This version of the form is not currently in use and is provided for reference only. Download this version of

Form B263

for the current year.

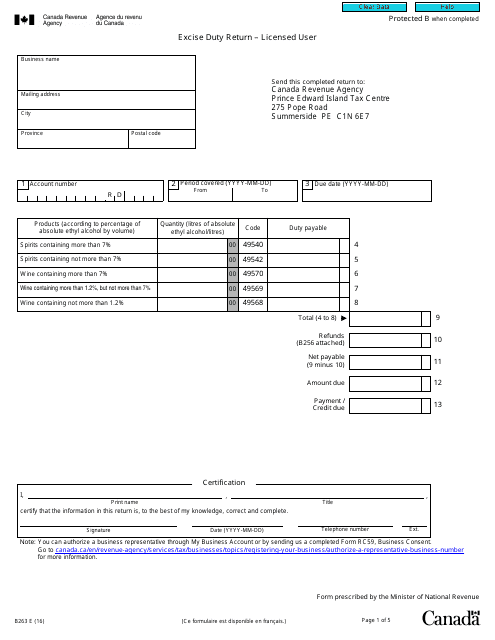

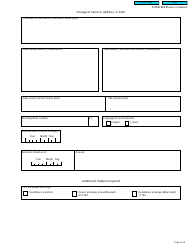

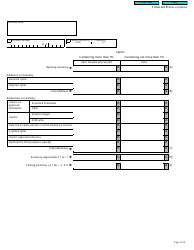

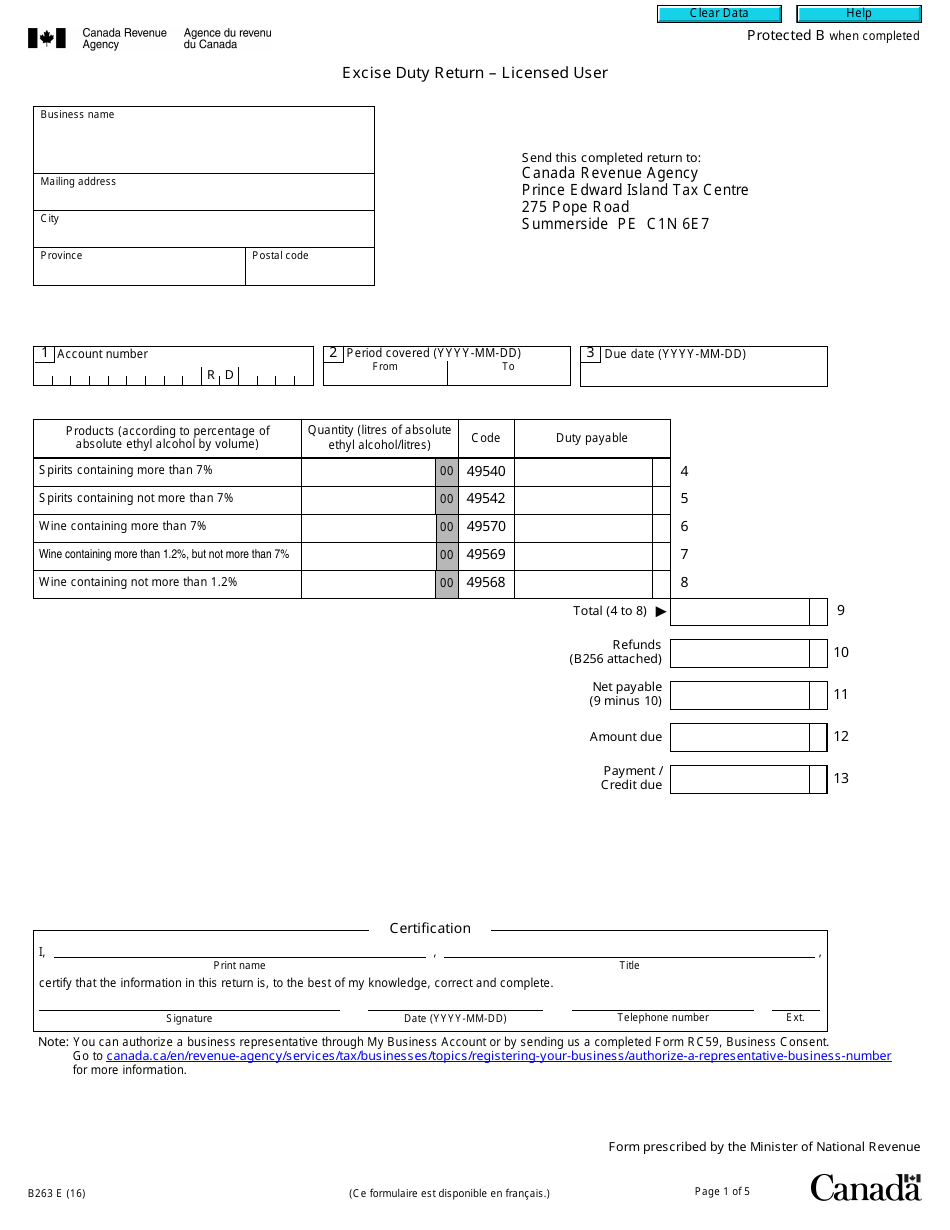

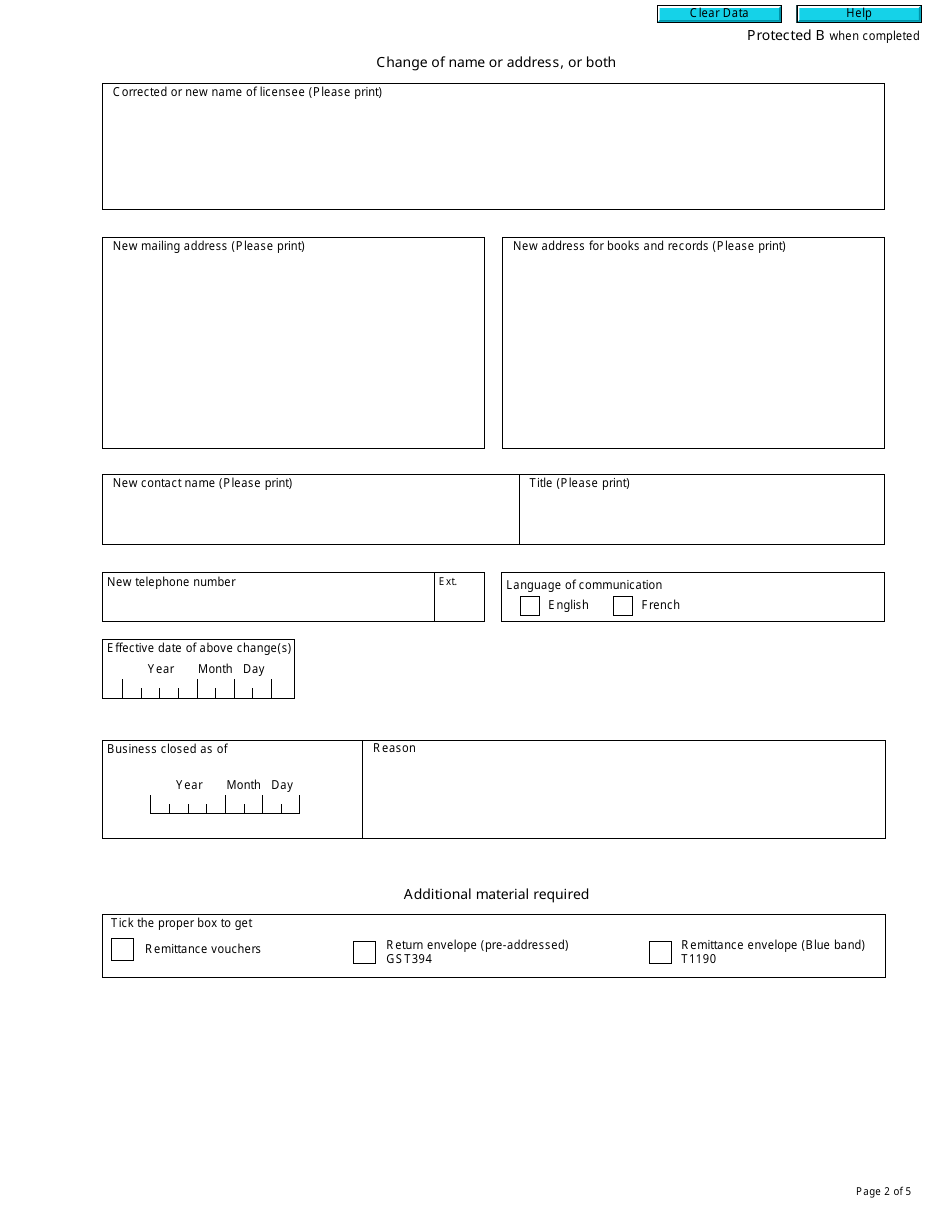

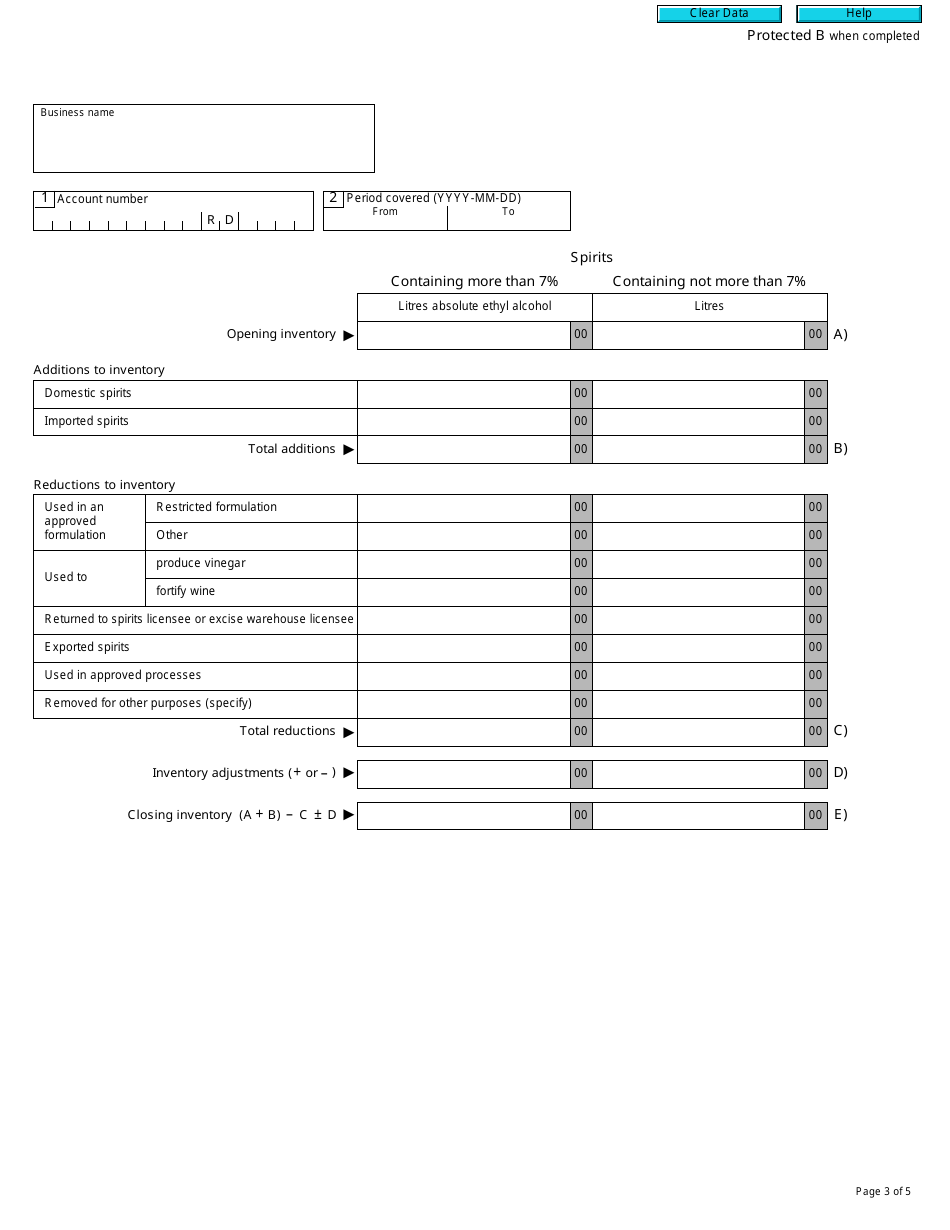

