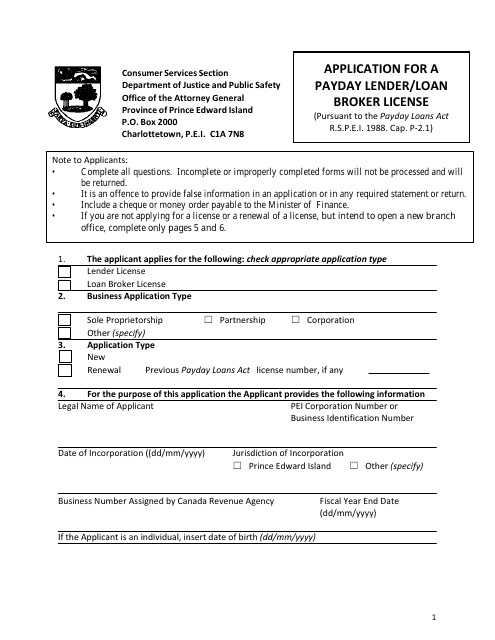

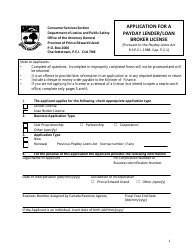

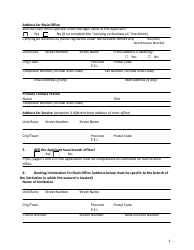

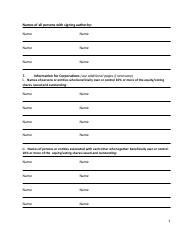

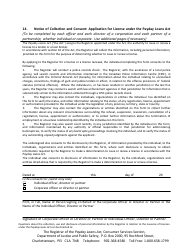

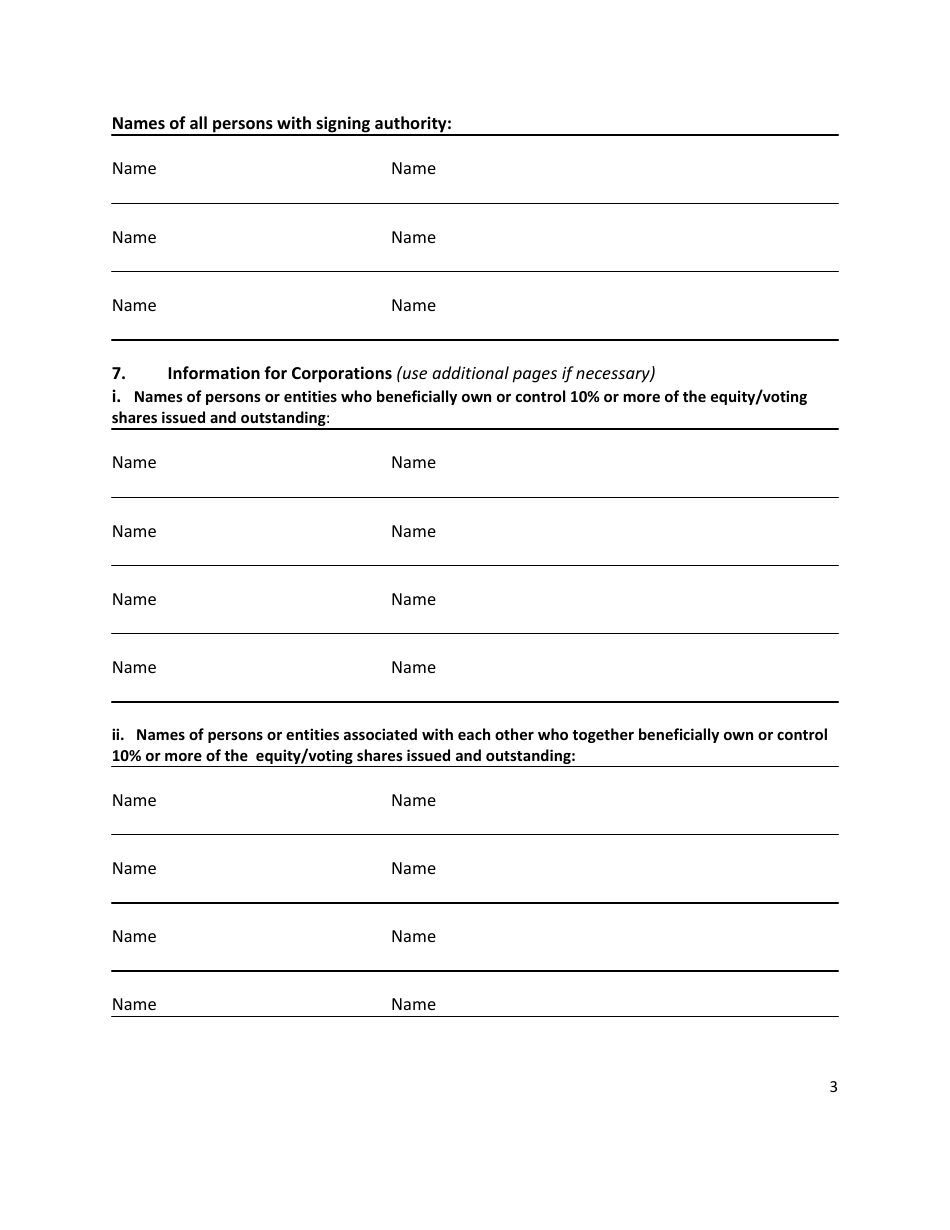

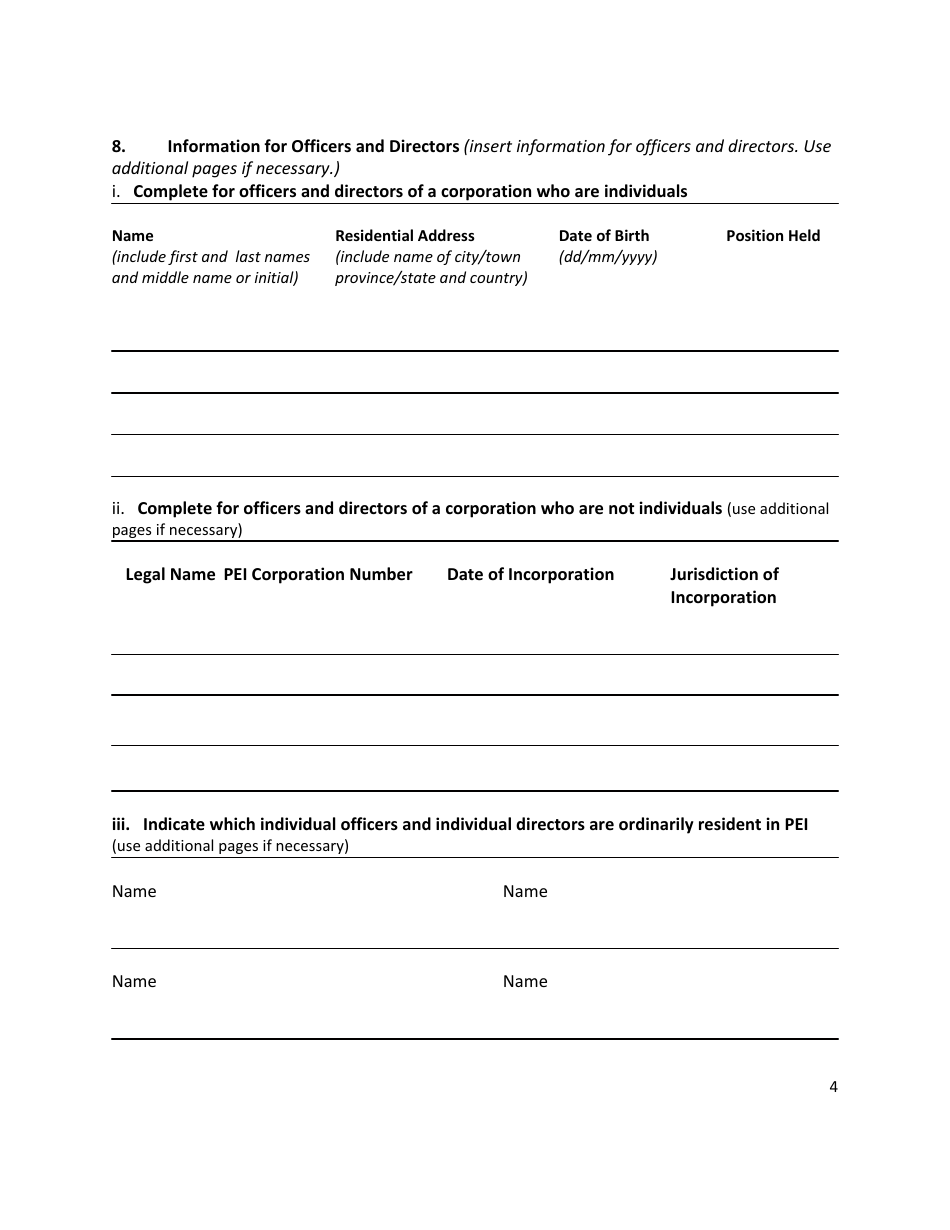

