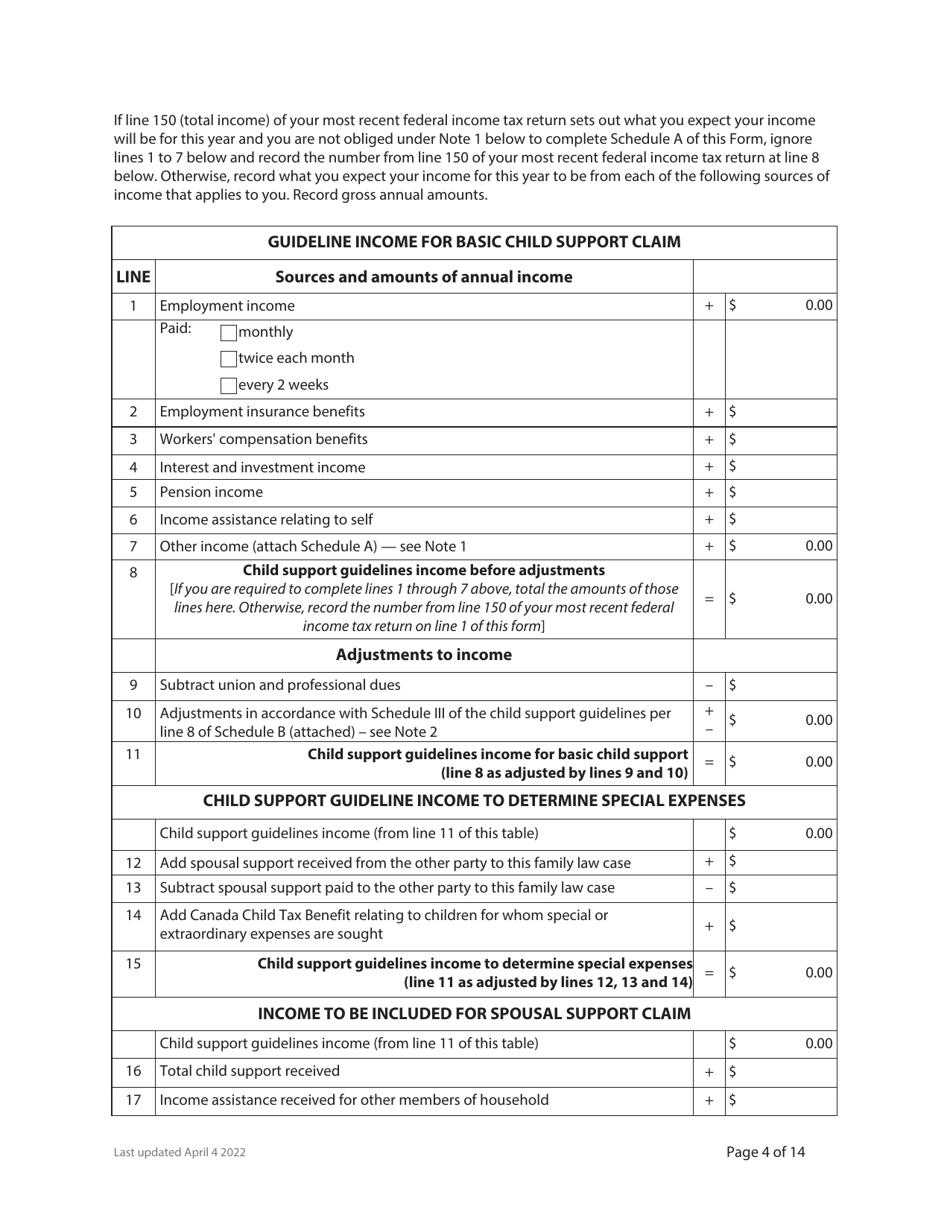

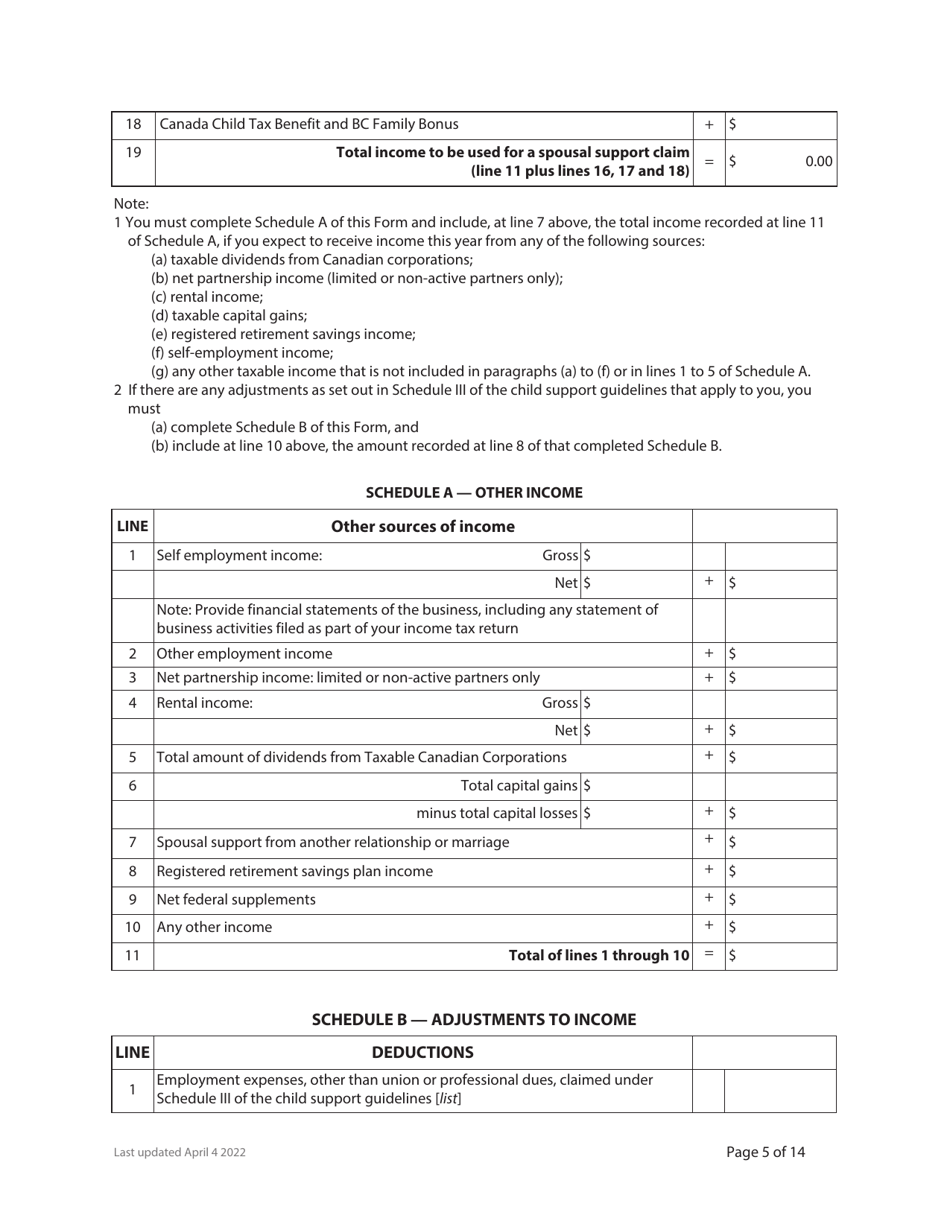

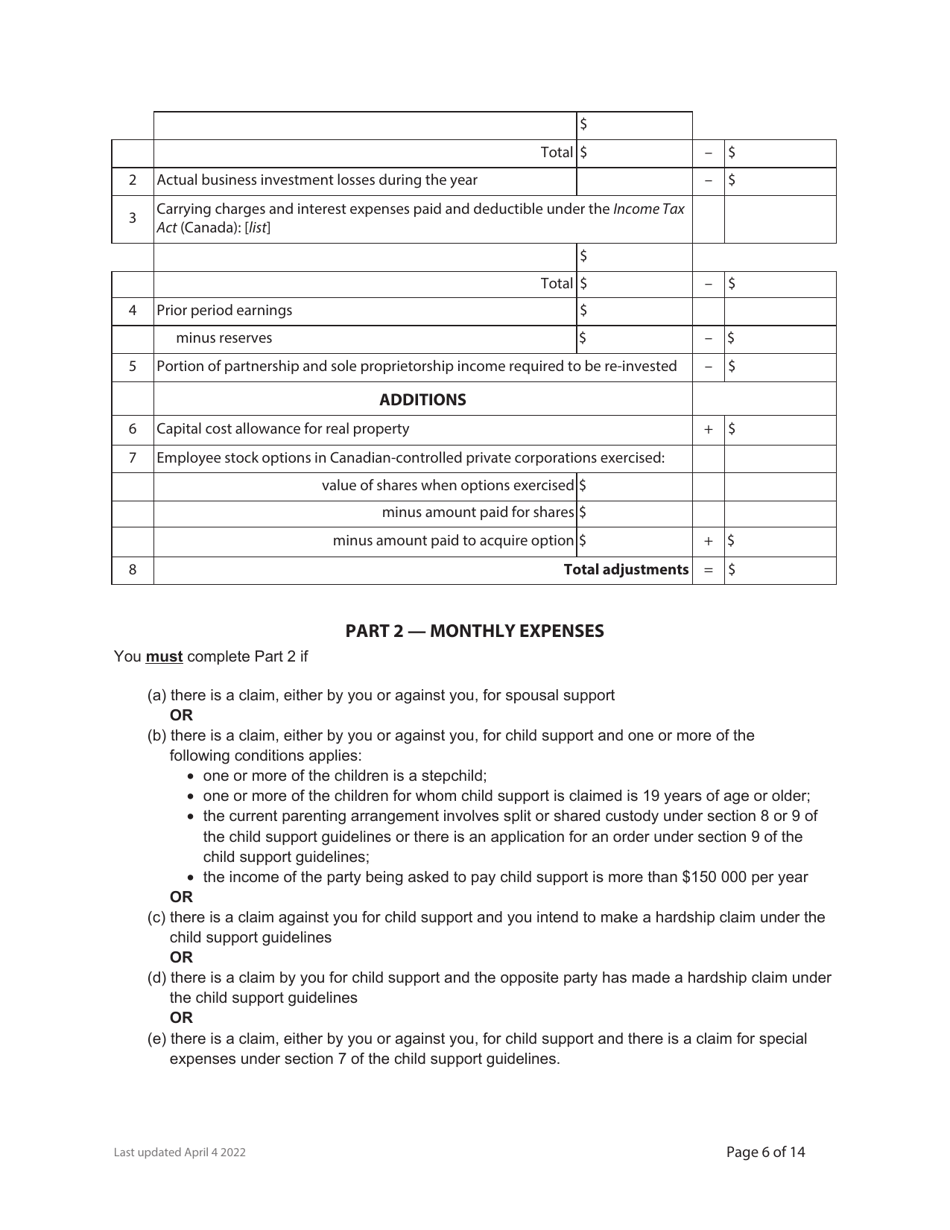

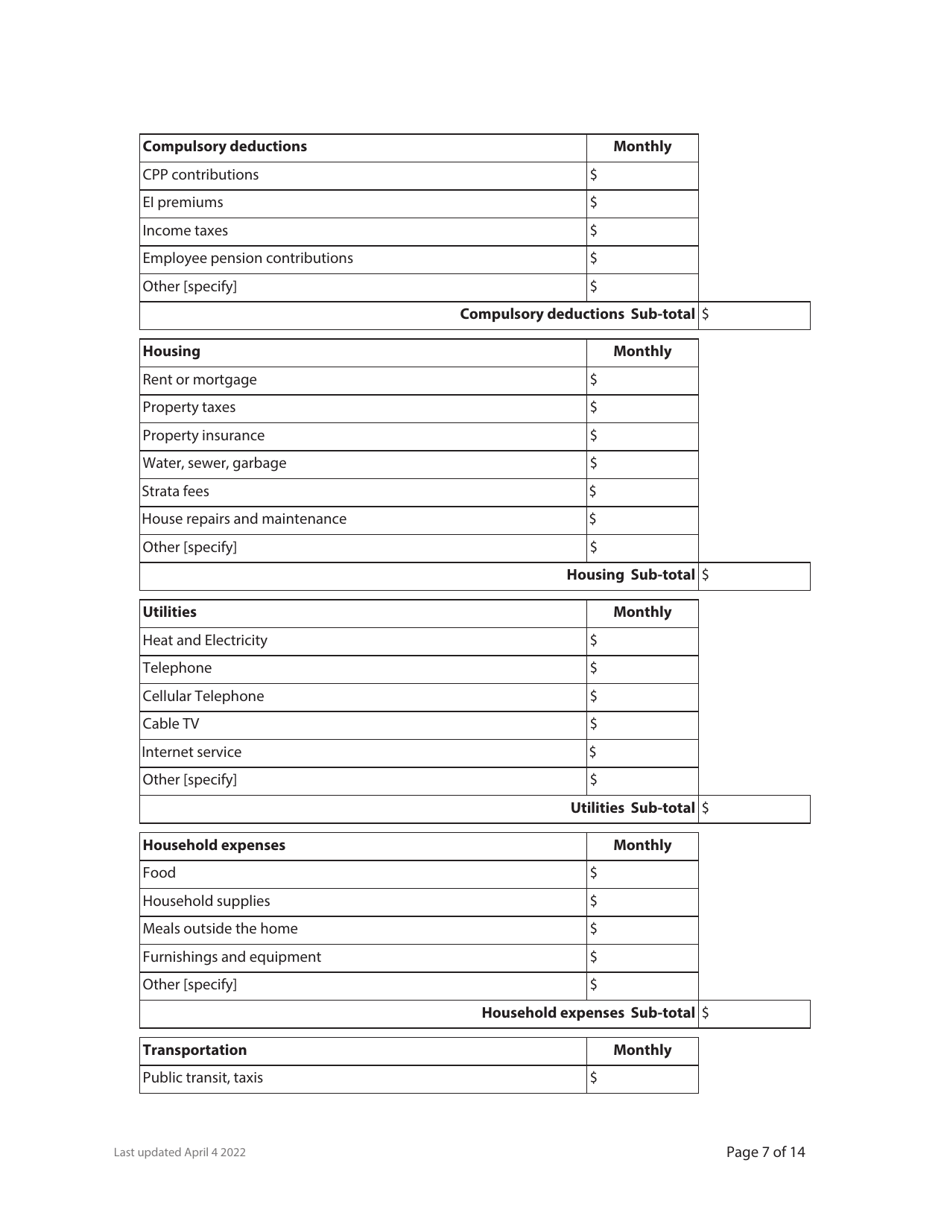

