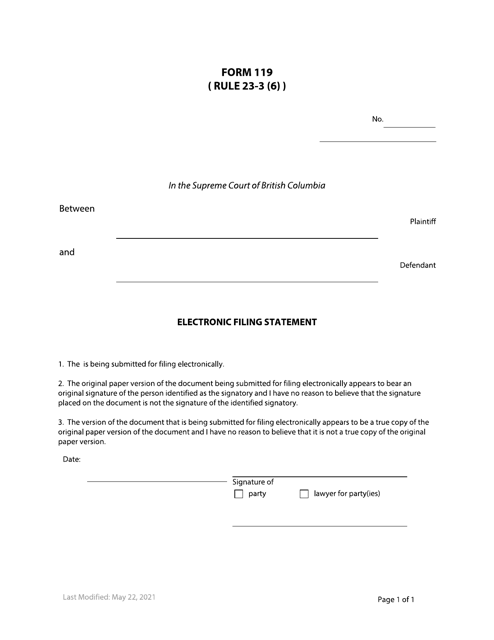

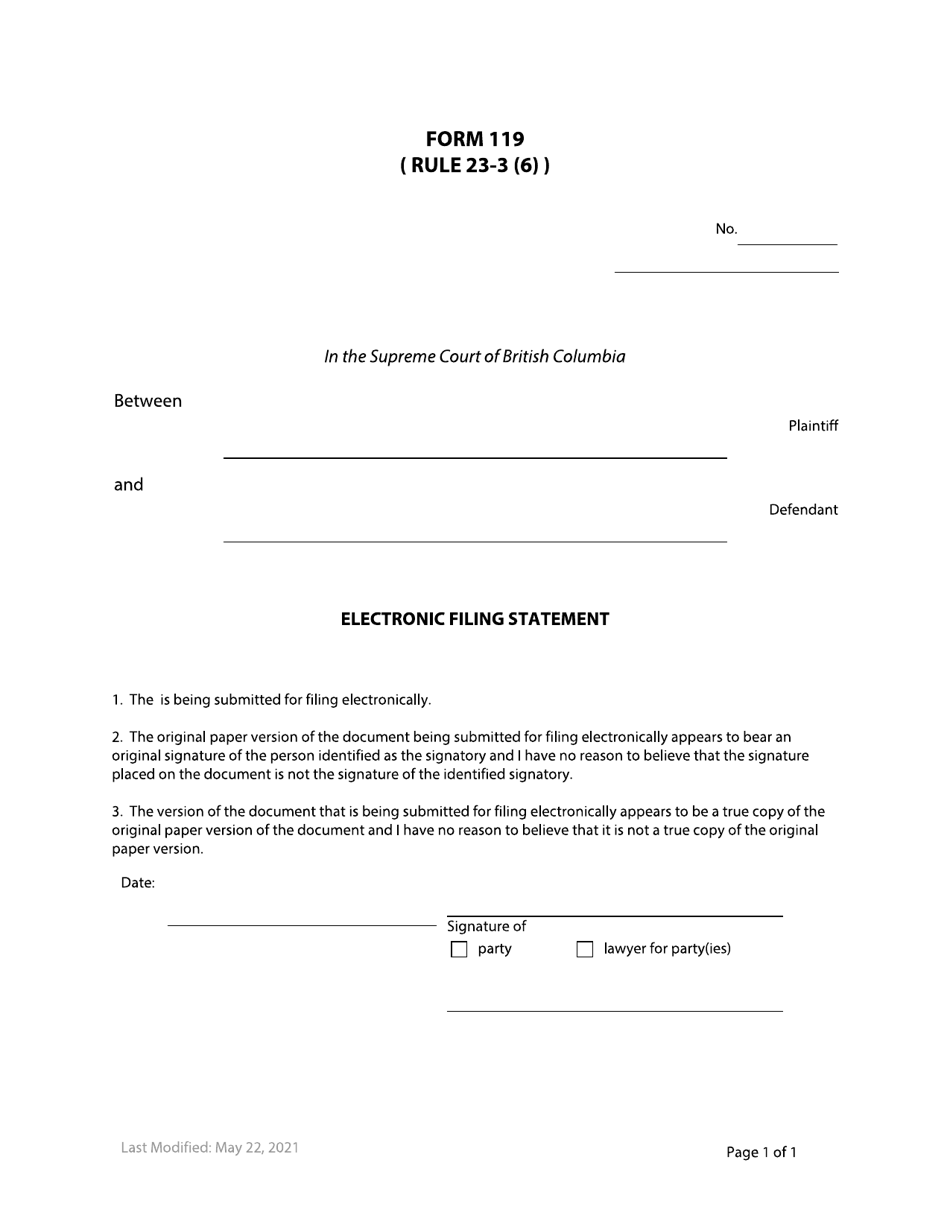

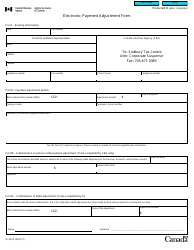

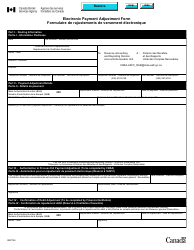

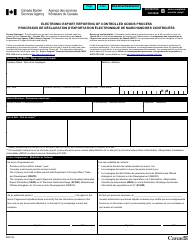

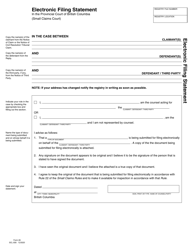

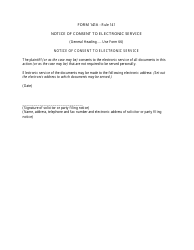

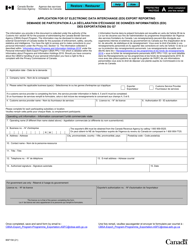

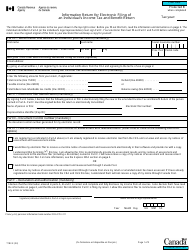

Form 119 Electronic Filing Statement - British Columbia, Canada

Form 119 Electronic Filing Statement is used in British Columbia, Canada for electronically filing tax returns.

According to my knowledge, the Form 119 Electronic Filing Statement in British Columbia, Canada is filed by the individual or business entity who wishes to electronically file documents with the British Columbia Corporate Registry.

Form 119 Electronic Filing Statement - British Columbia, Canada - Frequently Asked Questions (FAQ)

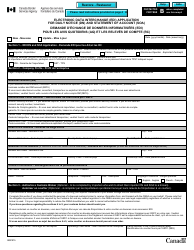

Q: What is Form 119?

A: Form 119 is the Electronic Filing Statement used in British Columbia, Canada.

Q: Who needs to file Form 119?

A: Anyone in British Columbia, Canada who wants to file their taxes electronically needs to file Form 119.

Q: What information is required on Form 119?

A: Form 119 requires personal information such as your name, address, and social insurance number, as well as information about your income and deductions.

Q: When is the deadline to file Form 119?

A: The deadline to file Form 119 varies depending on the tax year. Check with the British Columbia government for the specific deadline.