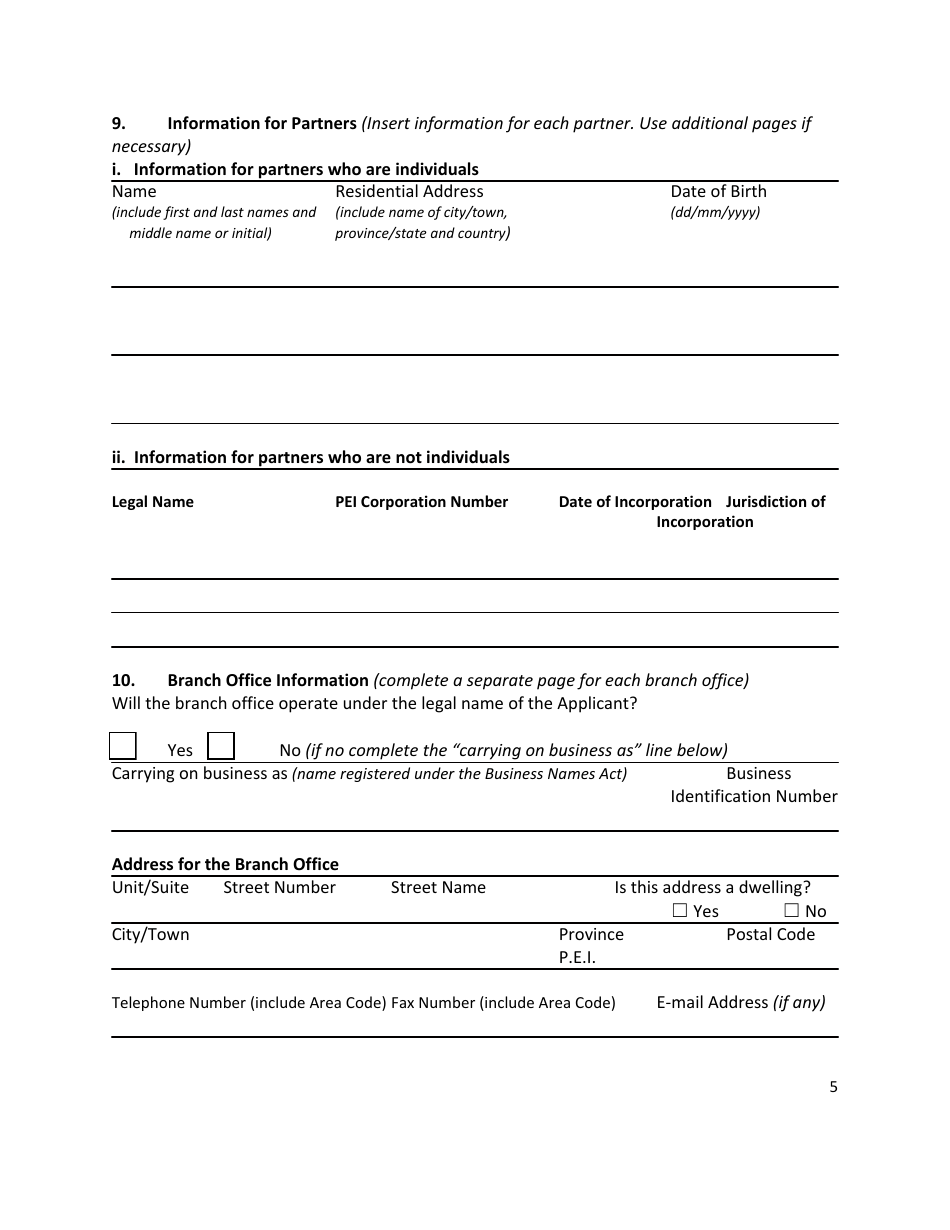

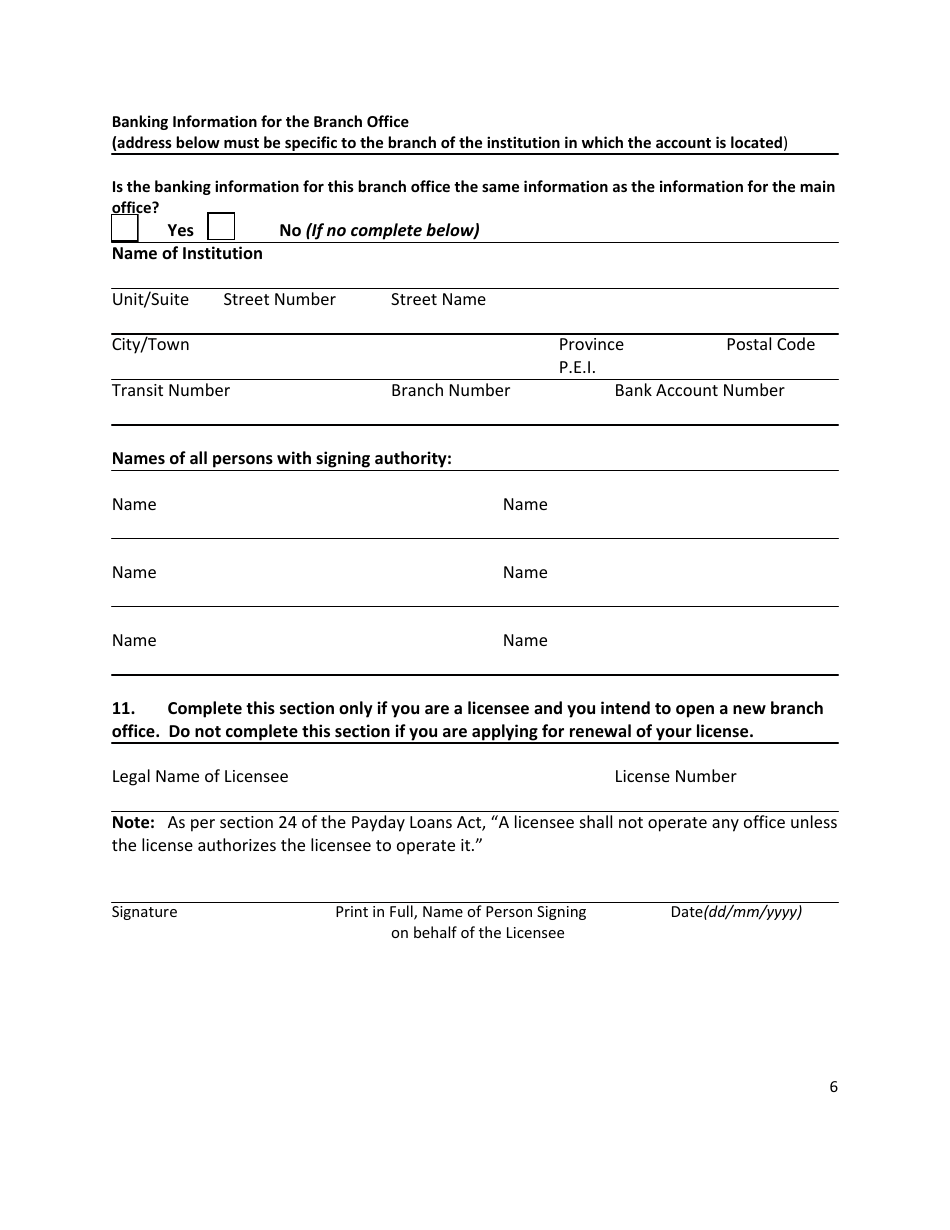

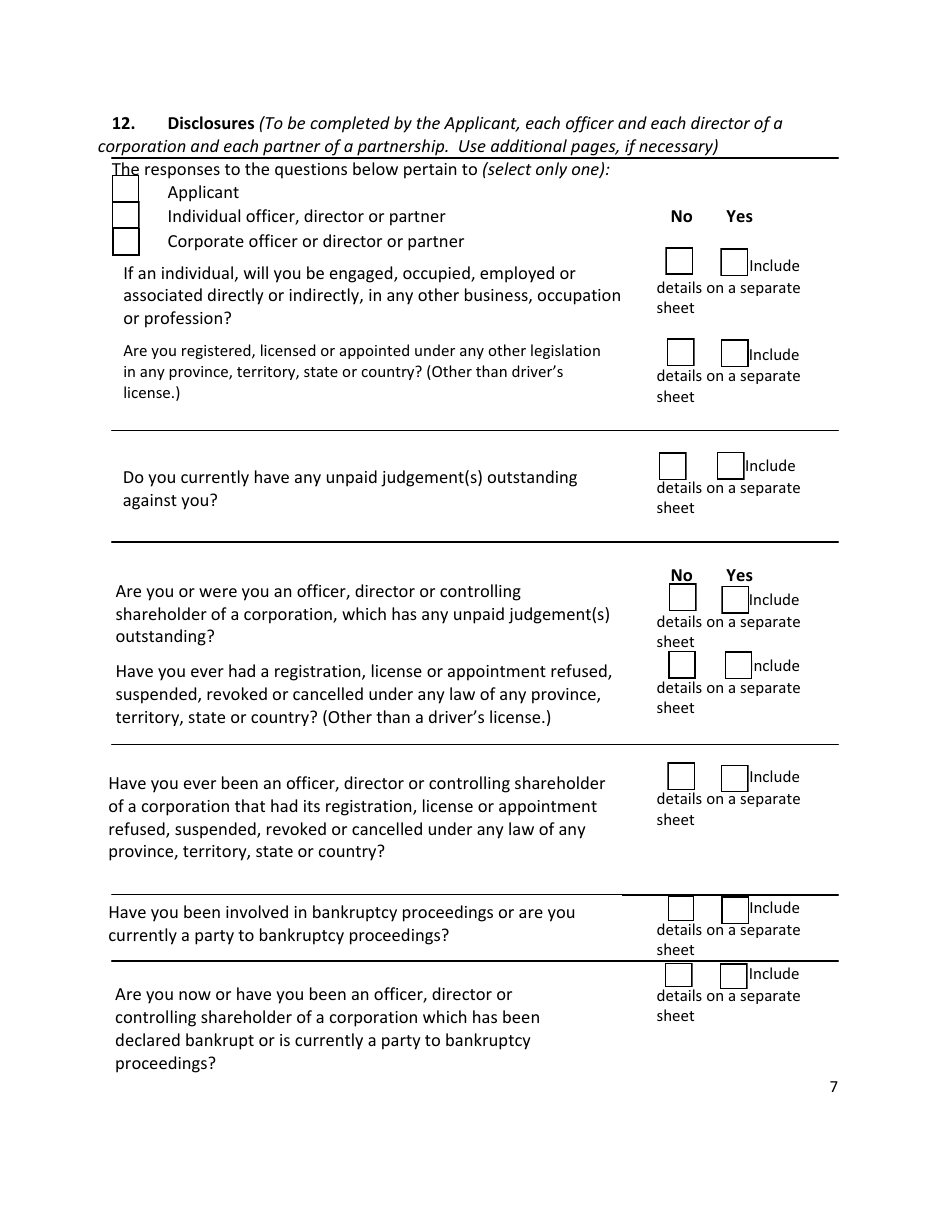

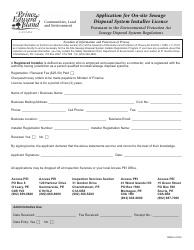

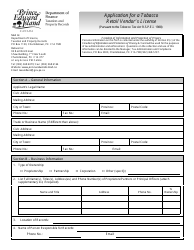

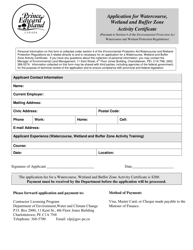

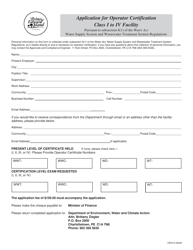

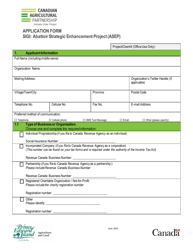

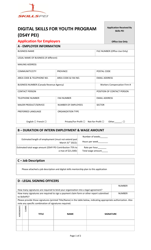

Application for a Payday Lender / Loan Broker License - Prince Edward Island, Canada

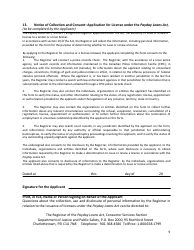

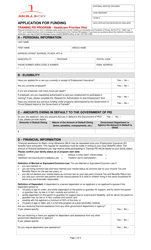

The Application for a Payday Lender/Loan Broker License in Prince Edward Island, Canada is used by individuals or companies looking to operate as payday lenders or loan brokers in the province. This license is required to legally provide payday loans or broker loans in Prince Edward Island.