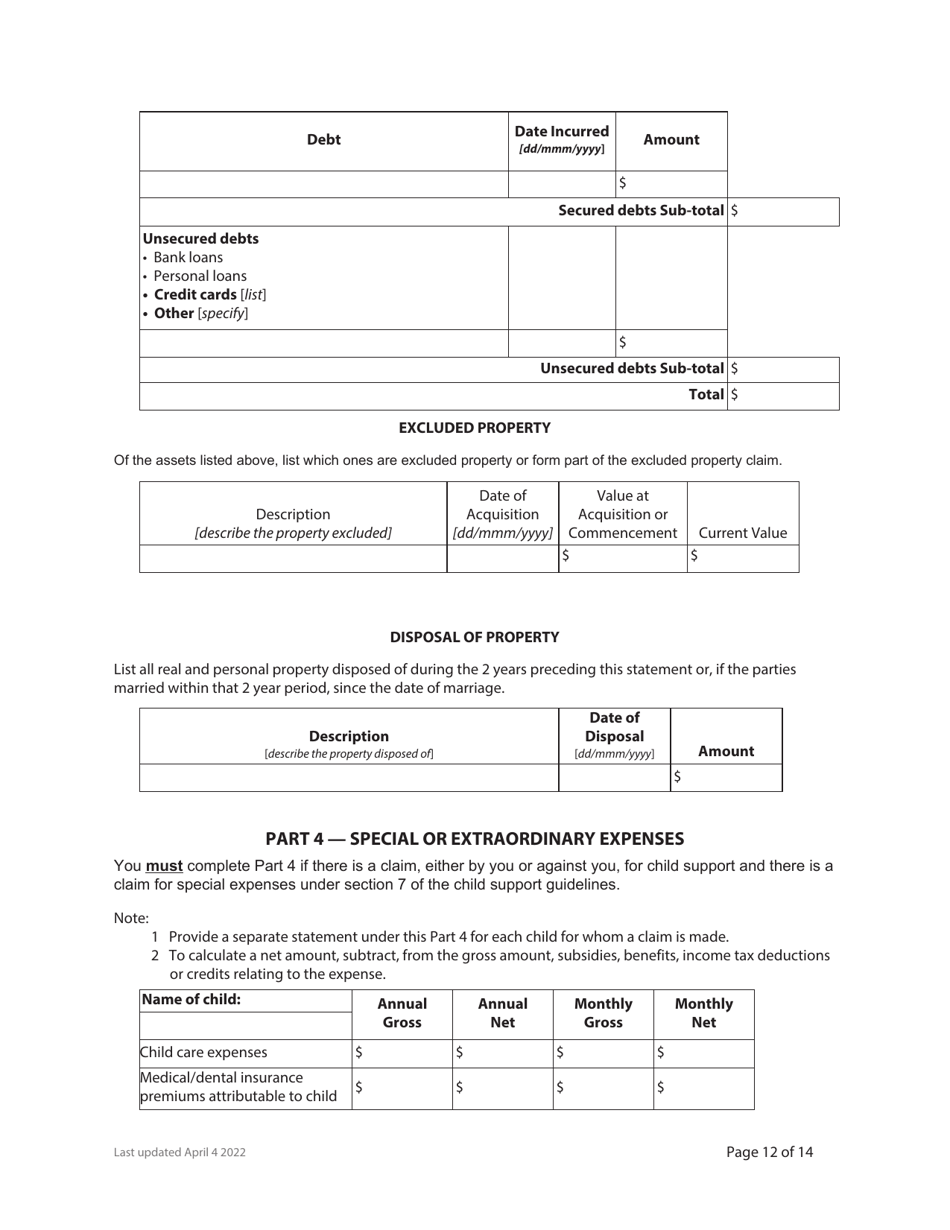

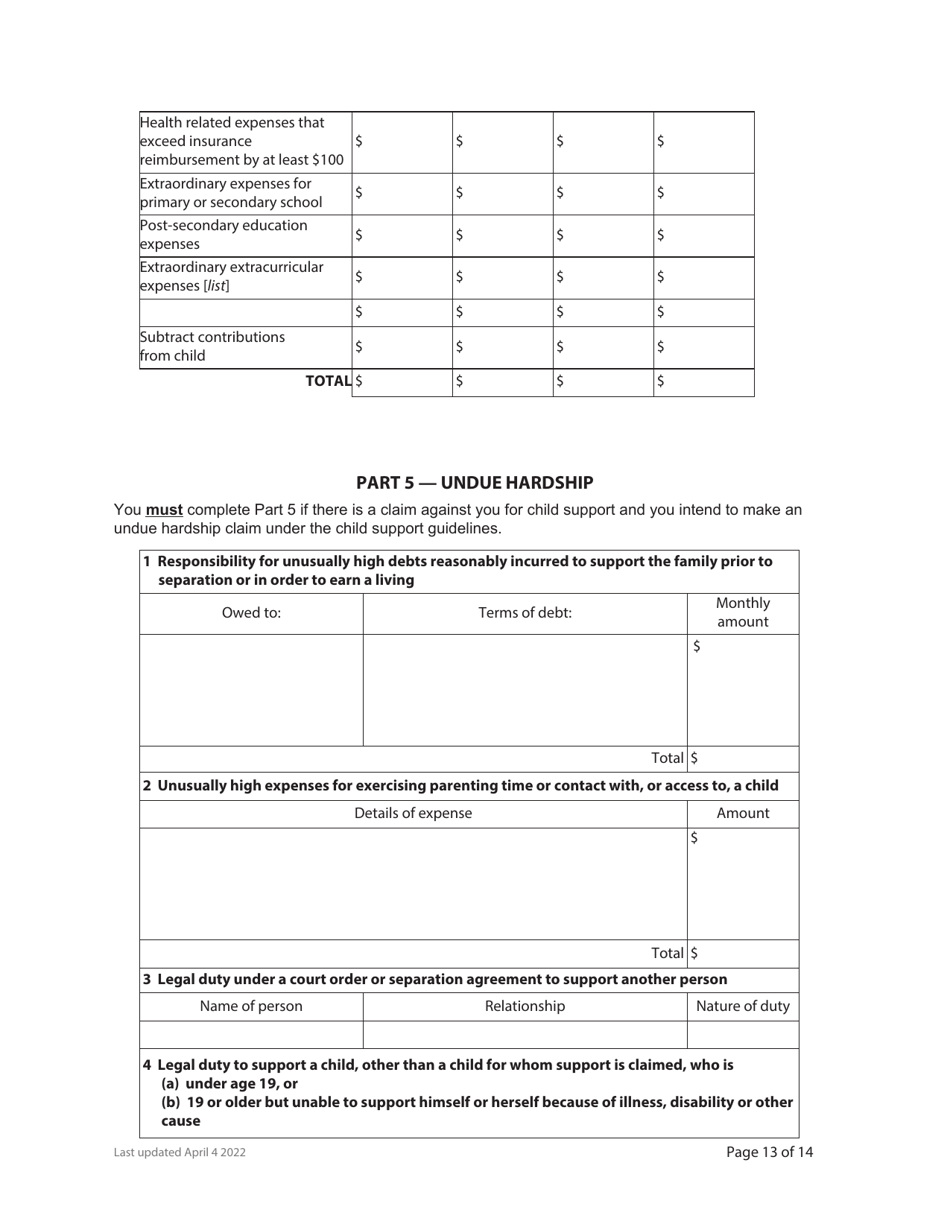

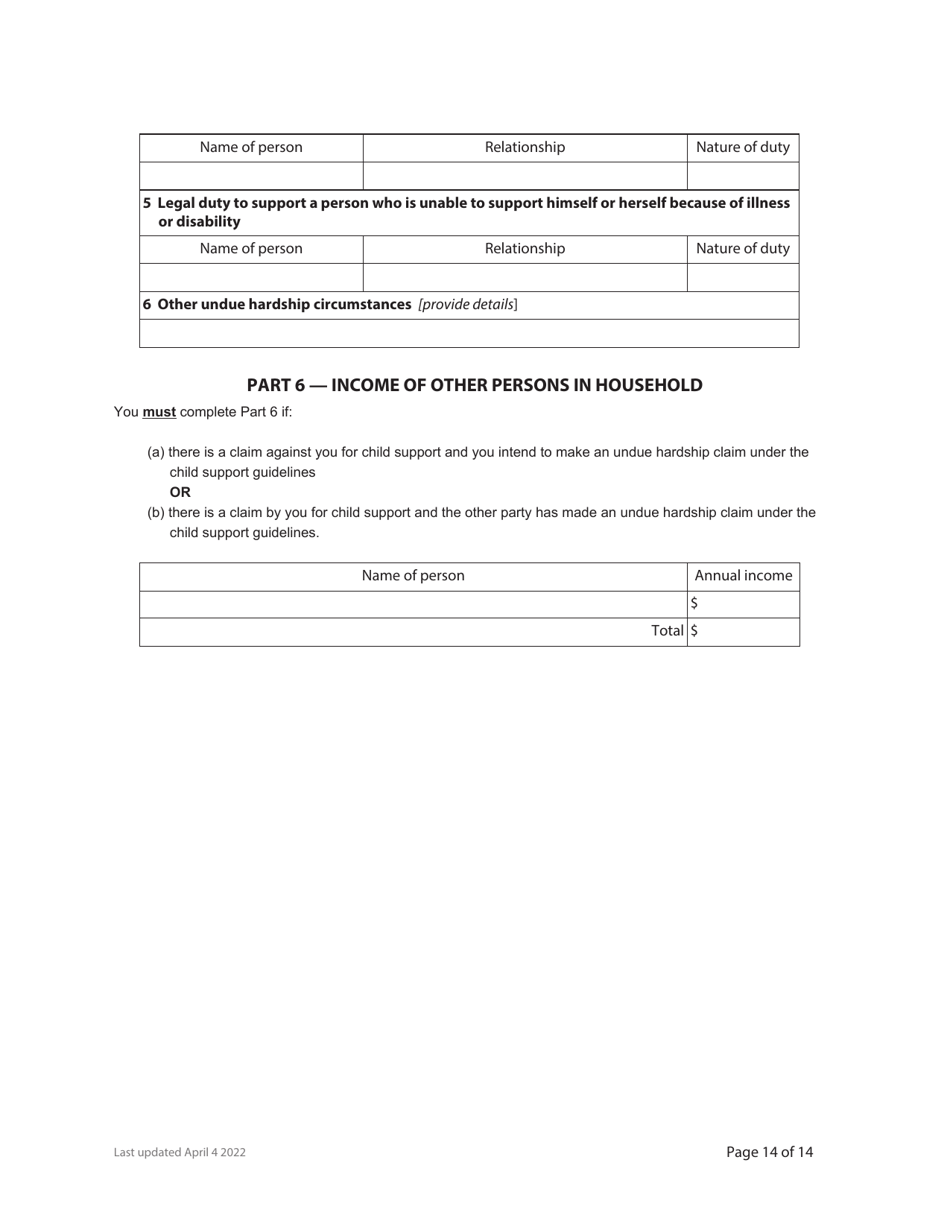

Form F8 Financial Statement - British Columbia, Canada

Form F8 Financial Statement is used in British Columbia, Canada for disclosing the financial information of parties involved in a legal proceeding, such as a divorce or separation. It helps the court evaluate financial matters, including income, expenses, assets, and debts, in order to make fair decisions regarding support, property division, and other related issues.