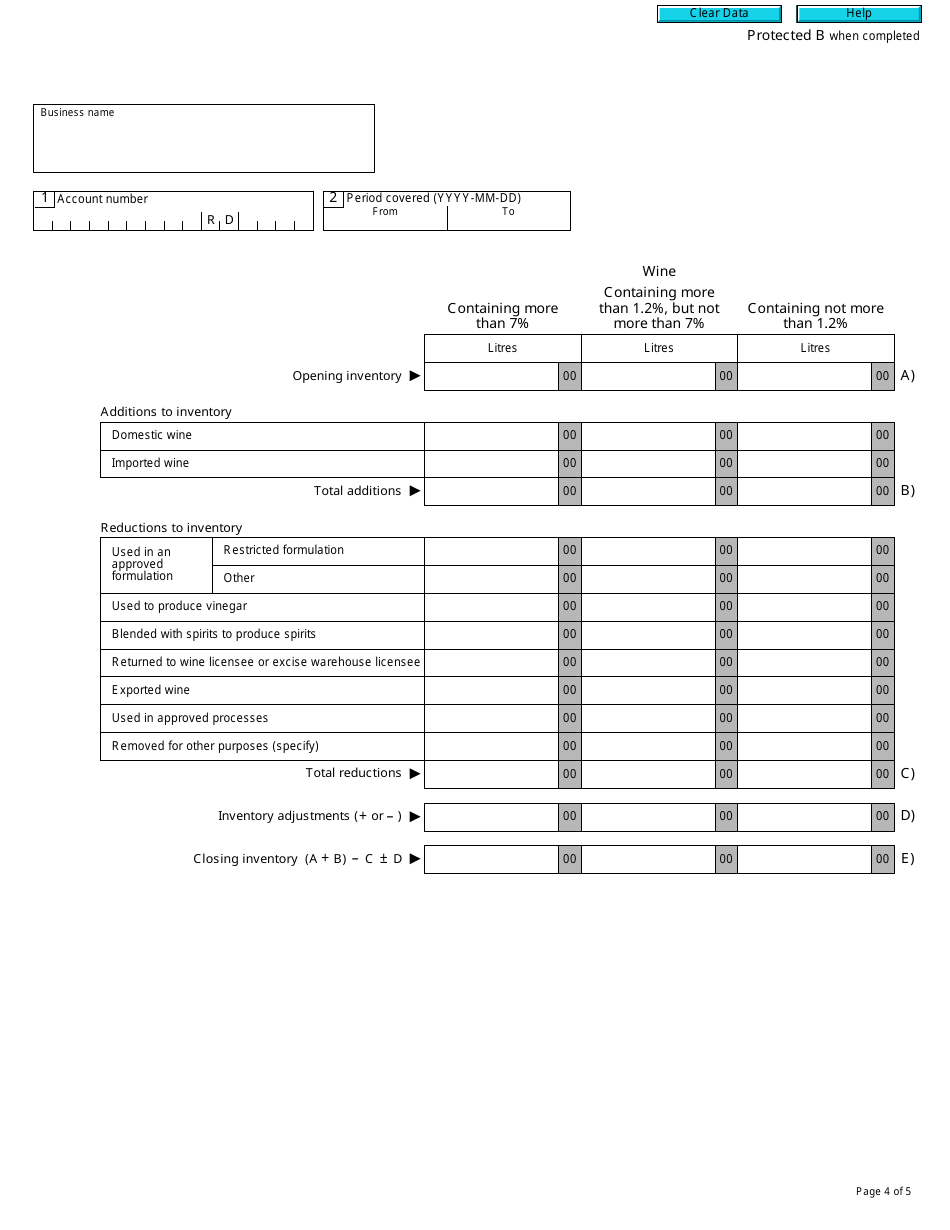

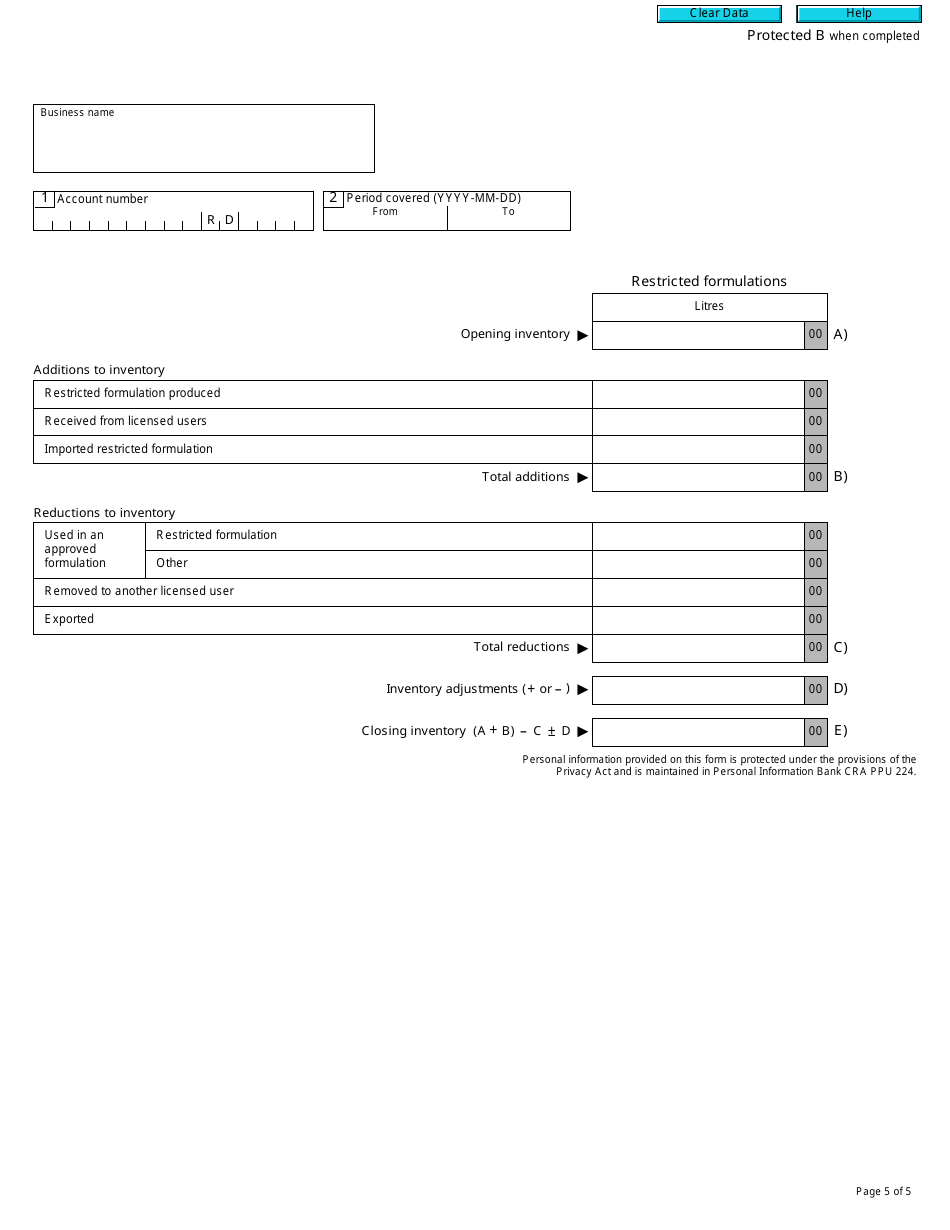

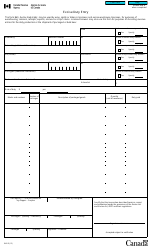

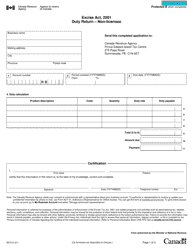

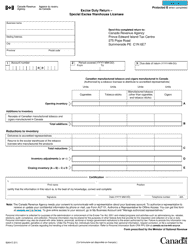

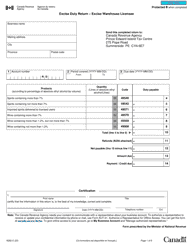

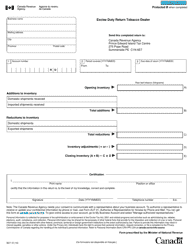

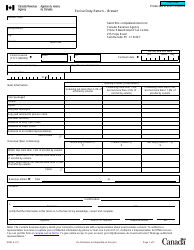

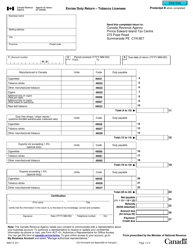