The Office of the Superintendent of Securities.

FAQ

Q: What is a payday lender/loan broker license?

A: A payday lender/loan broker license allows a business to operate as a lender or broker of payday loans in Prince Edward Island, Canada.

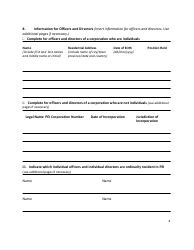

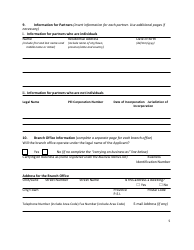

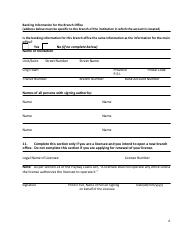

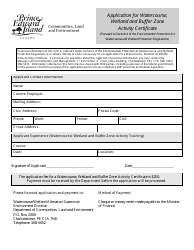

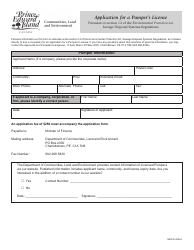

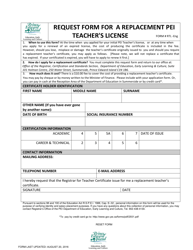

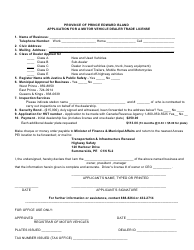

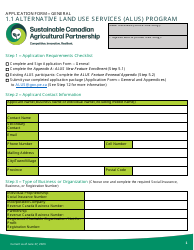

Q: How can I apply for a payday lender/loan broker license in Prince Edward Island?

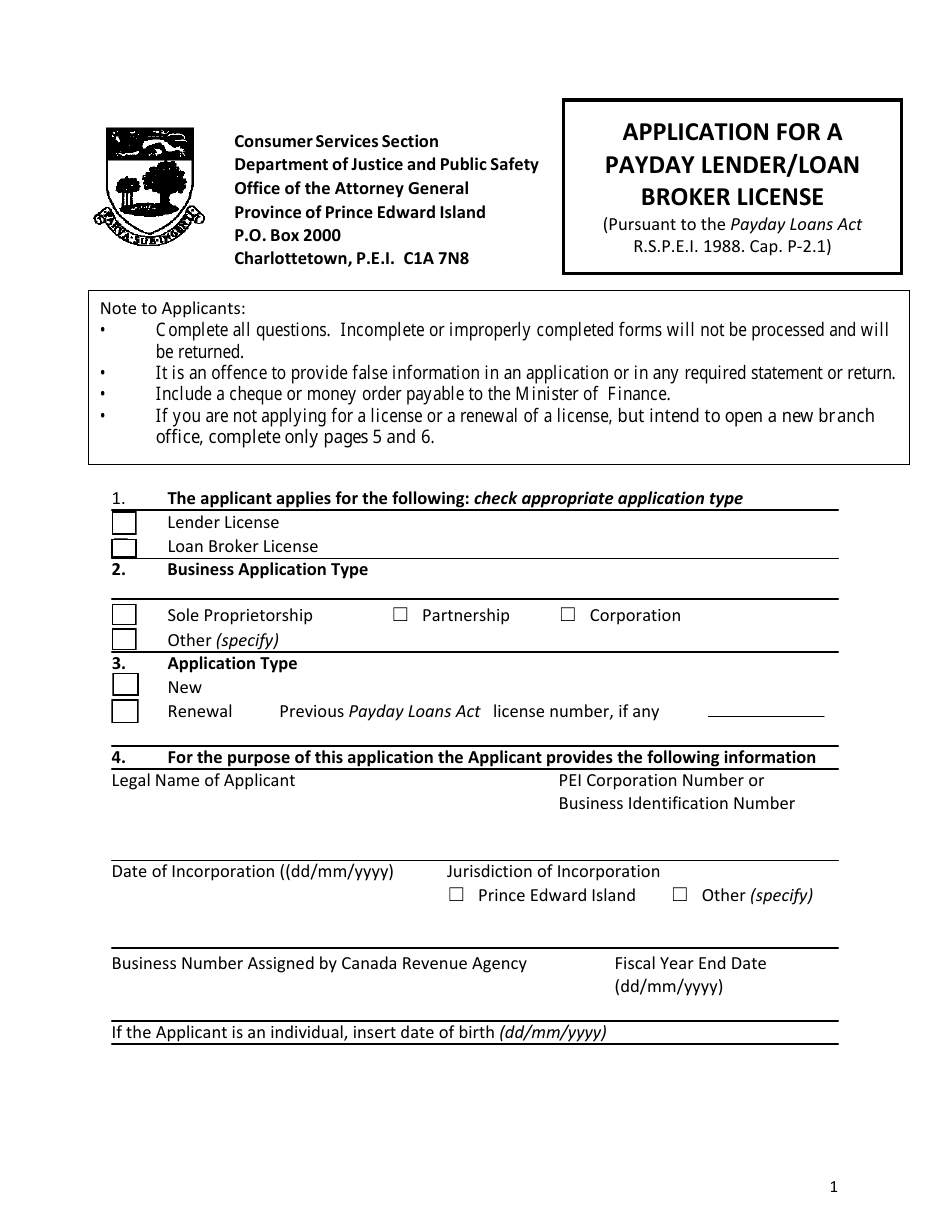

A: To apply for a payday lender/loan broker license in Prince Edward Island, you need to fill out an application form and submit it to the province's consumer services department.