In British Columbia, Canada, the Form F8 Financial Statement is typically filed by both parties in a family law case when they are required to disclose their financial information.

Form F8 Financial Statement - British Columbia, Canada - Frequently Asked Questions (FAQ)

Q: What is a Form F8 Financial Statement?

A: A Form F8 Financial Statement is a legal document used in British Columbia, Canada, to disclose the financial information of a party involved in a family law case.

Q: Who needs to file a Form F8 Financial Statement?

A: Any party involved in a family law case in British Columbia, Canada, needs to file a Form F8 Financial Statement.

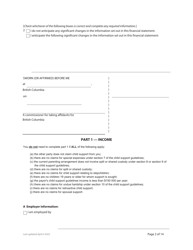

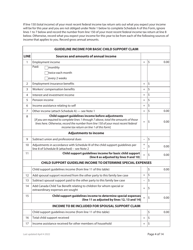

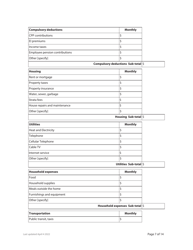

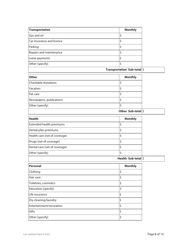

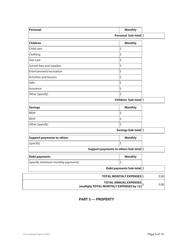

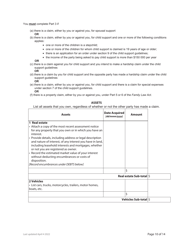

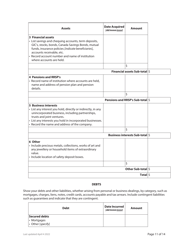

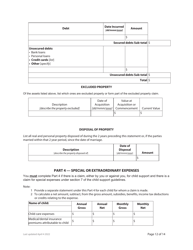

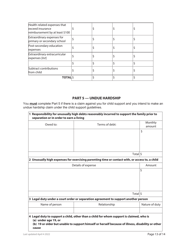

Q: What information is included in a Form F8 Financial Statement?