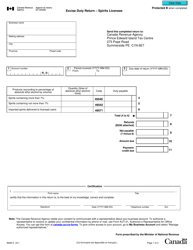

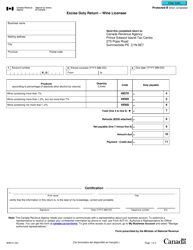

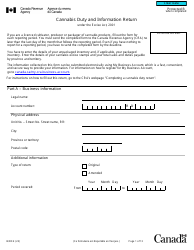

Form B263 Excise Duty Return - Licensed User - Canada

Form B263 Excise Duty Return - Licensed User is used by licensed users in Canada to report and pay excise duty on various goods. This form helps the government monitor and collect excise taxes on products such as alcohol, tobacco, and cannabis.

The Form B263 Excise Duty Return is filed by a licensed user in Canada.

FAQ

Q: What is Form B263?

A: Form B263 is an Excise Duty Return for Licensed Users in Canada.

Q: Who is required to file Form B263?

A: Licensed users in Canada are required to file Form B263.

Q: What is the purpose of Form B263?

A: The purpose of Form B263 is to report and pay excise duties on specific goods.

Q: What are excise duties?

A: Excise duties are taxes imposed on certain goods, such as alcohol, tobacco, and cannabis products.

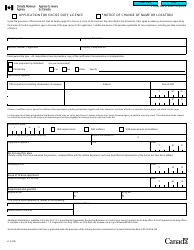

Q: What information is required on Form B263?

A: Form B263 requires information about the quantity and value of the goods subject to excise duties.

Q: How often must Form B263 be filed?

A: Form B263 must be filed monthly by licensed users.

Q: Are there any penalties for not filing Form B263?

A: Yes, there are penalties for not filing Form B263 or filing it late. It is important to comply with the filing requirements.

Q: Is there any assistance available for filling out Form B263?

A: Yes, the CRA provides guidance and support for filling out Form B263.