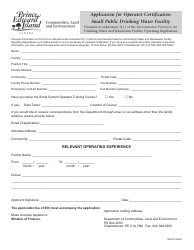

Q: What are the requirements to obtain a payday lender/loan broker license in Prince Edward Island?

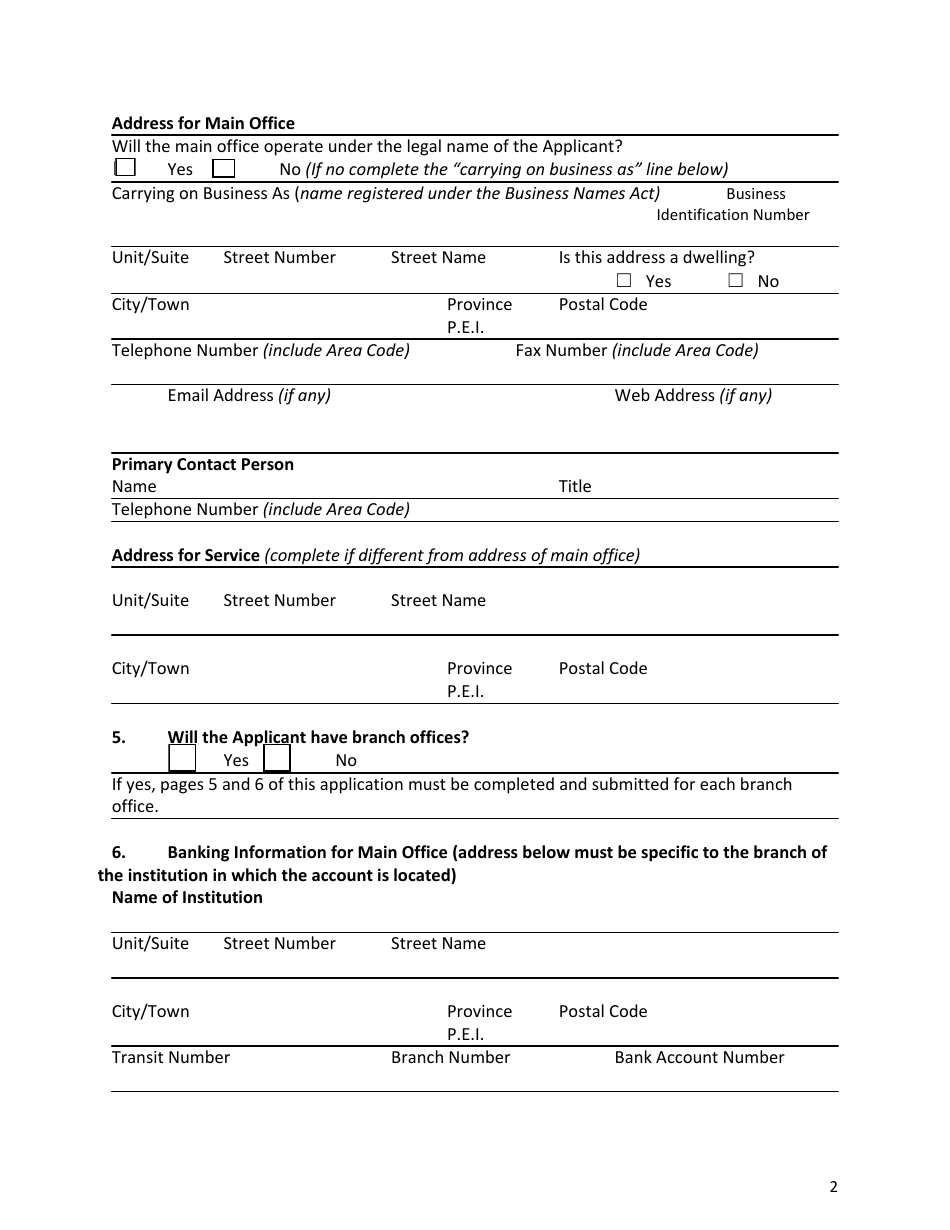

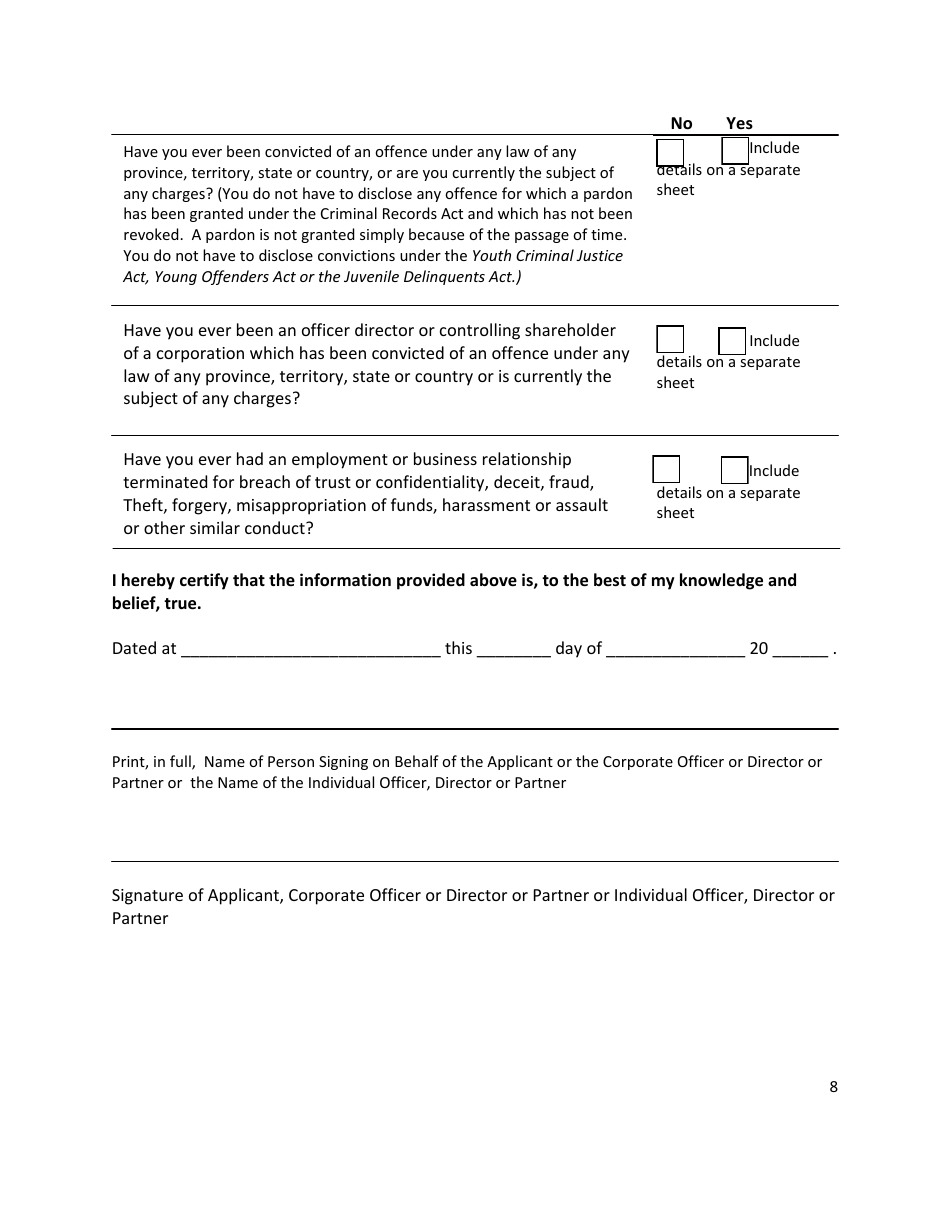

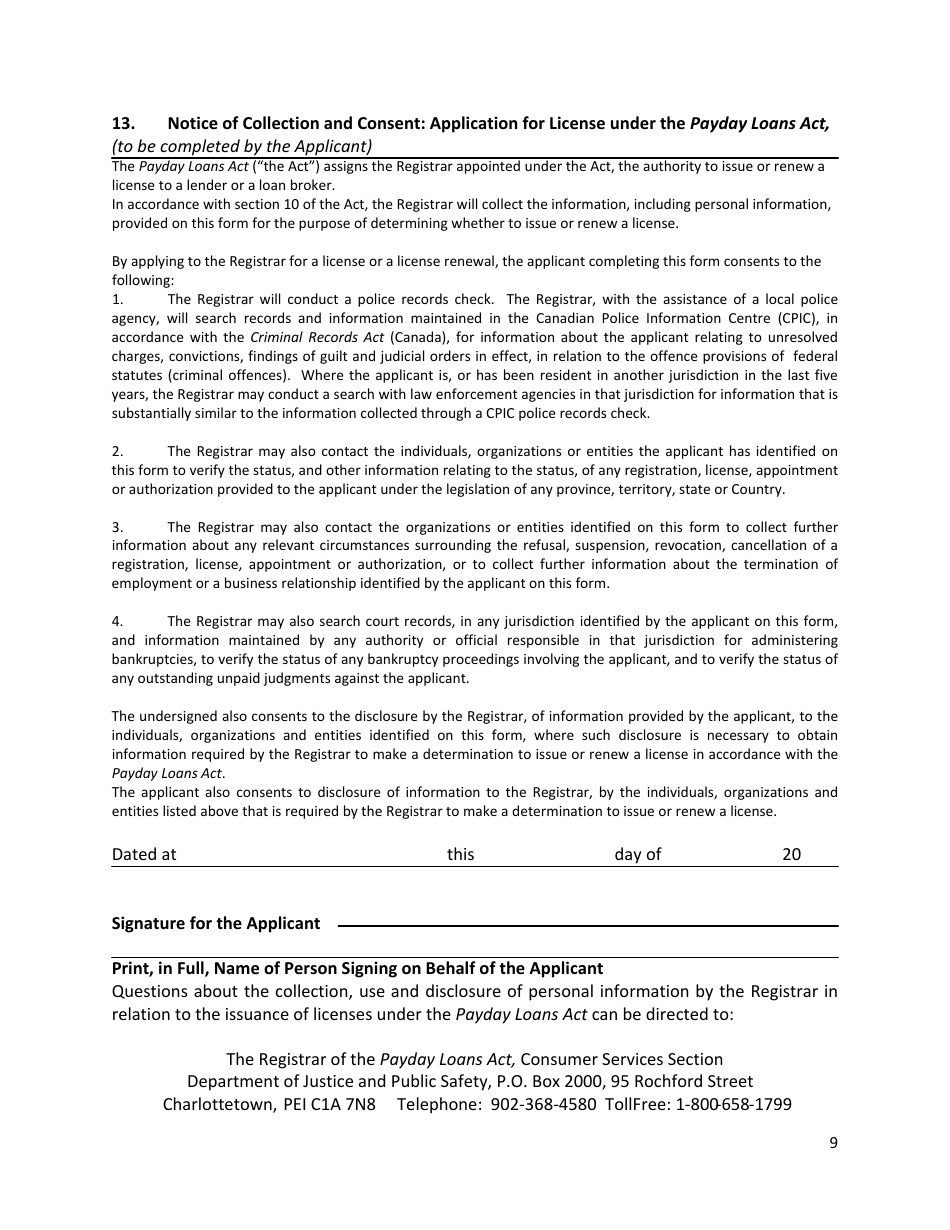

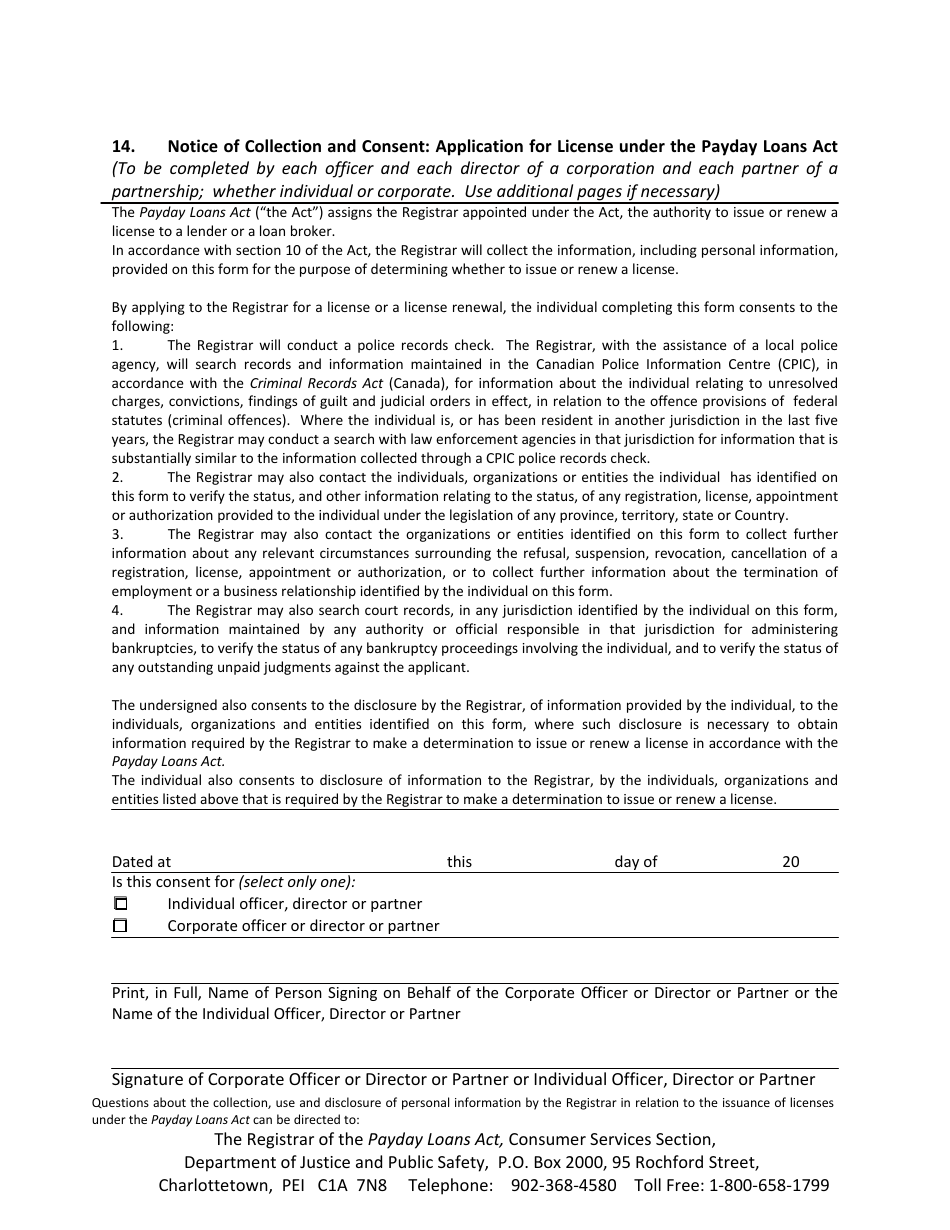

A: The requirements for obtaining a payday lender/loan broker license in Prince Edward Island include providing financial statements, a business plan, proof of bonding or security, criminal record checks, and compliance with the province's payday loans legislation.

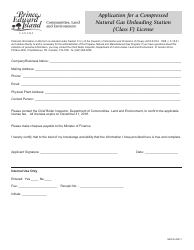

Q: How long does it take to get a payday lender/loan broker license in Prince Edward Island?

A: The processing time for a payday lender/loan broker license application in Prince Edward Island can vary, but it generally takes several weeks to months.

Q: Are there any fees associated with applying for a payday lender/loan broker license in Prince Edward Island?

A: Yes, there are fees associated with applying for a payday lender/loan broker license in Prince Edward Island. You will need to pay an application fee and an annual license fee.

Q: Can my payday lender/loan broker license be revoked in Prince Edward Island?

A: Yes, your payday lender/loan broker license can be revoked in Prince Edward Island if you fail to comply with the province's payday loans legislation or if you engage in any fraudulent or deceptive practices.