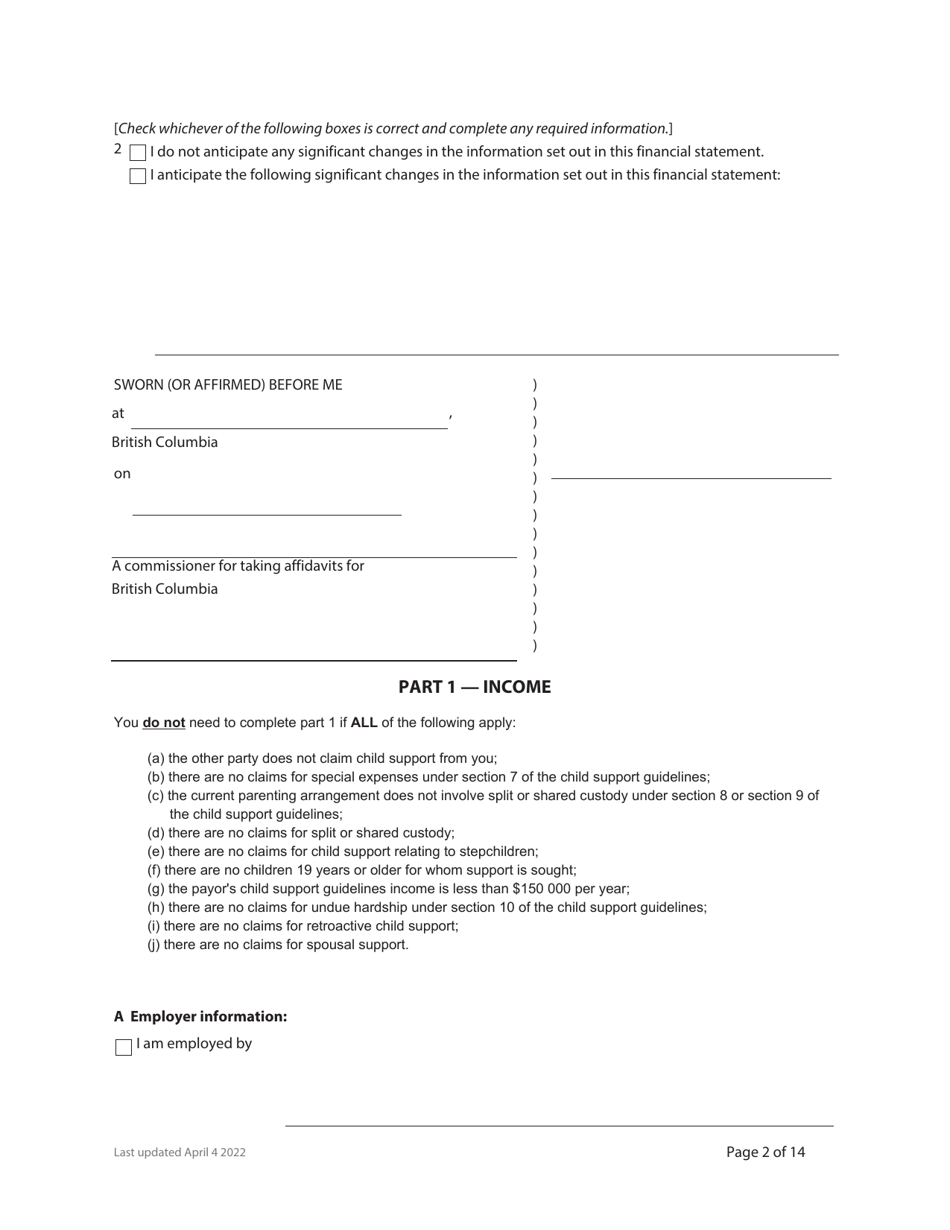

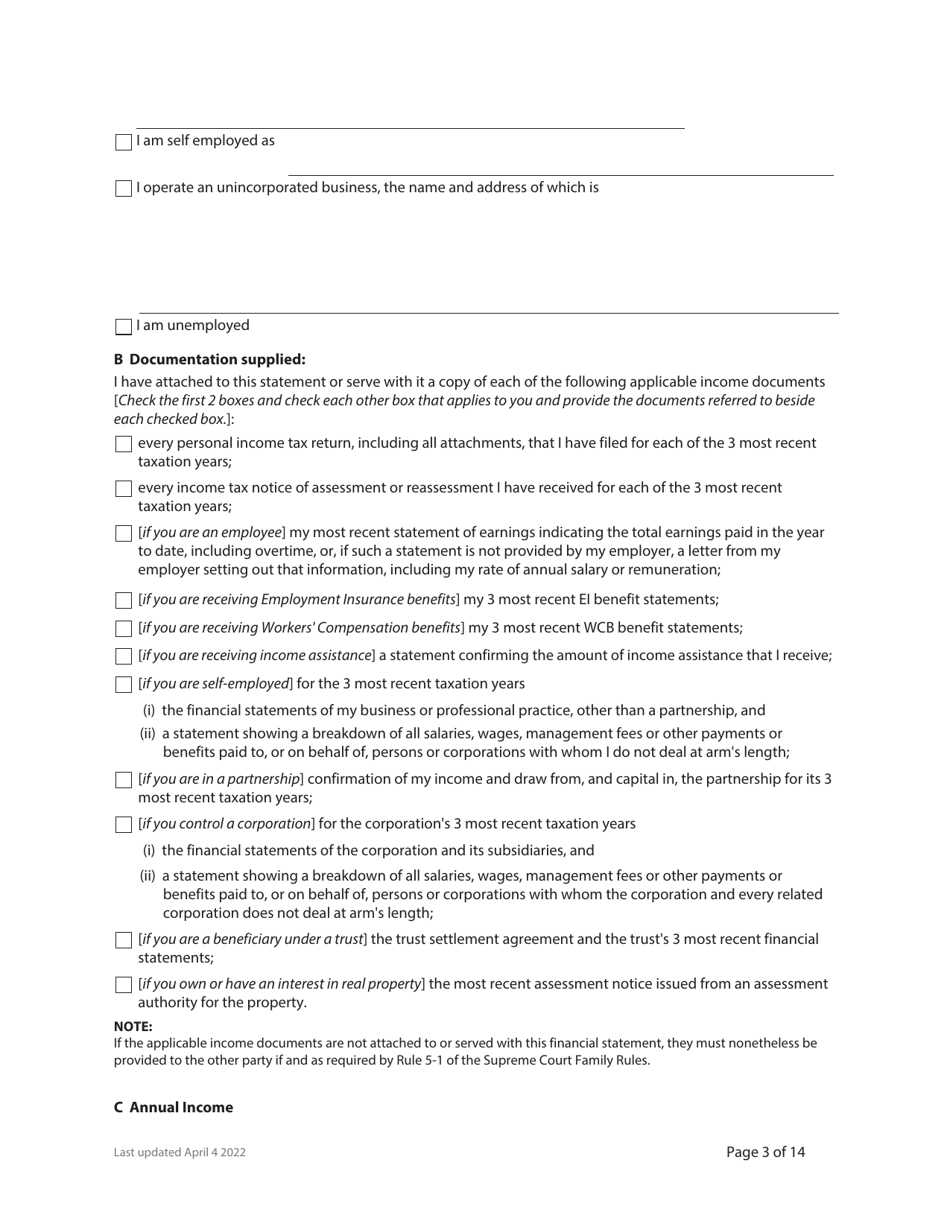

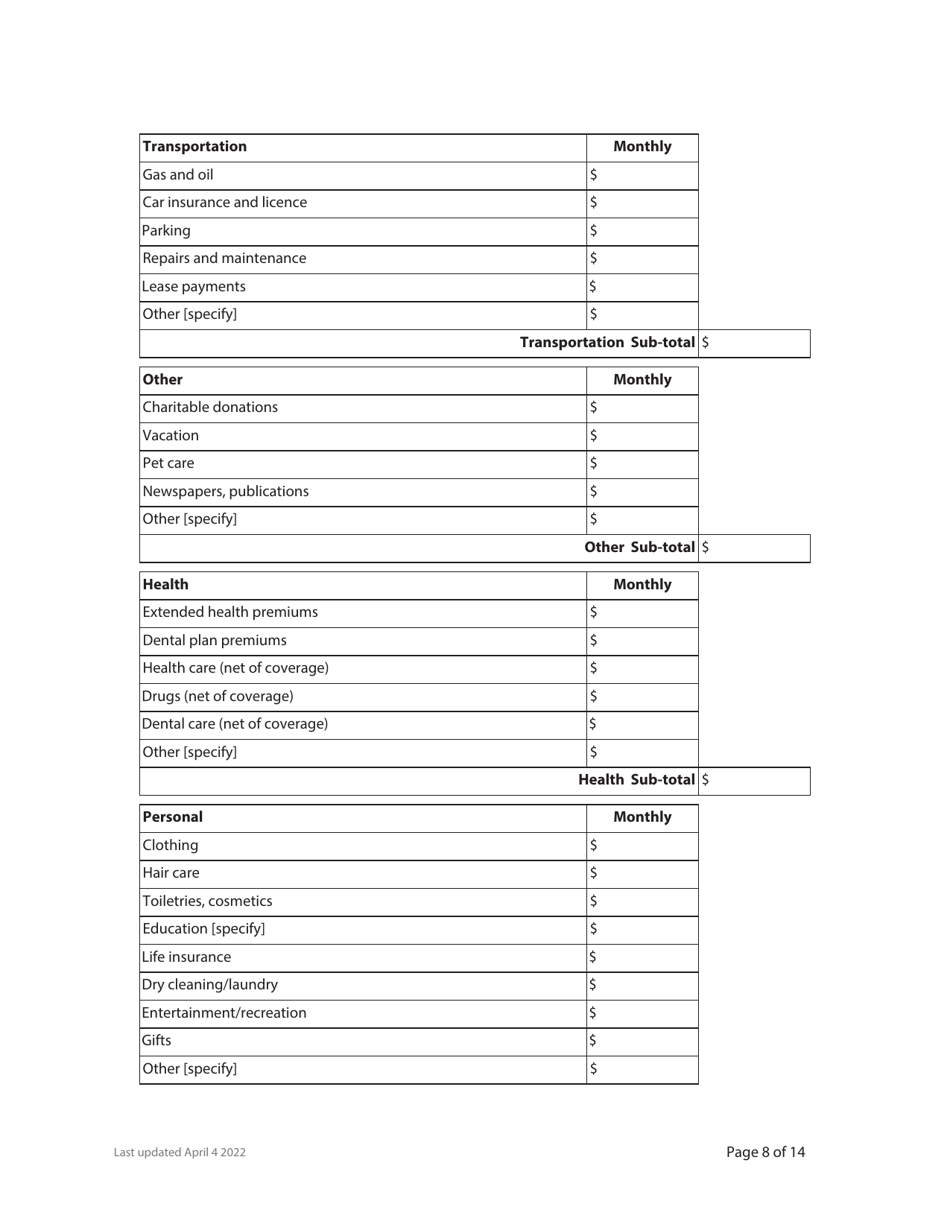

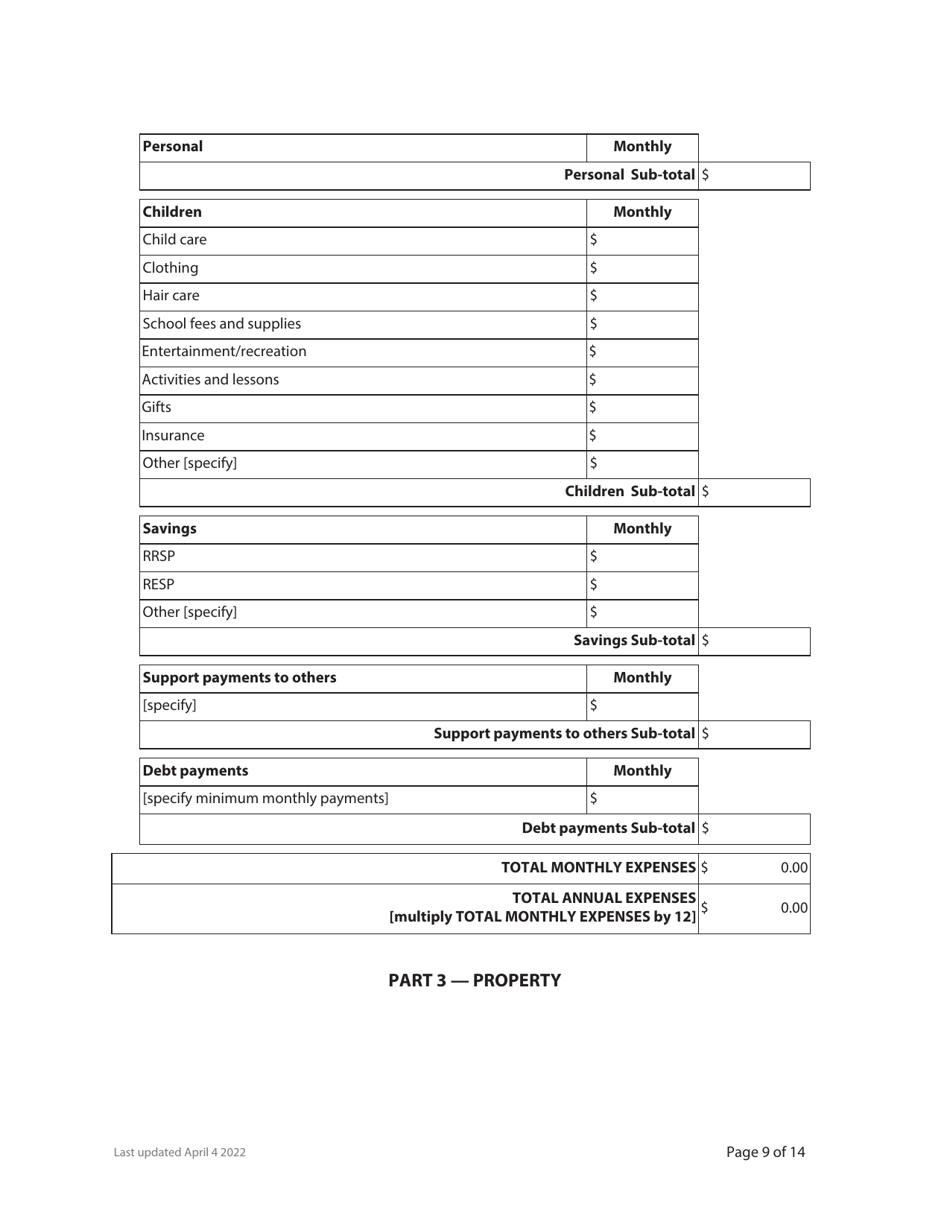

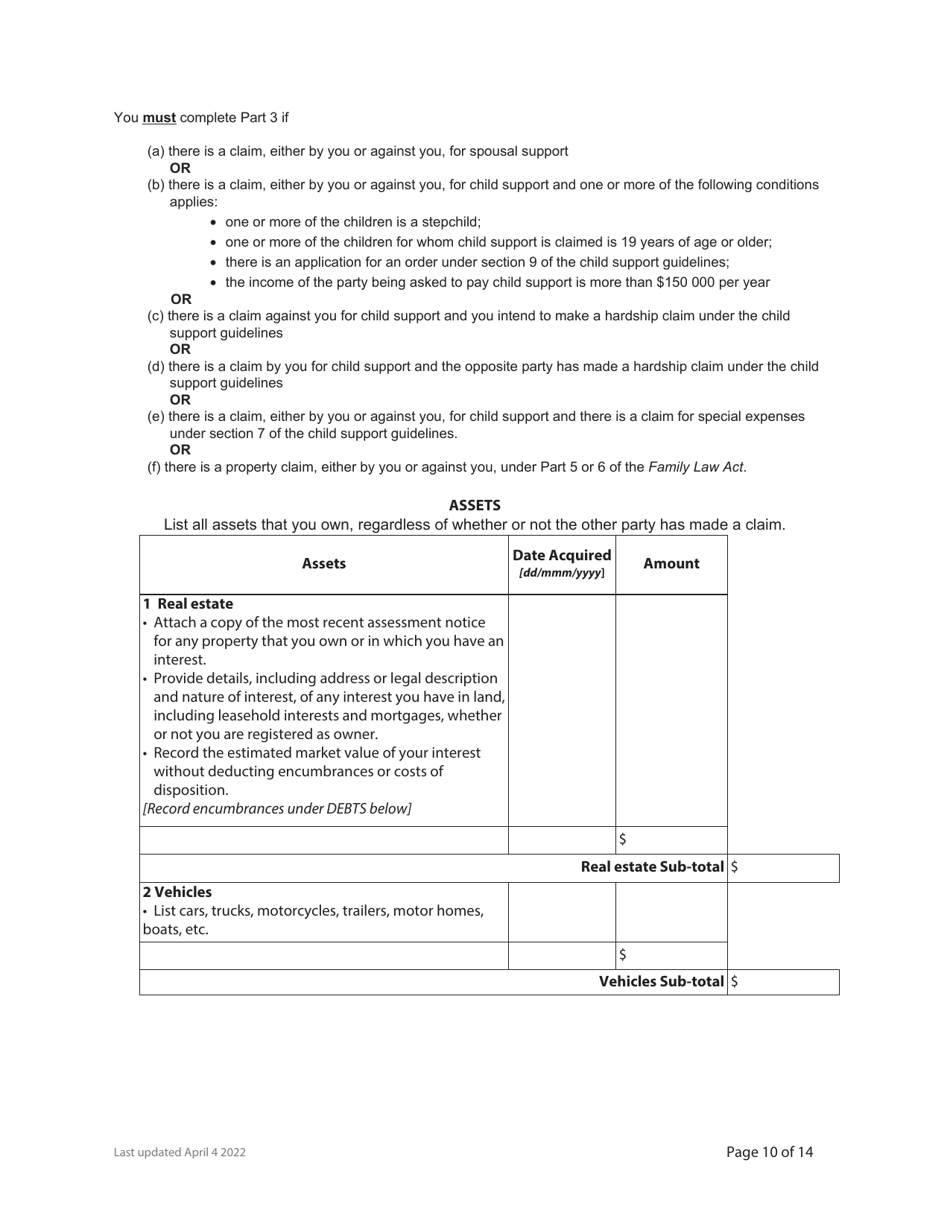

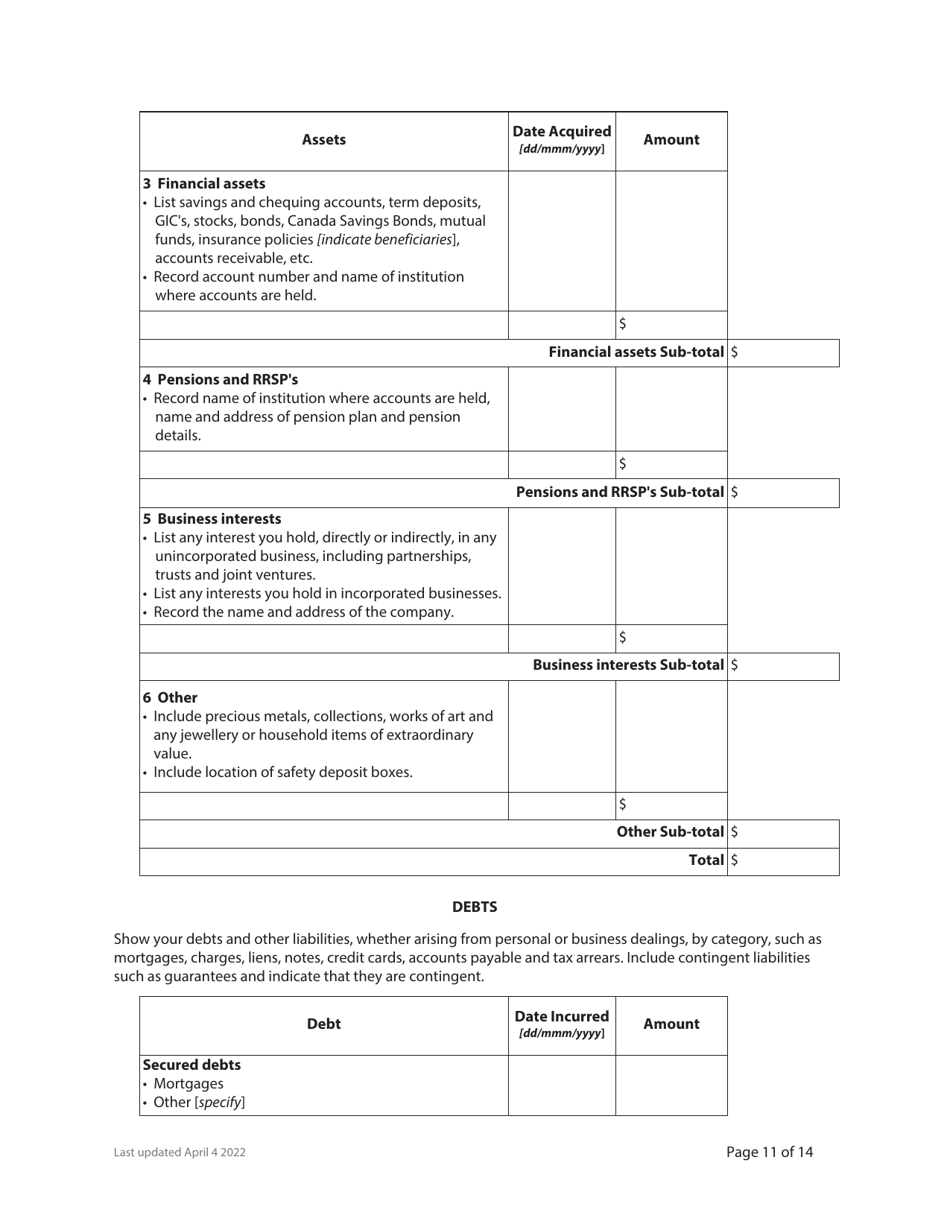

A: A Form F8 Financial Statement includes information about income, expenses, assets, and debts of the party filing the document.

Q: What is the purpose of a Form F8 Financial Statement?

A: The purpose of a Form F8 Financial Statement is to provide the court and the other party with a clear understanding of the financial situation of the party filing the document.

Q: Is it mandatory to file a Form F8 Financial Statement?

A: Yes, it is mandatory to file a Form F8 Financial Statement in family law cases in British Columbia, unless the court orders otherwise.

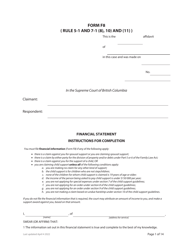

Q: Are there any guidelines or instructions for completing a Form F8 Financial Statement?

A: Yes, there are guidelines and instructions provided with the Form F8 Financial Statement to assist parties in completing the document accurately.

Q: Are there any fees associated with filing a Form F8 Financial Statement?

A: Yes, there may be fees associated with filing a Form F8 Financial Statement. The fee amount can vary, so it's best to check with the court or the family law registry for the most up-to-date information.