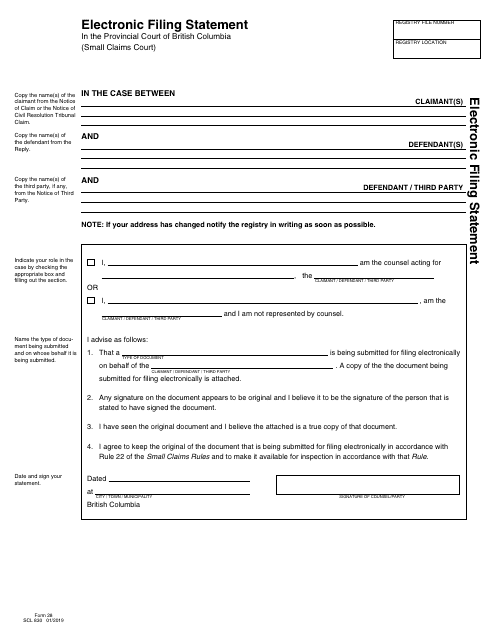

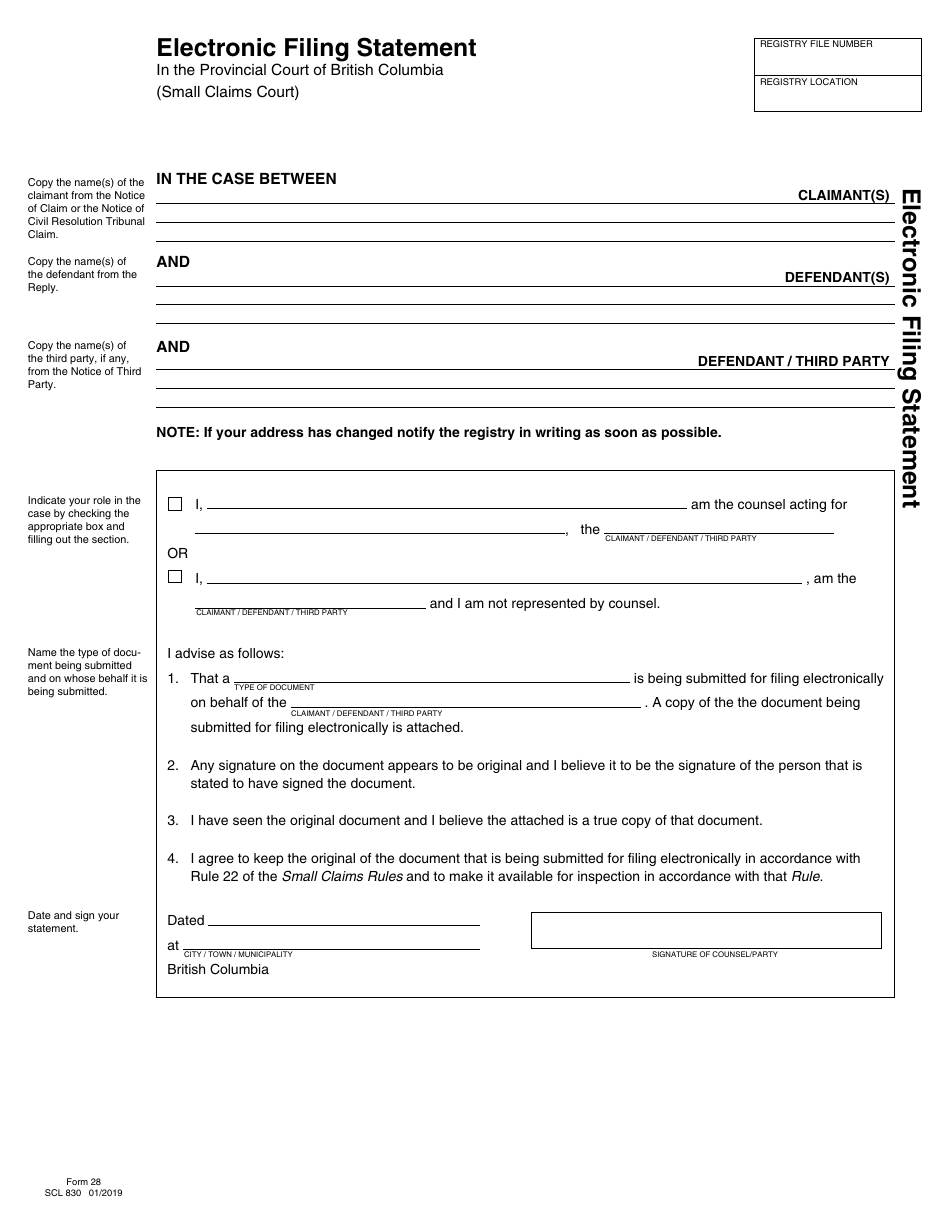

This version of the form is not currently in use and is provided for reference only. Download this version of

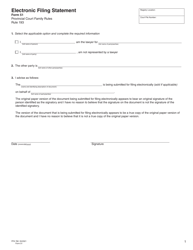

SCR Form 28 (SCL830)

for the current year.

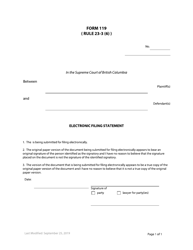

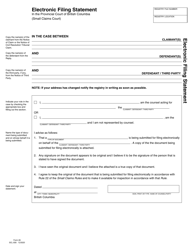

SCR Form 28 (SCL830) Electronic Filing Statement - British Columbia, Canada

SCR Form 28 (SCL830) Electronic Filing Statement is used in British Columbia, Canada for electronic filing of documents related to the payment of the provincial sales tax (PST).

The SCR Form 28 (SCL830) Electronic Filing Statement in British Columbia, Canada is filed by the designated electronic filing agent appointed by the vehicle dealer.

FAQ

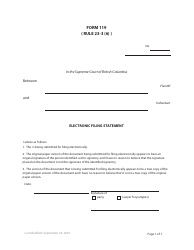

Q: What is SCR Form 28?

A: SCR Form 28 is a form used for electronic filing in British Columbia, Canada.

Q: What is SCL830?

A: SCL830 is the specific form number for SCR Form 28.

Q: What is the purpose of SCR Form 28?

A: The purpose of SCR Form 28 is to provide an electronic filing statement.

Q: What is the electronic filing statement for?

A: The electronic filing statement is for filing documents electronically.

Q: Can I submit SCR Form 28 electronically?

A: Yes, SCR Form 28 can be submitted electronically.

Q: Are there any specific requirements for SCR Form 28?

A: Yes, there may be specific requirements for completing SCR Form 28. It is important to review the instructions.

Q: Is SCR Form 28 only applicable in British Columbia?

A: Yes, SCR Form 28 is only applicable in British Columbia.

Q: Is SCR Form 28 mandatory?

A: The requirement to use SCR Form 28 may vary depending on the specific situation. It is important to check the applicable rules and regulations.