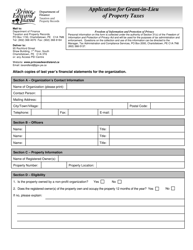

Application for Real Property Tax Deferral Program for Senior Citizens - Prince Edward Island, Canada

The Application for Real Property Tax Deferral Program for Senior Citizens in Prince Edward Island, Canada is for seniors who want to defer paying their property taxes. This program allows eligible seniors to delay payment of their property taxes, helping to ease financial burden.

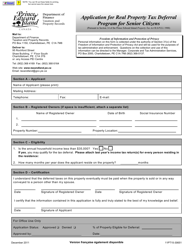

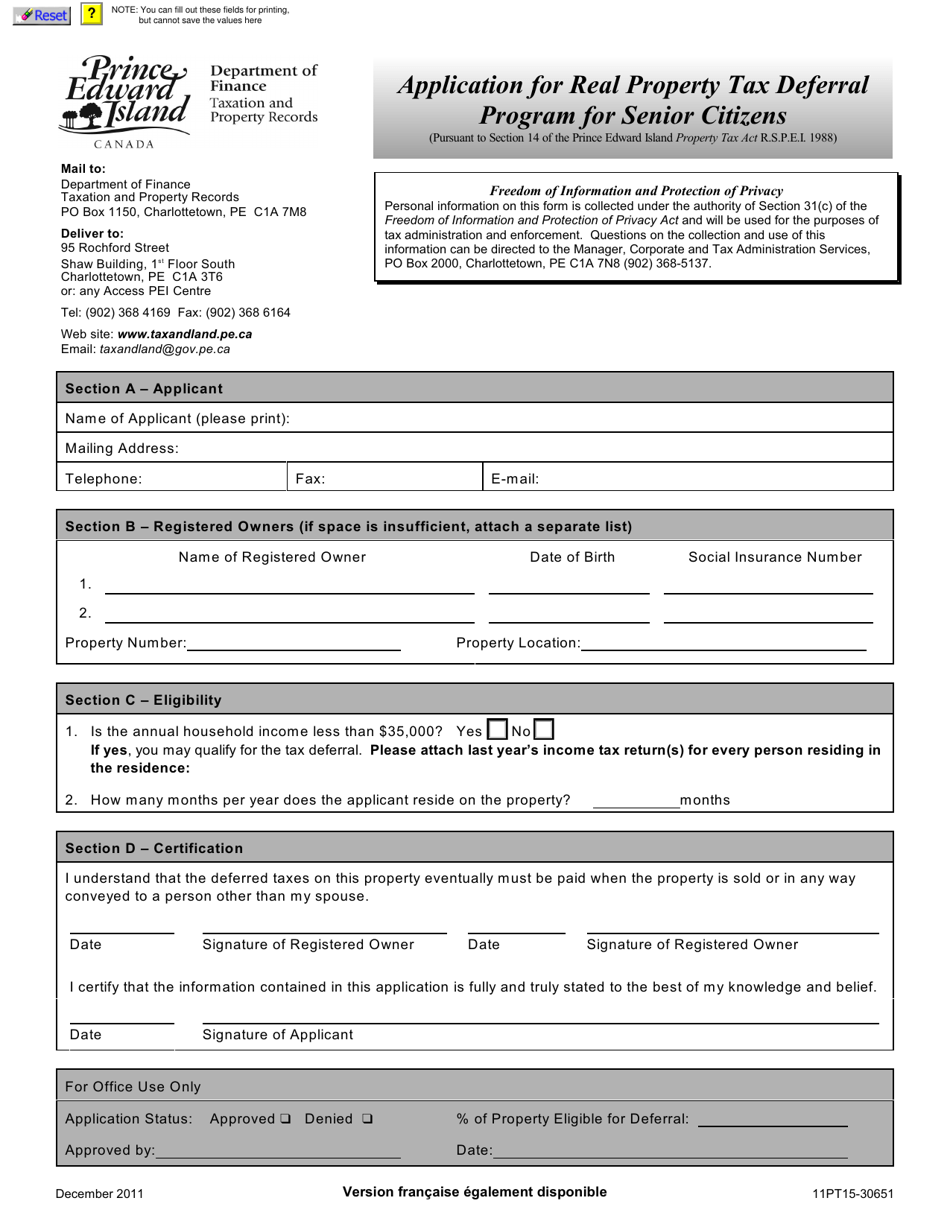

In Prince Edward Island, Canada, the senior citizen filing the application for the Real PropertyTax Deferral Program is responsible for submitting the application.

FAQ

Q: What is the Real Property Tax Deferral Program for Senior Citizens?

A: The Real Property Tax Deferral Program for Senior Citizens is a program in Prince Edward Island that allows eligible senior citizens to defer paying property taxes on their primary residence.

Q: Who is eligible for the Real Property Tax Deferral Program?

A: To be eligible for the program, you must be at least 65 years old, own and occupy your primary residence in Prince Edward Island, and meet certain income requirements.

Q: How does the deferral work?

A: Under the program, the government pays your property taxes on your behalf, and you repay the deferred taxes with interest when you sell your property or it becomes otherwise eligible for registration in the Land Registry.

Q: What is the income threshold for eligibility?

A: The income thresholds vary depending on the municipality in which you reside. You should check with your municipality or the program administrator to determine the specific income requirements for your area.

Q: Are there any fees or costs associated with the program?

A: Yes, there is an administrative fee associated with the program. Additionally, interest is charged on the deferred taxes at a specified rate.

Q: How do I apply for the program?

A: To apply for the Real Property Tax Deferral Program, you will need to complete an application form and submit it to your municipality's tax office. You may need to provide supporting documentation, such as proof of age and income.

Q: Can I apply if I have an outstanding mortgage on my property?

A: Yes, you can still apply for the program if you have an outstanding mortgage on your property. However, you will need to obtain consent from your mortgage lender.

Q: What happens if I sell my property before repaying the deferred taxes?

A: If you sell your property, the deferred taxes, along with any accumulated interest, will be repaid from the proceeds of the sale before you receive any remaining funds.

Q: Is the program available in all municipalities in Prince Edward Island?

A: Yes, the Real Property Tax Deferral Program is available in all municipalities in Prince Edward Island.